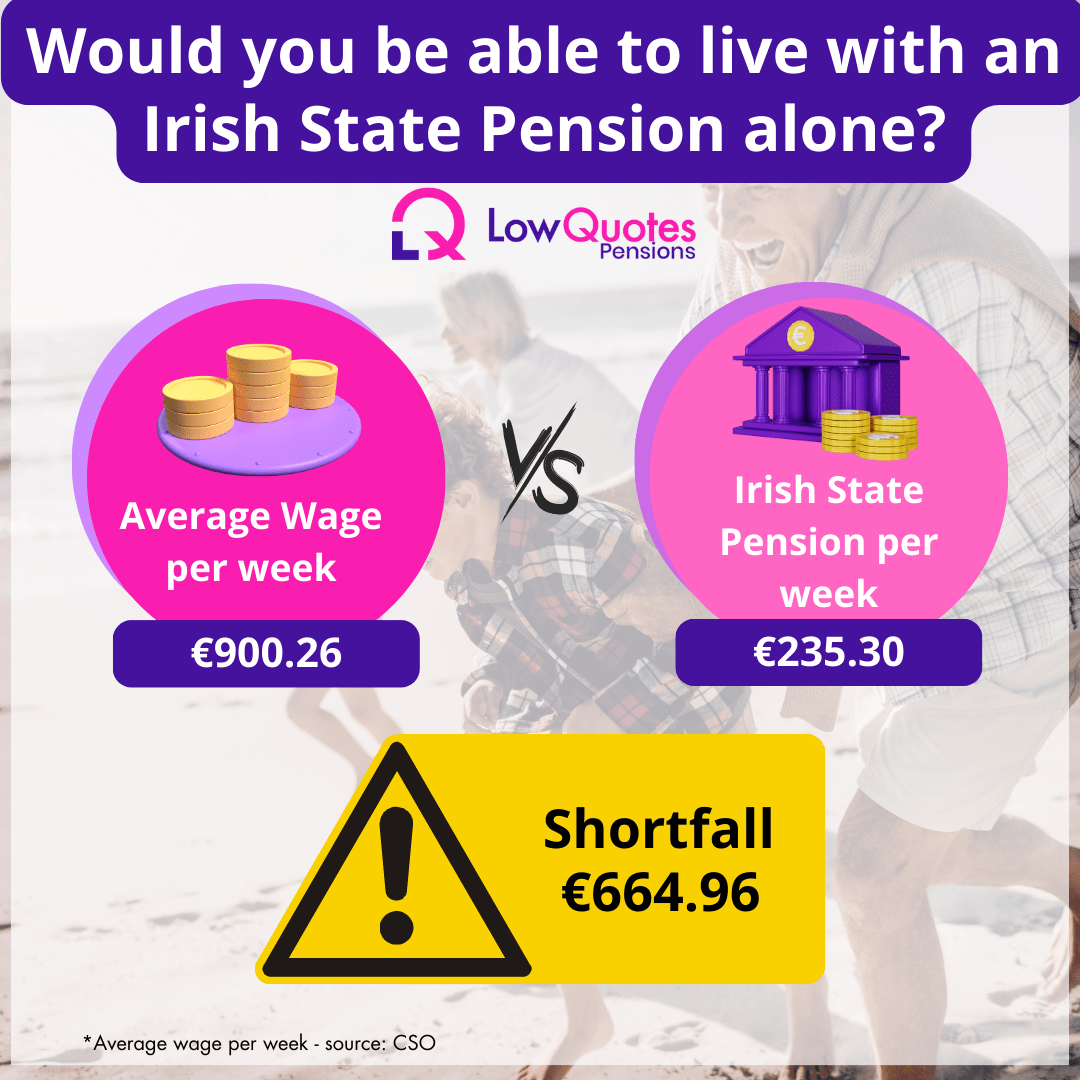

Contrary to what some people may believe, a private pension is not a luxury but a necessity in today’s world. Relying solely on a state pension to provide a comfortable lifestyle after retirement might not be possible due to the rising cost of living, and rising life expectancy.

