Table of Contents

It’s never too early to teach children about money and financial planning. This is an important life lesson that will prepare them for their future. It’s important to explain to children money doesn’t grow on trees, like they might think sometimes, it requires effort to earn money and it is limited, so you must be careful how you spend it.

For very young children, you can begin by exposing them to the idea of money and outlining its purposes. Using coins and bills in games and activities will show them the worth of money.

When kids are a little older, around 5 or 6 years old, is when you can start teaching them about saving properly. At this age, children can understand the concept of setting aside money for a specific purpose and learn fundamental financial ideas like budgeting.

It’s important to adjust your teaching approach to the children’s level of understanding. And the earlier you start teaching them about saving money, the more prepared they will be to make smart financial decisions in the future.

Here are some tips to help you get started:

Setting savings goals with your children

Identify simple goals such as purchasing a toy or a book, determining the cost of it, and how much time is necessary to achieve their goal. It can be simple as a pack of sweets in the grocery shop. Setting specific goals will help them stay motivated and focused.

You can make a savings chart on which they can track how their savings are building up. It will be a fun and visual way to remind them to keep saving.

This is an essential step in teaching your kids about financial responsibility and helping them develop good money habits. The sooner your child understands money, the sooner they’ll be able to build the foundations of their financial future.

Be a good example

Children learn by example, so it’s important to talk to your kids about your own savings goals and how you budget your money. For example, you can say you are saving for a new pair of trainers. So, in order to achieve that objective at the end of the month, you will stop buying the daily cup of coffee for 30 days.

Start saving with a piggy bank

A piggy bank is an easy way to teach your children the importance of saving. You can find piggy banks in all shapes and sizes, from traditional pig-shaped ones to ones that are designed to look like superheroes or animals.

Introduce a piggy bank and encourage them to put money regularly. This is a great lesson for them to learn about budgeting and financial management; also they can develop their math skills.

Show them their savings have more potential by investing

Teach them the concept of investing and compounded interests where you put your money into an account and see your money growing. You can add a few cents more during the night while they’re sleeping so when they wake up they will see there’s more money in the piggy bank.

This can provide a great source of motivation for your kids if they understand that their money will grow over time as long as they don’t touch it.

Start Building Your Child’s Dream Fund!

Open a savings account

Opening a savings account for your children can be a helpful step in teaching them to establish good financial habits. Take them on their first trip to the bank. You can encourage them to deposit the money they saved in the piggy bank or they can save part of their allowance if it’s the case. They can also save the money received from their christening, birthday celebrations, etc.

A bank account is useful for your children’s short-term goals such as saving to go to the cinema, or for a toy. It is important to highlight savings accounts typically offer a very low-interest rate and should be used for immediate goals. If you wish to save for long-term goals such as your children’s education it’s advisable to invest in funds.

Consider a Children’s savings plan for long-term goals

Investing in a fund can be an excellent way to save for a long-term goal such as a child’s education due to the possibility of larger returns than a standard savings account while still maintaining your purchasing power. If you wish to save for your kid’s college education you should consider a children’s savings plan.

Children’s Savings Plan is a regular premium, unit-linked savings plan. It allows you to invest in a range of investment funds at the start of the policy, and once you make your choice of funds, the fund choice applies for the life of the plan.

Opening a Child’s Savings plan is very simple, you can choose which funds you would like to invest, and how much you wish to put aside each month, it can be as little as €100. One of the financial advisors at LowQuotes can help you understand the risks and potential rewards of investing in a fund for your child’s education.

