Table of Contents

In Ireland, where mental health issues are rising, having serious illness cover that includes cover for mental health can be a very beneficial extra. It could offer essential financial support during a challenging period of mental health treatment and recovery in your lifetime.

Ordinarily, Serious illness cover provides protection for physical health problems. However, Royal London has made a significant move by being the first provider to introduce a Serious Illness Cover, which provides partial payment for adults being treated for a specified severe mental illness.

Mental health in Ireland

According to the HSE, mental health and well-being play a vital role in an individual’s overall quality of life and resilience in facing life’s many challenges.

The prevalence of depression is noteworthy, affecting over 450,000 people in Ireland, or one in ten individuals, at any one time. While one in every four individuals will experience a mental health concern over the course of their lifetime.

Aware’s national survey identified a significant prevalence of depression and anxiety in Ireland, with 60% of respondents reporting experiences of depression and a striking 80% acknowledging episodes of anxiety.

Key findings from Aware’s national survey on depression and anxiety:

- 60% reported experiencing depression.

- 80% reported experiencing anxiety.

- The most significant impact was observed among individuals under 25 and those with chronic illnesses.

- 1 in 10 individuals under 25 currently believes they are experiencing depression.

- Mental health affected by money concerns for 3 in 5 respondents.

- A concerning cycle: Almost half (48%) increase social media usage when feeling depressed or anxious, with 44% saying it contributes to stress.

- One-fifth of respondents feel they’ve faced unfair treatment due to mental health difficulties.

What is serious illness cover?

Serious illness cover, also known as Serious Illness Protection or Critical Illness Cover, is a type of insurance policy that provides financial protection to policyholders in the event they are diagnosed with a critical illness or medical condition covered by the policy conditions.

Serious illness cover typically includes a range of critical illnesses and conditions that policyholders might face. These often include major health issues such as cancer, heart attacks, strokes, organ transplants, and specific surgeries.

The coverage is designed to provide financial relief when individuals are diagnosed with one of these serious illnesses. In such challenging circumstances, policyholders receive a lump sum payment from the insurance provider. This offers valuable financial support to the policyholder, allowing them to fully focus on their rehabilitation.

This payout can be used to cover medical expenses, treatment costs, and any other financial burdens that may arise during the course of their illness.

Serious illness cover can also be added as part of a Life Insurance policy. There are two types of Serious Illness Cover you can add to a Life Insurance policy.

Types of Serious Illness Cover

You can purchase serious illness cover as standalone cover or combined as an extra benefit with life cover or mortgage protection under the one policy.

Standalone serious illness

Standalone serious illness cover means it is taken out as a policy without life insurance or mortgage protection covered on the policy. It is completely independent of any life protection you might purchase or already have in place.

