Table of Contents

Life insurance is essential to financial planning, providing peace of mind and security for loved ones. However, obtaining a life insurance quote can often seem time-consuming and complicated.

Finding the time to navigate this process can be challenging for busy people. But fear not; we are here to guide you through the quickest way to get a life insurance online quote in Ireland, ensuring you can secure the coverage you need without the hassle.

Why Life Insurance is Important

Before diving into the specifics of getting a quick life insurance online quote, it’s crucial to understand why life insurance is important.

While life is unpredictable, you can take control and ensure your love supports your family even after you’re gone.

Imagine the peace of mind that comes with knowing your family’s financial security is locked in. They wouldn’t have to worry about drastic changes – your passing wouldn’t mean giving up the house or struggling to afford groceries or bills.

Most importantly, your children’s education and well-being would be fully funded, giving them the foundation they need to thrive regardless of the circumstances.

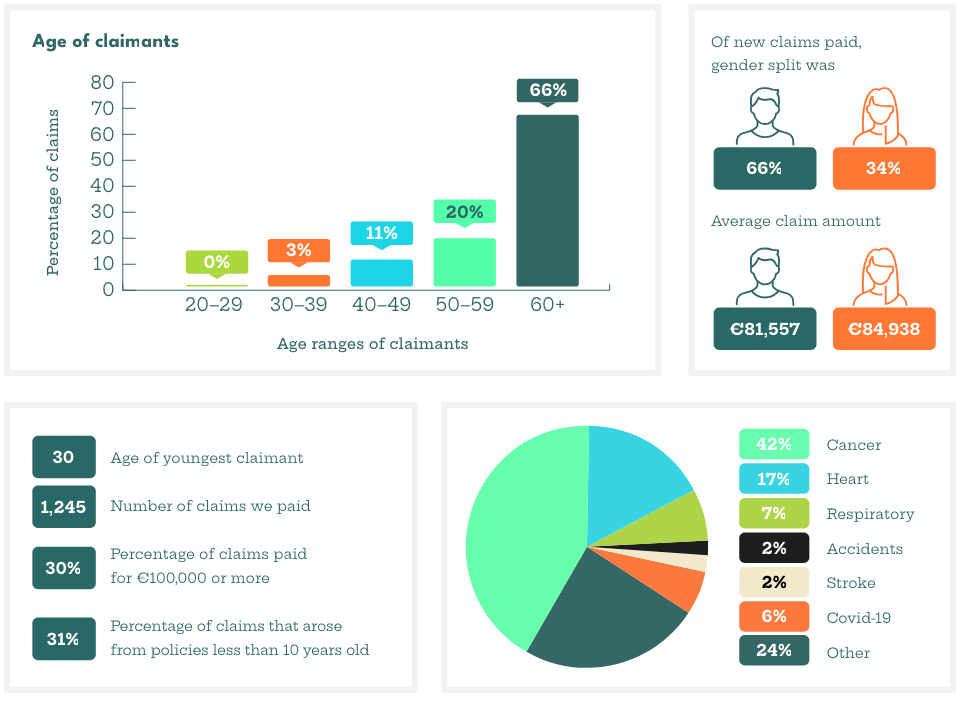

In 2022, cancer was the leading cause of Aviva Life claims, followed by cardiovascular and respiratory illnesses.

According to New Ireland’s life claim report, the youngest claimant was just 30 years old, with 66% of claims made by men and 34% by women.

