Life insurance is a crucial financial tool that provides peace of mind and financial protection to individuals and their loved ones. When considering life insurance options, convertible term life insurance is a unique and valuable choice to explore.

What is term life insurance?

Life insurance is a contract between an insurance company and a policyholder that commits the insurer to pay a specific beneficiary a lump sum in the event of the policyholder’s passing.

If you have a spouse and children who rely on your income to meet their daily living expenses, pay for education, cover outstanding liabilities, or cover other essential needs, life insurance can provide a financial safety net in the event of your premature death.

What is convertible term life insurance?

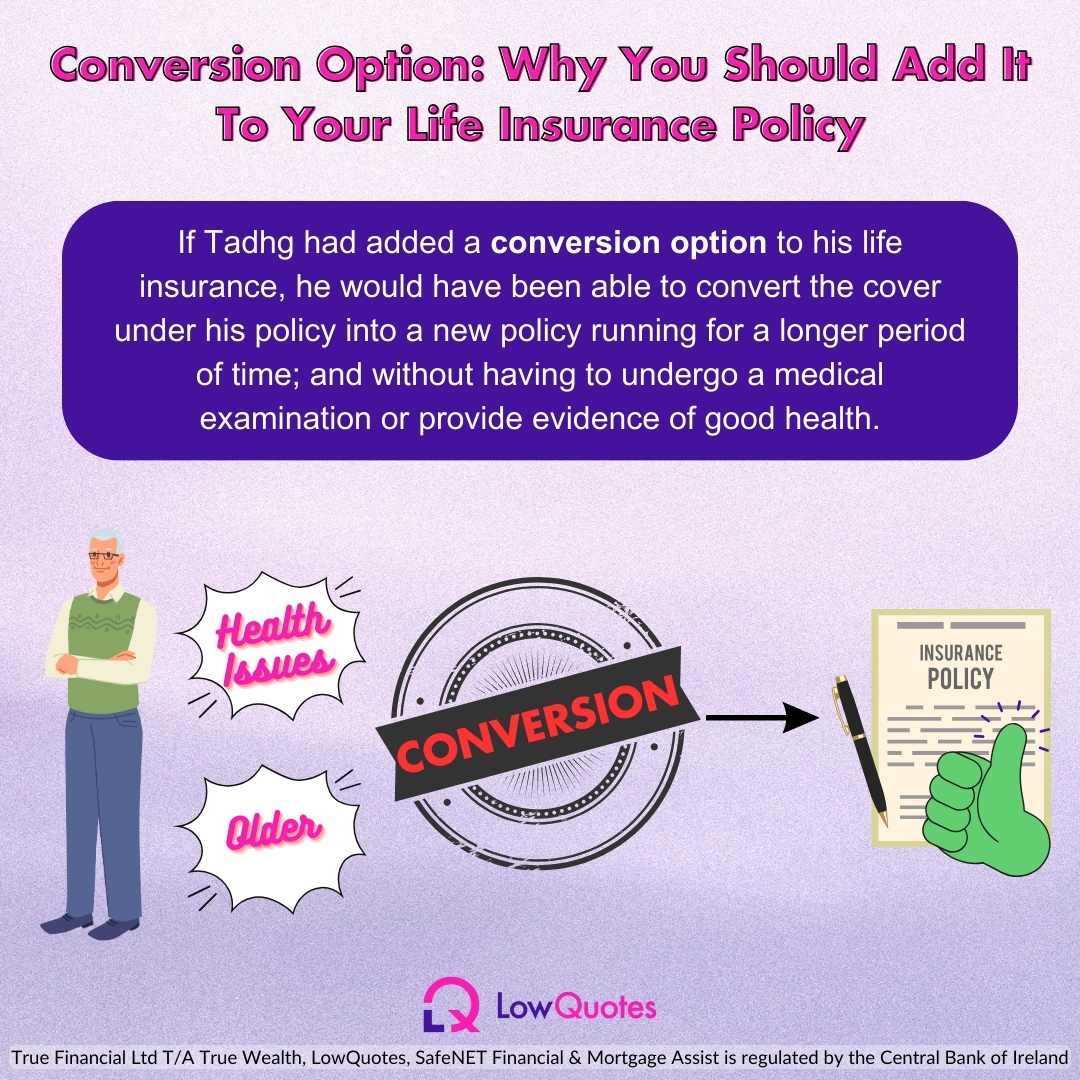

Convertible term life insurance is similar to term life insurance. The main difference is that when your existing term life insurance policy expires, you can choose to convert it into a new policy for another term.

