Table of Contents

Retirement could take up to a third of our life, that’s why having a Pension Plan in place is essential to make sure you will live comfortably in your golden years.

Pensions can be a confusing and overwhelming topic, there are many rules, regulations, and options to consider; it can be difficult to know where to start. That’s why we’ve compiled the most important questions to provide you with the necessary information you need to make informed decisions and ensure a comfortable retirement.

What is a private pension in Ireland?

A private pension in Ireland is designed to help individuals save for retirement and provide an additional source of income in addition to the state pension.

If you are employed, you may be covered by an employer-sponsored occupational pension scheme or relevant public-sector scheme.

If you aren’t covered by these or if you are self-employed, you may be able to take out your own Personal Pension, such as a Personal Retirement Savings Account (PRSA).

What’s the difference between State pension and private pension in Ireland?

The main difference between the state pension and private pension in Ireland is that the state pension is provided by the government and is available to all eligible individuals who have made the required social insurance contributions, while a private pension is set up and funded by an individual or their employer.

Usually, people start a private pension in order to supplement their state pension after retirement. This is to ensure the desired standard of living in retirement, as the state pension might not be sufficient to do this.

Why should I have a private pension in Ireland?

A good pension pot can help you ensure that your retirement years are spent doing the things you love the most like travelling, retiring to the country, or spending quality time with the grandkids.

Unfortunately, relying solely on the State Pension of €289.30 per week (as of 2025) might not be enough to secure a comfortable retirement. Taking into account the bills and expenses you might have after retirement it’s highly likely you will need another pension arrangement in place other than the state pension to support you financially when you retire.

This is why it’s important to start a pension plan as soon as possible. Lowquotes can help you find the best pension plan to fit your needs and budget, ensuring that you have the financial security you need in retirement.

What is a PRSA?

A PRSA (Personal Retirement Savings Account) is a personal pension plan that you can use to save for retirement.

You can make regular and/or lump sum contributions to your PRSA, and you get income tax relief on the contributions you make, within certain limits set down by Revenue.

A PRSA provides many benefits, including:

- Income tax relief on contributions.

- Employers can also contribute and receive tax relief whether it’s a sole trader or a limited company.

- Tax-free growth on investments.

- A retirement lump sum of up to 25% of the fund with a tax-free limit of €200,000.

- Choice of options at retirement: Annuity or ARF/vested PRSA. Vested PRSA / ARF options at retirement give the opportunity for inheritance planning and passing unused benefits to the estate on death

Can I have a separate personal pension and a PRSA at the same time?

Yes, however, the total contributions to both are taken into account when determining your age-based maximum tax relief.

It’s important to note there are some PRSA for key employees and directors that are not subject to age-based funding. Contact one of our advisors for personalised and expert guidance with your pension-related queries.

Retirement is closer than you think. Get a Pension Quote Today!

What happens to my pension when I leave a company?

When you leave a job, what happens to your pension depends on the type of pension scheme you have and the conditions of that specific scheme. The three main options are

- Leave the Pension where it is: In some cases, you may have the option to leave your pension funds in the scheme, allowing them to continue growing until your selected retirement age.

- Transfer to a new employer’s scheme: If the job you’re moving to offers a pension scheme, you might have the option to transfer your pension savings to the pension plan of your new employer.

- Transfer into a Personal Retirement Bond (PRB).

It’s important to review the specific terms and conditions of your pension scheme or you can contact LowQuotes for personalised guidance on the best course of action based on your individual circumstances.

How do I choose a pension provider in Ireland?

When choosing a private pension provider in Ireland, it is important to consider factors such as personal circumstances, work situation, fees, investment options, and the provider’s track record.

At LowQuotes, our advisors can guide you through the process of choosing the best provider that meets your needs and help you make an informed decision.

Can I put a lump sum into a pension?

Yes, you can top up your pension with a lump sum as well as with regular contributions with Additional Voluntary Contributions (AVC).

This option is available for both a personal pension and a PRSA (Personal Retirement Savings Account).

The benefits of making AVC are:

- Top up your pension at any time so that you receive a larger pension upon retirement.

- You may be able to retire earlier with the help of an AVC by filling in the gaps in your pension payments.

- Avail of tax relief on investments depending on your marginal rate of tax.

- Choose to make contributions to your pension through your company or privately.

- You can increase, decrease, pause, or restart your AVC contributions at any time.

- Tax-free investment growth.

Can I increase my pension contributions?

Yes, you can usually increase your pension contribution whether you have a personal pension, an occupational pension, or a PRSA (Personal Retirement Savings Account).

You can make Additional Voluntary Contributions – AVC to increase retirement savings, maximise tax relief, potentially boost your pension fund’s growth over time, and enable you to retire early.

Is there a limit to how much of my earnings I can contribute and for which I can claim tax relief?

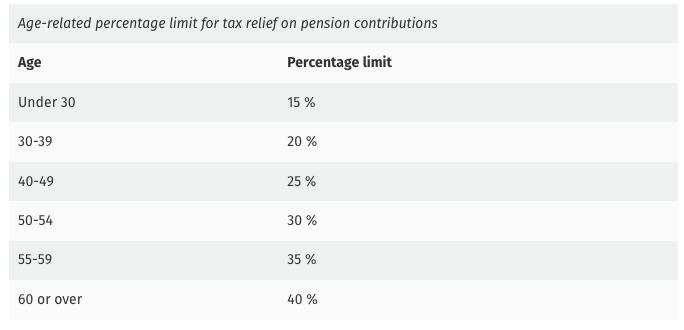

Yes. There are age-related contribution limits for pension contributions made by individuals, regardless of whether they are employees of companies or self-employed.

