Financial planning is a process through which a person can evaluate their entire financial picture and prepare for short to long-term financial goals. Financial planning doesn’t only involve investment management such as specific investment portfolios. It incorporates other elements such as tax and insurance planning, mortgage planning such as preparing for a new mortgage or switching mortgages to save money, pension planning, and everyday household expense management.

How to set financial goals for your future in your 20s, 30s, 40s, 50s and 60s

No matter what life stage you are in, it is important to have a financial plan in place to reach your needs and goals. Your financial needs, desires, and demands are going to change throughout your life as circumstances change. Here are some points to consider at different stages of your life and why financial planning is essential.

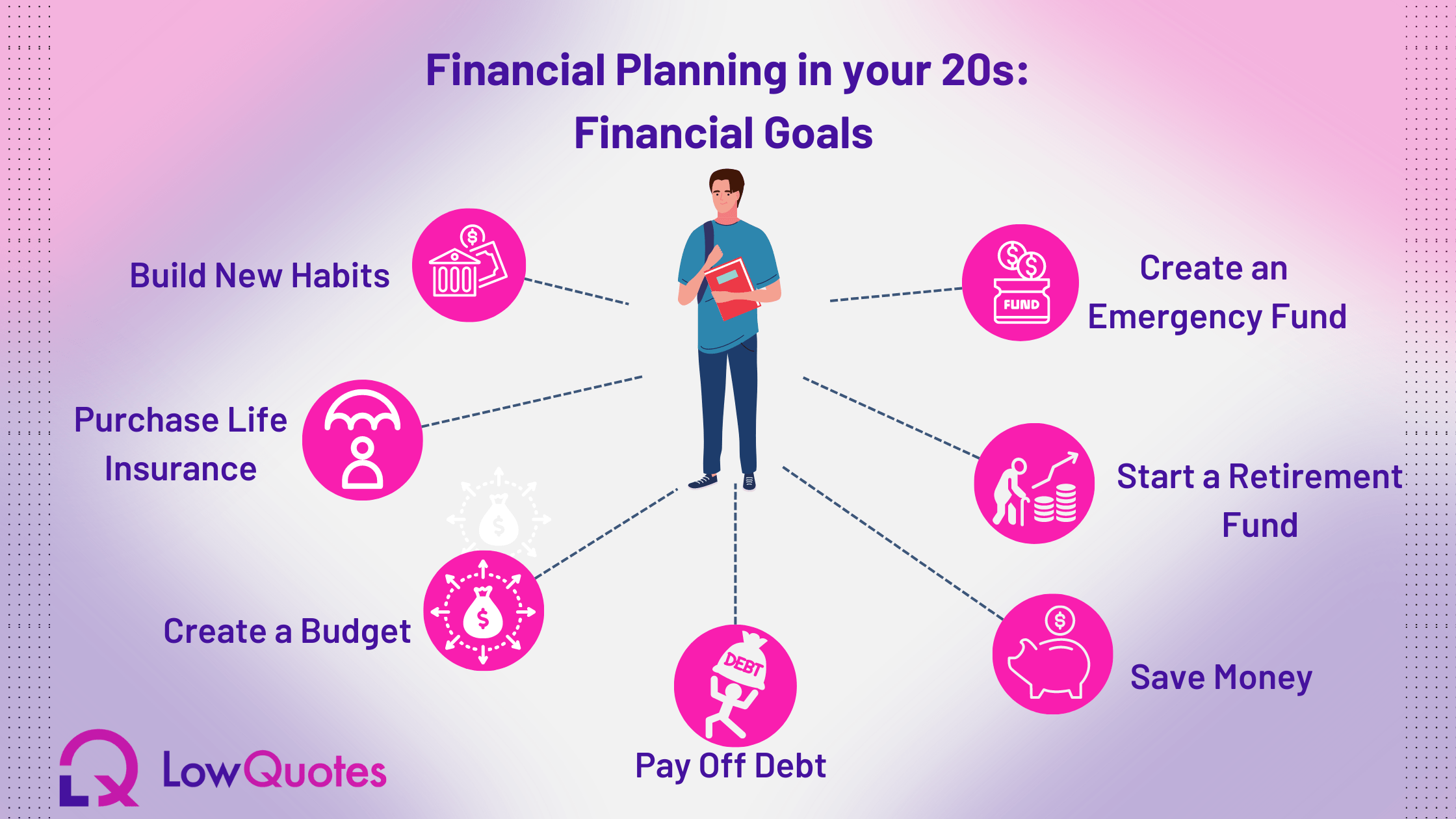

Financial Planning in your 20s

Your early 20s are a time for discoveries, new friends, new jobs, and new towns. But at the beginning of your adult life, mistakes are only natural. The actions you take in your 20s can have a significant impact on your financial future. That’s why it’s important to start building healthy financial habits now so that you’ll benefit later and why it’s crucial to start financial planning at this stage.

Even if you are 25 years old and don’t have children, you can still benefit from financial planning. At this stage of your life, you may be focused on paying off student loans, building your career, and establishing financial independence. A financial planner can help you to create a plan to outline these goals, to visualise what age you are likely to hit these goals at, and prepares you better for the future.

Some specific goals of financial planning for a 20-year-old might include:

Build new habits

Working on your finances can seem like a long process, but taking it one step at a time and developing healthy money habits will help you manage your finances and start a better future for yourself.

Create a Budget

It might be the most obvious piece of advice but this can be easily overlooked. The best way to get your finances on track is to make a detailed, realistic budget that you can stick to. To start, you can write down your income and expenses to determine your spending. You might want to use a spreadsheet to do this. At the start of the month, set up a budget and track your spending over the course of the month. This way you will have an overview if you are stuck to the budget or not.

