Table of Contents

When it comes to saving for retirement, every little bit counts, but tax relief can make a big difference. In Ireland, the government encourages you to save for your future by offering tax relief on pension contributions. This means you can reduce your tax bill today while building a bigger pension pot for tomorrow.

Whether you’re just starting out, self-employed, or already contributing to a scheme, there are smart ways to use tax relief to your advantage.

What Is Tax Relief on Pension Contributions?

When you pay into a pension in Ireland, the government gives you a tax break, which means you pay less tax and more of your money goes into your pension instead of to Revenue.

It’s one of the biggest financial benefits of having a pension, whether you’re employed or self-employed.

How Much Tax Relief Can You Get?

There are two limits to how much tax relief you can claim on pension contributions:

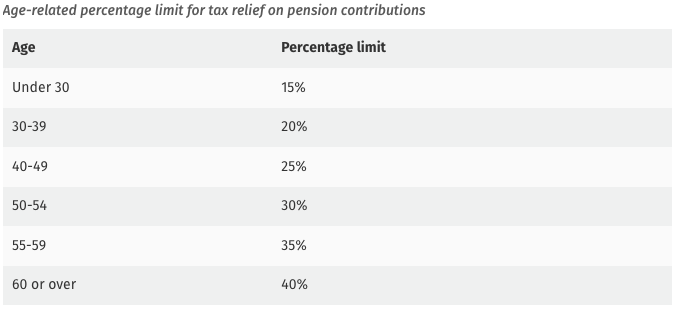

Your Age-Based Limit

The older you are, the higher the percentage of your income you can get relief on. Here’s how it breaks down:

Example:

If you’re 42 and earn €40,000 a year, you can get tax relief on up to €10,000 in pension contributions (because 25% of €40,000 = €10,000).

Important: If you have multiple sources of income, you only get tax relief from the income source where the pension contribution is made.

The €115,000 Total Earnings Limit

Even if you earn more, tax relief only applies to the first €115,000 of your income per year.

So if you’re 45 and earn €150,000:

- Your percentage limit is 25%

- But the max you can get tax relief on is 25% of €115,000 = €28,750

Note: If your employer also pays into your pension, their contributions don’t reduce your personal limit. You still get your full tax relief allowance based on your own contributions.

Why Tax Relief Should Be Part of Your Retirement Strategy

Planning for retirement isn’t just about putting money aside; it’s about doing it in a smart, tax-efficient way. That’s where pension tax relief comes in. It’s one of the most effective tools to help you grow your retirement savings faster.

Let’s look at how you can make the most of it and turn tax savings into future income.

Contribute as Much as You Can (Within Limits)

The government rewards you for saving for retirement by giving you tax relief on your contributions. The more you put in (up to a limit), the more tax relief you get—and the bigger your pension grows.

The limits depend on your age. For example:

- If you’re in your 30s, you can get relief on up to 20% of your income.

- In your 50s? That jumps to 30% or more.

There’s an overall cap (€115,000 income per year), but even hitting part of that gives your savings a solid boost.

Example: How Much You Save with Pension Tax Relief

Let’s say Emma is 40 years old and earns €50,000 a year. She decides to contribute €5,000 into her pension this year.

If Emma pays the 40% higher tax rate:

- She gets 40% tax relief on her contribution.

- That means Revenue gives her back €2,000 in tax relief (40% of €5,000).

- So while €5,000 goes into her pension, it only costs her €3,000 out of pocket.

- That’s a €2,000 saving—just for planning ahead!

If she’s on the 20% standard tax rate:

- She gets €1,000 back (20% of €5,000).

- So her net cost is €4,000 for a €5,000 pension top-up.

Either way, Emma’s full €5,000 goes into her pension, helping it grow faster—while she pays significantly less thanks to tax relief.

Secure your retirement with confidence. Get a personalised quote today!

Use AVCs to Boost Your Pension with a Lump Sum

If you’re already in a pension scheme, you can make extra contributions to boost your retirement savings. These extra payments are called AVCs (Additional Voluntary Contributions), and you can still get tax relief on them. This is a smart and flexible option, especially if you have some extra cash from a bonus, inheritance, or savings.

