Self-employment gives you freedom, but it also means you’re flying solo when it comes to planning for the future. Unlike PAYE workers, you don’t have access to a company pension scheme or employer contributions. That means it’s entirely up to you to take charge of your retirement savings.

Without an employer sorting out your pension, planning for the future is entirely up to you. And while retirement might seem far away now, the decisions you make today could mean the difference between scraping by and retiring comfortably.

In this article, we’ll break down why having a pension is essential if you’re self-employed, the different pension options available to you, and how starting early can make a big difference to your long-term financial security.

Why the Self-Employed Need a Pension

Many self-employed people put off thinking about retirement, assuming they’ll “sort it out later.” However, the truth is, the earlier you start planning, the better your future will look. Here’s why a pension isn’t just a good idea; it’s essential.

The State Pension Might not Be Enough

As of 2025, the full State Pension (Contributory) in Ireland pays €289.30 per week, which is just over €15,000 per year.

Now ask yourself: could you live on just the State Pension? Would it cover your rent or mortgage, bills, groceries, and healthcare? For most people, the answer is no, and if you haven’t made enough PRSI contributions, you might not even qualify for the full amount.

That’s why relying solely on the State Pension is a risky move. A private pension helps you fill the income gap and maintain your lifestyle after retirement.

You’re Responsible for Your Retirement

Unlike employees in PAYE jobs who might have access to employer-sponsored pension schemes, self-employed workers have to take care of everything themselves, from invoicing and taxes to savings and pensions.

If you don’t set up a pension, no one else will do it for you. The longer you delay, the more you’ll have to catch up later, or worse, the more you’ll have to sacrifice in retirement.

Think of it as paying your future self. You work hard now; make sure future-you gets to enjoy the rewards.

Pensions Come With Big Tax Benefits

One of the most significant benefits of contributing to a pension? Tax relief.

- If you’re a higher-rate taxpayer (40%), you’ll get back €40 in tax relief for every €100 you contribute.

- That means saving for retirement can also reduce your tax bill today, a smart two-in-one benefit.

Pensions are one of the most tax-efficient ways to grow your money. For self-employed individuals who don’t have access to many tax breaks, this is one benefit that’s well worth taking advantage of.

Read our Guide to Pension and Retirement Planning to learn more.

Your Income May Not Be Consistent

Being self-employed often means that your income can fluctuate throughout the year. That can make saving unpredictable.

The good news? Pension plans, such as a PRSA (Personal Retirement Savings Account), are flexible. You can increase, decrease, or pause your contributions depending on your income at the time. This makes pensions more manageable, even if your business has good and bad months.

Retirement Will Come Sooner Than You Think

You might love your work and plan to keep going for years, but at some point, whether by choice or necessity, you’ll likely want to slow down or stop working altogether. When that time comes, having a pension in place means you won’t have to rely on the State or your family for support.

It gives you more control over when you retire and the freedom to enjoy life without constant financial worry. It’s not just about retiring early; it’s about having the option to retire comfortably, on your own terms.

Retirement is closer than you think. Get a Pension Quote Today!

What Kind of Pension Can You Set Up?

There are solid options available to self-employed workers in Ireland, with significant tax incentives to encourage you to start.

Personal Retirement Savings Account (PRSA)

A Personal Retirement Savings Account (PRSA) is a flexible and portable pension option, ideal for self-employed people with variable income. You can pause or adjust your contributions at any time to suit your financial situation, and the account stays with you if you change jobs or move abroad. Plus, contributions qualify for tax relief at your marginal rate—20% or 40%—making it a tax-efficient way to save for retirement.

Company Pension (via Limited Company)

If you’re self-employed and operate through a limited company, you can set up an Executive Pension or contribute to your own PRSA via your business.

Why it’s worth considering:

- Your company can make pension contributions on your behalf.

- These contributions are corporation tax-deductible.

- You can build a pension pot more quickly than by contributing personally.

Read more about how to grow your money transferring your company profits to your own pension funds: A Guide for Business Owners on Protecting, Extracting, and Growing Wealth in Ireland.

