With house prices skyrocketing, it’s no wonder so many parents are wondering how their kids will ever afford a place of their own. These days, buying a home is more challenging than ever for young people. Saving for a deposit while paying high rent can feel like climbing a mountain in flip-flops.

However, there are some smart, tax-friendly ways you can step in and give them a real head start, making that first step onto the property ladder a lot less daunting.

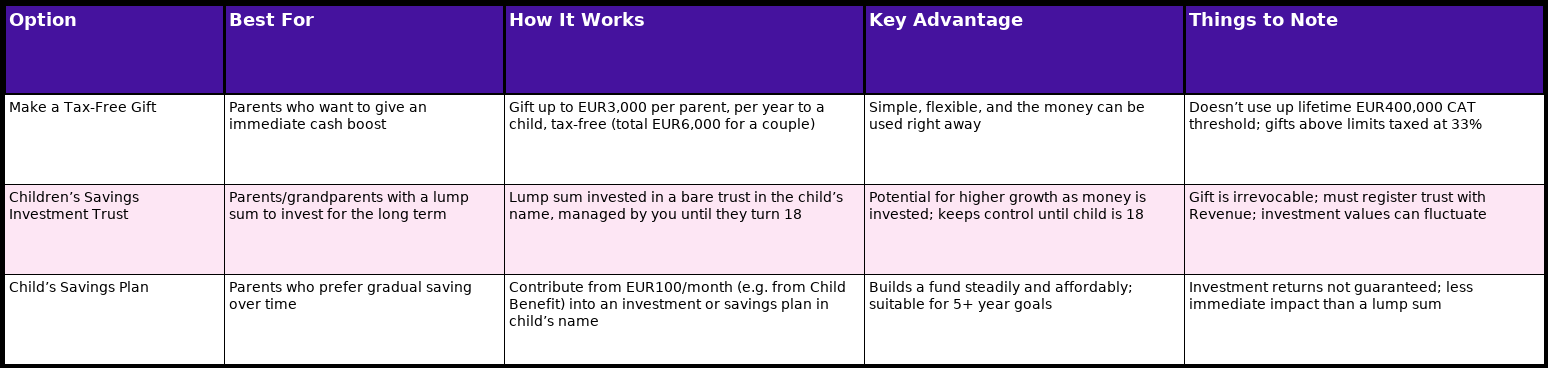

Here are three of the most popular options in Ireland.

Make a Tax-Free Gift

If you want to give your child a straightforward boost towards buying their first home, a tax-free gift is one of the simplest ways to do it.

In Ireland, parents can gift their child up to €3,000 each per year under the Small Gift Exemption, completely tax-free. That means a couple could give their child €6,000 in one year without triggering any tax bill or using up any of the bigger lifetime inheritance threshold.

Over time, this can add up to a serious contribution. For example, giving €6,000 a year for five years would mean your child receives €30,000, enough to make a real dent in a house deposit.

This annual gift is separate from the Group A lifetime tax-free threshold of €400,000 (as of 2025) that applies to gifts and inheritances from parents to children combined. That means you can help now without eating into the amount they can inherit tax-free in the future.

Why it works so well:

- Immediate impact – your child can use the money right away for their deposit or other costs.

- No paperwork – if you stay within the €3,000 per parent per year limit.

- Flexible – you decide when and how much to give each year.

If you gift above the annual exemption or lifetime threshold, the excess will be subject to Capital Acquisitions Tax (CAT) at a rate of 33%.

Example 1:

If both parents each contribute €3,000 per year, that’s a total of €6,000, with no tax, no paperwork, and no impact on the lifetime threshold. Over five years, that’s €30,000 towards a deposit, just from small gifts.

Example 2:

If you want to help your daughter and her husband with their house deposit, you can take advantage of the Small Gift Exemption. This allows you to gift up to €3,000 per person, per year, completely tax-free. That means you and your spouse could each give €3,000 to your daughter and €3,000 to her husband. In total, that’s €12,000 in one year — without affecting your lifetime inheritance tax thresholds or triggering any tax bill.

Grow their dreams with smart savings. Get a personalised quote today!

