The most obvious benefit of switching mortgages is the cost savings on your monthly payments. You can potentially save hundreds of euros every month by switching your mortgage to another lender with a lower interest rate. Over the course of your mortgage, this can result in savings of thousands of euros. The big question is: why haven’t you switched yet?

If you haven’t decided about switching your mortgage you should make a decision sooner rather than later as you might be paying an additional €2,400 in mortgage repayments each year on average. This means savings of €48,000 or more over the remaining term of your loan. A substantial amount of money that you may either invest or utilise as a deposit for a second home. Or even can help you pay off your mortgage faster.

Our CEO, Shane Tobin explains the advantages of switching your mortgage, including lower interest rates, reduced monthly payments, and the potential to save thousands of euros over your mortgage term.

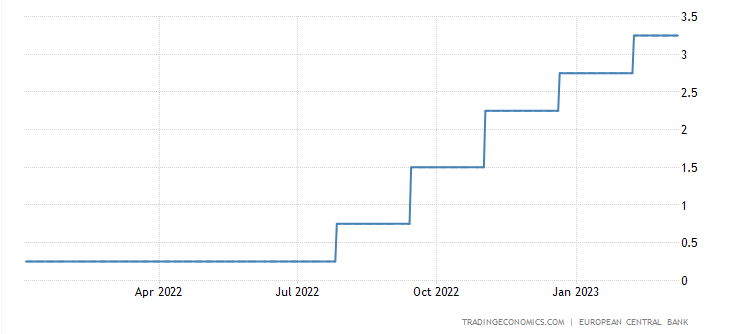

How rising ECB Interest Rates can impact your mortgage repayments

The most recent increase brought the deposit rate to 2.5% and the main lending rate to 3% in February 2023. Prior to that, in 2022, the ECB increased interest rates four times. And the Governing Council of the European Central Bank stated that it intends to raise interest rates by another 0.50% in March 2023 bringing the main lending rate to 3.5%.

The Central Bank of Ireland expects a recession and inflation for the Eurozone at 6.3% in 2023, which means there might be more interest rate increases to come.

ECB Interest Rates – April 2022 to February 2023

If you have a variable rate mortgage or a tracker mortgage, the ECB interest rates might have a major impact on your mortgage repayments. This is because the interest rate on these types of mortgages is usually linked to the ECB rate, which means that any changes in the ECB rate will be reflected in your mortgage rate. In other words, if the ECB raises its interest rates, your mortgage rate will also increase, which will lead to higher mortgage repayments.

If you have a fixed-rate mortgage, your mortgage repayments will not be affected by changes in the ECB rate during the fixed-rate period. However, when your fixed-rate period comes to the end your monthly repayments will increase. Lenders are required by law to tell you their cheaper options 60 days before your fixed-rate mortgage period ends.

However, they will only provide you with their best offer but this might not be the best deal available to you on the Irish market. That’s where we at LowQuotes can compare multiple lenders to guarantee you the cheapest rates.

Another situation is if your mortgage is a short-term fixed rate, you can break out of the fixed rate and lock into a long-term fixed rate in anticipation of the upcoming expected rate increases.

Remember that early termination of a fixed-rate mortgage may result in a penalty fee; however, in our experience, the cost of this fee should be weighed to any potential savings from changing your mortgage.

You must first check with your lender to determine whether there is a penalty before we can assess your situation and advise you on the best course of action for switching mortgages.

You should be aware of the impact of rising ECB rates on your mortgage repayments will depend on the size of your mortgage, the type of your mortgage, the interest rate on your mortgage, and the remaining term of your mortgage.

If you want to have an idea of what you could save by switching your mortgage each month, try out our Mortgage Switching Calculator or contact us, we will be happy to help you to give you the best advice on how to switch and save.

How much money can I save by switching my mortgage?

The amount of money you can save by switching your mortgage depends on a number of variables, including the current interest rates, the type of mortgage you have, the remaining duration of your mortgage, and any costs or potential penalties involved with moving.