Click here to learn more about Additional Voluntary Contributions.

Top Up Before the Tax Deadline

Each year in Ireland, there’s a tax deadline, usually 31 October, or a bit later if you file your taxes online using Revenue Online Service (ROS). If you haven’t put much into your pension yet, this deadline gives you a chance to make a lump sum payment and still get tax relief for the previous year.

Here’s how it works:

Let’s say you earned €50,000 last year but didn’t make any pension contributions. You may still add money to your pension and reduce the tax you owe for the previous year. It’s a great way to cut your tax bill and grow your pension at the same time.

You can do this by making a once-off lump sum payment into your pension scheme, even after the tax year has ended, as long as it’s done before 31 October of the following year. When you do, you can choose to have the tax relief apply to last year’s taxes, which can lead to a nice refund or reduce what you owe.

If you’re self-employed or using ROS, you usually get a few extra weeks to make the payment and still qualify for the relief.

Track Down Lost or Forgotten Pension Funds

If you’ve changed jobs a few times over the years, there’s a chance you have pension funds sitting in old schemes that you’ve forgotten about. And if you spent time working in the UK, you might even be able to transfer a UK pension back to Ireland—especially if you’re now returning or planning to stay here long term.

These old and forgotten pensions can be valuable additions to your retirement savings, and tracking them down could give your pension pot a real boost. It’s worth taking the time to look into it—you might be surprised by what you find.

Learn more by reading our article on Pension Tracing in Ireland.

Business Owner or Director? Contribute Through the Company

If you’re a business owner or company director in Ireland, one of the most tax-efficient ways to use your company’s profits is to contribute directly to your pension. Instead of taking profits as salary or dividends, which can trigger hefty taxes, you can transfer them into a company pension plan and enjoy significant tax advantages.

Taking profits as dividends could see you paying up to 40% tax. In contrast, pension contributions made by your company offer several valuable tax advantages:

- No Benefit-in-Kind (BIK) for you as the employer or director

- No employer PRSI on pension contributions

- Immediate corporation tax relief on employer contributions

- Pension fund grows tax-free

- No Capital Gains Tax (CGT) or income tax on investment growth

- You might access your pension from the age of 50

- You can take up to 25% of your pension as a tax-free lump sum at retirement

This strategy not only reduces your company’s tax bill but also helps you build a substantial retirement fund outside of the business. It’s a win-win for your personal wealth and your company’s bottom line.

Read Our Articles

We’ve put together plenty of articles to guide you through key financial decisions. You might like the following:

- Why a Private Pension in Ireland Is Smarter Than You Think

- Setting Up a Private Pension in Ireland

- 6 Reasons to Review Your Pension This Year

- 7 Smart Ways to Use Tax Relief to Grow Your Pension in Ireland

- What to Do 5 Years Before Retirement

- The Essential Guide to Pension and Retirement Planning

- Private Pension Myths in Ireland

- Do You Know What Happens to Your Private Pension Plan When You Die?

The sooner you start, the better your outcome.

Start Now, So Compound Growth Works in Your Favour

When it comes to building a pension, don’t fall for the myth that you don’t need to worry about it because you’re too young. The truth is, the earlier you start, the better. Thanks to tax relief, more of your money goes into your pension from day one—giving your fund a head start.

Over time, that money benefits from compound growth, where you earn returns not just on your contributions, but also on the returns themselves. The result? Even small, regular payments now can grow into a significant pension pot by the time you retire. The key is time—so don’t wait.

Want to learn more? Read our Retirement Planning Guide.

How Your Pension Grows – It Depends on Risk and the Market

Your pension doesn’t grow at the same speed for everyone. It depends on a few things, such as how well the investment markets are doing and how much risk you’re willing to take.

