Table of Contents

If you’re living with your partner but aren’t married, you may not realise the impact inheritance tax could have on life insurance payouts. Unlike married couples, cohabiting couples in Ireland are treated differently when it comes to taxes, meaning a significant portion of your inheritance could be lost to the taxman.

Luckily, there are ways to protect your loved ones from hefty tax bills and ensure that the full value of your life insurance payout reaches your partner. In this article, we’ll walk you through the options available to cohabiting couples, so you can make informed decisions to safeguard your financial future.

What Is A Cohabitation Relationship?

Cohabitation is when two people live together in a committed relationship without being married or in a civil partnership. This can include both opposite-sex and same-sex couples. Even though they’re not married, cohabiting couples can still share a deep connection, whether or not their relationship is romantic or sexual.

Although cohabiting couples do have some rights if the relationship ends or one partner passes away, they don’t have the same legal protections as married couples or civil partners. This can affect important things like owning property, raising kids, and what happens to your inheritance.

What is Inheritance Tax?

Inheritance tax, or Capital Acquisitions Tax (CAT), is a tax you pay on anything you inherit when someone passes away. This could include things like money, property, pensions, or even personal items.

The amount of tax you owe depends on the total value of everything you inherit.

You’re allowed to receive gifts and inheritances up to a certain limit during your lifetime before you have to start paying this tax.

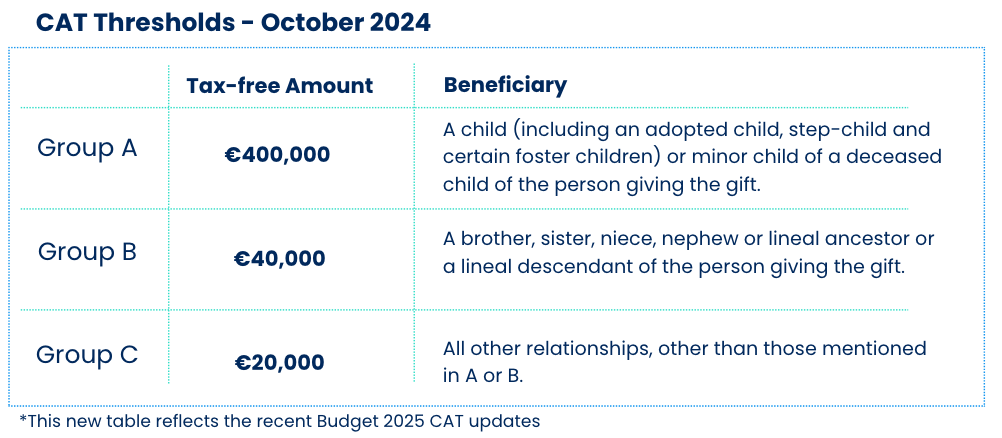

CAT – Group Thresholds

The amount of Capital Acquisitions Tax (CAT) you need to pay is based on your relationship with the person giving you the inheritance or gift. There are three different groups that determine this.

Don’t wait any longer, get a quote today!

How Does Inheritance Tax Affect Cohabiting Couples?

Married couples and civil partners are exempt from paying inheritance tax on anything they inherit from one another. In contrast, cohabiting couples face a 33% Capital Acquisitions Tax (CAT) on any inheritance above €20,000.

So, if you inherit things like property, money, or other assets, you could face a hefty tax bill. That’s why it’s really important for you as a cohabiting couple to understand these rules when planning your finances and making decisions about your future together.

What Are the Tax Implications of Life Insurance Payouts in Ireland?

In Ireland, whether life insurance payouts are tax-free depends on the relationship between the beneficiary and the deceased. Married couples and civil partners are exempt from this tax, however for cohabiting couples, things are a bit different.

When one partner inherits a life insurance payout, it could be subject to Capital Acquisitions Tax (CAT). This happens because cohabiting couples are treated as strangers for Inheritance and Gift Tax purposes.

Example

Let’s say Sarah and Tom are a cohabiting couple, but they aren’t married. Tom sadly passes away and leaves Sarah €300,000 from his life insurance.

Because they aren’t married, Sarah has to pay Capital Acquisitions Tax (CAT) on anything she inherits over €20,000. Here’s how it works:

Tom left €300,000 from his life insurance.

Sarah can inherit €20,000 tax-free, but the rest is taxed at 33%.

Here’s the tax calculation:

€300,000 – €20,000 = €280,000 (amount taxed).

33% of €280,000 = €92,400 in tax.

Sarah ends up with a €92,400 tax bill simply because they weren’t married.

Don’t let taxes take a chunk of your life insurance payout

What Can You Do About It?

Get married

It might sound a bit odd to suggest this, but from a financial perspective, getting married can really make sense—especially if you’ve been in this relationship for years or have kids together.

A simple registry office wedding in Ireland typically costs €200 on the notification fees. That’s a pretty small price compared to the potential tax hit a cohabiting partner might face.

Or, if your dream is to have a big wedding celebration, the total cost typically runs around €36,000. This covers everything—from the venue and the dress to the rings and the honeymoon. Of course, this is just an average!

For example:

If you’re cohabiting and inherit €300,000, you could face a tax bill of €92,400. But if you choose to get married, a quick registry office wedding for as little as €200 could save you that entire tax bill.

Even if you’re dreaming of a bigger wedding, with the average cost being around €36,000, the potential savings in inheritance taxes are still huge.

Whether you go for a simple ceremony or a grand celebration, getting married could save you a substantial amount in taxes.

Life of another policy

A simple and effective option for cohabiting couples is to take out a “Life of Another” life insurance policy.

This means each partner takes out a policy on the other, so if one of you passes away, the surviving partner gets the payout without having to pay any inheritance tax.

For example:

Sarah and Alan, who aren’t married, each take out a life insurance policy for €300,000.

- Sarah pays for Alan’s policy from her own bank account, and

- Alan pays for Sarah’s policy from his own bank account.

If one of them passes away, the other will get the full €300,000 payout, tax-free, because they own the policy and paid for it themselves. This is a simple way to make sure your partner is financially protected.

Is there another way to protect my family from inheritance tax?

You can take out a “Section 72” life insurance policy, where each partner takes out a separate policy that’s specifically designed to cover inheritance tax. The great thing about Section 72 is that the payout is exempt from tax, as long as it’s used to pay off any inheritance tax owed.

This can be especially helpful if you’re concerned about potential tax bills on your home or other assets, ensuring the surviving partner isn’t faced with a significant tax burden.

You can learn more by exploring our articles on inheritance and gift tax for cohabiting couples, which provide helpful guidance on managing this part of your financial planning. You’ll also find tips on how to protect your children from large tax bills in the future.

Get a Life Insurance Quote With LowQuotes

If you’re an unmarried couple, we can help guide you on the best steps to protect your partner and family. Get a life insurance quote today!

We also provide various financial services, such as mortgages, serious illness cover, pensions, financial planning, health insurance, and savings & investments.

Ensure your loved one is fully protected!

All our content has been written or overseen by a qualified financial advisor. However, you should always seek individual financial advice for your unique circumstances.