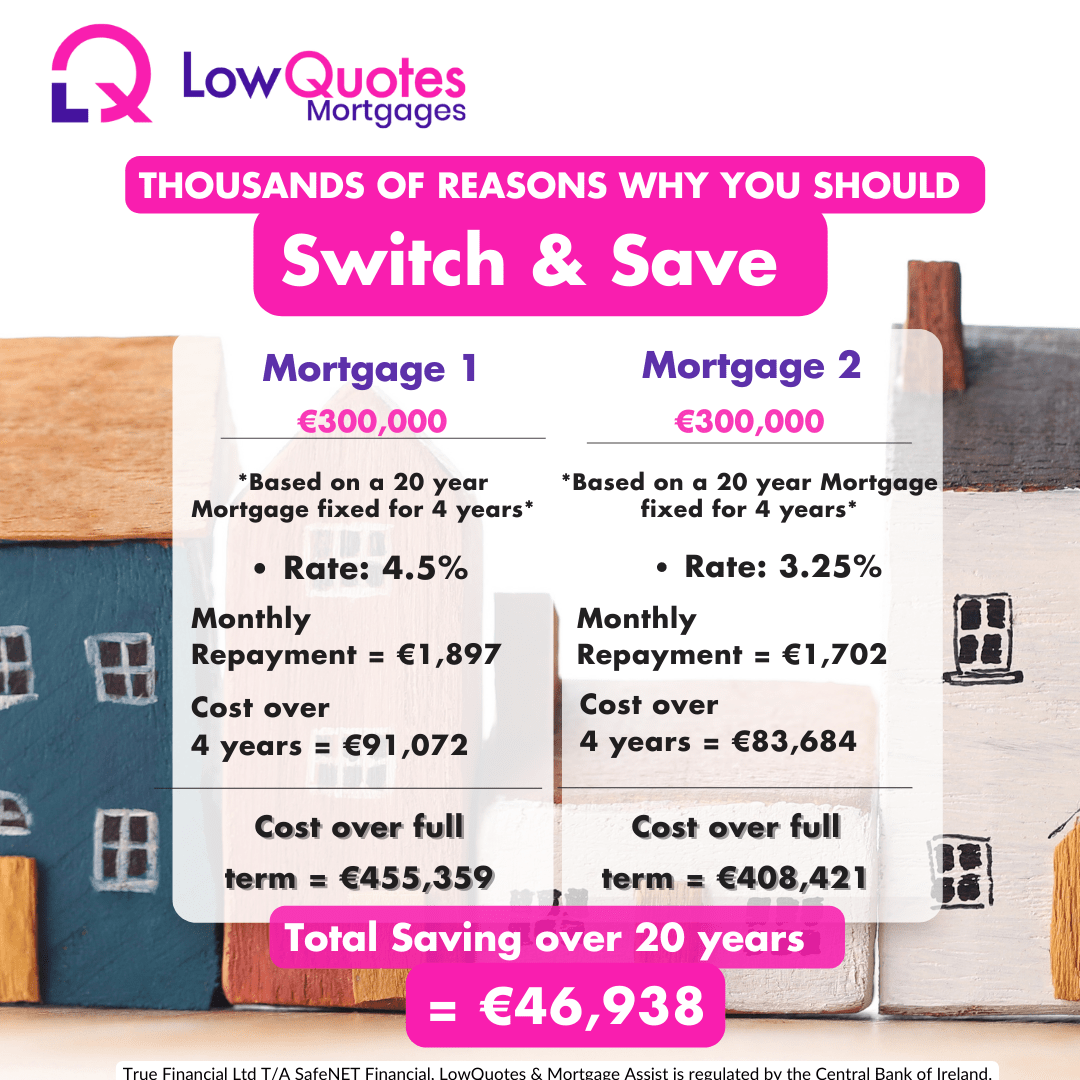

For instance, if you have a mortgage of €300,000 with a 4.5% fixed rate for 4 years and 20 years left to run, your monthly repayment would be about €1,897. The cost over 4 years would be €91,072 and €455,359 over the full term of your mortgage.

If you decide to switch your mortgage to another provider with an interest rate of 3.25% you would be saving €195 per month, €7,388 over 4 years, and €46,938 over the full term of your mortgage.

Note it’s only a difference of 1.25% and it doesn’t sound like a lot but if you put that money into a savings plan over 20 years you could pay for your child’s education, much-needed home renovations, overpay mortgage or whatever you want as it is your hard-earned money.

You also can use the money saved by switching your mortgage to top-up your pension to retire earlier or receive a larger pension upon retirement.

For example, if you contribute €195 net per month into your pension, with tax relief this would be a €325 gross contribution to your pension. By saving this extra amount of money over 20 years you would have an extra €135,000 in your pension pot (considering a 5.1% sector average annual rate of return).

