What is Serious Illness Cover and how does it work?

Specified serious illness cover in Ireland is a type of insurance policy that provides a lump sum payment that enables you to take care of yourself and your family if you are diagnosed with a life-threatening illness that is covered and defined under the policy conditions, examples would include some cancers, heart attack, or stroke.

You could use this money to pay for things like household expenses or medical costs. Depending on the policy and the insurance companies, the illnesses covered and the amount paid out will change.

You can buy serious illness cover as an extra benefit on a life insurance or mortgage protection policy. Or you can buy serious illness as a separate policy.

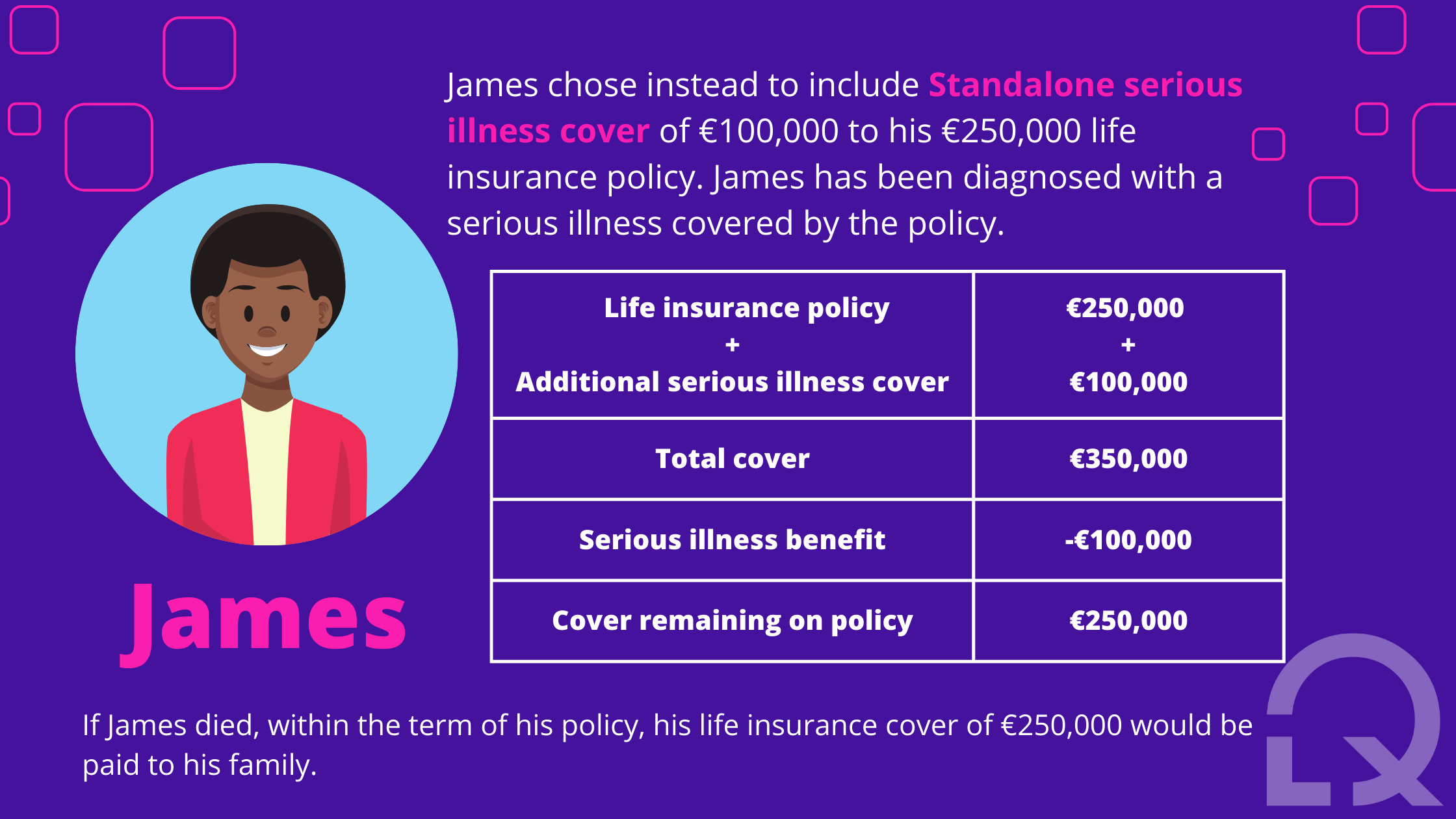

- Standalone serious illness cover means it is taken out as a separate policy and it is completely independent of any life protection you might purchase or already have. It is also sometimes called additional cover, separate cover, or double cover.