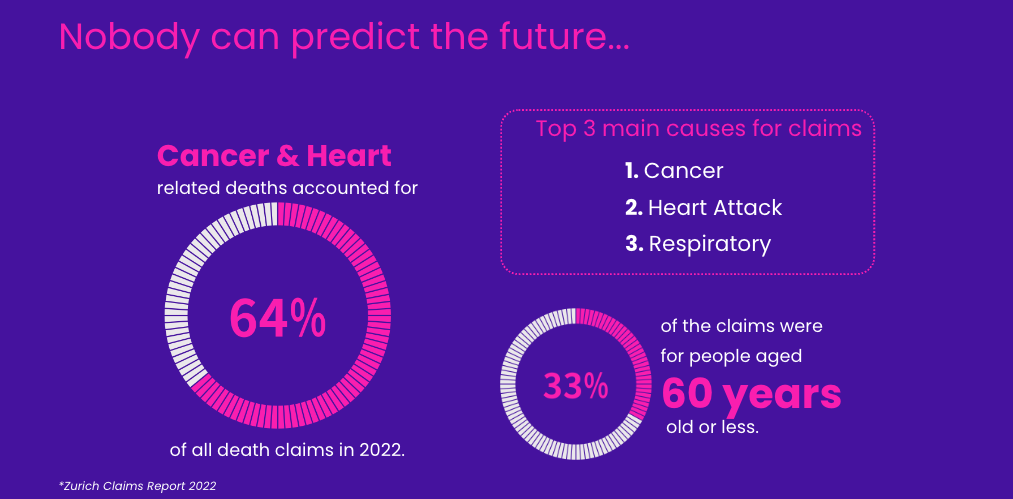

A look at Zurich’s 2022 life insurance claims data reveals cancer was the leading cause of death, responsible for nearly two-thirds (64%) of all claims when combined with heart-related issues. A third (33%) of all claims involved policyholders aged 60 or younger.

These numbers highlight the importance of having a life insurance policy in place to protect your loved ones financially in case of the unexpected.

Secure your family’s financial

future today!

Types of Life Insurance

Term Life Insurance

Term life insurance provides a lump sum payment to you and your family in the event of death. This type of life insurance applies to a specific fixed term; the policy will cease after the term has ended and no claim is made.

Whole of Life Insurance

Whole of Life Insurance will insure you for your entire life, continuing up until the event of your death. In most cases, this type of life insurance will cost considerably more than other products as there is a guaranteed payout.

Convertible Life Insurance

Convertible Term Life Insurance is similar to Term Life Insurance but has a different advantage.

The policyholder can convert the existing cover into a new, longer-term policy without requiring the insured person to provide further medical information at the time of conversion.

Read more about Convertible Life Insurance.

You can also change the policy to a “Whole of Life” policy, which guarantees you life insurance for the rest of your life.

Mortgage Protection

If you pass away before paying off your mortgage in full, Mortgage Protection insurance will cover the remaining balance.

Read more in our post about the most frequently asked questions about mortgage protection and the myths surrounding it.

Additional Features

These types of Life Insurance offer the flexibility to enhance your policy with additional features like the conversion option and indexation.

Adding a conversion option allows you to convert your term life insurance or mortgage protection policy to a new policy for another term without providing further medical information, thus securing cover as your needs and circumstances change over time.

Indexation, on the other hand, helps ensure that the value of your life insurance benefit keeps pace with inflation. By automatically adjusting your cover amount annually to match inflation rates, indexation protects the buying power of your future benefits, making sure that your policy’s value does not diminish over time.

Life Insurance – Types of Cover For Families

Single

Getting a quote by yourself and taking out a single policy.

Joint

This policy covers you and your partner and will pay out once. This policy can either be set up on a Joint Life First Death basis, i.e., the policy will pay out on the death of the first life assured, and cease.

Or on a Joint Life-Second-Death basis, i.e., there will be no payment on the death of the first life assured; however, the policy will pay out on the death of the second life assured, and then the policy will cease.

Dual

Dual cover will pay out on the deaths of both the first and second lives assured. On the death of the first life assured, the benefits will be paid to the remaining life assured.

The benefits will be paid to their estate upon the death of the second life assured. Once the policy has paid out on both the first and second lives assured, it will cease.

Don’t wait any longer,

get a quote today!

What do I need to Know Before Getting a Life Insurance Quote?

Estimate Cover Needs

- Use a life insurance calculator to estimate the financial cover your family would need.

- This helps determine the appropriate level of protection for your family’s financial security, covering everything from mortgage repayments to children’s education or basic expenses like bills and groceries.

Smoking Status

- Smoking status significantly impacts your premiums.