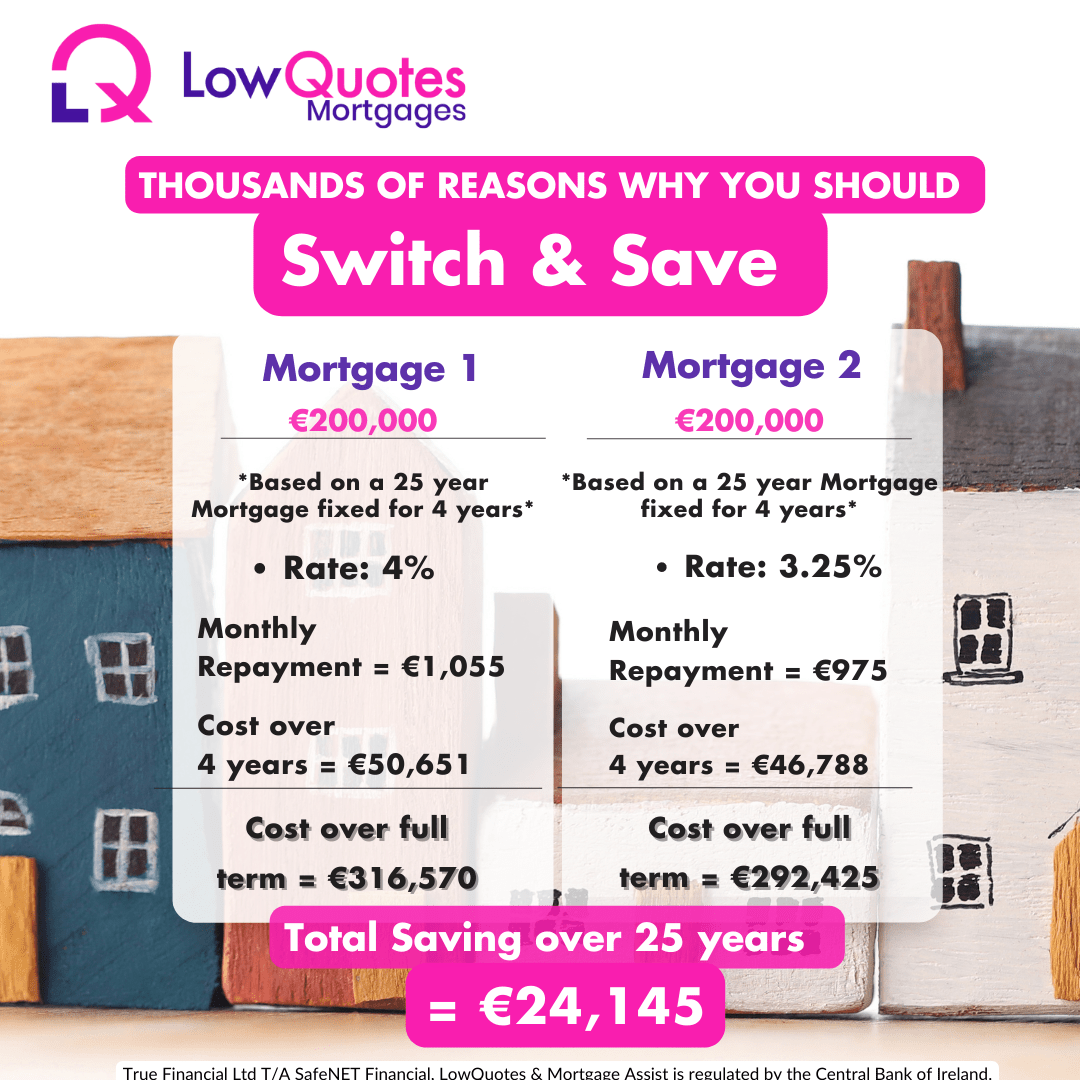

Another example:

Reasons why people don’t switch their mortgage

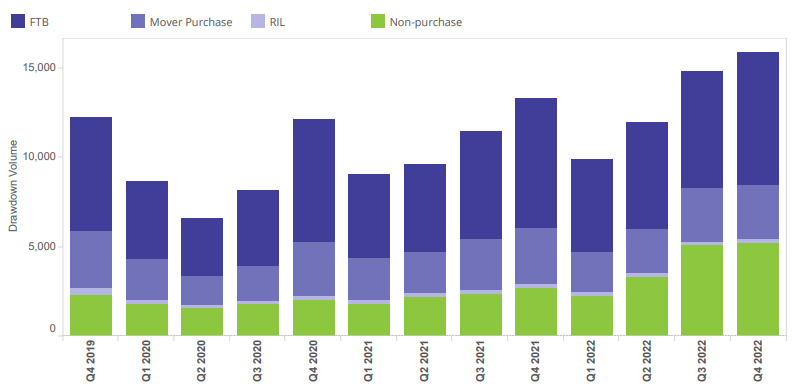

We can observe on the chart below non-purchase (switching and top-ups) mortgage drawdown volumes rose by 124.3% year-on-year to 5,199.

The BPFI report for January 2023 shows that despite a 2.1% increase in volume, non-purchase mortgages (switching and top-ups) approvals have slowed significantly from prior periods, according to the data. This shows that people are missing a huge opportunity to save money by switching.

There are many reasons why people might hesitate to switch mortgage even if they think they could save money by doing it.