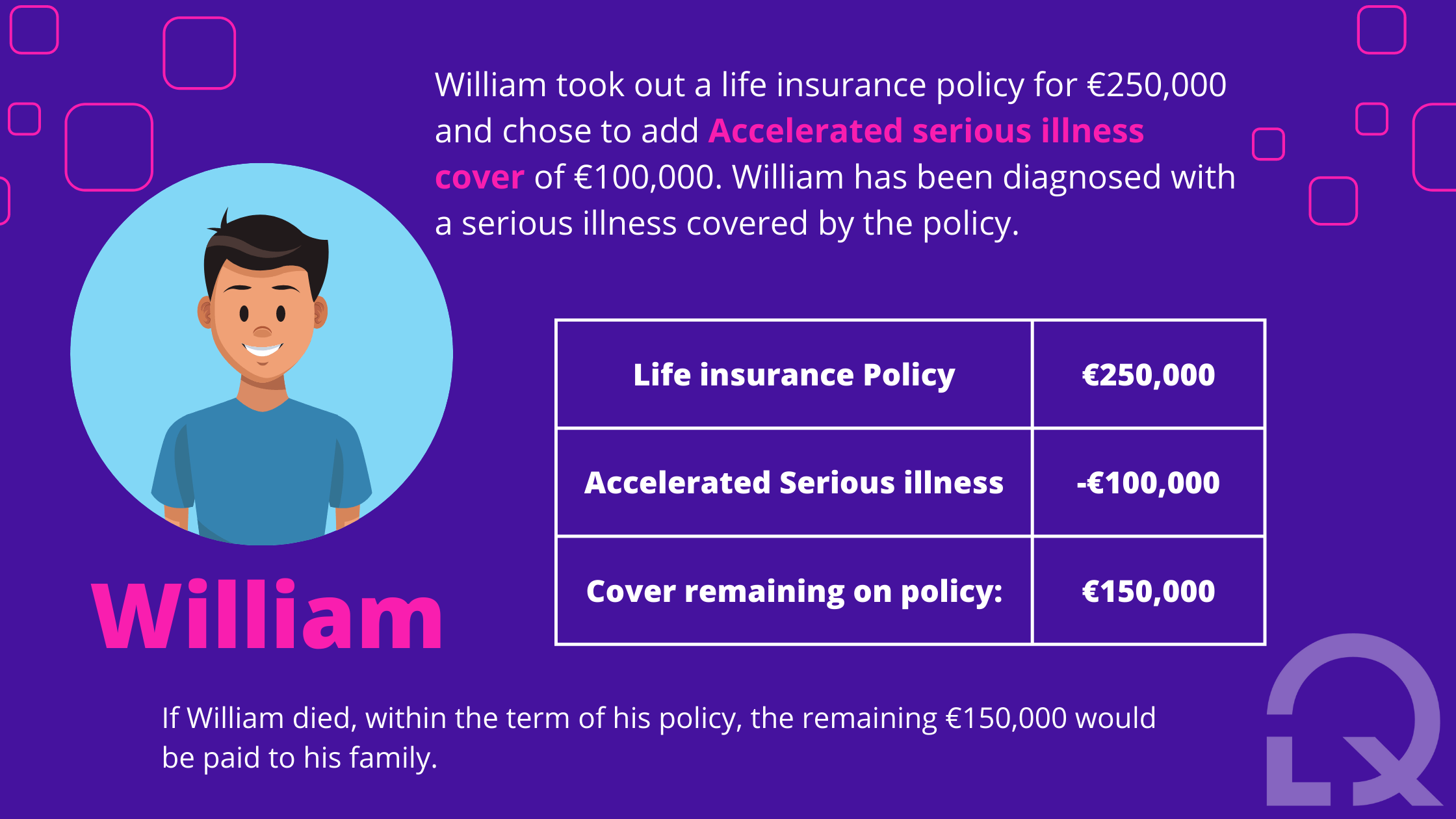

Life Insurance (or Mortgage Protection) with Accelerated Serious Illness Cover

When you opt to include accelerated serious illness cover with your mortgage protection or life insurance policy, the life cover amount decreases upon payout of a serious illness claim.

This is a cheaper way of ensuring serious illnesses are covered.

For example, you purchase €250,000 life insurance with €100,000 accelerated serious illness cover. You make a successful serious illness claim. €100,000 is paid out but your life cover amount reduces to €150,000.