- Smokers pay higher premiums due to increased health risks.

- Quitting smoking for a set timeframe can reclassify you as an ex-smoker, resulting in substantial policy savings.

Learn more by reading our article, where we explain what qualifies you as a smoker for life insurance and how quitting smoking can save you money on premiums.

Single vs. Couple’s Cover

- Single Cover: Protects one person, providing a payout upon their death.

- Couple’s Cover: Provides a combined benefit payout in case either partner passes away. It can be Joint or Dual Life.

Duration of the Policy

Decide on the duration of your cover based on your circumstances, such as:

- If You Just Got Married: If you’re a newlywed, this can vary; you could choose a term that covers the next major financial milestone (e.g., purchasing a home).

- If You Have Young Children: Whether Married or Single Parent, you might want a life cover until your youngest child is financially independent (typically until they finish college or start working).

- If You’re the Breadwinner with a Stay-at-Home Spouse: Until your planned retirement age or until your spouse is expected to earn or receive other financial support.

- Until Retirement Age: Alternatively, you could align the term with your planned retirement age.

Your situation is unique, so your needs and goals can vary. Talk to one of our financial advisors to ensure you make the best decision for your circumstances. They can help you assess your individual situation and determine the best duration for your life insurance policy.

Provide Valid Contact Information

- Obtain a free quote comparison tailored to your specific situation.

- Provide your contact information, and you’ll receive quotes directly to your email.

Considering these factors, you’ll be better equipped to find a life insurance plan that best suits your needs.

Steps to Get a Life Insurance Quote Quickly With LowQuotes

Our quick life insurance online system is straightforward to use; you only need to add your personal details, and you will get a quote in 60 seconds.

You can get a life insurance quote to cover only yourself or choose life insurance for two people if you’re a couple.

Fill in some quick details, such as how much cover you require and the term of the policy and you’ll receive a quote comparing the prices of the top life insurance providers in Ireland.

If you wish to combine Serious Illness Cover with your Life Insurance, the best way to determine the cost is to speak with us. We can help you understand your options and find the right policy for you and your budget.

If you’re looking for Mortgage Protection, you can quickly get a quote by visiting this link.

The process is the same, with the additional requirement of providing the remaining term of your mortgage in years, as mortgage protection must cover the exact remaining balance and term of your mortgage.

Additionally, you can read our blog explaining the differences between Life Insurance and Mortgage Protection.

For further questions, you can read our Mortgage Protection Guide or talk to one of our Financial Advisors at LowQuotes.

get a quote today!

Why Our Life Insurance Online Quote Quick

Time is of the essence for many people when it comes to securing life insurance. Whether you’re juggling work, family, or personal commitments, spending hours or even days to get a life insurance quote is not feasible.

This is why LowQuotes focuses on providing quick life insurance quotes that cater to people’s busy lives.

At LowQuotes, we understand the need for speed without compromising accuracy. Here’s why our service stands out:

Speed and Efficiency: Our platform is designed to provide instant quotes. Simply enter a few basic details, and you’ll receive quotes from the leading insurers in Ireland in under a minute.

Comprehensive Comparison: We compare quotes from all major Irish insurers, including Aviva, Royal London, Zurich Life, and New Ireland. This ensures you get the best possible deal tailored to your specific needs.

User-Friendly Experience: Our website is easy to navigate, allowing you to get quotes and compare them effortlessly. Whether you’re at home, at work, or on the go, you can access our service from any device.

Expert Advice: If you need further assistance, our team of financial advisors is always on hand to help you understand your options and choose the best policy. We combine technology with a personal touch to give you the best of both worlds.

Why should I get Life Insurance Quote From a Broker?

Using a broker to get a life insurance quote has several benefits, including:

Access to Multiple Insurance Providers

When you request a life insurance quote from a bank, you will only be given a price for life insurance from the provider to which the bank is tied.

LowQuotes is licensed to work with multiple life insurance providers, which means we can offer you a wider range of options and the lowest prices.

