The cost of covering your child’s college education in Ireland can vary widely based on multiple factors, including the type of college, course duration, potential inflation, and lifestyle choices.

According to The Zurich Cost of Education Survey 2023 shows that college students living at home and in rented or student accommodation face staggering costs.

The average cost of putting a child through third-level education during the period of 3-4 years is €66,152 with student accommodation and €46,560 with rented accommodation. It stands at €25,844 while still living at home, which is still a significant amount of money.

To estimate how much you might need to save for your child’s college costs, consider these steps:

Research Expected Costs: Research the current and projected costs of college education in Ireland. Consider tuition fees, accommodation, living expenses, and other associated costs.

Set a Savings Goal: Based on the anticipated expenses, establish a savings goal. Create a budget by estimating the total costs of a college education for your child.

Use a Savings Calculator: Utilize online savings calculators that take into account your expected savings period, estimated rates of return, and the targeted savings goal. These calculators can help determine how much you need to save monthly or annually to reach your goal.

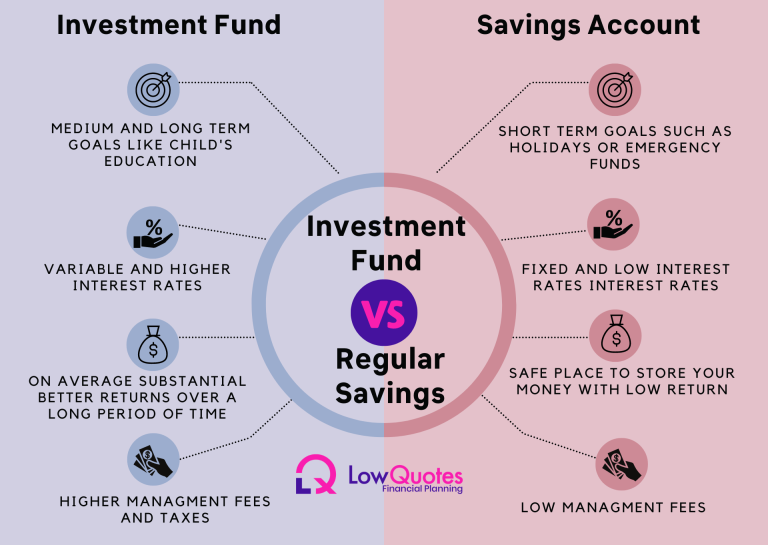

Invest and Save Wisely: Start saving early to take advantage of compound interest and investment returns. Explore various savings options, such as dedicated education savings plans, investment funds, or tax-advantaged savings accounts, to make the most of your contributions.

Regularly Review and Adjust: Periodically review your savings plan and make adjustments as needed. Keep an eye on changing education costs and adjust your savings plan accordingly.

Consider Other Financial Aids: Encourage your child to apply for scholarships, grants, or bursaries to help offset some college expenses.

Speak with one of our advisors to discuss your specific financial situation, long-term goals, and to create a tailored plan to ensure you’re on track to cover your child’s college costs. The earlier you start saving, the more time your money will have to grow, potentially lessening the financial burden when the time comes.