Pay off debt

If you have any student loans, credit card debts, or other debts, it’s time to think about how you plan to clear any debt you may have. Although it might take a while to pay off an entire student loan balance or car loan balance, you should take the steps needed to work toward that goal. Take the time to set up a debt payment plan so that you can get out of debt sooner rather than later.

Create an Emergency Fund

Even at a young age, it is important to start saving for the future. An emergency fund is like a pool of money that you keep for unplanned expenses. When unexpected life events happen, the fund will act as an insurance policy for your financial outgoings if you were to become ill or injured. In the perfect scenario, you should have an Income Protection policy in place so that your “Emergency Fund” is better suited towards saving for your future goals.

Start a Retirement Fund

The amount you will need to be financially secure in retirement depends on the lifestyle you would like to have. It is important when planning your retirement to ensure you will build up a substantial pension fund by your retirement age. Our pension & retirement calculator can help you with your retirement planning and will show you how much you need to put away for retirement.

Purchase a Life Insurance policy

The best time to buy life insurance is when you’re young and healthy. As a general rule, the earlier you buy a policy, the less you’ll pay. This is because, at a younger age, you’ll qualify for lower premiums that won’t increase for the length of the term you choose. This means you will be making significant savings by acting now.

Save for Short and Mid-Term Goals

If you intend to buy a car or get a mortgage, planning is necessary to succeed in your objectives. Putting very clear time frames on all the goals you want to achieve will help you identify concrete steps to get there. The bigger your Mortgage deposit, the better your loan-to-value ratio (LTV). So, if your deposit is more than 20%, your monthly mortgage payments will be less with a First Time Buyer Mortgage.