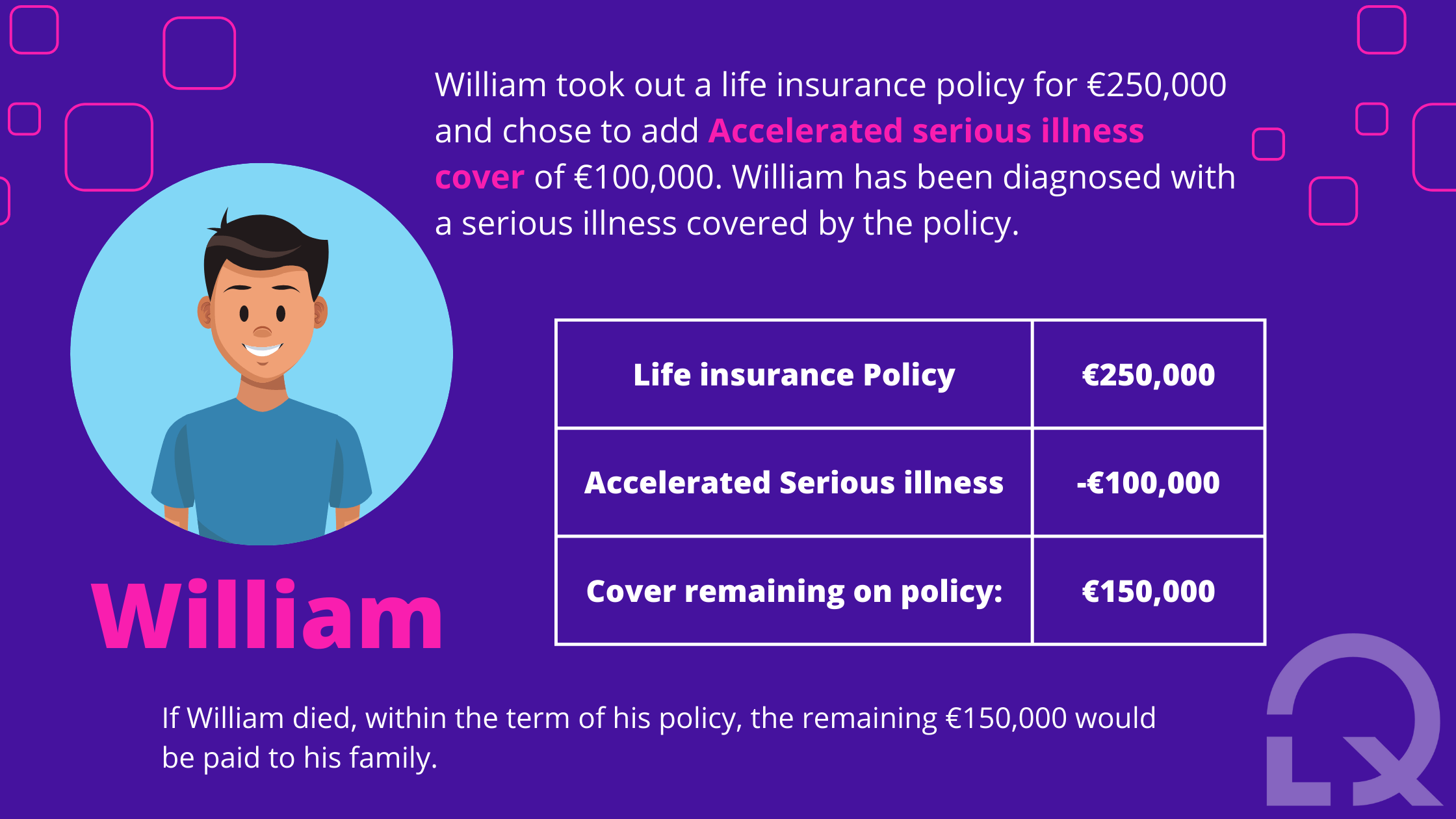

- If you are adding serious illness cover to your mortgage protection or life insurance when the payment is made the life cover amount is reduced accordingly. It is also called an accelerated serious illness cover.

What illnesses are covered under a serious illness policy?

