Multi Claim Protection Cover

A smart alternative to Serious Illness Cover.

We compare Life Insurance from every provider in Ireland to give you the best price, guaranteed.

Get your Life Insurance Quick Quote Comparison today to avail of additional discounts.

Multi Claim Protection Cover

Multi-Claim Protection Cover is a unique, severity-based policy that protects you from a broad range of possible health setbacks that may impact your daily life. It offers anyone the ability to claim on the policy issued, paying out multiple times over its length. Once you have not claimed 100% of your cover, it will still be in place and be available to claim from until the full amount has been reached.

Benefits of Royal London Multi-Claim Protection

- Cover a broad range of seious range of illnesses such as hert attack or cancer treatment.

- Life cover built into the policy

- Your premium will nor change after a claim

- Covers for big life impacts such as long hospital stays from serious accidents.

- Cover availeable if you've previously been declined Serious Ilness Cover.

- Ability to claim more than once(once not have cliamed 100% of sum assured.

- Pays out a specific amount depending on the severity of the illness

- Free One to One personal support to help your family cope with devastating effects of any illness or bereavement.

- Ability to have Additional Life Cover separate from your MCPC

- Children's cover and premature

Understanding Multi-Claim Protection Cover: A Case Study

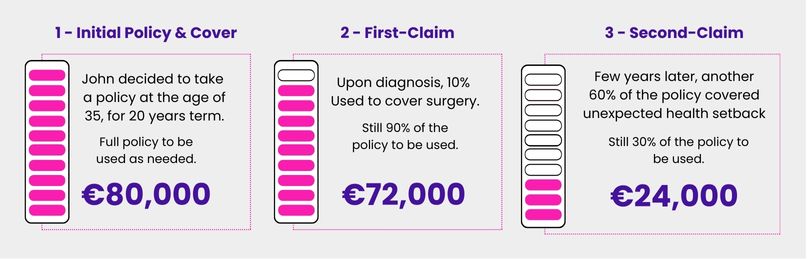

Multi-Claim Protection Cover is designed to provide comprehensive financial support in the event of serious health issues by paying out a portion of the total coverage amount as needed. Here’s how it works, illustrated through John’s experience:

Initial Policy and Coverage

- Profile: John, age 35, single, non-smoker.

- Policy: Single life Multi-Claim Protection Cover for €80,000 over a 20-year term.

- Premium: €23.68 per month.

First Claim: Cancer Diagnosis

- Health Issue: John is diagnosed with cancer and requires surgery.

- Payout: 10% of the total cover (€8,000) is paid out for surgery costs.

- Remaining Cover: €72,000 left for future health issues.

Second Claim: Testicular Cancer Diagnosis

- Health Issue: John is later diagnosed with testicular cancer, requiring extensive treatment.

- Payout: 60% of the total cover (€48,000) is paid out for treatments.

- Remaining Cover: €24,000 remaining for future health setbacks.

Through this Multi-Claim Protection Cover, John receives timely financial support for his medical expenses, ensuring that he can focus on recovery without the burden of financial stress. This type of policy allows multiple claims, reducing the total coverage amount available with each payout, but ensuring continuous support through various health challenges.

If you want to learn more and explore all the details about the multi-claim protection cover, please click here.

Meet our Team of Expert Advisors

Rebecca Sharpe

Isabel Humphreys

Seamus Phelan

Cormac Logue

Alan Broderick

Colin Bailey

Maik Ikponwen

Conor O'Hare

Aidan Butler

Rebecca Lynch

Barry Howlin

Colm Farrel

Your Questions Answered

Multi-Claim Protection Cover is a simple and cost-effective life and illness protection policy. It is designed to provide financial support if you experience certain health conditions that could impact your ability to work or manage day-to-day life.

Unlike traditional protection policies, Multi Claim Protection allows you to make multiple claims over the lifetime of the policy, depending on the severity of the condition. Payments are linked to predefined health events, and the amount paid varies based on the severity of the illness or injury.

The level of cover and the conditions included can differ from one provider to another, which is why it is important to speak with one of our advisors before choosing a policy. They can help you understand how each option works and which one best suits your needs.

You can complete our easy-to-understand form for a free online quote comparison, or speak directly with one of our Qualified Financial Advisors who will guide you through the process and help you get the right cover.

Multi-Claim Protection Cover is designed to provide financial support that reflects the severity of a medical condition and the impact it can have on your health, lifestyle, and ability to work.

With many traditional serious illness policies, a claim is usually paid once after diagnosis. Once the claim is paid, the cover typically ends, meaning you may not be able to take out the same type of protection again.

Multi-Claim Protection Cover works differently. Even after making a claim for a significant health setback, your policy can continue, as long as you have not claimed 100% of the total cover available. This means you can still have financial protection in place for future health events that may affect your wellbeing and lifestyle.

Multi-Claim Protection Cover is based on the severity of health setbacks rather than a single diagnosis. Claims are assessed according to how seriously a condition affects your health, recovery, and day-to-day life.

Cover typically includes a wide range of health events, from major serious illnesses such as cancer, heart attack, and stroke, to less severe but still impactful conditions that may require ongoing treatment or recovery time. Depending on the provider, cover can also extend to events such as long hospital stays, major surgeries, or injuries resulting from accidents, including traffic accidents.

The amount paid depends on the seriousness of the condition and how it is defined within the policy terms. Some conditions may trigger a partial payment, while more severe or life-changing illnesses can result in a higher percentage of the total cover being paid.

