Table of Contents

Embarking on the journey of securing a mortgage is a significant step towards achieving the dream of homeownership. However, many individuals need help figuring out where to start.

With proper preparation and understanding of the essential steps involved, the path to becoming mortgage-ready can be made smoother.

In this blog, we’ll explore the key steps you need to take to prepare effectively for a mortgage application.

By following these guidelines, you can increase your chances of getting approved first time and move closer to turning your homeownership dream into reality.

Determine how much you can borrow

Understanding your borrowing ability not only helps you set realistic expectations but also ensures you’re financially prepared to get a mortgage.

Under the loan-to-income limit, if you’re a first-time buyer, you may qualify to borrow up to four times your gross annual income.

For second and subsequent homebuyers, this limit is slightly reduced to 3.5 times your gross income.

Example 1:

Consider a scenario where an individual earning €60,000 annually is looking to buy their first home. According to the loan-to-income limit, they could potentially borrow a maximum of €240,000. (Once repayment capacity is evident).

It’s important to note that not all applicants may fit the conventional definition of first-time buyers. You may have previously owned property but no longer retain an ownership interest. In such cases, eligibility could still be established under the “Fresh Start” principle.

Example 2:

Now, let’s consider a case where a second-time buyer with an annual income of €60,000 is interested in purchasing a new property. Under the loan-to-income limit for subsequent buyers, they could potentially borrow a maximum of €210,000.

Start your homeownership journey!

The ultimate guide for First-Time Buyers.

Get instant access to a complete GUIDE that will save you the hassle and prepare you for a mortgage, providing a convenient checklist of essential documents and step-by-step instructions to help you secure your dream home. Don’t wait, download now!

Your journey towards your dream home starts here!

After you download your guide, one of our expert mortgage advisors will be in touch shortly to provide you with guidance and further relevant information including typical repayments, qualification amounts and mortgage requirements.

Save for a Deposit

If you’re purchasing your first home, you’ll require a minimum deposit of 10%. If you have previously owned a property, the deposit remains at 10%.

However, if you’re acquiring a buy-to-let property, a deposit of 30% is necessary.

By meticulously planning and saving, it’s possible to accumulate the required funds to secure the deposit for a mortgage.

Read our article for insights on strategies to help you to save for your deposit.

Gifts to boost your savings

Family support can play a significant role in accelerating your journey towards saving for a mortgage deposit.

Receiving a monetary gift from family can inject a substantial sum into your savings account, giving you a head start or helping you bridge the gap to reach your deposit target more quickly.

These gifts remain tax-free as long as they are capped at €3,000 per donor within a calendar year.

If you’re fortunate enough to have family members willing to contribute to your savings goals, accepting their support can significantly accelerate your path to homeownership.

Government schemes

Have you considered the Help to Buy or First Home Scheme as part of your strategy?

These government initiatives offer crucial support for first-time buyers, potentially transforming your path to homeownership.

By exploring these schemes, you could bridge the gap between your savings and the deposit required for your dream home, making homeownership more achievable.

You can explore the First-Time Buyers Guide for additional insights and information.

Your dream home is closer than you think!

Research Properties, Location and Price

When embarking on the journey to homeownership, thorough research into properties, locations, and prices is essential for making informed decisions.

Firstly, when browsing properties, ensure they fall within your price range, factoring in the maximum amount you can borrow along with your deposit.

Regarding the location, lenders typically consider an hour-long commute acceptable, but they may also take into account the possibility of remote work arrangements.