Lack of knowledge on how switching mortgage works

Some people might be hesitant to change their mortgage because they are not sure what the process will involve or how long it will take. They might think there is a huge amount of work involved however Switching mortgages with LowQuotes is a very simple process.

The duration of the entire switching process will vary depending on a number of factors such as your application, the lender and their requirements, and solicitors. But in general, around 6 weeks is an accurate estimate.

If you want to have an idea of what you could save by switching your mortgage each month, try out our Mortgage Switching Calculator.

It’s too much effort

Firstly, if the person had a negative experience with applying for their first mortgage with a bank, switching can be intimidating and overwhelming.

Also, some people might think switching mortgages is time-consuming because it requires research and comparison of different lenders and rates. It involves a lot of gathering information and analysis to find the best option.

With LowQuotes, the process of switching can be smoother and less daunting than people anticipate. We compare multiple lenders for you saving you the hardship of visiting multiple banks. All you need to do is provide some quick details and book your switching appointment with us. We will find the lowest rate available so you can make significant savings on your mortgage.

Our state-of-art digital mortgage portal makes it possible for you to switch mortgages while being at home. You can upload your documentation and get approved for a new mortgage from within your portal, which simplifies and accelerates the entire process.

Watch our online system in action

They don’t know they can switch

If you are on a variable rate or even potentially a tracker rate there is no better time than now to switch your mortgage to the lowest rate available to you, to avoid further imminent rate increases by the ECB and lenders. Enquiries from concerned mortgage holders to our offices had experienced increases of over €500 per month, which, over a 10-year period, totals €60,000.

If you started on a fixed rate, and at the end of that fixed rate term your mortgage automatically reverted to a variable rate, then your monthly payments will increase. Switching your mortgage might save you thousands of euros per year by getting a lower interest rate.

Another situation is if your mortgage is a short-term fixed rate, you can break out of the fixed rate and lock into a long-term fixed rate in anticipation of the upcoming expected rate increases.

Remember that there may be a penalty fee if you exit a fixed-rate mortgage early. However, based on our experience, switching could potentially result in savings that outweigh the expense of this charge. If there is a penalty we can analyse your situation and advise you on what is the best move towards switching your mortgage.

How easy is it to switch mortgages?

Choosing LowQuotes can make the process of switching mortgages easier and more efficient due to many reasons:

Access to multiple lenders

Switching your mortgage can be a tricky process if you want to apply with lenders and banks directly, not to forget that some lenders don’t deal with the general public, they are only available through a mortgage broker. We have access to multiple lenders and we compare rates and terms to find the best option for your needs.

Negotiate on your behalf

We can negotiate with mortgage providers on your behalf to help you get the lowest interest rates and best terms to fit your needs.

Expert Guidance

We are a market-leading online mortgage broker in Ireland and we can provide expert advice and guidance to make the process of switching mortgages seamless and easy.

Straightforward application process

All you have to do is click ‘Book a switching appointment’, enter some quick details and one of our mortgage advisors will contact you on the date & time you specified.

After your call you will be sent a link to our online application portal, which streamlines the mortgage switching process, allowing you to upload your documents and get the approval online for your new mortgage.

How simple your Mortgage switch process will be

Switching Consultation

Book a switching appointment online and get a call or a zoom call from one of our mortgage Advisors at a time that suits you best. We’ll discuss your needs, analyse your financial situation and help you find the best deal.

Online Application

You will receive a link to our online mortgage switching portal, allowing you to upload your documents & get the approval online. Check the list of documents here.

Online Approval & Saving

Once your lender has approved your loan, your next mortgage repayments will be reduced.

Book your switching mortgages appointment with the best online mortgage broker in Ireland

Low Quotes is a market-leading online insurance broker in Ireland with a 5-star Google rating and 25 years of experience. We are proud to be awarded as Insurance Broker of the Year 2022 as the result of our team’s dedication to providing market-leading independent advice and exceptional customer service.

You can book your appointment at the date and time that suits you better and you’ll get a phone call or a zoom call from one of our mortgage advisors.

We also provide a wide variety of financial services in Ireland such as Life insurance, Pensions, Financial Planning, Savings & Investments. If you have any questions about one of our services, feel free to contact us today.

Take control of your finances and make the smart decision to switch your mortgage!

All our content has been written or overseen by a qualified financial advisor. However, you should always seek individual financial advice for your unique circumstances.

Warning: You may lose your home if you do not keep your repayments.

Warning: The cost of your monthly repayments may increase.

Warning: You may have to pay charges if you pay off a fixed-rate loan early.

Warning: If you do not meet the repayments on your loan, your account will go into arrears. This may affect your credit rating, limiting your ability to access credit in the future.

Warning: The entire amount you have borrowed will still be outstanding at the end of the interest-only period. The lender may adjust the payment rates on this housing loan from time to time. (Applies to variable-rate loans only).