For many parents, providing their children with a good education is one of the most important things they can do to plan for their children’s future. Education in Ireland can be expensive, so it is important for parents to start saving early. It’s time to not only bring home the bacon but save part of the bacon too.

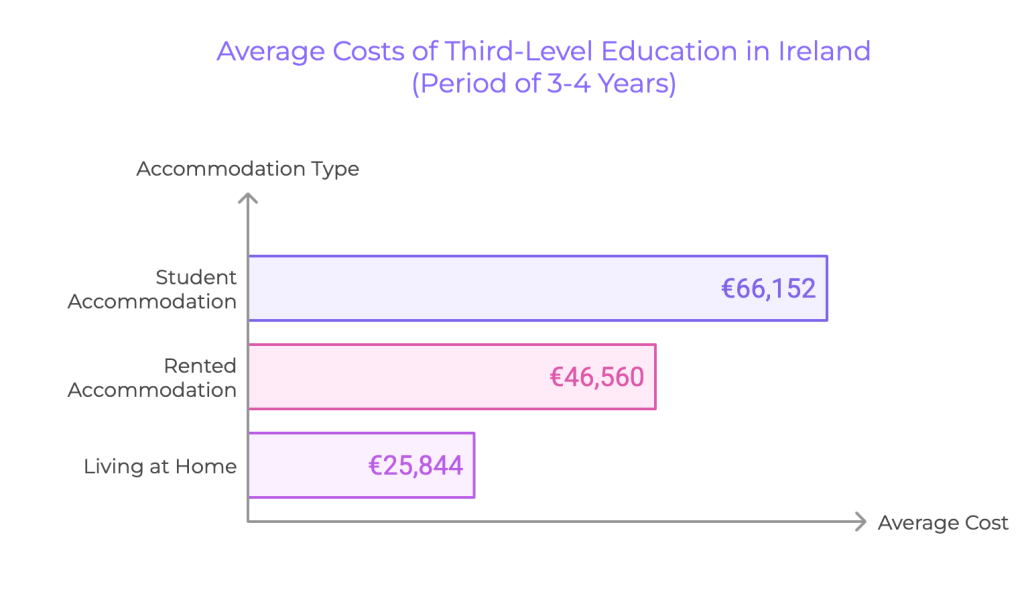

The Zurich Cost of Education Survey 2024 shows that college students living at home and in rented or student accommodation face staggering costs. You might think the cost of sending your child to primary and secondary school is high, but the expenses associated with third-level education are staggering.

The good news is that there are many ways you can save money for children’s education and planning smart choices is the key. By doing this you might be able to provide your little ones with a good financial start in life.

Identify your goal and then plan around it

Identifying your goals is the first step towards planning for the future whether you want to save for a long-term milestone in your child’s future, like their education, or help to get them the proper ladder later in life.

After determining your goal you need to create a savings plan that can help you understand your finances and how to be successful in your objective. You can roughly calculate how much you should aim to save each month by dividing the total cost of your goal by the number of months you have to save for it.

Is a regular savings account an effective way to save for a child’s education?