When you should start a Children’s savings plan

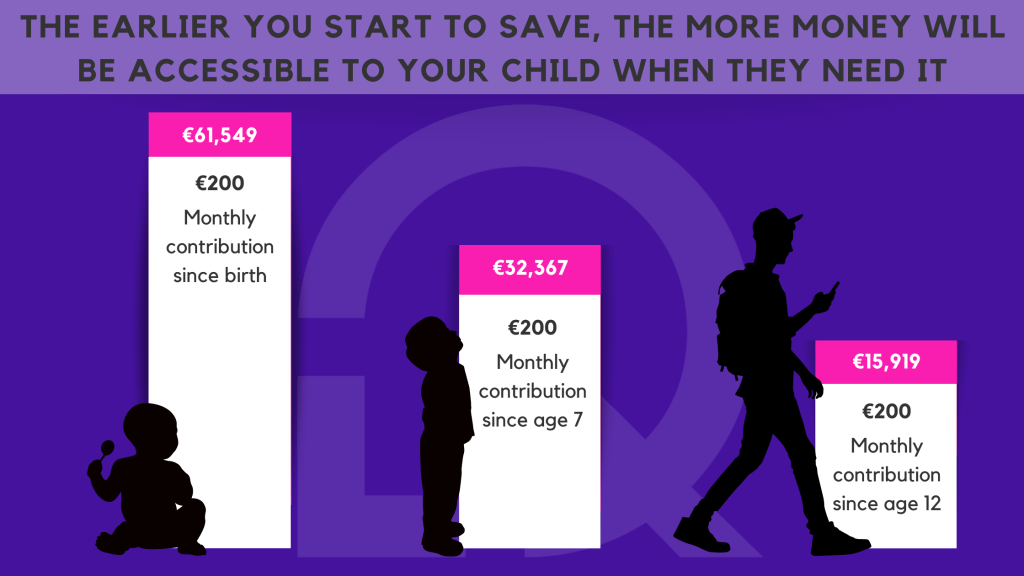

The earlier you start saving, the more money will be accessible to the child when they need it. Savings have more time to develop the earlier you start. By starting a savings plan early, you can give your child a strong financial foundation and help them achieve their dreams.

It’s a good idea to start a children’s savings plan as early as possible. This gives your child’s money more time to grow and can help them achieve their financial goals. But if you haven’t started it’s never too late, start as soon as you can.

When deciding on a savings plan for your child, consider your goals, budget, and how long you have to save. The image below shows the earlier you start saving the more your savings will build.

Planning for Their Future? Let’s Make It Happen!

How much you could save investing in Children’s savings plan

Investing in a children’s savings plan might generate substantial growth but the amount will depend on a variety of factors, such as the amount you wish to contribute, the length of time, and the level of risk you choose.

You even might want to invest your child’s benefit, the monthly payment to the parents or guardians of children under 16 years of age (or 17 if they are in full-time education or full-time training or have a disability and cannot support themselves).

Child Benefit is €140 a month for each child. This payment also known as children’s allowance could be invested to enlarge it.

If you invest €140 in a fund for 18 years you will have €30,240 saved up. Putting your money in a fund your savings can double. Instead of having only what you deposited €30,240 you may have €66,713. Investing in a fund can help protect against inflation, as investments have the potential to grow at a rate greater than the rate of inflation.

Investing in a bank’s regular savings, although is low risk, you will get no return. On the other hand, by choosing higher risks funds you might get the chance of higher returns as in the example below.

Regular Savings – you get exactly what you deposited

Child’s benefit | Years | Total – regular savings |

€140 | 18 | €30,240.00 |

Investing in a fund – you get what you deposited plus growth

Child’s benefit | Years | Total | Profit (estimate) | Total |

€140 | 18 | €30,240.00 | €36,473 | €66,713 |

How LowQuotes can help you choose the best Children’s Savings Plan

Low Quotes is an award-winning market-leading online insurance broker with a 5-star Google rating. We provide one of the best savings & investments advice in Ireland and our role is to guide you on how to manage your finances and have an effective plan projecting many years into the future.

We have a highly qualified team of financial advisors that can help you to make the best decision for your children’s financial future. By starting a children’s savings plan, you can invest in your child’s future and give yourself peace of mind knowing that they will have the financial resources they need to achieve their goals and dreams.

Secure Your Children’s Future Today!

Share this post

All our content has been written or overseen by a qualified financial advisor. However, you should always seek individual financial advice for your unique circumstances.

Warning: Past performance is not a reliable guide to future performance.

Warning: Benefits may be affected by changes in currency exchange rates.

Warning: The value of your investment may go down and up.

Warning: If you invest in these funds, you may lose some or all of your investment.