Table of Contents

Whether you have worked for different employers throughout your career or moved around between professions, you might have more than one pension. Keeping track of all your pensions is essential to ensure a stable and well-funded retirement; in other words, tracing your pensions might help you to retire with more money.

Pensions are a fundamental part of retirement planning and it’s not uncommon for people to lose track of their pension contributions or even for the company managing your occupational pension to change without informing you. Pension tracing can help you locate your pensions, determine their value, and make informed decisions regarding your retirement income.

What is Pension tracing?

Pension Tracing is the process of tracking down lost or forgotten pension funds. Finding your old pensions can provide you with a comprehensive overview of your retirement savings and plan for the future effectively.

How do I know if I am eligible for Pension tracing?

You might be eligible for pension tracing if you have had more than one employment throughout your career that provided pension schemes. This service is beneficial whether you have worked part-time, full-time, or have been self-employed.

Benefits of Tracing Your Old Pensions

Unlock Lost Funds

By searching for old pensions, you can rediscover forgotten funds and access money that you may not have been aware of. You might be entitled to cash in a 25% tax-free lump sum that you didn’t know you had.

Consolidate and Take Control of your Pensions

Pension tracing makes it possible for people to combine all of their retirement assets into a single account, making easier management and oversight. It simplifies the process for effective and successful retirement planning.

Increase your Retirement Income

By tracing and locating all your pension funds, you can accurately assess the value of your retirement savings. With this information, you are better equipped to choose investments, annuities, or other retirement income alternatives that will maximise your entire retirement income.

Access to Additional Benefits

Locating old pensions might give access to additional benefits associated with those pension schemes. Early retirement alternatives, inflation-linked annuities, or other incentives that can boost your retirement income are a few examples of these advantages.

Steps to trace your lost or forgotten pensions

Gather information about your old pensions

- Gather information about your previous employment such as the employer’s name, employment dates, and PPS number.

- Check if you got annual pension statements from your previous pension providers. They will give you details of any old plans. The more information about your previous plans, the better.

Contact Previous Employers / Pension Providers

- If you don’t know your pension provider you can enquire about the pension plans you were registered in while working with your previous employers.

- If you know which provider your old pension was with, you can contact them providing them as much information as possible to help them find your records, such as plan number and date of birth.

Contact LowQuotes to Trace your Pension

If you have difficulties during the pension tracing process, LowQuotes have experienced financial advisors who can provide valuable assistance in locating and consolidating your pension funds effectively.

We can not only track down all of your pensions for you but also combine them into one effective retirement plan.

Be smart with your money. Get a personalised quote today!

