The public healthcare system in Ireland provides essential medical services to the population. However, many people choose to take out private health insurance to supplement their healthcare needs. According to a report by the Health Insurance Authority, there were 2.4 million people in Ireland with private health insurance at the end of 2021, which represents almost 50% of the population.

There are several reasons to get health insurance in Ireland, which include having access to private healthcare services to having the peace of mind that you are protected in the event of an unforeseen illness or injury.

Do you need private health insurance?

Everyone ordinarily resident in Ireland and certain visitors to Ireland are entitled to a range of public health services either free of charge or at a reduced cost. Unfortunately, the limitations of the public health system feature almost daily in the news. We often hear the challenges people face when accessing healthcare services through the public health system, including:

Staff shortages: there are shortages of healthcare professionals in some places, which can contribute to longer wait times and lower quality of care.

Waiting times: appointment, diagnostic, and treatment wait times can be substantial, especially with elective surgery.

Overcrowding: Overcrowding in hospitals can be a problem and can prevent people from immediate access to a hospital bed.

Non-urgent treatment: Getting access to treatment for non-urgent health problems is another issue. This can be particularly difficult for people with chronic conditions or disabilities who require ongoing care and support.

More People in Ireland Considering Private Health Insurance Plans

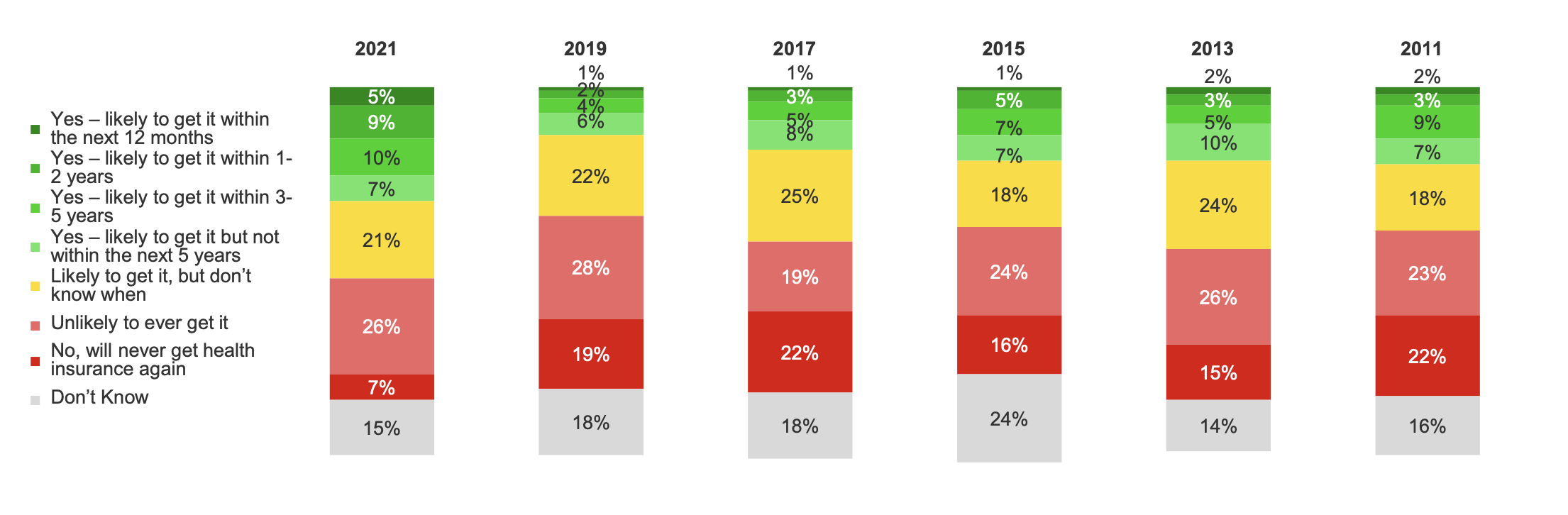

According to HIA’s report, it seems the desire to acquire health insurance coverage within the medium to short term (5 years) is increasing.