A private pension provides a vital safety net to ensure financial security and independence in your golden years. Also, a private pension is a wise and effective way to save for retirement due to the availability of income tax relief on pension contributions.

When should I set up a private pension?

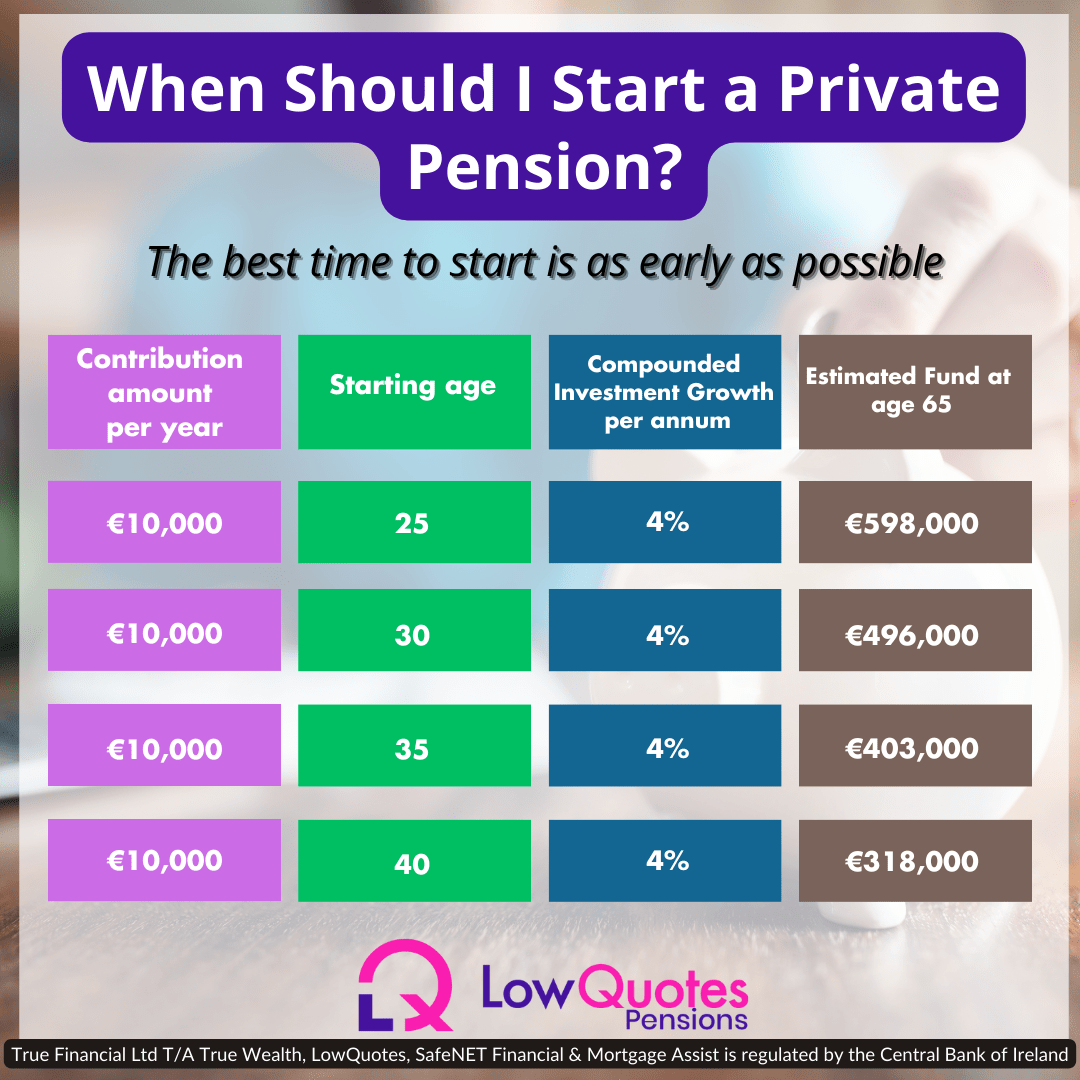

The ideal time to start a private pension in Ireland is as early as possible. The earlier you start saving for retirement, the longer your contributions will have to grow and take advantage of compound interest.