Children’s Savings Investment Trust

Let’s say you want to give your child a meaningful financial boost, whether for a future home, education, or just a solid foundation, but in a way that’s smart and tax-efficient. That’s where something like a Children’s Investment Trust comes in handy.

Here’s how it works:

- You invest a lump sum into an Investment Bond, which is held in what’s called a Bare Trust, essentially a long-term savings pot reserved just for your child.

- You stay in control as the trustee. This means you choose which funds to invest in, keep tabs on performance online, and make adjustments as needed.

- The trust locks everything in for the child until they turn 18, so the money can only be used towards something meaningful, such as a mortgage deposit, education, or a first car.

Why it’s a clever option:

- Growth potential: Unlike a regular savings account, your money gets invested in diverse funds and could grow substantially over time.

- Tax-smart: Contributions stay within the tax-free thresholds (like CAT limits), and any investment growth doesn’t count towards those thresholds. For example, if €40,000 grows to €83,000, the extra €43,000 isn’t taxed because only the original gift matters for tax purposes.

- Flexibility for the giver: You remain in charge as trustee, monitoring and adjusting investments until the funds are passed to the child at 18.

Things to keep in mind:

- Once the trust is set up, the gift is final—you can’t take the money back.

- It’s only for children under 18, and trusts must be registered with the Revenue for anti-money-laundering purposes.

If you’re looking to give your child a gift that grows, stays tax-efficient, and is carefully protected until they’re ready, a Children’s Investment Trust is a powerful way to set them up for real success, while giving you peace of mind that it’ll support them at just the right time.

Read more about Children’s Investment Trust.

Child’s Savings Plan

Another way to make steady progress towards your child’s financial future is with a Child’s Savings Plan, a solid and low-stress option.

Unlike a Children’s Savings Investment Trust, where you invest a lump sum upfront, a Child’s Savings Plan lets you contribute a small amount each month, starting from as little as €100, and gradually build a dedicated fund for your child over time.

Here’s why it works so well:

- Easy and reliable: Think of it like a regular savings account, but made specifically for your child’s future. It’s a smart, no-fuss way to start building a dedicated fund, especially for medium-term goals like college tuition or a mortgage deposit.

- Invest their Child Benefit payments wisely: In Ireland, you get €140 monthly in Child Benefit. Instead of letting it sit idle, consider putting it into a savings plan. Over time, that adds up, as it is parked in a fund and has room to grow.

- Long-term focus: This investment is suitable for individuals with a long-term horizon who are willing to save for a period of five years or more. You’ll need to decide how much you want to put aside each month – it can be as little as €100.

Read more:

The Key Takeaway on Gift & Inheritance Tax

All three of these options — the Small Gift Exemption, a Children’s Savings Investment Trust, and a Child’s Savings Plan — can be used without triggering gift tax, as long as you stay within the rules.

- €3,000 per parent, per year is always tax-free under the Small Gift Exemption. That means a couple can give a child up to €6,000 each year without paying any tax or filing paperwork.

- Over a lifetime, each child can receive a total of €400,000 from their parents (gifts and inheritance) before any Capital Acquisitions Tax (CAT) is due.

If you go above either the annual exemption or the lifetime limit, the excess is taxed at 33%.

Be smart with your money. Get a personalised quote today!

Get a Savings & Investments Quote

Whether you choose to gift a lump sum, grow it through an investment trust, or steadily save in your child’s name, the key is to start early and make the most of Ireland’s generous tax allowances.

By planning ahead, you give their savings time to grow and increase their chances of beating rising property prices. The result? Your child can step onto the property ladder sooner, with less financial stress, while you enjoy the peace of mind and pride that comes from knowing you’ve made a lasting difference in their future. Get a Savings & Investments quote today!

We provide a wide variety of financial services, such as mortgages, serious illness cover, pensions, financial planning, health insurance, and savings & investments.

Share this post

All our content has been written or overseen by a qualified financial advisor. However, you should always seek individual financial advice for your unique circumstances.

Warning: Past performance is not a reliable guide to future performance.

Warning: The value of your investment may go down and up.

Warning: If you invest in this product, you will not have any access to your money until you retire.

Warning: If you invest in this product, you may lose some or all of your investment.

Warning: This product may be affected by changes in currency exchange rates.