For example, an employee who is aged 42 and earns €40,000 can get tax relief on annual pension contributions up to €10,000.

The maximum annual earnings taken into account for calculating tax relief is €115,000.

Retirement isn’t a dream, it’s a plan. Get a pension quote today.

Can I cash in my company pension?

Usually, company pension plans are designed to be accessed after retirement. However, if you are in ill health and unable ever to return to work you might be able to retire early at any time.

In some cases, if you have left your employment with less than 2 years of service you can access your funds.

It’s important to remember that if you access your pension early, the funds may not be as high as they would be if you waited until the Normal Retirement Age (NRA).

Contact one of our qualified financial advisors to review your personal situation and provide personalised guidance based on your pension scheme.

How much pension do I need?

The amount of pension you need will vary depending on several factors such as living costs, lifestyle, and personal circumstances.

According to Numbeo, Ireland is the 13th most expensive place in the world to live, so you’re going to need a substantial amount in your pension pot.

There are some general guidelines that can help you have an idea of what amount of pension you might need. Based on the assumption that your expenses might decrease in retirement, you can aim for 70-80% of your pre-retirement income.

You can also use our Pension calculator to determine the pension contributions you’ll need to make in order to provide your desired retirement income.

Can I transfer my private pension to another provider?

Yes, you can transfer your private pension to another provider if you wish.

There are several reasons why you might consider transferring your pension, such as seeking better investment options, consolidating multiple pensions into one, or moving to a provider with lower fees.

Our qualified financial advisors can help you to make an informed decision that aligns with your financial goals and personal circumstances.

Do I need a pension review?

It’s important to review your pension plans regularly to avoid a shortfall in retirement.

Here are some reasons you may benefit from a pension review:

Changes in personal circumstances: If you have had significant life events such as marriage, divorce, the birth of a child, or change of employment, it might be a good time to review your financial goals and retirement plans.

Age-related adjustments: As you approach retirement age or if you have already reached it, a pension review is crucial to determine if your retirement strategy is still in line with your goals.

Making the most of pension benefits: Reviewing your pension arrangements can help you maximise your pension benefits. Consolidating multiple pension plans, optimising investment possibilities, and considering options for tax efficiency are some of the strategies you can make use of to make the most of your pension benefits.

Pension regulation changes: Pension regulations and legislation can change over time, potentially affecting the options and benefits available to you. By doing a pension review, you can make sure your pension plans are compliant with current laws and that you are taking advantage of any new opportunities or incentives.

If you’re not sure about your current pension plan, investment performance, or what benefits you’re entitled to, we can review your pension and help you understand your pension scheme, explore potential areas for improvement, and make informed decisions regarding contributions, investments, or benefit options.

What are your options near retirement?

As you approach retirement, you might feel your retirement fund may not be as large as you wish, or you might not be sure what the next steps are. Here are some common options:

– Review your pension strategy: Reviewing your pension arrangements is crucial to understand if your current pension plan is in line with your retirement goals and what you can do to improve it.

– Make Additional Voluntary Contribution (AVC): AVC means extra contributions you can make in addition to you existing company pension.

– Buy a Personal Retirement Bond (PRB): If you have pension funds from previous employments, you can transfer them into a Retirement Bond. This consolidates your pension savings into one account and provides you with more flexibility and control over your retirement funds.

– Tax-free Lump Sum: You’re entitled to take a cash lump sum from your pension policy. That’s normally up to 25% of the policy value and it is tax-free subject to a limit of €200,000. The next €300,00 will be taxed at 20% and anything more than €500,000 will be treated as income and taxed under the PAYE system.

– Consider Annuity options: after taking your retirement tax-free lump sum you may be able to choose an Annuity. This is a simple retirement payment option that guarantees to pay you a particular amount every month throughout your life in retirement.

Seeking financial guidance is very important in this case as there are mortality-related considerations.

– Consider investing in an Approved Retirement Fund (ARF): An ARF is a personal investment account into which an individual can (in certain circumstances) transfer part of their retirement fund, instead of using those funds to buy an annuity or take as a taxable lump sum.

Your future self will thank you. Get your pension quote today.

Why you should seek expert advice from LowQuotes

Whether you are just starting your career or nearing retirement, we have a wide range of pension options and investment strategies to suit your personal goals.

At LowQuotes, we are dedicated to assisting you in selecting the ideal private pension plan in Ireland. With our expert knowledge and extensive experience in the field, we understand the importance of securing your financial future.

We offer personalised guidance tailored to your specific needs and goals, taking into account factors such as your age, retirement aspirations, risk tolerance, and financial circumstances.

Let us be your trusted partner in navigating the complex landscape of private pensions, ensuring a comfortable and prosperous retirement for you.

We provide various financial services, such as life insurance, income protection, mortgages, serious illness cover, pensions, financial planning, health insurance, and savings & investments.

Share this post

All our content has been written or overseen by a qualified financial advisor. However, you should always seek individual financial advice for your unique circumstances.

Warning: You may lose your home if you do not keep your repayments.

Warning: The cost of your monthly repayments may increase.

Warning: You may have to pay charges if you pay off a fixed-rate loan early.

Warning: If you do not meet the repayments on your loan, your account will go into arrears. This may affect your credit rating, limiting your ability to access credit in the future.

Warning: The entire amount you have borrowed will still be outstanding at the end of the interest-only period. The lender may adjust the payment rates on this housing loan from time to time. (Applies to variable-rate loans only).

1 thought on “The Essential Guide to Pension and Retirement Planning”

Comments are closed.