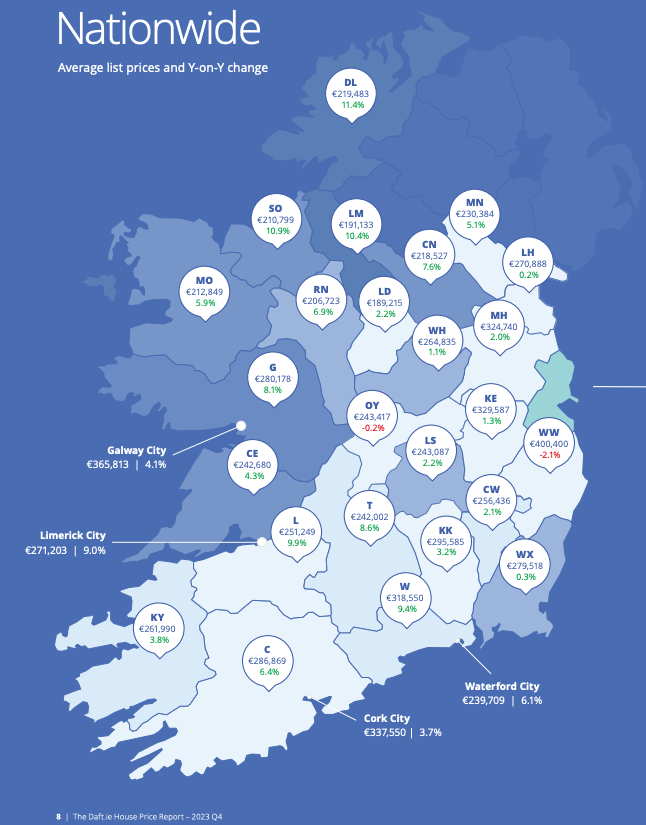

Do you consider living in a different county? Opting for a home in a nearby area could offer financial benefits, especially if you have the flexibility to work from home. Alternatively, opting for a property outside the city can result in substantial savings.

For instance, instead of choosing Galway City, where the average property price was €365,813 in Q4 2023, according to the Daft report, consider Galway County, where the average price was €280,723 during the same period. This decision could potentially save you €86,000.

By conducting thorough research and considering various factors, you can make a well-informed choice when purchasing your new home.

Read the Daft.ie House Price Report Q4 2023 here.

Manage Debt

Managing your debts effectively involves consistently making on-time payments, reducing outstanding balances, and keeping your debt-to-income ratio within acceptable limits.

Lenders assess not just your debt load but also your overall financial health and cash flow management.

You must meet the Central Bank of Ireland net disposable guidelines after all debt repayments.

If you can show that you’re comfortably meeting your existing debt obligations and still have significant leeway in your budget, it reassures lenders that adding a mortgage won’t pose a significant risk.

Establish a Good Credit History

Your credit history is really important when it comes to getting a mortgage. It shows how you’ve managed borrowing and repaying money in the past.

Lenders check your credit report to decide if they want to give you a mortgage. They look at things like whether you’ve paid bills on time and if you have other large borrowings, such as business loans, credit cards, and car finance. They can also access past borrowings on this report.

The details in your credit report can impact the lender’s decisions, such as offering you a loan.

Start your homeownership journey!

Demonstrate Repayment Ability

Lenders will carefully examine your employment situation, especially focusing on a stable, consistent income and repayment ability.

This evaluation must consider the details you provide in your loan application, supported by your documentation and the information in your credit report.

If you’re employed, you should have finished your probationary period and show a track record of at least 3-6 months of continuous employment.

If you’re self-employed or have irregular income, providing evidence of consistent earnings can strengthen your application. Lenders typically assess an average income over a period ranging from 2 to 3 years.

Feel free to reach out to one of our financial advisors at LowQuotes for more information.

Manage your Spending Wisely

Apart from verifying your employment, income, savings, and mortgage repayment ability, your lender will look closely at your bank accounts and spending habits.

Pay off your credit card balance monthly to avoid accumulating debt and interest.

It’s essential to control your spending and prove to your lender that you manage it responsibly and that you live within your means by spending less than you earn.

Understand the Additional Costs

Several additional costs are to be considered when purchasing a property, such as mortgage protection, stamp duty, home insurance, valuation fees, structural survey fees, and solicitor fees.