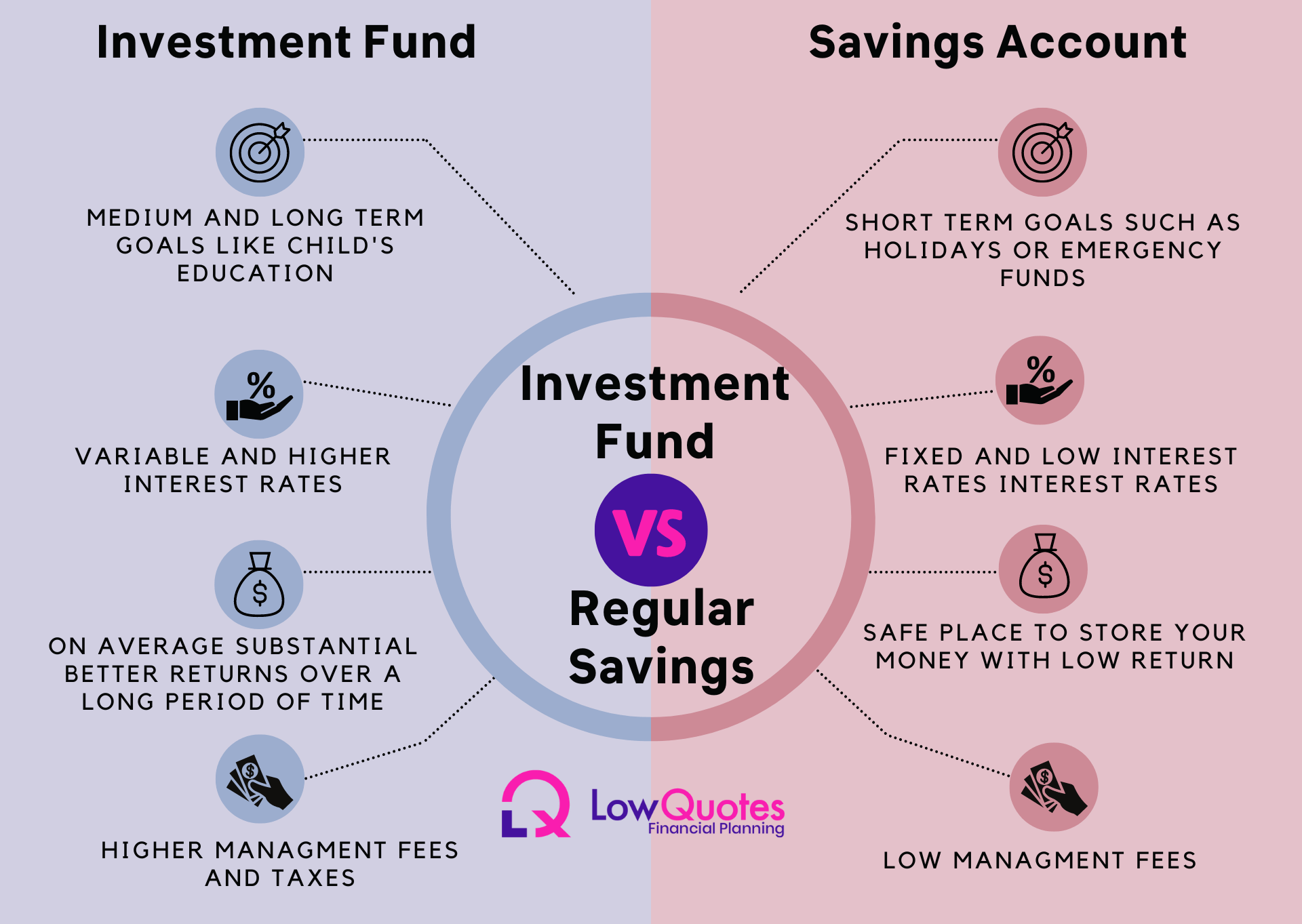

Most banks and credit unions offer a regular savings account. It is simple to open and allows you to access your money easily. If a family has short-term objectives, like holidays, regular savings accounts may be advantageous for them. However, if they have long-term goals like children’s education a regular savings account might not be the best option for them.

Regular saving accounts typically offer a very low-interest rate and this will cause your money to grow slowly or lose value, making it challenging to reach your financial objectives. Also, the low-interest rates earned on savings accounts may not keep pace with inflation, meaning the purchasing power of the savings may decrease over time.

Saving for child’s education is a long-term financial goal that requires careful planning and consistent saving and using an investment fund to achieve it can be an effective strategy. This is because of the potential for compounding returns. The returns earned on an investment fund are reinvested, generating more returns over time.

Save Smart for your Children’s Future!

Differences between a regular savings account vs a children’s investment fund

Children’s investment fund is an account created with the objective of making investments for children. The account’s purpose in this case is to give the child long-term financial benefits, like a college fund or a future savings account.

Your goals should be considered when choosing between a regular savings account and an investment fund. A savings account is only a good choice if you’re seeking a safe location to save your money for short-term goals, such as an emergency fund. An investment fund, on the other hand, can be a better option if you’re hoping to grow your money over the long term for events such as saving for your child’s education.

When choosing the best option between a savings account and an investment fund you need to consider your financial goals, level of risk tolerance, and time frame you want to reach your goal. Remember: to boost your savings, you don’t have to be rich or skilled. All you need to do is get advice from a qualified financial advisor. At LowQuotes we have a highly qualified team of financial advisors that can assist you with this, we will advise and help you to make a decision as to what is the best way to save for your child’s college.

We can help you make the right decision about saving for your child’s education as well as providing financial planning advice considering every aspect of your finances and creating a plan to meet your personal and financial goals.

How can a unit-linked fund help you save for your child’s education?

In a unit-linked savings plan, investors purchase units that correspond to a share of the fund’s overall assets. You can choose from a variety of investment funds when you first purchase the policy, and your selection of funds is valid for the duration of the coverage.

Opening a unit-linked savings plan is very simple, you can vary your payments whenever you like and you can choose which provider life funds to invest in at the beginning of it. This plan also makes full use of annual gift tax exemption limits.

This investment is suitable for those who have a long-term horizon and happy to save for a period of 5 years or more. You’ll need to decide how much you want to put aside each month – it can be as little as €100.

Comparing interest rates banks vs unit-linked funds

Some of the banks in Ireland offer interest rates on savings accounts for children that fluctuate from 0.01% to 1.00%. Unit-linked savings’ interest rates can be up to 10% or even more depending on the plan. Over the long term, the returns on deposit accounts are unlikely to match the returns you may enjoy from investing in the funds.

- EBS – Pay 1% with a maximum balance of €5,000.

- AIB- Get an interest rate of 1% on the first €1,000. All amounts above €1000 will earn a lower rate of interest.

- Bank of Ireland – The Childsave account pays an interest rate of 0.75% up to €10,000.

- Unit-linked fund – Pays up to 10% or more depending on the risk of the selected plan.

Invest in your Children’s Future! Start Today!

How much can you save investing in funds for your child’s college savings?

