If you’ve heard people talking about auto-enrolment and wondered what it means for you, your pension, your pay, and your future, you’re not alone. Ireland is bringing in this new system to help more people save towards retirement, and it’ll affect many employees.

In Ireland, about 800,000 employees lack a private pension, almost one in three workers. That could mean depending solely on the State Pension later on. Auto-enrolment helps by nudging people to save more for the future.

Use this straightforward LowQuotes.ie guide to understand auto-enrolment—how it works, why it matters, and your next steps.

What is Auto-Enrolment?

Auto-enrolment is a government-backed plan which will automatically sign up eligible employees into a pension savings scheme, unless they choose not to. The idea is to make saving for retirement easier and more consistent, especially for those who don’t already have a private or occupational pension.

Instead of having to opt in, it means saving becomes the default. You’ll be contributing a small share of your pay, your employer contributes too, and the State gives top-ups. Over time, this builds up a pension pot without you having to think about it constantly.

Why It’s Being Introduced

Here are a few of the key reasons behind auto-enrolment:

- Many workers currently don’t have a private pension, meaning in retirement they rely largely on the State Pension, which may not be enough to maintain their standard of living.

- Automatic saving helps reduce the “forgotten pension” problem of people putting it off or never getting around to enrolling.

- Shared contributions (you, your employer, and the State) help make saving more affordable.

- It gives more people some degree of financial security in retirement without forcing them to do lots of paperwork or make complex decisions.

When Does It Start?

Auto-enrolment is scheduled to begin on 1 January 2026. On that date, the new pension scheme will be live. If you meet the eligibility criteria, you’ll be automatically enrolled then.

Who Will Be Eligible?

Here’s who will be enrolled automatically:

- Employees aged 23 to 60.

- Earning €20,000 or more per year.

- Not already in a private pension or occupational pension through payroll.

If you don’t meet those criteria, you won’t be enrolled automatically. If your situation changes, you may become eligible.

What Will It Cost Me?

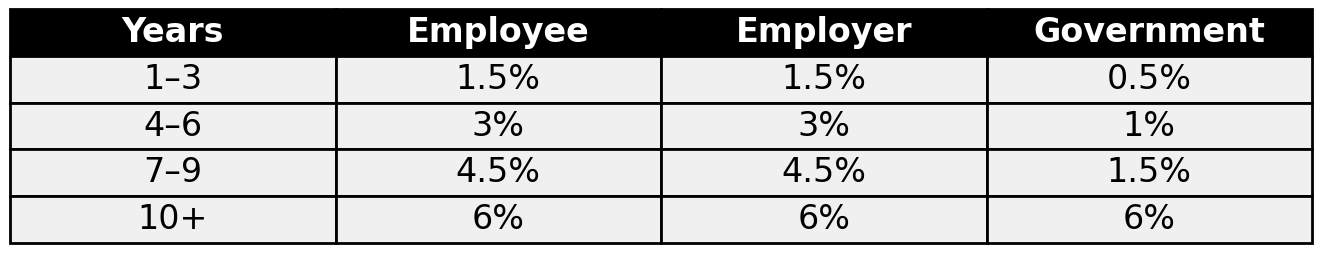

You start by paying a small percentage of your salary. Your employer puts in the same amount, and the State adds an extra top-up on top of both. The initial rate is low and ramps up gradually over time, so the impact on your take-home pay starts modest but your pension pot grows with help from both your employer and the State.

At the beginning, the percentage is low, to avoid big deductions from your pay. Over time (over about 10 years) the rate will increase gradually.

So for example, putting in €3 of your salary might be matched by your employer by €3, and the State might add €1. That gives you €7 saved, even though only €3 came from you.

Contribution Rates

The scheme starts small and builds up gradually over 10 years, so it won’t feel like a big hit to your payslip right away.

Be smart with your money. Get a personalised quote today!

Can I Opt Out?

Yes, it’s not mandatory forever. You’ll have the option to opt out if you prefer after a period of:

- 6 months after you joining (in months 7-8)

- 6 months after a rate increase (also in months 7–8, during the first 10 years)

When you opt out:

- You’ll get back your own contributions.