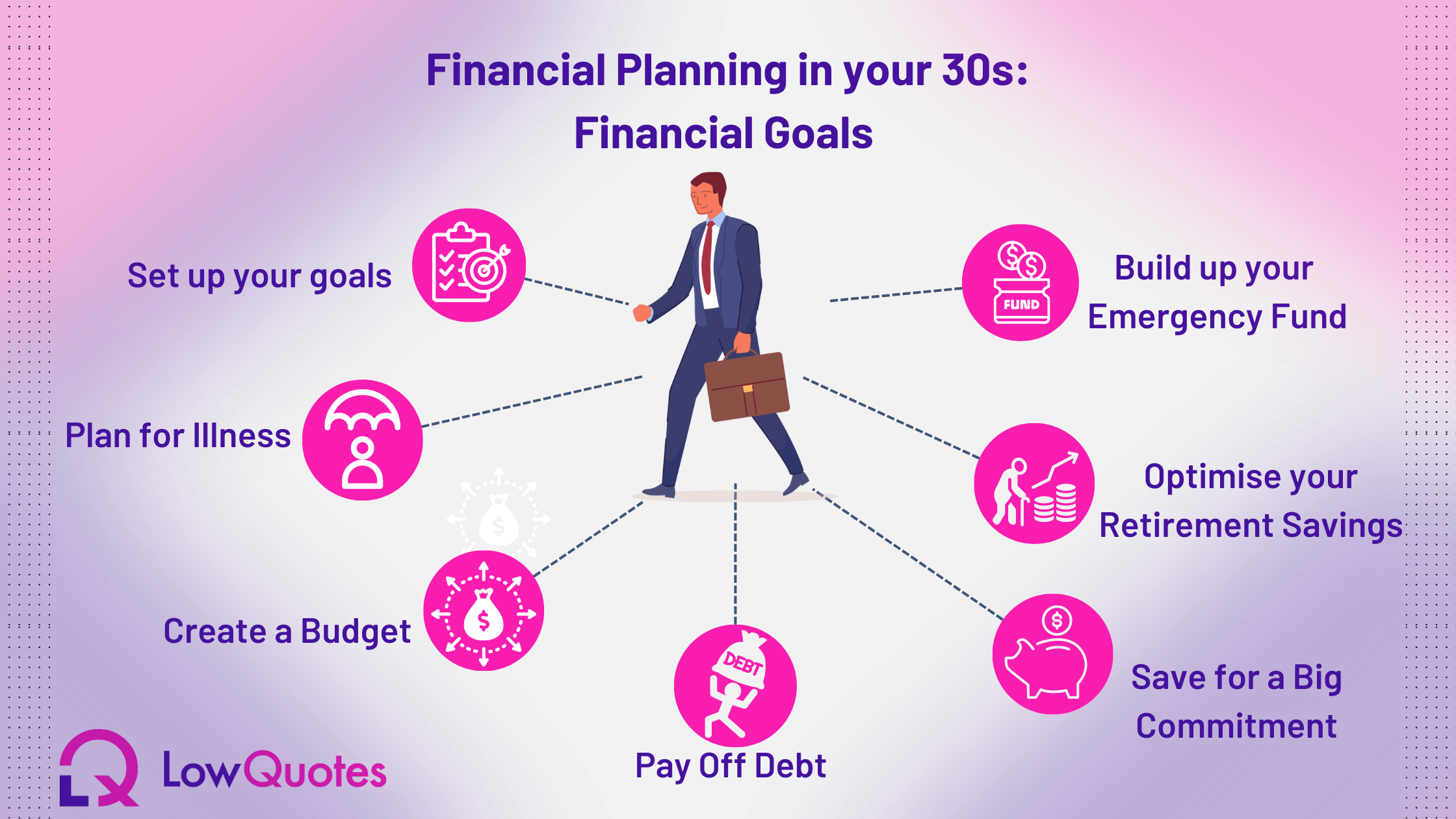

Financial Planning in your 30s

At this stage, you might have met many of your personal milestones, whether that’s starting a family, or advancing in your career. Your first step to financial planning in your 30s is to understand where you are today and where you want to be in your future.

Here are some key things to consider when financial planning in your 30s:

Set up or re-evaluate your goals

That’s the most important part of your financial planning process. Once you’ve identified what’s important in your future, you need to figure out what is achievable in the short, mid-range, and long term. Your goals will vary depending on your personal circumstances and your priorities. Whether it is buying a house, retiring early, or even traveling the world, a solid financial plan will help you to set your objectives, implement changes and visually show you when you should meet your objectives.

Create a Budget

It is essential that your financial plan includes a budget because it will help you visualise how much money you get, spend and save. Setting up a budget in your 30s can help you stay on track with your financial goals to avoid overspending. The 50/20/30 rule is an easy way to budget and help you manage your money effectively. Basically, this rule allows you to spend 50% of your income on your needs, 30% on your wants and put the remaining 20% into an emergency fund. It can be a good way to manage your money.