Serious illness policies typically cover a range of specified illnesses that are considered severe and life-changing. The specific illnesses covered can vary depending on the insurance provider and the policy, but some of the common illnesses that may be covered include:

- Cancer

- Heart attack

- Stroke

- Multiple sclerosis

- Parkinson’s disease

- Kidney failure

- Organ transplant

- Blindness

- Deafness

- Paralysis

- Motor neuro disease

It’s important to note that each policy has its own unique definitions and criteria for what qualifies as a “serious illness”. It is essential to examine the terms and conditions of your policy carefully to understand what is covered.

When should I take out Serious Illness Protection?

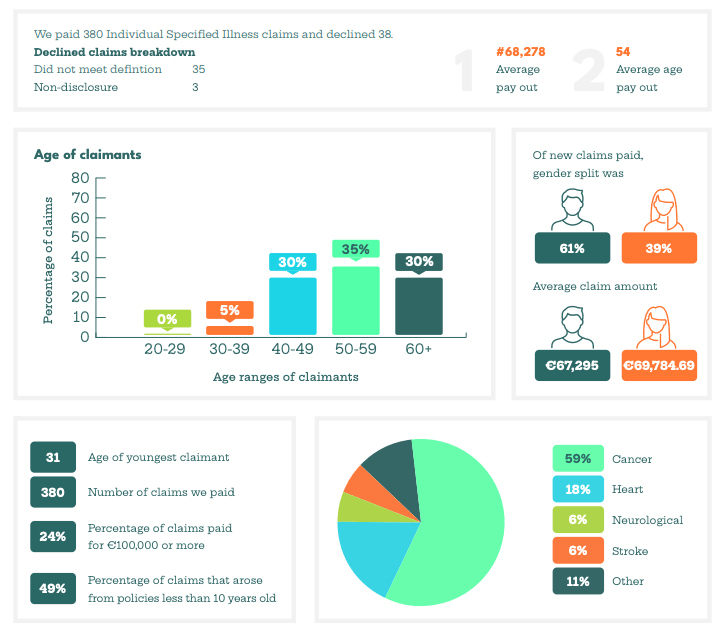

According to New Ireland, 49% of the payouts to policyholders due to serious illness occurred within the first 10 years of purchasing the insurance policy. And considering the youngest claimant was 31 years old this suggests that people should be getting serious illness protection as early as possible as the best time to take out Serious Illness Cover is when you are healthy! The healthier you are with any protection product, the more likely you are to be accepted, like all protection policies your age affects price. So the younger you are, the cheaper the premium should be.

If you’d like to get a quote and compare the best Irish providers in an instant click here.

Why do I need Specified Serious Illness Cover?

Serious illness cover is essential because it can provide financial protection and peace of mind if you become seriously ill. It’s worth considering this cover if you want to protect yourself and your family from the financial impact of a serious illness.

Here are some reasons why you might consider getting specified serious illness protection.

– You don’t have alternative means of covering illness, such as a rainy day fund.

– You have a mortgage, personal loans, debts, or other financial commitments that you would still need to pay in the event of becoming seriously ill and possibly unable to work

– You have children or other family members that rely on you financially

How much does serious illness cover cost in Ireland?

The cost of a specific specified serious illness policy might differ depending on a number of factors, including the insured’s age, health status, desired level of coverage, and kind of policy.

Keep in mind that there are many different types of specified serious illness insurance policies available.

- Standalone Serious Illness: Serious illness cover only.

- Life Insurance with Accelerated Serious Illness: your life insurance would be reduced by any amount paid under Accelerated Specified Illness Benefit.

- Life insurance with Standalone Serious Illness: your life insurance stays the same regardless of any amount paid under Specified Illness cover. This cover is more expensive than the accelerated cover.

You can get a serious illness quote in 60 seconds, you only need to inform some personal details and you’ll be able to compare prices from the best life insurance providers in Ireland.

Contact us today, we can help you understand your options and find a policy that is right for you and your budget.

What are the most common specified serious illness claims?