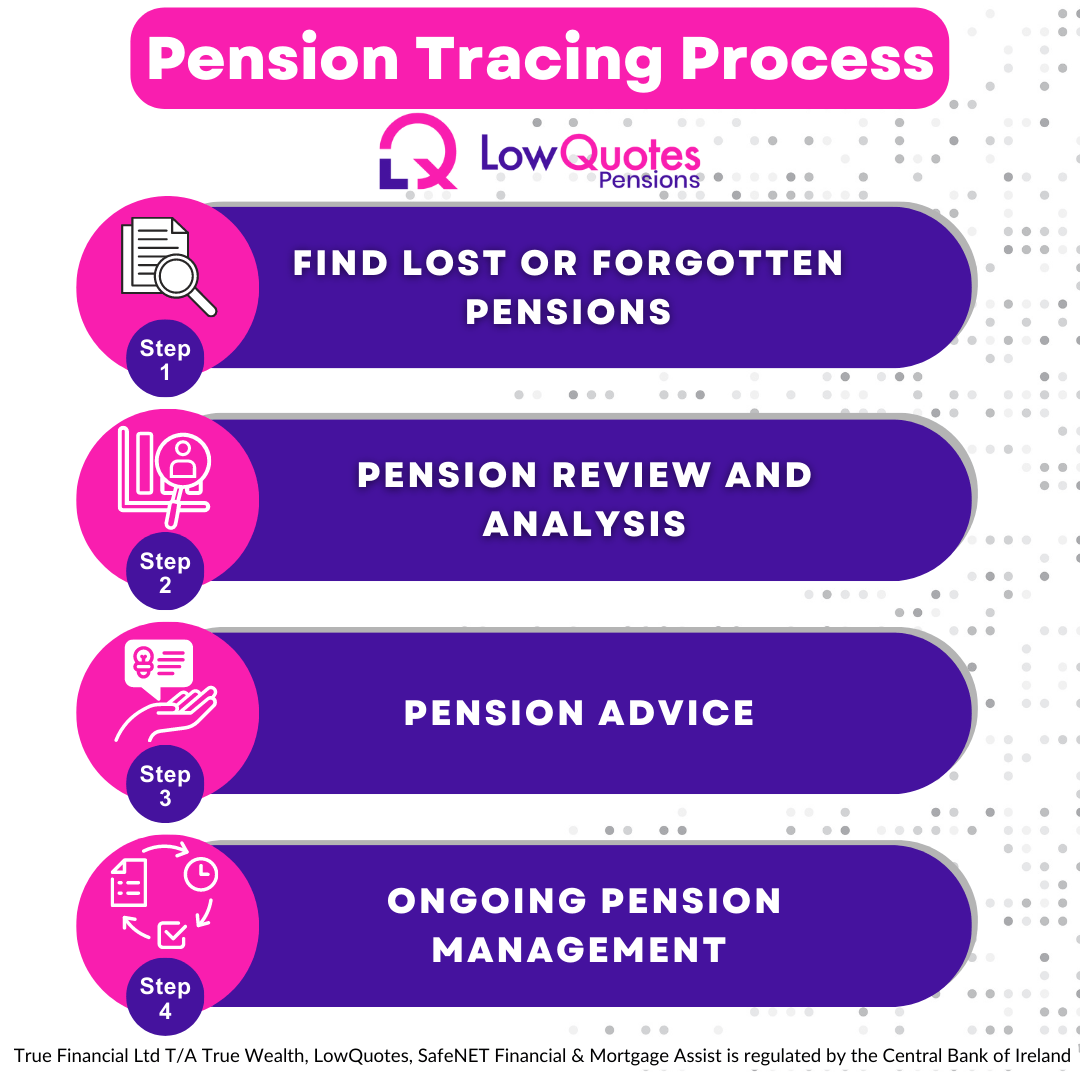

LowQuotes Pension Tracing Process

Our Pension Tracing Service reduces the time-consuming process of tracing and consolidation by conducting extensive research and communicating on your behalf with numerous pension providers.

Find Lost or Forgotten Pensions

To start tracking down your pension, you’ll need to provide information and any possible supporting documents about you, your employment, or pension you might still have.

Pension Review and Analysis

Our qualified Financial Advisors will thoroughly review and analyse your pensions in order to ensure that you are completely informed about your pension funds and the various solutions available to you.

Pension Advice

We will provide you with the information you need to make well-informed decisions about your retirement income, including possibilities for pension consolidation and investment strategies.

Ongoing Pension Management

Your pension funds will be regularly monitored and reviewed by us, adjusting investment strategies as necessary while keeping you updated on any new opportunities.

What Should I do after I find my old pensions?

Once you locate the pensions you’ve lost track of, you can choose what to do with them.

Leave the Pension where it is

In some cases, you may have the option to leave your pension funds in the scheme, allowing them to continue growing until your selected retirement age.

Transfer to a new employer’s scheme

If the job you’re moving to offers a pension scheme, you might have the option to transfer your pension savings to the pension plan of your new employer. You can maintain full active control over your entire pension pot.

Transfer into a Personal Retirement Bond (PRB)

PRB offers investment flexibility and might provide you access to additional benefits, such as retirement age options, the possibility to take a tax-free lump sum from age 50, or increased investment options. It’s advisable to talk to our team of experts about it as some PRBs might have higher fees compared to your existing pension scheme.

If you don’t know what to do with your old pension, we can guide you by taking into consideration your financial situation and retirement goals.

I’ve just found an old pension fund. Can I cash in my pension fund before retirement?

You might be eligible to access your pension funds from age 50 in certain circumstances. If you have ever paid into an occupational scheme and have left your job or changed employment you might be entitled to take a 25% tax-free lump sum up to €200,000. However, this will rely on your pension scheme rules.

Talk to one of our financial advisors for an expert advice. We can provide personalised guidance based on your personal circumstances, goals, and the most up-to-date information regarding pension regulations.

Read Our Articles

We’ve put together plenty of articles to guide you through key financial decisions. You might like the following:

- Why a Private Pension in Ireland Is Smarter Than You Think

- Setting Up a Private Pension in Ireland

- 6 Reasons to Review Your Pension This Year

- 7 Smart Ways to Use Tax Relief to Grow Your Pension in Ireland

- What to Do 5 Years Before Retirement

- The Essential Guide to Pension and Retirement Planning

- Private Pension Myths in Ireland

- Do You Know What Happens to Your Private Pension Plan When You Die?

Be smart with your money. Get a personalised quote today!

Trace your Pension with LowQuotes

We understand Pension tracing is crucial in helping individuals in Ireland secure their financial future by locating and consolidating their pension assets. We have the necessary expertise and resources to navigate complex pension landscapes and help you make informed decisions regarding your retirement planning.

If you want to find your old pensions and ensure a stable retirement contact us; we can guide you throughout the whole pension process. We discuss more in-depth about pensions in our guide to Pension and Retirement Planning.

We also provide the best financial planning in Ireland and our role is to guide you on how to manage your finances and have an effective plan projecting many years into the future.

Share this post

All our content has been written or overseen by a qualified financial advisor. However, you should always seek individual financial advice for your unique circumstances.

Warning: You may lose your home if you do not keep your repayments.

Warning: The cost of your monthly repayments may increase.

Warning: You may have to pay charges if you pay off a fixed-rate loan early.

Warning: If you do not meet the repayments on your loan, your account will go into arrears. This may affect your credit rating, limiting your ability to access credit in the future.

Warning: The entire amount you have borrowed will still be outstanding at the end of the interest-only period. The lender may adjust the payment rates on this housing loan from time to time. (Applies to variable-rate loans only).