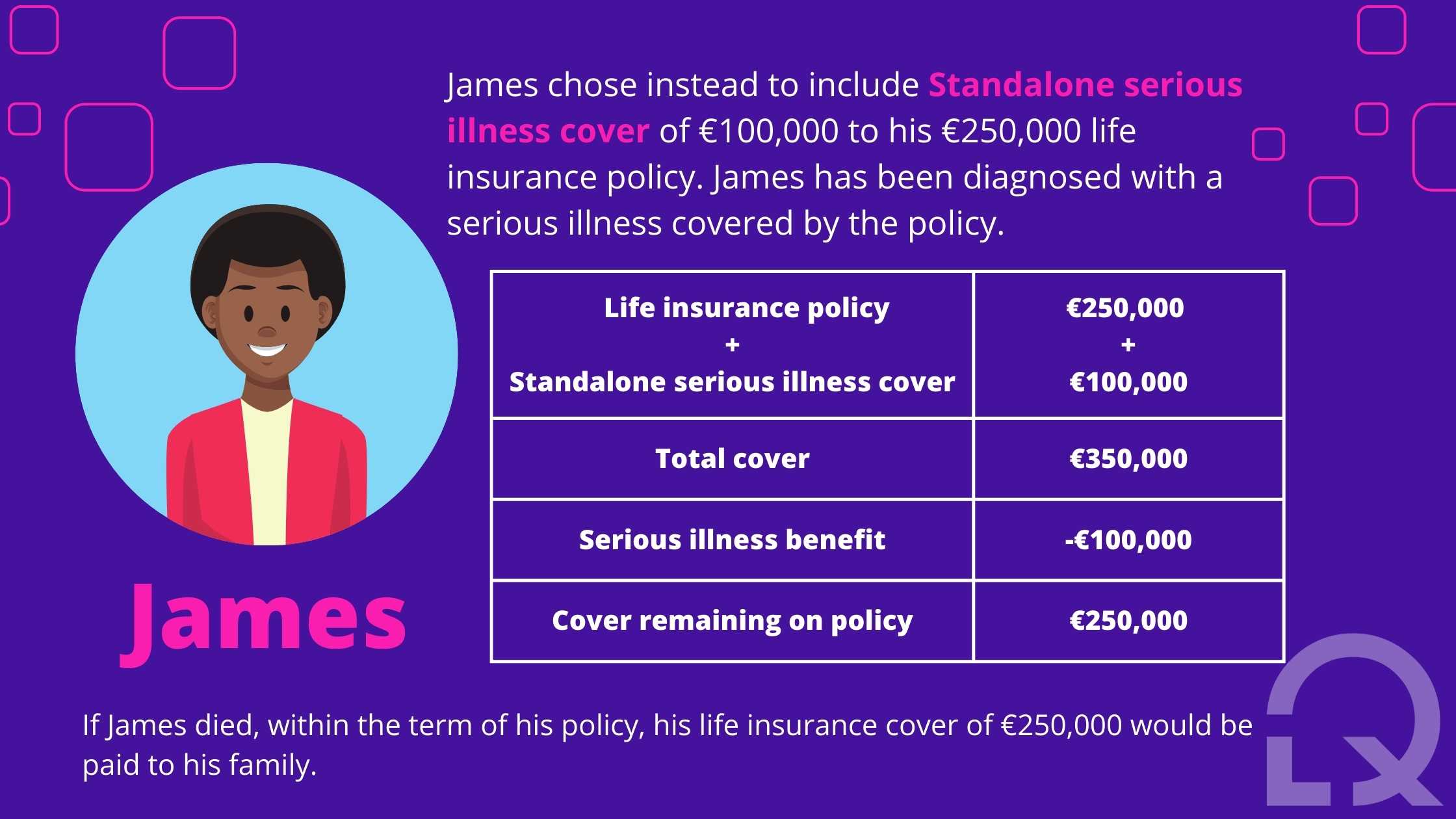

Life Insurance (or Mortgage Protection) with Standalone Serious Illness Cover

When you include standalone serious illness cover with your mortgage protection or a life insurance policy, the life cover amount isn’t reduced in the event of a serious illness claim.

For example, you purchase €250,000 Life insurance with €100,000 standalone serious illness cover. You make a successful serious illness claim, €100,000 is paid out while your life cover amount remains at €250,000.

Difference between standalone and accelerated

The distinction between accelerated and Standalone serious illness cover lies in the fact that, with accelerated cover, a claim under serious illness coverage will result in a reduction of your life cover amount.

In the case of a claim with standalone serious illness cover, your life insurance policy’s remaining amount will remain unchanged.

Protect yourself and your family from life’s unexpected health challenges.