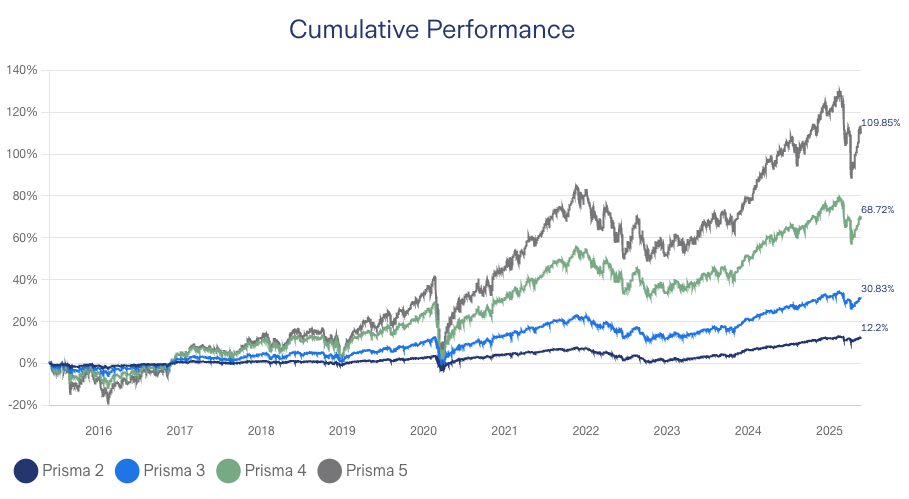

The image above shows how different pension funds from Zurich performed over 10 years (2015 to 2025). These funds are called Prisma funds, and they range from low risk (Prisma 2) to high risk (Prisma 5).

Here’s how much they grew:

- Prisma 2 (low risk): Grew by 12.2%

- Prisma 3: Grew by 30.83%

- Prisma 4: Grew by 68.72%

- Prisma 5 (high risk): Grew by 109.85%

As you can see, the higher-risk funds grew the most, but they also went up and down more along the way. Lower-risk funds grew less, but they were more stable.

This shows why it’s important to pick a pension fund that suits your comfort with risk and your long-term plans.

Review Your Pension – It Might Boost Your Retirement Fund

If you haven’t checked in on your pension in a while, you could be missing out on opportunities to grow it. Reviewing your pension regularly can help you make smarter choices, like adjusting your risk level based on your stage of life. For example, if you’re younger, you might benefit from taking a bit more risk for higher growth. If you’re closer to retirement, a lower-risk approach could make more sense.

You can also look at options like switching investment funds, transferring old pensions, or diversifying your portfolio to spread risk and improve returns. And don’t forget to check the management fees—they can eat into your savings over time.

Learn more by reading our article: 6 Reasons to Review Your Pension This Year

How Do You Claim the Tax Relief?

If You’re a PAYE Employee:

- If your contributions are taken from your payslip (via payroll), the tax relief is usually applied automatically.

- If not, you can claim it manually through Revenue’s myAccount portal:

- Log into myAccount

- Go to “Review your tax” > “Complete Income Tax Return”

- Add your pension contribution details under “Tax Credits and Reliefs”

If You’re Self-Employed:

- You’ll claim tax relief when filing your annual tax return through ROS (Revenue Online Service).

- Just make sure to include all the relevant pension contributions in your return.

Be smart with your money. Get a personalised quote today!

Get a Pension Quote Today

Tax relief isn’t just a bonus—it’s one of the smartest ways to save for your future while cutting your tax bill today. Whether you’re new to pensions, self-employed, or a business owner, using tax relief effectively can help your pension grow faster and work harder for you. The earlier you start, the more you benefit over time.

Want to see how it could work for you? Get a personalised pension quote today and take the first step towards a more secure retirement.

We provide a wide variety of financial services, such as mortgages, serious illness cover, pensions, financial planning, health insurance, and savings & investments.

Share this post

All our content has been written or overseen by a qualified financial advisor. However, you should always seek individual financial advice for your unique circumstances.

Warning: Past performance is not a reliable guide to future performance.

Warning: The value of your investment may go down and up.

Warning: If you invest in this product, you will not have any access to your money until you retire.

Warning: If you invest in this product, you may lose some or all of your investment.

Warning: This product may be affected by changes in currency exchange rates.