Many self-employed people in Ireland are unaware of the wide range of tax reliefs and strategies available to them. Whether you’re a sole trader or running a limited company, there are plenty of legitimate ways to reduce your tax liability and hold on to more of your hard-earned income.

With the right planning, especially if you own a business, you can make your money work smarter and more efficiently.

Here are some of the most effective tax-saving strategies for the self-employed in Ireland.

Contribute to a Pension and Cut Your Tax Bill

If you’re self-employed, contributing to a pension is one of the most effective and tax-efficient ways to reduce your income tax bill. The government offers tax relief as an incentive to help you save for your future.

Here’s how it works:

When you contribute to a personal pension or Personal Retirement Savings Account (PRSA), you can claim tax relief at your marginal rate, that’s either 20% or 40%, depending on how much you earn.

This means that for every €100 you contribute, the actual cost to you could be as little as €60 if you’re on the higher tax rate, with the remaining €40 effectively covered through tax savings.

How much can you contribute?

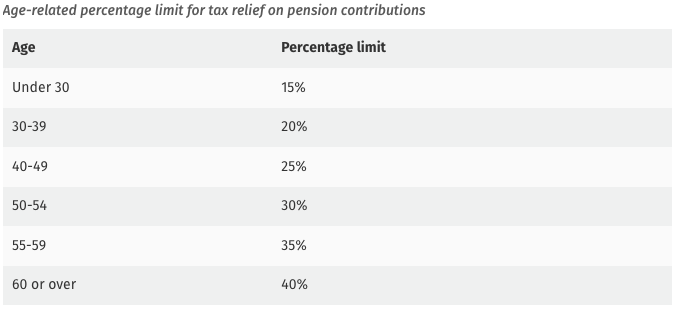

It depends on your age. The older you are, the higher the percentage of your income you can put into your pension and still get tax relief:

No matter how much you earn, you can only claim tax relief on income up to €115,000. So even if you earn €200,000, the maximum amount that qualifies for tax relief will be based on €115,000.

Boost Your Pension Funds with AVCs

Making Additional Voluntary Contributions (AVCs) is a smart way to increase your pension savings while reducing your income tax bill.

If you’re already part of an occupational pension scheme or have a PRSA, AVCs let you top up your pension fund with extra contributions on top of your regular payments. These extra contributions qualify for tax relief at your marginal rate—20% or 40%—making them especially valuable for higher earners.

In simple terms, you’re not only boosting your retirement pot but also paying less tax today. AVCs are a flexible and effective way to take control of your long-term financial future.

Be smart with your money. Get a personalised quote today!

Protect Your Income, Reduce Your Tax

Income protection is a valuable safety net that can pay out up to 75% of your income if you’re unable to work due to illness or injury. It helps cover essential living costs so you can focus on recovery without the added financial stress.

-

Tax Relief: The premiums you pay qualify for tax relief at your marginal rate, either 20% or 40%, which helps reduce the overall cost of the policy.

-

Executive Income Protection: If you’re a company director, your business can pay the premiums on your behalf. These payments are treated as a business expense and are not considered a Benefit in Kind (BIK), making it a highly tax-efficient option.

Employ Family Members

Hiring your spouse or children in your business can be a smart and legitimate way to reduce your overall tax bill, while keeping income within the family.

Benefits:

- Wages are deductible expenses: If a family member is doing real work for your business, the salary you pay them can be written off as a business expense, reducing your taxable profits.

- Family income splitting: This spreads income across more people, potentially keeping everyone in a lower tax bracket and lowering the total tax paid.

- Pension planning: Once employed, family members may be eligible to start their own pension, giving the household even more opportunities for long-term tax relief.

Rules to Follow:

- Pay a fair and reasonable market rate for the work they actually do.

- Keep proper records—like contracts, payslips, and timesheets.

- Make sure you’re operating PAYE correctly and following all Revenue guidelines.

This approach works best when the family member genuinely contributes to the business, for example, your spouse managing admin tasks, marketing, or bookkeeping.

Deductible Business Expenses

As a self-employed individual, you can claim a wide range of business-related expenses to reduce your taxable profits, lowering the amount of income tax you owe.

