Table of Contents

There are several reasons why you might consider getting a mortgage as a single person. You might require a single mortgage if you are single, unmarried, separated, or divorced. Whether you’re just starting to explore your options or have specific questions about the process, you’ll find clear explanations and helpful advice to guide you every step of the way.

What insights does the Irish housing market offer for single buyers?

For single individuals seeking a mortgage in Ireland, the data published in The Irish Times provides valuable insights into the housing market landscape.

Recent data from the Banking and Payments Federation Ireland (BPFI) reveals that the average income of individual first-time buyers (FTBs) of new properties in Ireland was €67,000 in 2022.

Analysing the FTB sector, the BPFI’s findings show that solo FTB applicants purchasing or constructing new homes constituted 16.5% of all FTB mortgage drawdowns in 2022, compared to 15% in 2019.

Regarding FTBs purchasing existing homes, solo applicants represented 32% in 2019 and increased slightly to 33% in 2022.

The consistent proportion of solo first-time buyer (FTB) applicants for both new and existing homes between 2019 and 2022 underscores the enduring significance of single individuals in the housing market, even despite a nearly 26% rise in average property prices over the same timeframe.

An article published by the Irish Independent revealed that approximately 201,000 single adults had intentions of purchasing a new home in 2023. This figure highlights the significant aspirations within the single demographic towards homeownership and its significance in the context of the housing market.

Will being single affect my chances of getting approved for a mortgage?

Firstly, your ability to repay a mortgage is more important than your marital status or whether you have someone you wish to apply with jointly.

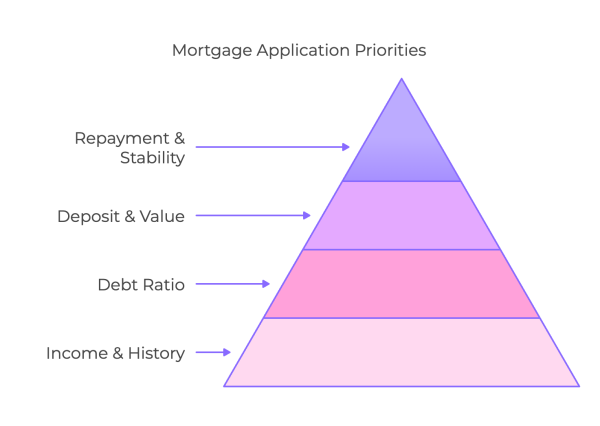

Lenders typically consider your income, credit history, debt-to-income ratio, deposit, loan-to-value, proven repayment ability and employment stability when assessing your application.

Start your homeownership journey today!

I’m a first-time buyer. Is there government support available for single individuals seeking assistance with mortgage deposits?

As a single applicant, you bear the sole responsibility for meeting all your monthly expenses, including significant costs like rent, which can weigh heavily on your budget. This may leave you with limited disposable income to save towards a deposit, creating a gap between your available funds and the cost of purchasing your desired home.

To address these challenges, several government initiatives are available to provide support: Help to Buy Scheme and the First Home Scheme. These schemes aim to make homeownership more accessible by offering assistance with mortgage deposits.

First-time buyers can leverage both schemes simultaneously to cover the complete deposit needed for property acquisition.

Help to Buy Scheme

The Help-to-Buy Scheme, a government initiative, aims to support first-time buyers in achieving their goal of becoming homeowners. This programme is open to individuals seeking to purchase or self-build their first home, valued up to €500,000.

Eligible applicants may receive a refund of income taxes and DIRT (deposit interest retention tax) paid over the preceding four years. The refund is based on the four tax years preceding the application date, with a maximum refund limit of €30,000 or 10% of the purchase price, whichever is lower. For further details, visit the Revenue website.

First Home Scheme

The First Home Scheme (FHS) assists first-time buyers and eligible homebuyers in purchasing a home by bridging the gap between their deposit, mortgage, and the property price.

It works as a shared equity scheme, where buyers receive funds from the scheme in exchange for the FHS acquiring a percentage ownership in the property purchase. The FHS can provide up to 30% of the property’s market value.

Note that the “Fresh Start” principle allows individuals who are divorced or separated and have no stake in the family home, or have experienced personal insolvency, bankruptcy proceedings, or similar legal processes, to qualify for the first home scheme. For further details, visit www.firsthomescheme.ie.