Save for a Big Commitment

In your 30s, many consider buying a home. We can guide you through the process, from saving for a deposit to choosing the right mortgage.

Stop spending your whole paycheck, if you are thinking about buying a house or getting married, for example, you have to start saving now.

Sometimes we get sidetracked and if you wait until the end of the month to save, the likelihood will be that there is not much left to save. Make it automatic and have money transferred straight out of your paycheck.

Read our blog post with Top tips on how to save money for your mortgage deposit.

Optimise your retirement savings

When you hit your 30s, it’s important to remember that you are halfway to retirement. The earlier you start saving for retirement, the more time your money has to grow, so it’s important to start saving as soon as you can. Our pension & retirement calculator can help you with your retirement planning and will show you how much you need to put away for later in life. Also the older you get the more you can contribute, if your income levels bring you into the higher income tax bracket then you get tax relief at that rate.

Build up an emergency fund

An emergency fund is a separate savings or bank account used to cover the expense of an unforeseen situation. While the size of your emergency fund will vary depending on your lifestyle, monthly costs, income, and dependents, the rule of thumb is to save at least three to six months’ worth of expenses. The idea is to put a small amount away each week or two to build up to that goal.

Planning for Illness

If you become ill or get hurt and are not able to work for an extended period of time, it is important to have a plan in place to help you make up for some of that lost income. You might consider Serious Illness Insurance which pays a lump sum benefit in the event you are diagnosed with a Serious Illness. Or even Income Protection that provides you with a replacement source of income if you can’t work due to an illness or injury after a certain period of time.

Pay Off Your Debts

The 30s are the years when many people get married, start having kids, and buy a house and some of us might still be hanging on to debts we accumulated in our 20s. This can be student debt you’re still making payments on or an old credit card. These debts can end up being roadblocks that prevent you from reaching your bigger financial goals. Clearing your debts will have a significant impact on your finances, so focusing on clearing one debt at a time in a snowball method will help you to focus on savings sooner rather than later.