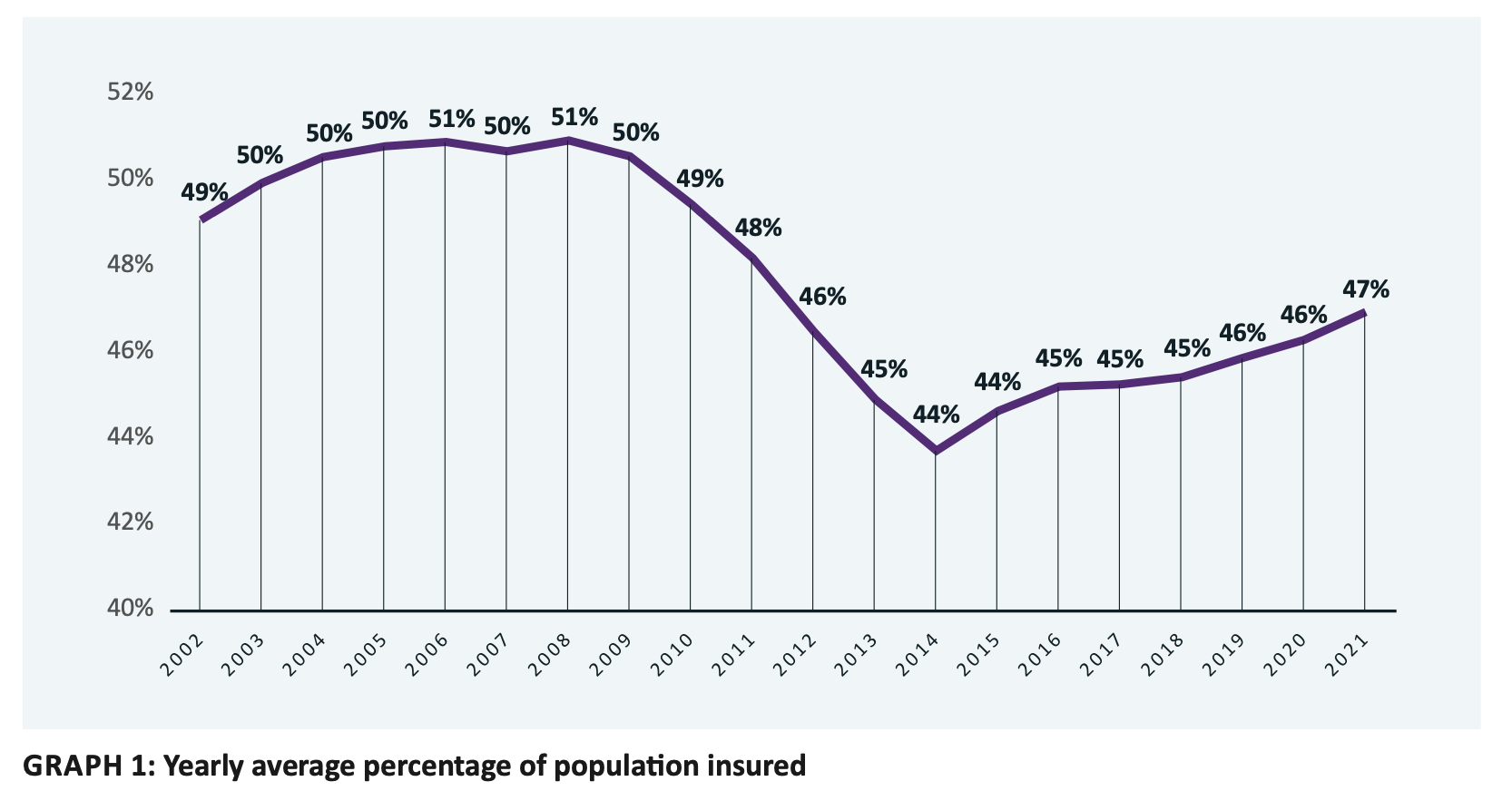

Health insurance coverage is growing. Although it has not yet recovered pre-2008 levels when an economic crisis hit Ireland, 2.4 million people had health insurance as of the end of 2021, accounting for 47.1% of the total population. There were 53,469 more people having health insurance than there were in 2020, representing a 2% increase.

Health insurance coverage is growing. Although it has not yet recovered pre-2008 levels when an economic crisis hit Ireland, 2.4 million people had health insurance as of the end of 2021, accounting for 47.1% of the total population. There were 53,469 more people having health insurance than there were in 2020, representing a 2% increase.

Protect Your Health, Secure Your Future. Get a quote Today!

LowQuotes Private Health Insurance Benefits

Digital Doctor

Unlimited consultations by phone or video with an Irish GP. You could use this service for:

- Consultations for you or co-appointments with your children.

- Prescriptions are sent to your local pharmacy.

- Referrals to the hospital or to a specialist.

