Buying a home for the first time is an exciting milestone in life. However, it can also be a daunting process filled with many obstacles Many first-time homebuyers make mistakes that, with a little information and planning, could have been easily avoided.

1. Not doing enough research

Not doing adequate research on the real estate market, the places you’re interested in, and the whole purchasing process can be a mistake. It makes sense to learn about current market conditions, house pricing, available financing options and the hugely helpful government supports that are available to first time buyers.

The ultimate guide for First-Time Buyers.

Get instant access to a complete GUIDE that will save you the hassle and prepare you for a mortgage, providing a convenient checklist of essential documents and step-by-step instructions to help you secure your dream home. Don’t wait, download now!

Your journey towards your dream home starts here!

After you download your guide, one of our expert mortgage advisors will be in touch shortly to provide you with guidance and further relevant information including typical repayments, qualification amounts and mortgage requirements.

Visit the following pages to learn more about Government Schemes to help first-time buyers to purchase their dream home: https://www.firsthomescheme.ie/ and www.revenue.ie

2. Overextending your budget

Once you’ve set a budget you’re comfortable with, it’s time to start looking at properties. Be careful at this stage and avoid the temptation to buy a property that is beyond your means. Be realistic about what you can afford and don’t put yourself in a vulnerable financial situation. Start the search under your max budget.

For instance:

Aiofe and Cillian have a budget limit of €300,000 for their first home. They understand the importance of not stretching themselves too thin and decided to look at properties in the €275,000-€280,000 range, allowing them some financial flexibility.

3. Overlooking Hidden Costs

If you’re looking to buy your first home and feeling worried about the deposit and monthly mortgage payments, remember that there are additional costs involved in the home-buying process. However, there’s no need to worry! With careful organisation and planning, you can navigate these costs successfully.

When budgeting for your first house, don’t forget to include expenses such as Stamp Duty, Solicitor’s fees, property taxes, Mortgage Protection Insurance, and potential repairs.

Read our article for a comprehensive list of all the additional costs involved in home buying.

4. Insufficient or Inaccurate Financial Documentation

One of the most critical aspects of buying a home is providing accurate financial documentation to the lender. Many first-time homebuyers often make the mistake of inadequately preparing their financial documentation, which causes delays in loan approval or even loan rejection.

To avoid this, gather all necessary financial documents in advance, such as payslips, tax returns, bank statements, and proof of savings. Ensure that the information is accurate and up-to-date to streamline the mortgage application process.

5. Large or unusual deposits on your bank statements

Lenders may be concerned if they see large or unusual deposits in your bank statements as this could be a sign of hidden debts or an unverified source of income. To guarantee a smooth mortgage approval process, be ready to offer paperwork and justifications to the lender if you anticipate making any significant deposits.

6. Lack of savings history

Having a solid savings history is important when applying for a mortgage because it enables First Time Buyers to show potential lenders their ability to save money consistently over time and their responsibility with money.

Mortgage providers will examine your financial history and income carefully. If you’ve experienced rent arrears or faced challenges in demonstrating regular savings, you’ll need to take control of your finances before applying for a mortgage.