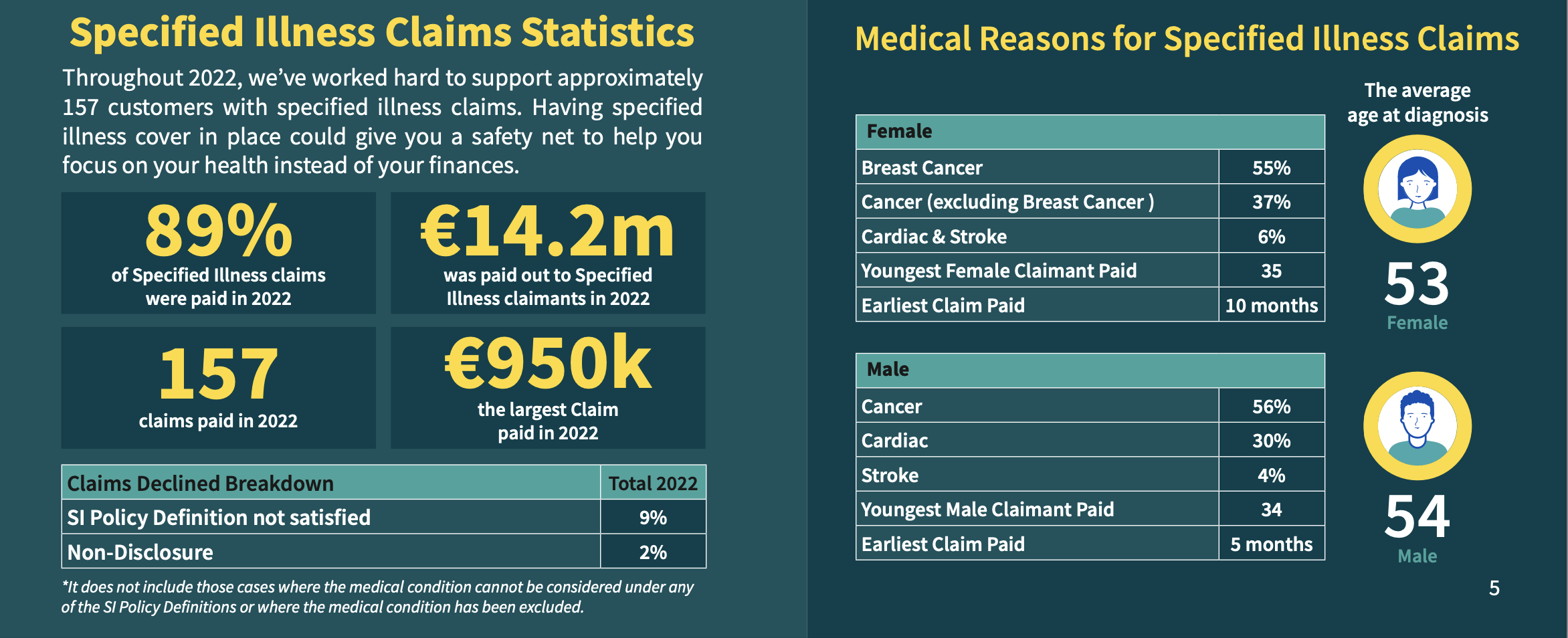

According to Aviva’s Report 2022, the most medical reasons for specified Illness claims were breast cancer, cancer (excluding breast cancer), cardiac, and stroke.

New Ireland stated in their Claim Statistics Report that 5% of the claimants were 30 to 39, 30% were 40 to 49, 35% were 50 to 59%, and 30% were 60 and beyond. And the most medical reasons for specified Illness claims were cancer, cardiac, neurological and stroke.

New Ireland stated in their Claim Statistics Report that 5% of the claimants were 30 to 39, 30% were 40 to 49, 35% were 50 to 59%, and 30% were 60 and beyond. And the most medical reasons for specified Illness claims were cancer, cardiac, neurological and stroke.

How long do I get paid after making a serious illness claim?

The length of time it takes to receive a payout after making a specified serious illness claim can vary and depends on a number of factors, such as the provider’s claims process, the terms of your policy, and the nature of your illness.

The claim process is unique for each insurer but usually, to make a claim:

– You contact the insurer

– You complete a claim form with your doctor and ask them to include any relevant medical evidence of your serious illness

– The insurer will contact you if they need more information

– If approved, your benefit will be paid directly to your bank account

What is the difference between income protection and serious illness cover?

While both income protection and serious illness are protection for you should you become ill and are unable to work, there is a difference between the two.

If you have serious illness insurance and are diagnosed with a condition that matches the policy’s stipulated illness criteria, you will be given a one-time lump sum payment.

On the other hand, income protection will guarantee that, in the event that you are unable to work, you would receive a fixed monthly income. Until you are able to return to work or the conclusion of the insurance term, income protection will be paid.