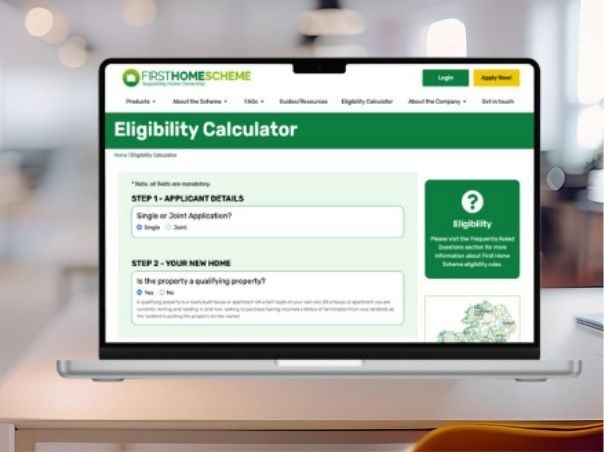

Check if you are eligible.

Find out in minutes using this calculator to assess if you and the property you are interested in buying are eligible for this scheme.

Check if you qualify and calculate your Repayments.

Eligibility Requirements for Single Mortgage Applicants

The mortgage measures instituted by the Central Bank of Ireland extend to individual applicants as well. These regulations impose limits based on both income (loan-to-income limit) and property value (loan-to-value limit).

Borrowing Limits for Single Applicants

Under the loan-to-income limit, first-time buyers can borrow up to 4 times their gross annual income. And a second/subsequent buyers can borrow up to 3.5 times their gross income.

Example 1 : A first-time buyer earning €60,000 annually could potentially borrow a maximum of €240,000. Note that not all single applicants fit the conventional definition of first-time buyers, as some may have previously owned property but no longer retain ownership interest. In such cases, eligibility could still be established under the “Fresh Start” principle.

Example 2: A second-time buyer earning €60,000 per year could potentially borrow a maximum of €210,000.

Deposit Requirements for Single Applicants

The loan-to-value limit mandates that first-time buyers maintain a minimum deposit equivalent to 10% of the home’s value to qualify for a mortgage. For instance, if the desired property costs €300,000, a deposit of €30,000 would be required.

The deposit required for a mortgage is a percentage of the property’s value, varying based on the property’s price and purpose:

- For first-time homebuyers in Ireland, the deposit is typically 10%.

- If you’ve previously owned a property, the deposit remains at 10%.

- If you’re purchasing a home to rent out, 30%

The size of your deposit and loan-to-value ratio (LTV) impact the mortgage deals available to you. A smaller deposit may limit your options when searching for a mortgage.

Exceeding Limits

From time to time, some lenders have the flexibility to lend beyond specified limits.

We are here to make your homeownership journey easier.

What preparation steps should I take when applying for a mortgage as a single person?

Before applying for a mortgage, review your credit report to strengthen your financial profile. Save for a deposit and closing costs, and gather the necessary financial documents. Then, contact one of our financial advisors for comprehensive guidance on preparing for a mortgage. Alternatively, you can explore our First Time Buyers Guide for additional insights and information.

The ultimate guide for First-Time Buyers.

Get instant access to a complete GUIDE that will save you the hassle and prepare you for a mortgage, providing a convenient checklist of essential documents and step-by-step instructions to help you secure your dream home. Don’t wait, download now!

Your homeownership journey starts here!

After you download your guide, one of our expert mortgage advisors will be in touch shortly to provide you with guidance and further relevant information including typical repayments, qualification amounts and mortgage requirements.

Are there common mistakes single first-time buyers should avoid?

Yes, there are several common pitfalls that single first-time buyers should be aware of and avoid such as overlooking hidden costs or unusual activities on bank statements.

To learn more about these mistakes and how to steer clear of them, we recommend reading our article: 10 First-Time Buyer Mistakes To Avoid. This resource provides valuable insights to help you navigate the homebuying process more effectively and make informed decisions.

What other costs are involved in a property purchase?

There are several additional costs to consider when purchasing a property in Ireland. These may include:

Mortgage Protection Insurance

Mortgage Protection Insurance is a decreasing form of Life Insurance, tailored to pay off the outstanding balance of your mortgage in the event of your death during the term of your mortgage. Mortgage Protection runs for the same length as your Mortgage.

Stamp Duty

This is a tax imposed by the government on property transactions. The amount varies depending on the purchase price and whether you are a first-time buyer or not.