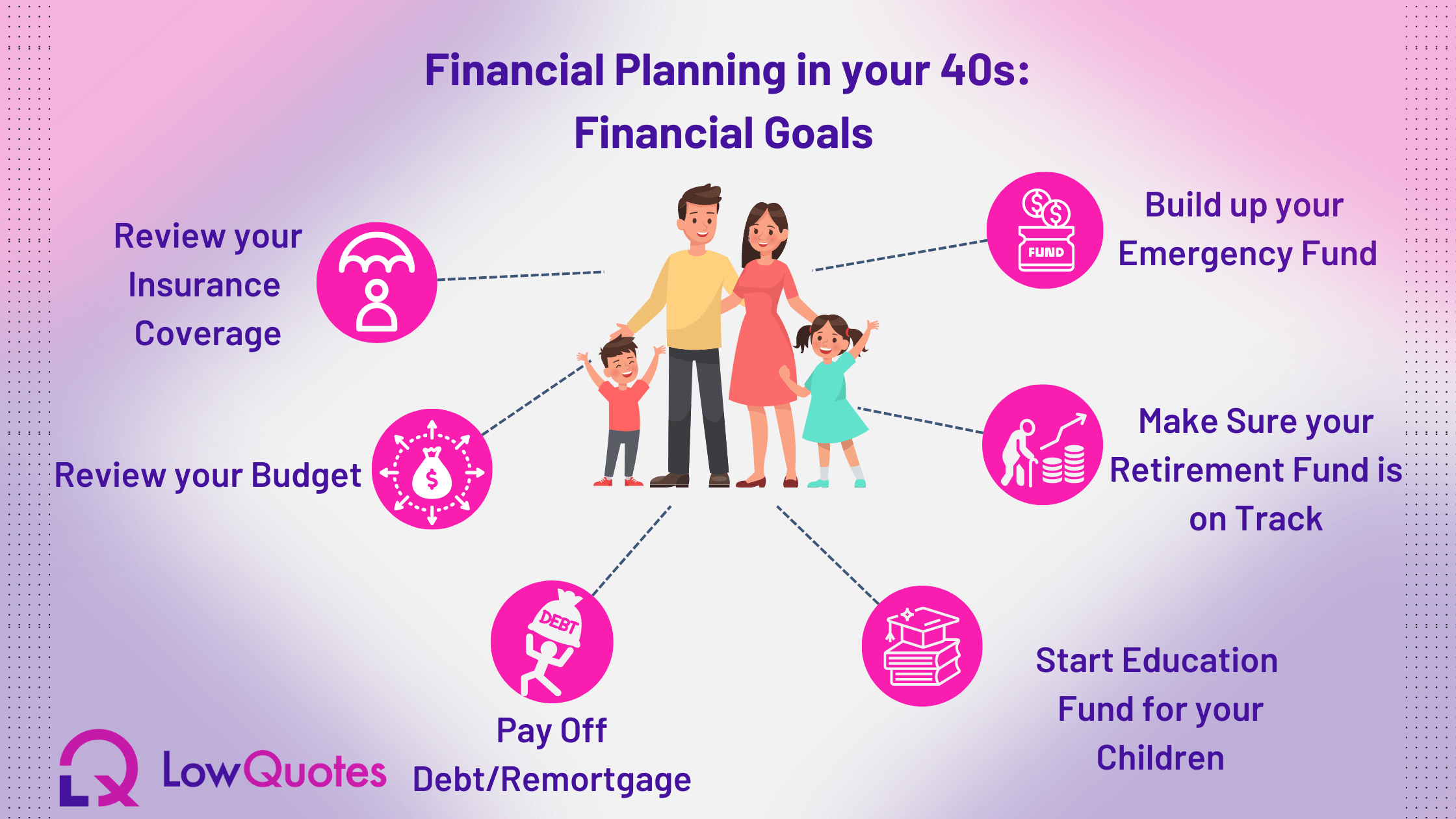

Financial Planning in your 40s

In your 40s, your priorities, and objectives become clearer than ever; it’s your mid-life opportunity to get your goals on track. Financial planning in your 40s is a crucial time to review your financial situation and make sure you are on track to achieve your long-term financial goals.

Your expenses will likely rise in your 40s as you grow a family and potentially take on big responsibilities like a mortgage or even a buy-to-let mortgage. The key is to continue contributing to your retirement as you have been, but watching your new expenses to make sure they don’t eat away at your progress.

Here are some key things to consider when financial planning in your 40s:

Review your budget

You might have more spare money than you did in your 20s, but your expenses will likely rise in your 40s as you grow a family and take on big liabilities like a mortgage. Setting a budget for your costs and spending only on what is necessary is one of the most significant financial suggestions for those in their 40s. Check your income and expenses, cut unnecessary costs and any extra money should be put into saving accounts or investments. Another necessity you should have in place by now is an Income Protection policy, as because you have gotten older – unfortunately the risks of becoming ill or injured and being unable to work increase as you get older.

Make sure your retirement is on track

Review your retirement account to ensure you have enough savings for retirement. If you still don’t have one, start now and maximise your contributions. Read more about the importance of setting up a private pension.

To have an idea of how much you need to put away for your retirement you can use our Pension Calculator.

Read our guide to Pension and Retirement Planning to learn more.

Pay off debt

Try to pay off high-interest debt, such as credit card debt, as soon as possible. You might consider remortgaging to reduce monthly payments, or even to pay off the mortgage earlier. Or you can save money by switching your mortgage provider to a lower interest long-term fixed rate. Read our article to know more about the benefits of switching mortgage providers.

Helping your children plan for their future

Consider opening an education savings account to start saving for your children’s college expenses. In 2022 the average cost of putting a child through third-level education is €60,616 with student accommodation and €61,308 with rented accommodation. It stands at €30,544 while still living at home, which is still a hefty fee to cover. As a parent, you want to give your child the best start for their adult life so it may be wise to start saving now. Read more about how to save for your children’s college education.

Build an emergency fund

Have enough savings to cover at least three to six months’ worth of your fixed monthly living expenses (including rent, insurance fees, gas, electricity bills, grocery and etc.)