We recommend starting a private pension in your 20s or 30s when you have a longer time horizon for investment and can make regular contributions over several years. However, there is always time to start a private pension, even if you’re in your 40s, 50s, or beyond. Keep in mind that any amount you put into your retirement pot is better than not saving at all.

If you are not sure when or how to start your pension, our financial advisors can help you choose the best retirement plan to meet your retirement goals. We can also evaluate your entire financial picture and build a financial planning that will help you define and prioritise your financial goals. Read our article about How to set financial goals for your future in your 20s, 30s, 40s, 50s and 60s.

Who can set up a private pension?

Private pensions are accessible to a variety of people, and eligibility isn’t limited to particular groups. The following people are qualified to establish and make contributions to private pensions:

Employees: Employees with either a full-time or part-time contract, as well as those who have temporary contracts, or casual jobs, are allowed to set up a private pension. As part of their employment benefits, employers often offer occupational pension plans to which employees can make contributions.

Self-employed individuals: Self-employed individuals have the opportunity to set up and contribute to a private pension making regular contributions or a one-off contribution. This includes sole traders, freelancers, contractors, and business owners.

Individuals with multiple employments: If you hold many jobs at the same time or throughout your career you can establish separate private pensions for each employment.

There are specific rules, contribution limits and different tax benefits for each type of pension. Contact one of our award-winning advisors to know the eligibility criteria and options available based on your specific situation.

Which type of pension plan should I choose?

With a wide range of pension options to choose from, let us help you explore the main types of pensions available on the Irish market at present and their key features, so you can decide which one best suits you.

There are several types of private pensions available in Ireland, including:

Personal Retirement Savings Accounts (PRSAs)

A Personal Retirement Savings Account (PRSA) is a personally owned pension that lets you save for retirement on your own terms. They are flexible, meaning you can increase, decrease or stop your contributions at any time without any charge or penalty.

PRSAs are portable pensions, so you can transfer them between different jobs and pension providers. You can use a PRSA if you’re self-employed or an employee. If you are already a member of a pension scheme you can top up your existing pension with a PRSA AVC. You can get tax relief at your marginal rate.

A PRSA is for everyone, regardless of employment status. You can use it if you are self-employed, a contractor, an employer, an employee, or a partner in a partnership.

There is no legal obligation for an employer to set up or contribute to a pension scheme. If your employer doesn’t have a pension scheme or if you are an ‘excluded employee’, your employer will need to provide you with access to at least one standard PRSA.

Occupational Pension Schemes

Also known as ‘company pension plans’ these are workplace pensions employers offer to their employees. The advantage is that your employer can contribute towards your pension also.

Occupational pension schemes may be Defined Benefit (where the pension amount is based on salary and years of service) or Defined Contribution (where the pension amount depends on contributions made and investment performance).

The Employers’ contributions do not affect your personal limits.

Personal Pension

A personal pension is held in your name and it can only be funded by you, as opposed to an occupational pension plan where your employer may contribute to your pension.

In terms of suitability, fees, and investment fund selection, a personal pension is frequently a better option, especially if you are a self-employed/sole trader and plan to stay that way in the foreseeable future.

Executive Pension

An Executive Pension is a pension set up by the Ltd company for the benefit of the Directors/Employees of the company. The pension is set up under a Master trust with the pension provider.

With an Executive Pension both employees and employers can make contributions. The ultimate value of your pension plan will depend on the contributions that have been made over the years and the investment return the funds have achieved in your Executive Pension.

How to Start a Private Pension in Ireland

Starting a pension can be daunting, especially if you’re not familiar with the process and financial concepts. Here is some guidance to help you get started with your pension plan.

Research Pension Options: Take the time to learn about different pension options, contribution limits, tax benefits, and investment strategies. This will help you understand the basics of pension planning.

Set your retirement goals: Begin by defining your retirement goals and what kind of lifestyle you wish to have when you wish for your golden years. Also, consider factors such as your retirement age and estimated expenses during retirement. This will help you determine the amount you need to contribute and the timeframe you have to achieve your goals.