As cover definitions and payment levels can vary between providers, speaking with one of our advisors is important. They can explain what is included, how claims are assessed, and help you choose a policy that offers the right level of protection for your needs.

Multi-Claim Protection Cover is designed to align the amount paid with the impact a serious illness or health setback has on your life, rather than paying a fixed amount for a single diagnosis. This allows the policy to respond more fairly to different levels of medical severity and recovery.

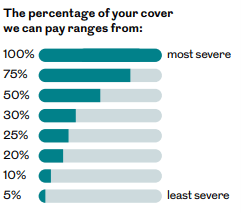

Claims are assessed using multiple predefined severity levels, which determine how much of your total cover is paid. These levels reflect factors such as the seriousness of the condition, the treatment required, recovery time, and how significantly the illness or injury affects your day-to-day life.

There are typically eight levels of severity, with payments ranging from a smaller percentage of your cover for less severe conditions, up to 100% of the cover for the most serious or life-changing events. This structure allows you to claim more than once over the life of the policy, provided the full cover amount has not already been paid.

As definitions and payment percentages can vary between providers, speaking with one of our advisors will help ensure you understand how severity levels work and what level of protection is right for you.

Multi-Claim Protection Cover allows more than one claim and continues after a payout, as long as the full amount of cover has not been used. This reflects the significant advances in medical diagnosis and treatment, which mean people are increasingly living longer and recovering from serious illnesses.

As a result, more people are being diagnosed earlier and successfully treated for serious conditions. This also means that some illnesses may have a less severe long-term impact than they once did, which is why Multi Claim Protection assesses claims based on severity rather than a one-time diagnosis.

For example, 1 in 2 people in Ireland will develop cancer during their lifetime. Thanks to earlier detection and improved treatments, many people recover or manage their condition and continue with their lives. Multi-Claim Protection Cover recognises this reality by allowing for partial claims and ongoing cover, where appropriate.

Cost example

As an example, a single, non-smoker aged 39, looking for €100,000 of Multi Claim Protection Cover over a 25-year term, could expect to pay approximately €45.77 per month. Actual premiums will depend on age, health, smoking status, and the level of cover chosen.

If you would like a personalised quote or a comparison of providers, our advisors can guide you through the options and help you find the right level of protection.

Royal London’s Helping Hand benefit provides one-to-one personal support for you and your family during difficult times, at no extra cost. It is available as part of eligible Royal London protection policies and is designed to support both your physical and emotional wellbeing.

Helping Hand gives you access to a dedicated team of medical and wellbeing experts who can support you before, during, and after a serious illness diagnosis.

This free benefit includes access to:

Bereavement counsellors, speech therapists, physiotherapists, massage therapists, and face-to-face medical opinions for serious health conditions

Cardiac rehabilitation support

Specialist support for coping with cancer, including emotional and practical guidance

Family support services, including help following the loss of a loved one

Helping Hand is available even if you never make a claim, and support can be extended to your immediate family members, depending on the service. This makes it a valuable wellbeing benefit, not just a claims-related service.

You can learn more about Royal London’s Helping Hand benefit.

If you would like to understand how this benefit works alongside your protection cover, our advisors can explain what is included and help you choose the right policy for your needs.

It is important to note that Multi-Claim Protection Cover and Health Insurance can work alongside each other, rather than replacing one another. Each serves a different purpose, and together they can provide more comprehensive financial and medical support.

Multi-Claim Protection Cover focuses on providing tax-free cash payments if you experience a serious illness or health setback, based on the severity of the condition. These payments are designed to help cover everyday expenses such as mortgage repayments, household bills, or loss of income during recovery.

Health Insurance, on the other hand, primarily covers medical treatment costs, such as hospital stays, consultant fees, and access to private healthcare services. It does not usually provide a direct cash payout to the policyholder.

In summary:

What does it pay out for?

Multi-Claim Protection Cover pays a cash benefit for serious illnesses or health events, based on severity. Health Insurance pays for medical treatment and hospital care.

Who does it pay out to?

Multi-Claim Protection Cover pays directly to you. Health Insurance pays hospitals or medical providers.

Can it pay out multiple times?

Multi-Claim Protection Cover can pay out more than once, provided the full cover amount has not been used. Health Insurance does not provide cash payouts.

How are payments used?

Multi Claim Protection Cover pays a guaranteed, tax-free percentage of your total cover, which you can use however you need. Health Insurance does not provide cash payments for living expenses.

Does it provide a financial payout on death?

Multi-Claim Protection Cover can include a death benefit, depending on the policy. Health Insurance does not provide a death benefit.

For a detailed comparison between Multi-Claim Protection Cover and Health Insurance, you can view Royal London’s guide.

If you are unsure which type of cover is right for you, or how they can complement each other, our advisors can explain the differences and help you choose the most suitable protection for your circumstances.

Related Products

Serious Illness Protection

Tax free payout on diagnosis of up to 40 critical illnesses.

We’re proud to have been featured in Ireland’s leading media outlets, sharing insights on insurance, mortgages, and financial planning.

As seen on

You may also be interested in...

Follow us on Social Media

For press, marketing, or partnership enquiries, please reach out to our Media & PR team.

Career at LowQuotes

Here at LowQuotes, we want to ensure that our clients receive the highest standard of service. If you have a passion for connecting with people and aspire to thrive in a culture built on trust, dedication and excellence, please send us your CV below.