How Much Should You Contribute?

Figuring out how much to contribute to your pension starts with understanding how much you’ll need in retirement to maintain your lifestyle comfortably. While the exact figure will vary from person to person, a good rule of thumb is to save as much as you reasonably can, starting as early as possible.

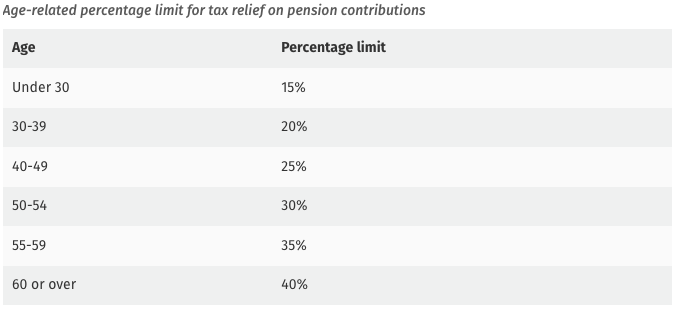

In Ireland, there are age-related limits on the percentage of your income that qualifies for pension tax relief, whether you’re self-employed or an employee. For example, if you’re 42, your contribution limit is 25% of your earnings. So, if you earn €40,000, you can contribute up to €10,000 per year to your pension and claim tax relief on the full amount.

The maximum annual earnings taken into account for calculating tax relief is €115,000.

When Can You Access Your Pension?

The age at which you can access your pension depends on the type of plan you have. If you set up a pension while self-employed or worked for an employer that didn’t contribute to your pension, you likely have a Personal Pension or PRSA.

In most cases, you can access your PRSA anytime between the ages of 60 and 75. However, in certain situations, such as if you retire early or stop working due to ill health, you may be able to start drawing benefits as early as age 50. Because each case is different, it’s always best to speak with a financial advisor to understand your specific options and timelines.

What Options Do You Have When You Retire?

When you retire, you’ve got a few solid options, and depending on your pension type, you might be able to combine them. The choices you have will depend on the kind of pension plan you’ve built up over the years, but in general, there are four main routes you can take.

- You can take 25% of your pension tax-free when you retire (up to a lifetime cap of €200,000).

- Take a taxable lump sum (any amount above the €200,000 limit is taxed).

The rest can be used to buy an annuity (guaranteed income for life) or go into an Approved Retirement Fund (ARF), which gives you more control and flexibility.

Read Our Articles

We’ve put together plenty of articles to guide you through key financial decisions. You might like the following:

- Why a Private Pension in Ireland Is Smarter Than You Think

- Setting Up a Private Pension in Ireland

- 6 Reasons to Review Your Pension This Year

- 7 Smart Ways to Use Tax Relief to Grow Your Pension in Ireland

- What to Do 5 Years Before Retirement

- The Essential Guide to Pension and Retirement Planning

- Private Pension Myths in Ireland

- Do You Know What Happens to Your Private Pension Plan When You Die?

The Countdown Is On! Get a Pension Quote and Take Control.

Get a Pension Quote With LowQuotes

As a self-employed worker, planning for your retirement is entirely in your hands. At LowQuotes, we make it easy to get started. Your income might vary, but your retirement goals don’t have to. Get your free pension quote today and take the first step towards a more secure future.

If you’ve got questions, our Retirement Planning Guide is a great place to start, it covers the basics and might clear up any doubts. You can also speak to one of our qualified financial advisors, who’ll guide you through your options and help you make confident decisions about your future.

We provide various financial services, such as life insurance, income protection, mortgages, serious illness cover, pensions, financial planning, health insurance, and savings & investments.

Share this post

All our content has been written or overseen by a qualified financial advisor. However, you should always seek individual financial advice for your unique circumstances.

Warning: Past performance is not a reliable guide to future performance.

Warning: The value of your investment may go down and up.

Warning: If you invest in this product, you will not have any access to your money until you retire.

Warning: If you invest in this product, you may lose some or all of your investment.

Warning: This product may be affected by changes in currency exchange rates.