Assistance with Jargon

Life insurance brokers can help customers navigate the often complex and confusing terminology and jargon used in the life insurance industry. Brokers have a deep understanding of the terminology used in life insurance policies, such as indexation and a convertible option.

LowQuotes can explain complex terminology used in the life insurance industry. We can help clients comprehend how certain terms affect their coverage and prices by defining them in plain English.

Time Savings

Instead of having to research different insurance providers and policies on your own, a broker can do the work for you. This will save you time and effort, while still ensuring that you get the cover you need.

Using our Life Insurance online system you will get a quote in 60 seconds comparing the prices of the best life insurance providers in Ireland.

Personalised Service

A broker can take the time to understand the customer’s unique needs, concerns, and financial situation, and then use that information to help them find the right life insurance cover that suits their individual circumstances.

Because we work independently from insurance companies, we are not tied to any particular product or company. This allows us to offer unbiased advice and help customers compare policies from multiple insurance providers to find the best coverage options and value for their needs.

Speak with one of our expert and award-winning Financial Advisors!

Cost Savings

Brokers have access to policies from multiple insurance companies and can compare the costs and benefits of different options to find the most cost-effective solutions for their customers.

We can help customers take advantage of discounts and special promotions offered by insurance companies. By purchasing your life insurance with LowQuotes you will get the best price online because we provide discounts that aren’t even available to other brokers.

We offer up to a 30% discount, and you can get a Free ‘Will Kit’ worth €120 and €50 Cash back on policies over €30 p/m.

Introduce Unknown Insurance Benefits

When you’re purchasing life insurance, there are a lot of options and benefits that come with some policies that people might be unaware of.

Aviva Care

When you choose Aviva for your Life Insurance, Serious Illness Cover, Mortgage Protection, or Income Protection, you can access an exclusive health and well-being service called Aviva Care.

This service is included free of charge with all new protection policies, offering a suite of valuable benefits designed to support your overall health and well-being.

Aviva Care provides policyholders with four great benefits at no additional cost: Digital GP, Best Doctors Second Medical Opinion, Family Care Mental Health Support, and Bereavement Support.

Helping Hand

Royal London goes beyond the typical insurance offering by providing access to a service called Helping Hand, which grants you access to dedicated medical professionals from the day your policy starts—not only when you make a claim.

This unique feature includes all nurses available to give you a second opinion on your diagnosis and future treatment options without additional cost. Helping Hand isn’t just for policyholders; your spouse and children can also use the service.

Should you ever experience a serious illness, injury, or bereavement, Helping Hand offers crucial support that extends beyond financial aid.

To aid in recovery or coping, Royal London, through Helping Hand, may provide access to specialist therapies such as bereavement counsellors, speech and language therapists, face-to-face second medical opinions, complementary therapies, and physiotherapy for specific serious health conditions.

Life Insurance Living Benefits

Life insurance isn’t just about providing financial security after you’re gone; it also offers benefits you can use while you’re alive.

For instance, the Hospital Cash Benefit provides a daily cash payout for each day you spend in the hospital. This benefit helps cover out-of-pocket expenses, including meals, transportation, and parking fees, which might not be covered by your private health insurance.

These additional funds can ease the financial burden during hospital stays, ensuring you can focus on recovery without worrying about unexpected costs.

Read our article to learn more about the various living benefits of life insurance and how they can support you and your family in times of need.

LowQuotes can guide you through the different policies and extra benefits available in the market. Talk to one of our advisors to learn about the right cover for you and your family and how you can get extra protection.

Get A life Insurance Quote With LowQuotes

Speak with one of our financial advisors, who can guide you, help you understand your options, and ensure you get the best possible policy for your situation.

Whether you’re looking for term life insurance, whole-of-life cover, a single, joint, or dual policy, or a specific plan tailored to your circumstances, LowQuotes provides the tools and information you need to make an informed decision.

We also provide a wide variety of financial services, such as mortgages, serious illness cover, pensions, financial planning, health insurance, and savings & investments.

get a quote today!

All our content has been written or overseen by a qualified financial advisor. However, you should always seek individual financial advice for your unique circumstances.