Review your insurance coverage

If you have one make sure you have adequate life and disability insurance to protect you and your family in case of unexpected events. If you are in your 40s or later and you still don’t have one, life insurance should be a particular consideration. You can quote how much the cost of life insurance is considering age, cover amount, provider, and other personal information.

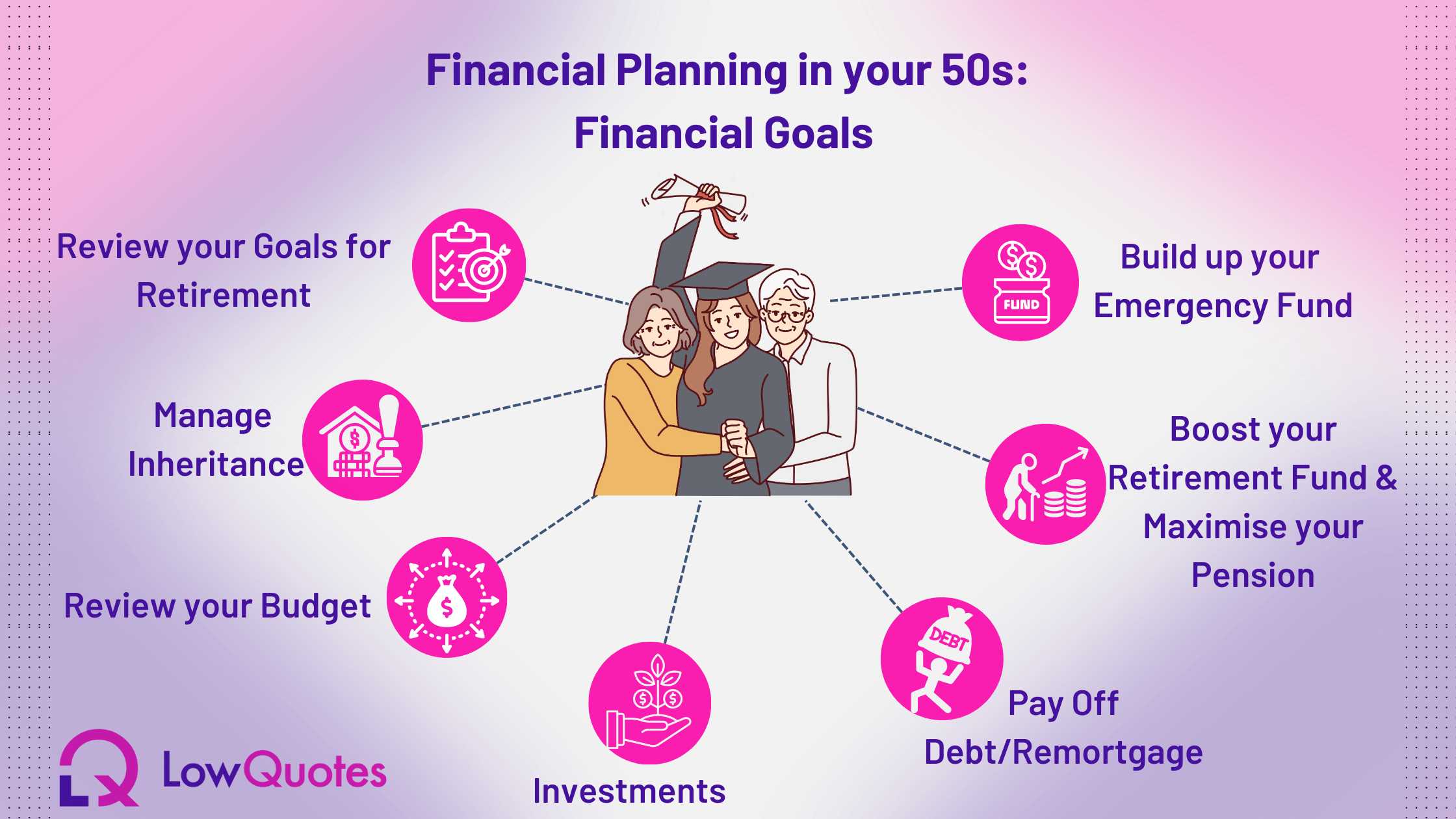

Financial Planning in your 50s

The 50s can be a decade of significant transition, your expenses and priorities are changing. With retirement potentially around the corner, you’ll want to make sure you’re saving enough each month to achieve the retirement you desire.

