Multi Claim Protection Cover

A smart alternative to Serious Illness Cover.

We compare Life Insurance from every provider in Ireland to give you the best price, guaranteed.

Get your Life Insurance Quick Quote Comparison today to avail of additional discounts.

Multi Claim Protection Cover

Multi-Claim Protection Cover is a unique, severity-based policy that protects you from a broad range of possible health setbacks that may impact your daily life. It offers anyone the ability to claim on the policy issued, paying out multiple times over its length. Once you have not claimed 100% of your cover, it will still be in place and be available to claim from until the full amount has been reached.

Google Reviews

Benefits of Royal London Multi-Claim Protection

- Cover a broad range of seious range of illnesses such as hert attack or cancer treatment.

- Life cover built into the policy

- Your premium will nor change after a claim

- Covers for big life impacts such as long hospital stays from serious accidents.

- Cover availeable if you've previously been declined Serious Ilness Cover.

- Ability to claim more than once(once not have cliamed 100% of sum assured.

- Pays out a specific amount depending on the severity of the illness

- Free One to One personal support to help your family cope with devastating effects of any illness or bereavement.

- Ability to have Additional Life Cover separate from your MCPC

- Children's cover and premature

Understanding Multi-Claim Protection Cover: A Case Study

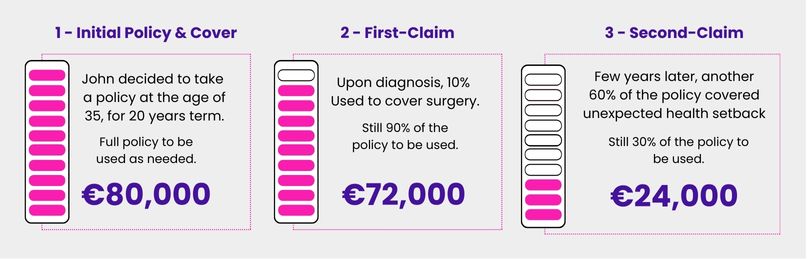

Multi-Claim Protection Cover is designed to provide comprehensive financial support in the event of serious health issues by paying out a portion of the total coverage amount as needed. Here’s how it works, illustrated through John’s experience:

Initial Policy and Coverage

- Profile: John, age 35, single, non-smoker.

- Policy: Single life Multi-Claim Protection Cover for €80,000 over a 20-year term.

- Premium: €23.68 per month.

First Claim: Cancer Diagnosis

- Health Issue: John is diagnosed with cancer and requires surgery.

- Payout: 10% of the total cover (€8,000) is paid out for surgery costs.

- Remaining Cover: €72,000 left for future health issues.

Second Claim: Testicular Cancer Diagnosis

- Health Issue: John is later diagnosed with testicular cancer, requiring extensive treatment.

- Payout: 60% of the total cover (€48,000) is paid out for treatments.

- Remaining Cover: €24,000 remaining for future health setbacks.

Through this Multi-Claim Protection Cover, John receives timely financial support for his medical expenses, ensuring that he can focus on recovery without the burden of financial stress. This type of policy allows multiple claims, reducing the total coverage amount available with each payout, but ensuring continuous support through various health challenges.

If you want to learn more and explore all the details about the multi-claim protection cover, please click here.

Meet our Team of Expert Advisors

Related Products

Serious Illness Protection

Tax free payout on diagnosis of up to 40 critical illnesses.

Your Questions Answered

Multi Claim Protection Cover(MCPC) is a simple, cost-effective life and illness protection policy. MCPC pay outs are directly linked to the severity of certain health set backs that will cause difficulty in your day to day life.

It offers anyone the ability to claim on the policy issued, paying out multiple times over its length. The amount of protection covered vary from provider to provider, so it is important to speak to one of our advisors before making your choice.

You can fill out our easy to understand form for a free online quote comparison, or speak to one of our Qualified Financial Advisors who will assist you with getting a quote.

Multi Claim Protection Cover is designed to give full financial support that will strategically align with the severity of a medical emergency or significant health impact on your wellbeing and lifestyle.

For instance some insurance policies will only pay out once for the specific serious illnesses after diagnosis, meaning you cant get that type of insurance again once the cover ends.

With Multi Claim Protection Cover even after a significant health setback has been claimed, as long as you have not claimed 100% of you cover you will still have cover in place for any potential impacts on your health and lifestyle.

Multi-Claim Protection Cover is based on severity of health setbacks that will occur. Serious illnesses such as heart attack and cancer treatment covering all requirements. MCPC covers major incidences , such as long hospital stays and traffic accidents.

Multi Claim Protection Cover is in line with the consequences of a serious illness or health setbacks. This is how Multi Claim Protection Cover is paid out multiple of times, by keeping up with advancements in medical technologies providing an exclusive cover

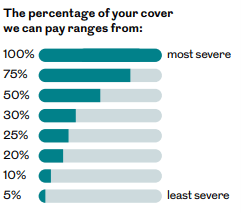

There are eight levels of severity that determine how much money will be paid out to make a claim. Based on the impact of the health difficulty and how it affects your lifestyle.

Claims paid more than once – with cover that continues Thankfully there are great strides in medical diagnostics and treatments more efficiently.

It also means that more people are likely to be diagnosed with and be successfully treated for a serious illness.

For example, 1 in 2 people in Ireland will develop cancer during their lifetime. Illnesses are easily detected now, meaning any serious illness are having a smaller impact.

Example of what can you expect to pay for your MCPC: A single , non-smoker aged 39 who wants a sum assured of €100,000 for a 25 year term would pay €45.77 per month.

Royal London’s Helping Hand gives you one to one Personal Support from Royal London.

This free extra includes:

- Providing bereavement counsellors, speech therapists, face to face medical opinions, therapies, massages, physiotherapy for serious health issues

- Cardiac rehabilitation support

- Support for coping with cancer

- Family support for the loss of a loved one

Remember you can put Multi Claim Protection Cover in place in addition to your health insurance. Both insurance compliment each otehr. the table outline the main differences between Multi Claim Protection Cover and Health Insurance.

What does it pay out for ?

Who does it pay out to ?

Dos it pay out multiple times ?

It pays a guaranteed tax – free percentage of your full cover amount to help with monthly expenses.

Does it provide a financial payout on death?

Yes.

https://www.royallondon.ie/siteassets/site-docs/mcpc/rl-mcpc-brochure-dac.pdf

You may also be interested in...

Career opportunities at LowQuotes.

Here at LowQuotes, we want to ensure that our clients receive the highest standards of service. If you have a passion for connecting with people and aspire to thrive in a culture built on trust, integrity, dedication, and excellence, this could be the perfect fit.