Serious illness cover is often used in combination with Income protection insurance. Where, after a specified deferral period – will pay out up to 75% of the policyholder’s income as a monthly wage. Learn more about income protection insurance here and the differences between critical illness and income protection.

Does serious illness cover mental illnesses?

Yes, Royal London Ireland recognises the significance of mental health in Ireland and its impact on individuals’ lives.

They have taken a step forward in ensuring crucial aspects of life are protected by introducing a partial payment with Serious Illness policies for those undergoing treatment for specified severe mental illnesses.

This coverage stands out because it recognises the complexities involved in ensuring mental health conditions from an insurance perspective.

And given the increasing concern surrounding mental health issues in today’s world, it’s important to acknowledge that anyone can be affected by them.

Serious Illness Cover that provides cover for mental illnesses holds great financial importance. It alleviates the burden of steep medical expenses, lost income due to illness-related absences, rehabilitation costs, and helps maintain overall financial stability during a challenging period.

Criteria for Eligibility

Royal London will pay out a mental illness claim following the definitive diagnosis from a consultant psychiatrist of any mental illness that has led to all the following outcomes:

Hospitalisation Requirement

Admission to a psychiatric ward where treatment was provided for at least 14 consecutive nights; and

Chronic Unremitting Symptoms

You are experiencing chronic unremitting symptoms; and

Unresponsiveness to Treatment

You have not responded to comprehensive management and treatment based on best clinical practise for more than 1 year.

Exemptions

Situations connected to or worsened by the consumption of alcohol or drug abuse

Royal London’s Helping Hand: Extra Support, No Extra Cost

Helping Hand is a valuable service offered by Royal London Ireland that is designed to provide additional support to policyholders and their families during difficult times.

Helping Hand is available to use from the very first day your policy starts, not just for when you’re putting in a claim.

In the event of a serious illness, injury, or bereavement, Helping Hand provides you with the additional support you might need beyond a financial payout.

This service may include access to expert advice, counselling services, and guidance on various aspects of coping with a serious illness or loss. Click here to learn more.

This service includes access to expert advice, counselling services, and guidance on various aspects of coping with a serious illness or loss, such as:

- Bereavement Counsellors or

- Speech and Language Therapists or

- Support for mental health conditions such as stress, anxiety, depression, bipolar disorder and more.

- Support for carers – supporting someone caring for a parent or child with a serious health condition or disability.

- Face-to-face second medical opinion or

- Complementary therapies or

- Physiotherapy for specific serious health conditions or

- Many others according to nurse assessment.

Managing stress and depression with Helping Hand

Whether it’s associated with physical illness or not, there are experienced mental health nurses available to help.

They can help you or your family members with any mental health issues whether this be management of symptoms or dealing with a diagnosed condition.

An example of the importance of Helping Hand with Royal London policies

Mark Roberts, a former advisor with almost two decades of experience, shares a deeply personal and moving story about the importance of Royal London’s Helping Hand.

Mark’s narrative revolves around the life-changing events that unfolded when his partner, Elise, was diagnosed with stage 4 malignant melanoma.

Facing a difficult prognosis of 6 to 12 months to live, Mark highlights how the Critical Illness cover from Royal London allowed him to spend precious time with Elise, fulfil her dream of getting married in Rome, and support her in setting up a charity to raise £1 million for her hospital.

However, the story goes beyond financial assistance, emphasising the vital role of Helping Hand’s 1-to-1 personal support from RedArc nurse advisors, stress management, and complementary therapies.

These services, provided at no extra cost, offer invaluable emotional and practical support to those facing serious illnesses and their families, making a profound difference in challenging times.

Illnesses strike without warning. Be prepared!

Additional Benefits Of Choosing Royal London’s Serious Illness Cover

Top-Notch Cancer Coverage

Comprehensive and exceptional cancer coverage, including partial payment cover for advanced (Non‑Melanoma) skin cancer.

Outstanding Cardiac Care

Royal London offers the most comprehensive cardiac coverage in the market, encompassing heart attack, heart failure, and heart surgery.