Review your planning and goals for retirement

If you’re saving for retirement and you are in your 50s, it might be time to reassess your plan. You are likely at a point where you are still accumulating savings and investments, while also beginning to think about how to make your money last throughout retirement.

Boost your retirement fund & maximise your pension

Take advantage of the tax relief offered on pension contributions. Pension contributions are eligible for tax relief at the highest rate of income tax that you pay. Another option is to make Additional Voluntary Contributions (AVCs). AVCs are extra contributions that can be made on top of the mapped-out pension contributions you make. Use any bonuses you receive to boost your retirement savings, as you are closing in on retirement sooner than you think. We explain more about pension top-ups here.

Review your budget

Developing your financial plan is a personal process, so review your spending, create a budget and stick to it to be prepared for the upcoming years. You might be spending less as children could have left the home, so if you are already maximising your pension contributions, a short-term savings & investment policy could be beneficial depending on your circumstances.

Manage inheritance (planning and receiving)

If you have previously received an inheritance know that Ireland has one of the highest inheritance taxes in the world. If you do not plan ahead, your family can lose part of their inheritance or be faced with a difficult decision between having to sell part of their inheritance, or borrow the money to pay the tax bill. A Section 72 Life Insurance policy can also be put in place to cover any inheritance tax your children or beneficiaries may incur.

Making the most of your investments

Retirement investments will vary depending on the person’s financial profile, family situation, and needs. It’s time to review your fund choices and understand how you feel about risk, for example, or how involved you want to be in managing your own investment decisions.

Pay off your mortgage

You can use your pension to pay off your mortgage. However, there are certain limitations in place. It’s important to note that if you withdraw money from your pension plan to pay off your mortgage, you will lose the tax benefits associated with contributing to your pension and you may lose the opportunity to grow your savings.

Build up your emergency fund

It’s more important than ever to have your emergency savings account fully funded. The unknown is still possible and you don’t want to dip into your retirement savings in case of an unexpected event.