Some common allowable expenses include:

- Rent, utilities, and phone bills

- Travel and motor expenses (for business use)

- Wages and salaries

- Consultancy, legal, and accounting fees

- Advertising and marketing costs

- Insurance premiums

- Interest on business loans

- Bank charges

- Maintenance and repairs

To stay on the right side of the Revenue, it’s important to ensure these expenses are wholly and exclusively for business purposes. Always keep clear records, receipts, and invoices in case Revenue requests them during an audit.

Move Company Profits into Your Pension

If you’re a company director, one of the most tax-efficient ways to extract profits from your business is by moving them into your pension rather than taking them as income.

Why do it?

- Avoid income tax: Instead of paying yourself a bonus—triggering income tax, PRSI, and USC—your company can contribute directly to your pension.

- Corporation tax relief: Pension contributions made by the company are fully deductible against corporation tax.

- Tax-free growth: The money in your pension grows tax-free until retirement.

- Future planning: It builds long-term retirement savings without reducing your personal take-home pay today.

Boost your tax strategy. Get a personalised quote today!

Use Capital Gains Tax Exemptions

Capital Gains Tax (CGT) is charged at 33% (as of July 2025) on the profit from selling or disposing of an asset, but certain reliefs can reduce or even eliminate this tax.

One of the most valuable is Retirement Relief, which allows sole traders, business partners, or company shareholders to sell qualifying business assets or shares tax-free if certain conditions are met.

If you’re aged 55 or older and have owned the business or shares for at least 10 years, you may qualify. The relief applies to business sales, farm transfers, or shares in a family trading company.

- Disposals to children can qualify for full relief with no upper limit.

- Disposals to others may qualify for relief on gains up to €750,000 (reduced after age 66).

Without this relief, a large business sale could mean a hefty CGT bill—with it, the tax could be reduced to zero.

Learn more in our full guide: Tax-Efficient Planning: Retirement Relief in Business Asset Disposals.

Corporate Tax Advantage

Using your company to make investments can be a smart way to save on tax. When a business invests, the exit tax is 25%, including on any future interest earned. That’s much lower than the 41% tax rate that applies to most investments held in your own name, like mutual funds.

By investing through your company, you keep more of the returns and grow your money more efficiently.

Want to learn more? Read our guide: Corporate Investments: Can You Invest Money from Your Company?.

Additional Tax Relief Opportunities

Beyond pensions and expenses, there are some lesser-known, but highly valuable, tax reliefs available to self-employed individuals and company directors.

Employment and Investment Incentive Scheme (EIIS)

- Invest in qualifying Irish businesses and claim income tax relief of up to 40%.

- You can invest up to €500,000 per year (subject to conditions).

- To qualify for full relief, you must hold the investment for at least four years.

- This scheme not only supports Irish enterprise but can also significantly reduce your personal income tax.

Accelerated Capital Allowance (ACA)

- This relief applies when you invest in energy-efficient equipment for your business.

- You can write off 100% of the cost in year one, giving you an immediate reduction in taxable profits.

- It’s an ideal option for businesses looking to upgrade operations while lowering their tax bill.

These reliefs can be powerful tools for tax planning, especially if you’re looking to reinvest in your business or support the wider economy.

Thinking of Starting a Business?

If you’re thinking about starting a business or are already in the early stages, don’t forget to check out our guide on Tax Reliefs and Grants for Starting a Business in Ireland. It covers valuable support you may be eligible for, from start-up grants to corporation tax reliefs and everything in between.

Build your tax-efficient future. Get a personalised quote today!

Get a Financial Planning Quote

Tax planning isn’t just for accountants. Whether you’re a sole trader or running your own company, the tax system offers many ways to reduce your bill if you plan ahead. Work with our qualified financial advisors to structure your contributions, protections, and investments in the most tax-efficient way.

If you’re unsure where to start, reach out to our team at LowQuotes — we’re here to help you take control of your finances.

Additionally, you can check out our Retirement Planning Guide is a great place to start — it covers the basics and might clear up any doubts.

We provide various financial services, such as life insurance, income protection, mortgages, serious illness cover, pensions, financial planning, health insurance, and savings & investments.

Share this post

All our content has been written or overseen by a qualified financial advisor. However, you should always seek individual financial advice for your unique circumstances.