Solicitor Fees

You’ll need a solicitor to look after all the legal aspects of the property purchase. Their fees can vary, so it’s a good idea to get quotes from different professionals.

Other Costs

Additional expenses may include valuation fees, surveyor’s fees, property taxes, home insurance, and moving costs. For more detailed information we recommend reading our article: Hidden Extra Costs When Buying A House In Ireland.

Case Study: Securing a Mortgage as a Single Applicant in Ireland

Helen, a single individual living in Limerick, Ireland, and working from home, had long dreamt of owning her own home. As a first-time buyer earning a steady income of €70,000 annually, she decided it was time to turn her dream into a reality.

Despite the challenges of being a single applicant in the housing market, Helen was determined to explore her options. Armed with a clear understanding of her financial situation and goals, she embarked on her journey to secure a mortgage. Helen began by assessing her borrowing capacity. With a maximum borrowing limit of €280,000 (she can borrow 4 times her gross annual income), she carefully calculated her affordability, factoring in her income, expenses, and savings. Fortunately, her diligent financial planning allowed her to comfortably meet the requirements for a mortgage.

Being well-informed about the local property market, Helen knew she wanted to purchase a home within Limerick County. While the average property price outside the city was around €270,000, according to the Daft report for Q4 2024, Helen remained undeterred. Working from home provided her with the flexibility to explore properties in more affordable areas without compromising her lifestyle or career.

Helen has €50,000 in savings earmarked for a deposit and additional costs, such as solicitor fees. After months of diligent searching, Helen finally found a charming property that met her needs and budget.

With the help of one of our mortgage advisors at LowQuotes, she navigated the application process smoothly, providing all necessary documentation and ensuring she met the lender’s criteria.

Despite the challenges of being a single homebuyer, Helen’s determination, financial prudence, and careful planning paid off. She successfully secured a mortgage and purchased her dream home in Limerick County, marking a significant milestone in her journey towards homeownership.

FAQ: Single Person Mortgage

Is it possible to exclude my spouse from the mortgage application and apply individually?

While it’s possible to apply for a mortgage as a single person, most lenders have policies that require both spouses to be included on the application if you’re in a relationship. Contact one of our financial advisors at LowQuotes; we can provide personalised guidance tailored to your specific circumstances.

How can I save for a mortgage deposit on a single income?

Saving for a mortgage on a single income may require careful budgeting and financial planning. It’s essential to budget carefully, establish savings goals, automate your savings, reduce debt, and undertake additional actions to ensure effective financial management.

Another effective method to help you in saving for a mortgage is to use tax-free gifts, which can amount to up to €3,000 per year. You can find more detailed information by reading our article: Top Tips For Saving Money Towards Your Mortgage Deposit In Ireland.

Who can get a mortgage as a single applicant?

You can get a single mortgage if you’re buying a home for the first time or if you’re already a homeowner.

If you’re married and wish to apply for a mortgage independently, such as when you’re a first-time buyer but your spouse already owns a property, it’s possible, but not all lenders offer this option. Most lenders typically require married couples to apply jointly for a mortgage.

Ready to take the first step toward owning your home?

Get your personalised quote today!

Get mortgage advice for single applicants with LowQuotes

At LowQuotes, we understand that navigating the mortgage process can be daunting, especially for single applicants. That’s why we’re here to help. Whether you’re unsure about your eligibility or simply need guidance on securing a mortgage as a single individual, our experienced advisors are ready to assist you every step of the way.

You can request a mortgage quote to check your elegibility; simply provide your information and our team of financial advisors will promptly reach out to discuss your specific requirements and provide personalised guidance tailored to your needs.

We also provide a wide variety of financial services, such as life insurance, mortgage protection, Income protection, serious illness, pensions, financial planning, health insurance, and savings & investments.

Share this post

All our content has been written or overseen by a qualified financial advisor. However, you should always seek individual financial advice for your unique circumstances.

Warning: You may lose your home if you do not keep your repayments.

Warning: The cost of your monthly repayments may increase.

Warning: You may have to pay charges if you pay off a fixed-rate loan early.

Warning: If you do not meet the repayments on your loan, your account will go into arrears. This may affect your credit rating, limiting your ability to access credit in the future.

Warning: The entire amount you have borrowed will still be outstanding at the end of the interest-only period. The lender may adjust the payment rates on this housing loan from time to time. (Applies to variable-rate loans only).