- Sick-notes

Public/Semi-Private/Private Cover

Cover available for Public hospitals, Private Hospitals, and High Tech Hospitals such as:

- Consultants fees

- Inpatient Scans

- Day Case

- Private or semi-private rooms

Nurse on Call 24/7

24/7 support from qualified nurses for non-emergency advice, whether it be flu, a fall, or childcare advice.

Back & Neck Physiotherapy

Connect directly with a chartered physiotherapist who will manage and assess your issue & create a treatment plan for your issue. This plan can include:

- Exercise programmes.

- Virtual physiotherapy.

- In-person at-home treatment.

- In-person at-clinic treatment.

- Whichever option suits you best.

Maternity benefits

Planning & fertility benefits, maternity care options, pre-natal benefits, and additional supports.

There is a huge range of benefits from start to finish, such as money off fitness wearables, contributions to gym membership, smear testing, health screening, contributions for dieticians, digital doctors on-hand at any time, digital prescriptions, GentleBirth App, and much, much more.

Not forgetting paid accommodation, whether it’s semi-private or in a private hospital.

Female Health Consultation

Access to expert female health GPs for in-depth video consultations from anywhere. The GPs, who have a special interest and experience in female health, will give you support and advice in the areas of menstrual health, contraception, fertility, menopause, and beyond.

Elective Overseas Cover

Benefit abroad for surgical procedures that are available in Ireland subject to the amount of cover available in Ireland

Benefit abroad for surgical procedures that are not available in Ireland for up to the level of the most similar surgical procedure to treat the same condition in Ireland.

Professional counselling service 24/7

Gain access to independent counselling support 24/7, which provides professionally trained counsellors at any time.

It is a dedicated counselling service via phone, webchat, video call, or in-person for members aged 18 and over. Telephone and web chat services are available for members ages 16 and over.

Continue treatment at home

Certain therapies and IV treatments can be delivered at home by trained nurses, allowing you to leave the hospital early and recover in the comfort of your own home.

Some examples of treatment that can be completed at home:

- Pneumonia.

- Post-Op Infections & Wounds.

- Cellulitis.

- Urinary tract infections.

- Respiratory tract infections.

- Osteomyelitis.

- Negative pressure wound therapy.

- Endocarditis.

- Septic Arthritis.

Free Travel Insurance

Available on our selected plan only.

Cashback for sports-related expenses such as physio visits and a FREE annual worldwide multi-trip travel insurance policy.

Reasons You Should Have Private Health Insurance

Overall, health insurance in Ireland can offer you financial security and access to essential medical care, providing you and your family peace of mind about your health and well-being.

Faster access to Private Healthcare

Access to private healthcare services is one of the key reasons people buy health insurance in Ireland. This can include quicker access to specialist appointments, reduced waiting times for procedures and surgeries, and access to treatments that are not available through the public healthcare system.

Choice of healthcare providers

You can choose your own healthcare providers, including doctors and specialists. This is especially critical if you have a medical condition that requires specialised care.

Coverage for Essential Medical treatment

Health insurance policies in Ireland generally cover essential medical care, such as hospital stays, surgical procedures, diagnostic tests, and specialist consultations.

Access to Specialist Care

If you have health insurance, you may be able to see a specialist for a specific medical condition more quickly and without the need for a referral from a GP.

Reduced Out-of-Pocket Expenses

Health insurance can help reduce your out-of-pocket expenses for medical treatment, such as hospital stays, doctor’s visits, and prescription medications.

Tax Relief

When you buy health insurance or get a quote for health insurance, your premium breakdown will include the tax relief being deducted at source.

Peace of Mind

Health insurance can provide you with peace of mind knowing that you have financial protection in case of unexpected medical emergencies.

Find the Right Health Insurance for You – Get a Free Quote!

What makes LowQuotes the best choice for your health insurance needs?

At LowQuotes, we are committed to offering our clients the best possible health insurance solutions to meet their unique needs and budget.

Low Quotes is a market-leading online insurance broker in Ireland with a 5-star Google rating and 25 years of experience. We are proud to be awarded as Insurance Broker of the Year 2022 as the result of our team’s dedication to providing market-leading independent advice and exceptional customer service.

Don’t wait until you need medical care to get health insurance. Get your health insurance quote today and our award-winning advisors will get in touch.

We also provide a wide variety of financial services in Ireland such as Life insurance, Mortgage Protection, Income Protection, Pensions, Financial Planning, Savings & Investments. If you have any questions about one of our services, feel free to contact us today.

Share this post

All our content has been written or overseen by a qualified financial advisor. However, you should always seek individual financial advice for your unique circumstances.

1 thought on “Why Private Health Insurance is a Must-Have in Ireland”

Comments are closed.