7. Not seeking assistance from a Broker

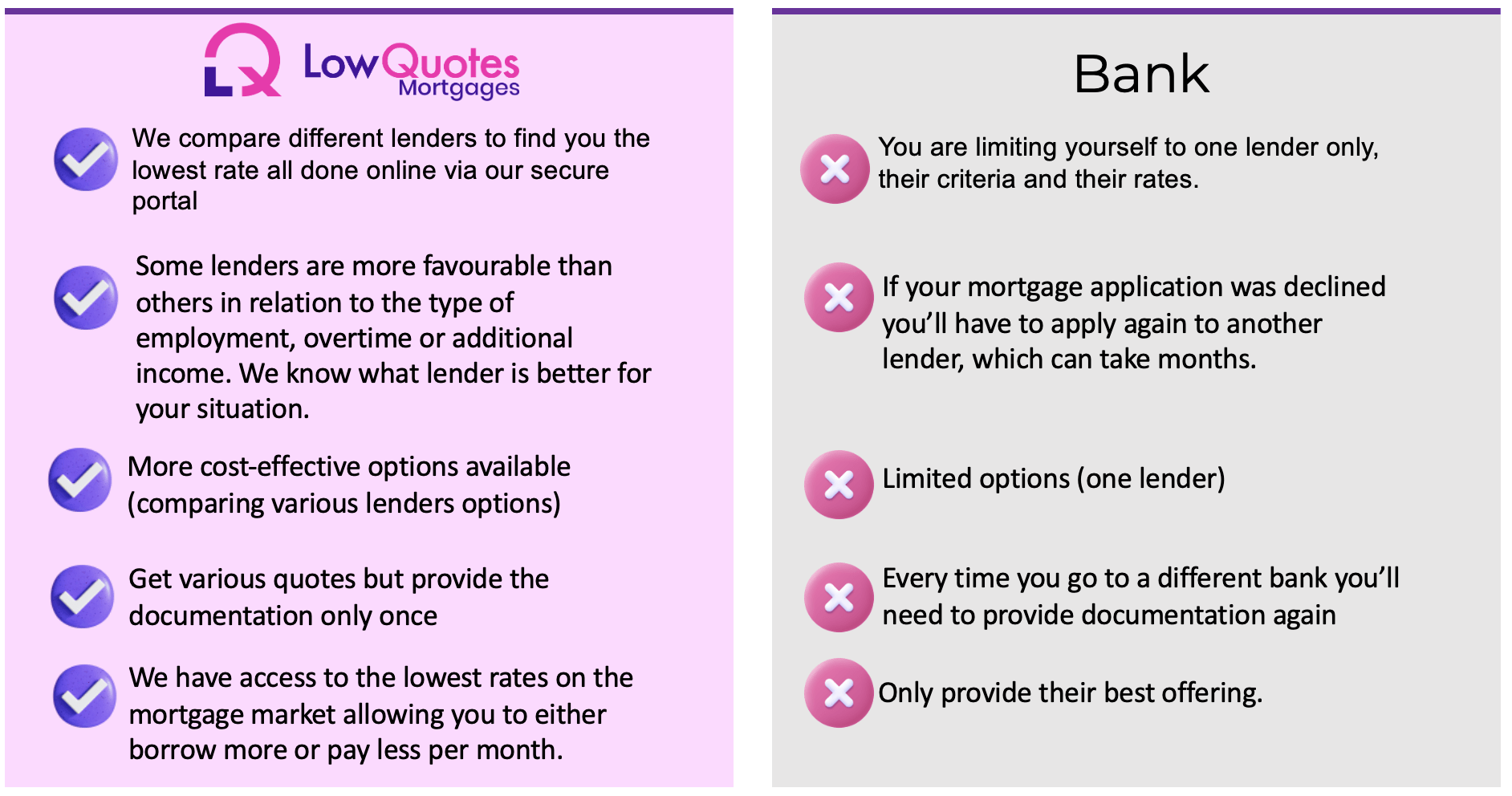

Brokers such as LowQuotes are experienced professionals who can provide valuable insights, guidance, and advice throughout the home-buying process.

We compare mortgages across several lenders and banks providing you with the best price and conditions to suit your personal circumstances. We have a strong relationship with Permanent TSB, Haven, Finance Ireland, ICS (Dilosk), and Avant.

We support you throughout the lifetime of your mortgage process to ensure you get your mortgage approved as fast and smoothly as possible.

You can make huge savings by taking out mortgage protection through LowQuotes as we provide discounts of up to 30% on your mortgage protection. We compare life insurance policies from leading providers on your behalf.

Learn all about Mortgage Protection Insurance in Ireland and The benefits of using A broker to Get Life Insurance Quotes.

8. Online gambling

Having transactions on gambling websites doesn’t mean it will exclude you from being eligible for a mortgage. However, if there is a consistent history of transactions to betting sites this might raise a red flag with mortgage lenders. If you’re serious about saving for a house, cut out the betting.

9. Credit History

Lenders may be concerned if they see old arrears on a borrower’s credit history, even if they have been paid off. Late or missed payments, even if they occurred in the past, can have a negative impact on your credit score.

Even though having previous arrears on your credit report can be difficult, it doesn’t necessarily imply that you won’t be able to get a mortgage. Talk to one of our financial advisors to get personalised advice when it comes to mortgages. We can help you navigate the complexities of the mortgage process and find the best solution for your individual needs.

10. Stick with your bank

If you’re buying a home for the first time, going to the bank can seem like an obvious choice. However, this is a mistake because your bank might not be offering the cheapest or most suitable mortgage for your needs.

With a bank, you are limiting yourself to one lender only, their criteria, and their rates. While with LowQuotes we compare different lenders to find you the lowest rate.

Some lenders are more favourable than others in relation to the type of employment, overtime, or additional income. We know what lender is better for your situation and you can get various quotes from different mortgage providers.

On the other hand, with a bank, if your mortgage application was declined you’ll have to apply again to another lender, which can take months. Every time you go to a different bank you’ll need to provide documentation again.

This doesn’t happen with LowQuotes as we have your supporting documents submitted to our online system and can apply to additional lenders if one rejects your application.

Get your mortgage with LowQuotes

LowQuotes is your first stop when looking for the best mortgage offers. We ensure that you get access to competitive rates tailored to your specific needs. Whether you’re a first-time homebuyer or looking to switch or remortgage, our financial advisors are dedicated to guiding you through the mortgage process, making it seamless and stress-free.

Don’t miss out on the opportunity to secure your dream home with the help of LowQuotes. Start your journey towards homeownership today and experience the convenience of finding your perfect mortgage match in just a few clicks.

All our content has been written or overseen by a qualified financial advisor. However, you should always seek individual financial advice for your unique circumstances.

Warning: You may lose your home if you do not keep your repayments.§

Warning: The cost of your monthly repayments may increase.

Warning: You may have to pay charges if you pay off a fixed-rate loan early.

Warning: If you do not meet the repayments on your loan, your account will go into arrears. This may affect your credit rating, limiting your ability to access credit in the future.

Warning: The entire amount you have borrowed will still be outstanding at the end of the interest-only period. The lender may adjust the payment rates on this housing loan from time to time. (Applies to variable-rate loans only).