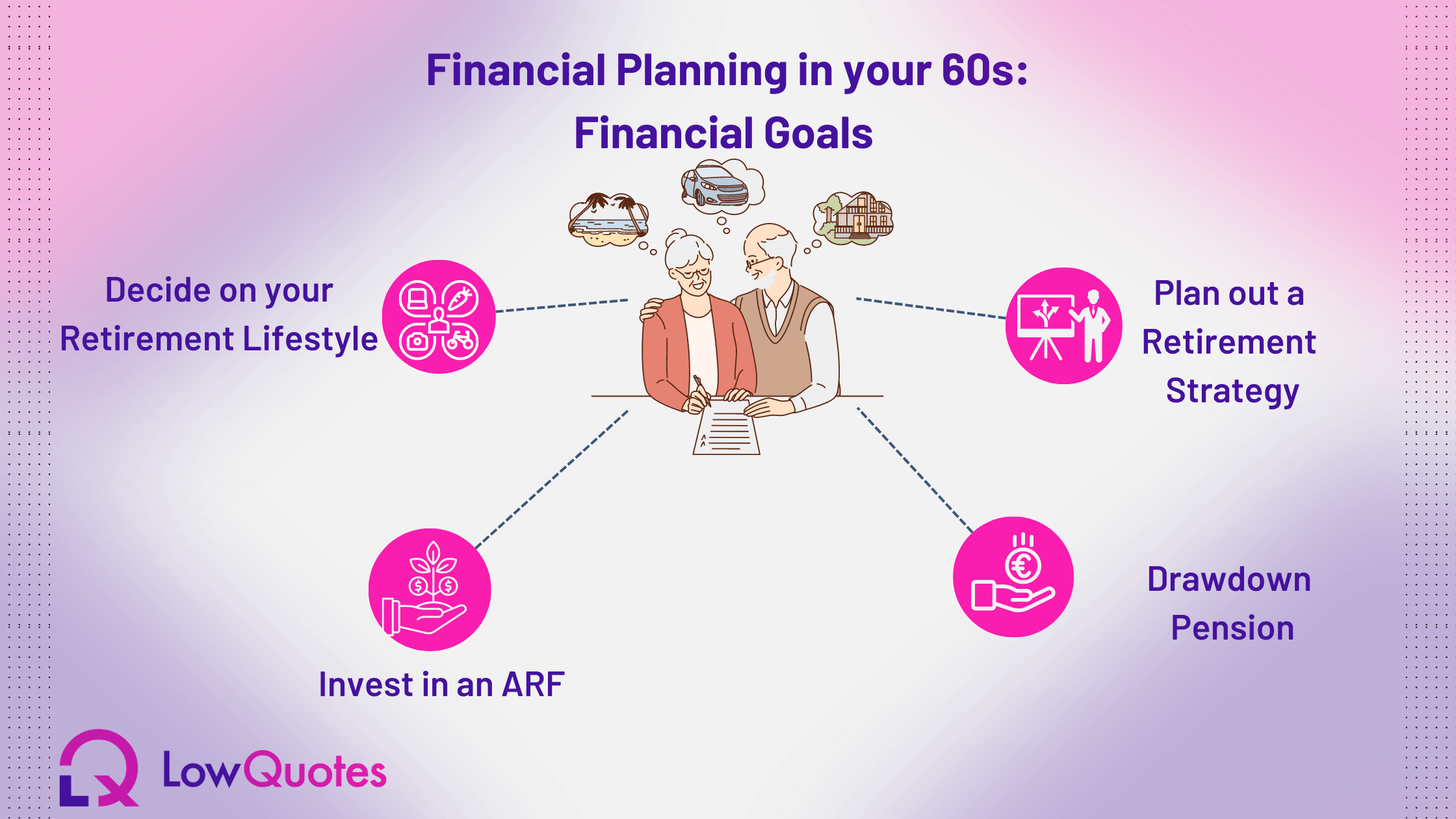

Financial Planning in your 60s

You’re nearly there! Now is a good time to take a look at what you have, what your retirement requirements are, and what you have to do now to get there.

Decide your retirement lifestyle

You may have a set of new dreams and goals for your life and you may wish to comfortably maintain your day-to-day lifestyle. There are some questions you should ask yourself. What kind of lifestyle do you want after retirement? Do you plan to continue working, such as providing services as a consultant? Do you plan to take up a hobby that would also potentially make you money? Do you still have debts or financial responsibilities such as your children’s education? It is important to understand your retirement lifestyle will impact how much you might spend on a weekly or monthly basis.

Invest in an ARF

You might want to leave your pension fund invested in an Approved retirement fund (ARF). An ARF lets you keep all or part of your retirement fund invested while withdrawing money when you need to.

Plan out a retirement income strategy

When you’re planning for retirement it’s important to think about the income you’ll need to live the lifestyle you want. You might have a different pattern of income and spending when you retire, that’s why you need to put a plan in place to define your budget, and types of expenditures such as essential (housing costs, bills, etc.) and non-essential (holidays, eating out, etc.)

Decide how to draw down your pension

You’re entitled to take a cash lump sum from your pension policy. The way you receive your retirement income depends on the policy you choose. That could be either an Approved Retirement Fund (ARF) or an annuity. It’s important to understand how each option works, as well as how you might be taxed, so you can factor that into your plans and make the most of your retirement.

Advantages of getting a Financial Planning with LowQuotes

Financial planning with us will help you save money, make informed decisions, and negotiate for better deals, all of which can contribute to achieving your financial goals. It is essential to the success of your financial future, the sooner you start planning – the better the results you will get throughout your life.

There are several advantages to financial planning with us. These include:

- Improved financial stability

- Cost savings

- Greater control over your finances

- Increased peace of mind

- Increased ability to reach financial goals

- Customised solutions

- Expert advice

Low Quotes is an award-winning market-leading online insurance broker with a 5-star Google rating. We provide the best financial planning in Ireland and our role is to guide you on how to manage your finances and have an effective plan projecting many years into the future.

1 thought on “Financial Planning goals throughout your life”

Comments are closed.