- But employer contributions and State top-ups already in your pension pot stay there until you retire.

Also, every two years, if you still qualify, you’ll be automatically re-enrolled. So the system gives you flexibility but encourages staying in.

What Happens If I Change Jobs?

If you change jobs, your pension pot follows you. If you move employers, your contributions, employer match, and State top-ups already saved remain intact. You don’t lose what you’ve built up.

What Doesn’t Change: State Pension Still There

Auto-enrolment is additional to the State Pension; it doesn’t replace it. Think of it as a way to have more than just what the State provides. It’s there to help you maintain a more comfortable financial situation in retirement.

What Employees Should Do Now

Even though much of this will happen automatically, there are smart moves you can make in advance:

Check if you’re likely to be eligible

Are you between 23-60, earning at least €20,000, and not already in a pension scheme? If yes, this will apply to you.

Review your existing pension setup (if any)

If you’re already in a payroll pension, you won’t be auto-enrolled. Know what you’re paying in—and whether it’s enough.

Get ready for deductions

Even though they start small, pension contributions will reduce your take-home pay slightly. Adjusting your budget so you’re not surprised is wise.

Think long term

Seeing these contributions as part of your future income, not just money you don’t see now, helps. The sooner you start, the more your pension pot can grow.

Think before opting out

You can leave after six months, but you’ll miss out on the free employer match and State top-ups. Weigh short-term cash against long-term gains.

Use the online portal

When it launches, the My Future Fund portal (via MyGovID) will let you see your pot, switch investment options, or pause contributions.

Stay in the loop

Rates step up over 10 years. Check your payslip and employer updates so you always know what’s changing.

Is Auto-Enrolment Right for Everyone?

Auto-enrolment is built to suit most employees, but the benefits can look a little different depending on your situation:

Lower to middle-income employees

Auto-enrolment works well here. It’s simple, automatic, and boosted by State top-ups. Even small contributions from your pay are matched by your employer and supported by the government—making it a cost-effective way to grow your pension.

Higher earners

You’ll still benefit from employer contributions, but you might get more value from a private pension, like a PRSA. That’s because higher earners can claim more tax relief and often have more flexibility with investment choices.

Business owners and employers

Auto-enrolment is a great way to make sure all eligible staff are saving for retirement. But for senior or higher-paid employees, private pensions can offer added control, flexibility, and tax advantages. See our article: Is Auto-Enrolment the Best Option for Your Business?

In short, auto-enrolment is a strong starting point for retirement savings. For many, it’ll be enough on its own, but combining it with a private pension can sometimes deliver the best long-term results.

Read Our Articles

We’ve put together plenty of articles to guide you through key financial decisions. You might like the following:

- Why a Private Pension in Ireland Is Smarter Than You Think

- Setting Up a Private Pension in Ireland

- 6 Reasons to Review Your Pension This Year

- 7 Smart Ways to Use Tax Relief to Grow Your Pension in Ireland

- What to Do 5 Years Before Retirement

- The Essential Guide to Pension and Retirement Planning

- Private Pension Myths in Ireland

- Do You Know What Happens to Your Private Pension Plan When You Die?

Be smart with your money. Get a personalised quote today!

Get a Pension and Retirement Planning Quote

Auto-enrolment is a handy way to build retirement savings—automatic, simple, and boosted by employer and State contributions. For many, that’s enough. But if you’re a higher earner, a private pension (like a PRSA) may offer better tax relief and flexibility.

Get a pension quote today; we’re happy to help you build a retirement strategy that works for you. We’ll provide clear, personalised information so you can make confident, informed decisions about your financial future.

We provide a wide variety of financial services, such as mortgages, serious illness cover, pensions, financial planning, health insurance, and savings & investments.

Share this post

All our content has been written or overseen by a qualified financial advisor. However, you should always seek individual financial advice for your unique circumstances.

Warning: Past performance is not a reliable guide to future performance.

Warning: The value of your investment may go down and up.

Warning: If you invest in this product, you will not have any access to your money until you retire.

Warning: If you invest in this product, you may lose some or all of your investment.

Warning: This product may be affected by changes in currency exchange rates.