For more detailed information, we recommend reading our article: Hidden Extra Costs When Buying A House In Ireland.

Get your documents in order

Before diving into the mortgage application process, it’s crucial to ensure that all your necessary documents are ready and organised.

Proof of Identity

- Current valid passport or Driver’s license

- Your PPSN or tax reference number

- Marriage Certificate (if applicable)

- Separation agreement or divorce decree

Proof of Address:

- Current utility bill or bank/financial statements (such as a gas or electricity bill)

- Revenue document dated in the last 6 months as proof of your address.

Proof of deposit:

Provide details of the source of your deposit (proof of savings, help-to-buy scheme, gift letter, etc.)

Proof of Income:

From 3 to 6 months (depending on the lender)

- Payslips

- Employment Detail Summary (former P60)

Proof of Employment:

Salary Certificate stamped and signed by your employer.

Proof of Savings:

Last 6 months (including Revolut)

- Current account

- Savings

- Investments

Proof of outstanding debts:

Last 6 months (including all your credit cards)

- Loans

- Overdrafts

- Credit cards

- Hire Purchases

- Mortgages

- Any other borrowings

Your dream home is closer than you think!

Additional Documents

- Rental Agreement: In case you are renting and there is no regular standing order or direct debit evidencing rent being paid out of your current account.

- Foreign credit check: If you have lived abroad in the past three years or have a bank account outside of Ireland, you must provide this credit check from that country in English.

- Divorce/separation agreement: or alternatively, solicitor’s written confirmation of any financial obligations and/or maintenance payments.

- Visa / Residency permit (front and back)

- Tax returns for rental income

Extra documents required for self-employed

Your audited or verified financial accounts: 2 or 3 years certified by your accountant.

Your Revenue documents: Accountant’s confirmation that personal and

business tax affairs are paid up to date and in order, and/or the last 3 years’ worth of Revenue Notices of Assessment

- Your 3 most recent Revenue Acknowledge Form (11)

- Up to date Tax clearance certificate

Your business bank statements: You will typically be required to provide business bank statements going back from 6 to 12 months, in addition to personal bank account statements.

Your outstanding loans: 6 months of any business borrowings.

Seek Professional Advice

Navigating the mortgage application process can be daunting, but at LowQuotes, our financial advisors are committed to providing you with the necessary information and guidance to make it as smooth as possible.

You can request a mortgage quote to check your eligibility; simply provide your information, and our team of mortgage advisors will promptly contact you to discuss your specific requirements and provide personalised guidance tailored to your needs.

We also provide a wide variety of financial services, such as life insurance, mortgage protection, Income protection, serious illness, pensions, financial planning, health insurance, and savings & investments.

Start your homeownership journey!

How is the process to apply for a mortgage?

1. Enter your details

Your dedicated award-winning mortgage advisor will guide you through your application.

2. Digital Application

Log in to your digital application portal and upload all documents required. You can even sign digitally to make the process even easier and hassle-free.

3. Approval

Check your application’s status at your convenience. Indicative Approval in 72 hours after assessment.

Watch our online system in action

Watch how seamless and straight-forward Applying for your first mortgage is. In under 10 minutes you can complete your application. All with guided assistance from your very own dedicated Mortgage advisor.

Our Services

All our content has been written or overseen by a qualified financial advisor. However, you should always seek individual financial advice for your unique circumstances.

Warning: You may lose your home if you do not keep your repayments.§

Warning: The cost of your monthly repayments may increase.

Warning: You may have to pay charges if you pay off a fixed-rate loan early.

Warning: If you do not meet the repayments on your loan, your account will go into arrears. This may affect your credit rating, limiting your ability to access credit in the future.

Warning: The entire amount you have borrowed will still be outstanding at the end of the interest-only period. The lender may adjust the payment rates on this housing loan from time to time. (Applies to variable-rate loans only).