Investing in a fund can be an excellent way to save for a child’s education due to the possibility for larger returns than a standard savings account. Due to the possibility for investments to increase faster than inflation, you might be able to receive returns that are larger than those from standard savings accounts while still maintaining your purchasing power.

To understand the risks and potential rewards of investing in a fund for your child’s college, it’s advisable to seek advice from one of the financial advisors at LowQuotes. We can help you understand the risks and potential rewards of investing in a fund for your child’s education.

It’s important to keep in mind that setting up money for your child’s college expenses is a long-term plan. It requires adopting a steady and consistent approach, keeping your contributions over time.

For instance, if you save €150 per month over 10 years, you will have €18,000 saved up. This might seem like a lot of money right now, but inflation and increasing costs will cause it to be worth considerably less in five years. Investing in funds will be more profitable.

Investing in a bank’s regular savings, although is low risk, you will get no return. On the other hand, by choosing higher risks funds you might get the chance of higher returns as in the example below.

In 10 years your investment could be worth | |

Banks – Regular Savings account | €18,000 (same) |

Unit-linked fund – Risk 3 | €19,083 |

Unit-linked fund – Risk 4 | €22,353 |

Unit-linked fund – Risk 5 | €25,042 |

We can help you determine the best investment strategy for your specific needs and goals getting financial planning. By choosing our financial planning services we can help you decide what plan is better for you, how much you need to save each month and what is the best strategy overall to ensure the financial future of your child.

Investing your child’s benefit

Most likely, you have never considered investing your child’s benefit. The payment made to all parents regardless of income received by the Irish Government could be invested to enlarge it. Child Benefit, also known as children’s allowance, is a monthly payment to the parents or guardians of children under 16 years of age, You can get Child Benefit for children aged 16 and 17 if they are in full-time education or full-time training or have a disability and cannot support themselves. Child Benefit is €140 a month for each child.

One strategy can be to put the child’s benefit into a regular savings account in a bank or credit union but there is no interest earned on that money. It’s important to have some kind of return because of constantly escalating costs and living expenses.

By starting early and investing, you can take advantage of compound interest, or interest on interest, to see your investment increase over time. Long-term, this may lead to substantial growth. Investing in the benefit can help your child build a nest egg for their future, such as saving for their university.

If you invest €140 in a fund for 18 years you will have €30,240 saved up. Putting your money in a fund your savings can double. Instead of having only what you deposited €30,240 you may have €66,713. Investing in the child’s benefit can help protect against inflation, as investments have the potential to grow at a rate greater than the rate of inflation.

Regular Savings – you get exactly what you deposited

Child’s benefit | Years | Total – regular savings |

€140 | 18 | €30,240.00 |

Investing in a fund – you get what you deposited plus growth

Child’s benefit | Years | Total | Profit (estimate) | Total |

€140 | 18 | €30,240.00 | €36,473 | €66,713 |

Obs: The rate of tax on growth and income from ‘Funds’ is 41%.

It’s important to keep in mind that all investments have some level of risk, so before making a choice seek advice from one of our financial advisors. We can help you weigh the benefits and risks and make an informed decision about your child’s education fund.

Build Your Family Financial Safety Net!

FAQ: Saving for your Children's Future

Can I gift money to my children tax-free?

Yes, you can gift money to your children tax-free under certain conditions.

According to Capital Acquisitions Tax (CAT) regulations, money gifts taken for support, maintenance, or education are exempt from tax if given during the lifetime of the disponer (the person giving the gift). This exemption applies specifically if the recipient is:

- A child of the disponer or the civil partner of the disponer who is under 18 years of age.

- Aged between 18 and 25 years and in full-time education.

- Unable to maintain themselves due to a permanent physical or mental disability, with no age limit applicable in this case.

- A person to whom the disponer stands in loco parentis (in place of a parent).

For children who do not fit these categories, you can still use the annual gift exemption, which allows you to gift up to €3,000 per person each year without incurring any gift tax.

This can be an effective way to contribute towards larger expenses, such as college tuition, without impacting your tax liability.

Can grandparents gift money to grandchildren tax-free?

Yes, grandparents can gift money to their grandchildren tax-free under specific conditions.

Similar to parents, grandparents can take advantage of the annual gift exemption, which allows them to give up to €3,000 to each grandchild every year without any gift tax implications.

This exemption can be particularly useful for contributing towards education expenses or as financial support without affecting the grandparents’ tax situation.

Are you ready to take the first step?

Get your Personalised Quote Today!

Why choose LowQuotes Financial Planning and Savings & Investments?

With LowQuotes you can achieve your financial objectives by reducing costs, making wise decisions, and negotiating for better deals. The earlier you begin planning for your financial future, the better the outcomes you will experience throughout your life.

Low Quotes is an award-winning market-leading online insurance broker with a 5-star Google rating. We provide one of the best financial planning in Ireland and Savings & Investments and our role is to guide you on how to manage your finances and have an effective plan projecting many years into the future. Contact us today!

Share this post

All our content has been written or overseen by a qualified financial advisor. However, you should always seek individual financial advice for your unique circumstances.

3 thoughts on “What is the best way to save for your child’s college education?”

Comments are closed.