Seek professional advice: LowQuotes can provide personalised guidance based on your specific situation. We can help you navigate through the complexities, explain the options available to you, and assist in creating a pension plan tailored to your needs.

Make use of online tools and calculators: We offer a pension and retirement calculator to help you estimate your retirement income needs, assess the impact of different contribution levels, and project the growth of your pension fund. These tools can provide valuable insights and help you make informed decisions.

Assess your current financial situation: Review your current investments, savings, pension plans, and other benefits you may be receiving. You can use this as a starting point to calculate how much additional money you’ll need to save for retirement.

Determine your risk tolerance: Your degree of comfort with investment risk depends on how much risk you can take. Take into account how long you plan to work before retiring, your financial objectives, and your ability to cope with changes in the value of your investments. investments.

Choose a pension provider: Choose a reliable pension provider that offers the retirement plan of your choice. Don’t worry if you’re not sure, we can give you professional advice to help you make informed decisions and increase the likelihood of achieving a financially stable retirement.

Tax relief on pension contributions

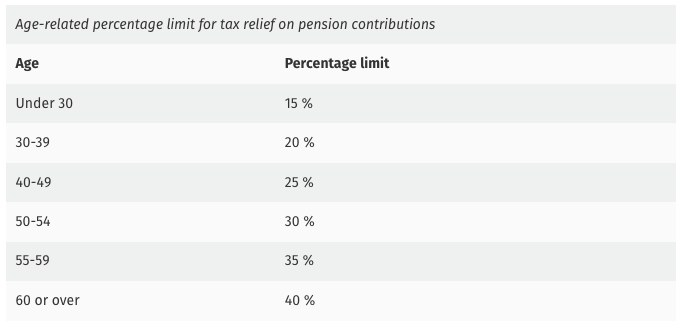

Tax relief is a key advantage for contributions to private pensions in Ireland. Individuals can contribute up to a certain percentage of their earnings annually, subject to certain limits.

The current tax relief rates are:

- Standard rate taxpayers: 20% tax relief on contributions.

- Higher rate taxpayers: 40% tax relief on contributions.

The maximum allowable earnings for tax relief purposes are €115,000 per year.

Age-related earnings percentage limits for employees

If you are an employee the Tax relief for your pension contributions is subject to two main limits:

- an age-related earnings percentage limit

- a total earnings limit

You can get tax relief up to the relevant age-related percentage limit of your earnings in any year.

If you have multiple sources of income, the relief only applies to the income for which the contributions were made.

For example, an employee who is aged 42 and earns €40,000 can get tax relief on annual pension contributions up to €10,000.

The maximum amount of earnings taken into account for calculating tax relief is €115,000 per year.

Setting Up Your Pension with LowQuotes

If you want to start your pension and ensure a stable retirement contact us and we can guide you throughout the whole pension process. LowQuotes can help you determine the appropriate pension plan and contribution levels based on your personal situation and retirement goals. You can also read our guide to Pension and Retirement Planning.

Low Quotes is a market-leading online insurance broker in Ireland with a 5-star Google rating and 25 years of experience. We are proud to be awarded as Insurance Broker of the Year 2022 as the result of our team’s dedication to providing market-leading independent advice and exceptional customer service.

Let us be your trusted partner in navigating the complex landscape of private pensions, ensuring a comfortable and prosperous retirement for you.

All our content has been written or overseen by a qualified financial advisor. However, you should always seek individual financial advice for your unique circumstances.

Warning: You may lose your home if you do not keep your repayments.

Warning: The cost of your monthly repayments may increase.

Warning: You may have to pay charges if you pay off a fixed-rate loan early.

Warning: If you do not meet the repayments on your loan, your account will go into arrears. This may affect your credit rating, limiting your ability to access credit in the future.

Warning: The entire amount you have borrowed will still be outstanding at the end of the interest-only period. The lender may adjust the payment rates on this housing loan from time to time. (Applies to variable-rate loans only).