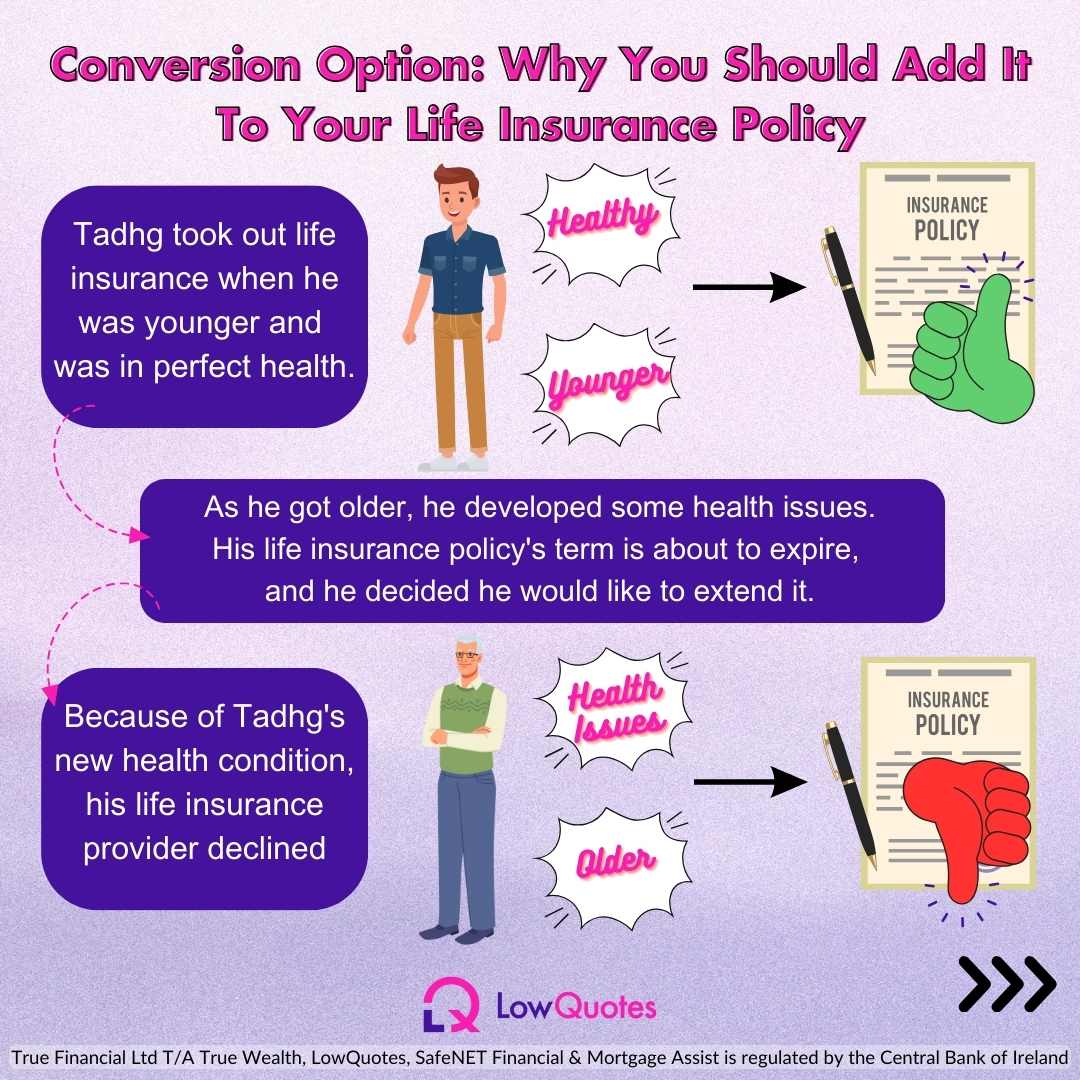

Imagine that you decide to buy new life insurance to protect yourself for a longer period of time after your current policy expires. By the time the coverage expires on this policy, you might have a health problem. Since you now have a medical issue, your life insurance company can decline to cover you without the convertible option selected on your policy.

With a convertible term life insurance policy, you can extend your current policy without having to undergo a medical exam or show proof of good health at the time of conversion.

get a quote today!

Is there a maximum age to buy convertible term life insurance?

Many insurers impose an age restriction on the purchase of convertible policies. Usually, insurers won’t let people over the age of 64 buy convertible term life insurance.

Also, the age at which a person can convert their life insurance usually has a limit.

Even though it varies significantly depending on the insurer, some providers will allow you to convert your policy up to the age of 85.

Keep in mind that different life insurance companies will have different age limits. To fully understand the advantages and restrictions of including a conversion option in your life insurance policy, speak with one of our financial advisors.

Is it worth adding a conversion option to your term life insurance?

Yes, definitely. The future is unpredictable. Convertible Term Life Insurance essentially provides you with the opportunity to lock in coverage for a longer duration, regardless of any changes in your health.

For example:

Imagine you have convertible term life insurance up to the age of 50.

Unfortunately, you get cancer when you’re 48 years old.

You decide to extend your life insurance for a longer period of time, considering your health history.

Your insurer must:

- guarantee cover in later life without being asked about your health.

- offer you coverage based on your health when you initially purchased your policy.

- disregard any subsequent medical issues.

Compare Life Insurance with LowQuotes

LowQuotes is a market-leading online insurance broker in Ireland, with a 5-star Google rating and over 800 Google reviews. We are proud to be awarded Insurance Broker of the Year in 2022 as the result of our team’s dedication to providing market-leading independent advice and exceptional customer service.

We compare all Irish life insurance providers to find you the most affordable coverage that best meets your needs. Getting a life insurance quote from LowQuotes is a quick and easy way to get the protection your family needs for the future.

If you want to learn more about life insurance, read our article with the most frequently asked questions about it.

Unsure about whether you should take out a life insurance policy? There are a lot of myths around this topic that might cloud your judgement. Read our article about myths and misconceptions about life insurance to make informed decisions.

Life insurance and mortgage protection products frequently include specified illness insurance. This guide explains precisely what specified illness coverage is and how it works.

Compare all providers and get covered in under 10 minutes!