What’s the difference between Health Insurance and Serious Illness Cover?

Health insurance is a type of insurance that covers the cost of medical expenses such as hospitalisation expenses, maternity benefits, doctor visits, surgery, treatments, or preventive care. The coverage provided by health insurance varies depending on the specific policy and can be customized to meet the needs of the insured. If you want to know more read our articles explaining why private health insurance is a must-have in Ireland.

Serious Illness, on the other hand, is a specific type of insurance that pays out a tax-free lump sum if you’re diagnosed with one of the specific illnesses or disabilities that your policy covers. The payment is made to the insured regardless of whether they are able to work or not, and it can be used to cover any expenses related to the illness, such as medical bills, home modifications, or travel expenses. Serious illness cover is typically purchased as a standalone policy or combined with a life insurance policy.

In summary, health insurance provides ongoing coverage for a range of healthcare expenses, while serious illness cover provides a lump sum payment in the event of a specific medical condition.

Can I get both life insurance and serious illness at the same time?

Yes, you can buy serious illness cover as an extra benefit on a life insurance policy. Or you can buy serious illness as a separate policy.

Standalone serious illness cover means it is taken out as a separate policy and it is completely independent of any life protection you might purchase or already have. It is also sometimes called additional cover, separate cover, or double cover.

If you are adding serious illness cover to your mortgage protection or life insurance when the payment is made the life cover amount is reduced accordingly. It is also called an accelerated serious illness cover.

Does specified serious illness insurance protect my salary if I’m out of work due to a serious illness?

No. Specified serious illness pays a lump sum if you’re diagnosed with a life-threatening illness. The type of policy that protects your salary, replacing your income is known as Income Protection.

What should I do if I’ve been declined the specified serious illness cover?

If you have been declined for serious illness protection due to particular health concerns, there may be alternative options available to you. Here are some alternatives you may want to consider:

Multi-Claim Protection Cover

Multi-Claim Protection Cover is a unique, severity-based policy that protects you from a broad range of possible health issues that might impact you and your financial well-being. It can potentially payout multiple times, so you can retain some level of cover even after making a claim. For the most severe health events, such as death and terminal illness, the full amount is paid out; lesser amounts are paid out for illnesses having a lesser effect on your health and lifestyle.

If your Serious Illness application was denied due to a pre-existing condition, such as heart issues, cancer, or diabetes, you can still get Multi-Claim Protection cover with relevant exclusions.

You can read more about Multi-claim Protection in our article.

Cancer Cover Only

Cancer-only insurance policies normally pay out a lump sum of money if the policyholder is diagnosed with cancer as defined in the policy, which can be used to pay for medical expenses, make lifestyle adjustments, or cover other costs associated with the illness.

Cancer Cover is different from traditional serious illness plans because it focuses solely on cancer; therefore, it can cost less than serious illness protection. In this article, we discuss this topic in more detail.

Income Protection

This type of insurance provides coverage in the event that you are unable to work due to illness or injury. It can provide a regular income to help you cover your living expenses while you are unable to work. Learn more by reading our article with the most asked questions about income protection.

Is Mental Illness covered under specified serious illness?

Yes. Specified Mental Illness cover is a partial payment for adults being treated for a specified severe mental illness. It is paid out following the definitive diagnosis from a Consultant Psychiatrist of any mental illness that has resulted in all of the following:

– An admission to a psychiatric ward where treatment was provided for at least 14 consecutive nights; and

– You are experiencing chronic unremitting symptoms; and

– You have not responded to comprehensive management and treatment based on best clinical practice for more than 1 year.

Get your Serious Illness Quote with LowQuotes

Low Quotes is a market-leading online insurance broker in Ireland with a 5-star Google rating and 25 years of experience. We are proud to be awarded as Insurance Broker of the Year 2022 as the result of our team’s dedication to providing market-leading independent advice and exceptional customer service.

With LowQuotes, you can easily compare policies from top insurance providers to find the Specified Serious Illness cover that best meets your needs and budget. Simply fill out a short online form, and LowQuotes will provide you with a list of policies and prices to choose from. LowQuotes makes it easy to get the serious illness insurance cover you need to protect yourself and your family.

We provide a wide variety of financial services in Ireland such as Mortgage Protection, Health Insurance, Mortgages, Pensions, Income Protection, Financial Planning, Savings & Investments. If you have any questions about one of our services, feel free to contact us today.