Mental Illness Benefit for Adults

Royal London is the first provider to introduce Serious Illness Cover partial payment for adults receiving treatment for severe mental illness. They guarantee coverage upon receiving a definitive diagnosis from a consultant psychiatrist under specific conditions.

Unique Illness Coverage

Royal London Ireland provides full and partial payments for unique illnesses not covered by other providers. These include Chronic Rheumatoid Arthritis, Drug-Resistant Epilepsy with specified surgery, and Severe Sepsis requiring admission to a critical care unit.

Children’s Serious Illness Cover

Royal London’s serious illness covers children from birth until their 18th (or 21st if in full-time education) birthday.

Donor Recipient Cover

If you, the life assured, donate an organ to a family member, Royal London provides a one-time cash lump sum of €2,500 to the recipient.

Advance Payment for Heart Surgery

Should you require heart-related surgery in the future, Royal London’s coverage includes an upfront payment of up to €20,000.

Indexation Option

Opting for Indexation within your policy safeguards you from the adverse impacts of inflation. To put it simply, Indexation guarantees that your coverage grows by 3% annually in exchange for a 4% rise in your premiums each year.

Conversion Option

When you choose to add a Conversion Option to your policy, you gain a valuable benefit that allows you the flexibility to convert your coverage into a different policy of the same type. All without the need for medical proof of your health status, regardless of your age or health condition at that time.

What’s the difference between full payment and partial Payment?

The difference between serious illness full payment and partial payment lies in the amount paid out by an insurance policy when the policyholder makes a successful serious illness claim.

Full Payment

When a policy offers full payment for a specified illness, it means that if you are diagnosed with that illness, you will receive a lump sum payout equal to the policy’s full coverage amount.

For example, if your policy covers €100,000 for a stroke and you suffer a stroke, you would receive the full €100,000 as a payout.

Partial Payment

In contrast, partial payment covers specific illnesses but provides a payout that is less than the full coverage amount.

When Serious Illness Cover is included as part of your policy, alongside the full coverage for 60 specified serious illnesses, it extends additional cover by offering a partial payment upon diagnosis of one of 40 supplementary specified illnesses.

This partial payment, except in the case of Coronary Angioplasty (of specified severity), will amount to €15,000 or 50% of your Serious Illness Cover as of the diagnosis date, whichever is less.

To provide you with an overview, here are some of the medical conditions included in the partial payment serious illness cover offered by Royal London Ireland.

- Severe mental illness

- Advanced (non-melanoma) skin cancer

- Diabetes mellitus type 1

- Early-stage thyroid cancer

- Coronary angioplasty

If you want to see the full list, click here.

Read our insightful articles

- Critical Illness Vs. Income Protection: Which Is The Best?

- 6 Things To Know Before Purchasing Serious Illness Cover

- 6 “What Ifs” That Everybody Should Think About

- Does Critical Illness Cover Heart Attack?

- Serious Illness Cover Explained: Your Comprehensive Handbook

- Is Cancer Covered Under Specified Serious Illness In Ireland?

Health Scares Don’t Wait. Neither Should You.

Get a serious illness cover quote with LowQuotes

Low Quotes is a market-leading online insurance broker in Ireland with a 5-star Google rating and over 1,400 Google reviews.

We are proud to be awarded as Insurance Broker of the Year 2022 as the result of our team’s dedication to providing market-leading independent advice and exceptional customer service.

Using LowQuotes, you can effortlessly compare Serious Illness Cover policies offered by leading providers, allowing you to discover the coverage that aligns perfectly with your requirements and financial plans.

All it takes is a short online form, and LowQuotes will furnish you with a selection of policies and their corresponding prices.

With LowQuotes, securing the serious illness insurance you require to safeguard both yourself and your family has never been more straightforward.

Share this post

All our content has been written or overseen by a qualified financial advisor. However, you should always seek individual financial advice for your unique circumstances.