Buying your first home is an exciting and significant milestone, but it can also be a complex and overwhelming process.

We at LowQuotes understand the challenges that first-time homebuyers face, and we’re here to make your journey to homeownership as smooth as possible.

That’s why we’re thrilled to introduce The Ultimate Guide for First-Time Buyers, available for download now!

The ultimate guide for First-Time Buyers.

Get instant access to a complete GUIDE that will save you the hassle and prepare you for a mortgage, providing a convenient checklist of essential documents and step-by-step instructions to help you secure your dream home. Don’t wait, download now!

Your journey towards your dream home starts here!

After you download your guide, one of our expert mortgage advisors will be in touch shortly to provide you with guidance and further relevant information including typical repayments, qualification amounts and mortgage requirements.

Mortgage Drawdowns Report Q3 2023

First-time buyers with record drawdowns

The rising cost of living and the difficult process of locating reasonably priced homes have made owning a home a difficult aspiration for many first-time purchasers.

Against all odds, there is a glimmer of hope. The Q3 2023 Mortgage Drawdowns Report includes important statistics indicating that, at 60.4% by volume and 61.2% by value, first-time buyers (FTBs) continue to hold the majority of drawdowns.

FTB drawdowns reached €1.9 billion in Q3, the highest Q3 values since 2006, demonstrating their sustained dominance in the mortgage market.

These encouraging numbers hint at a resilient market, providing a positive outlook despite the challenges faced in the real estate landscape.

Drawdown increase

First-time buyer (FTB) mortgage drawdown volumes rose by 6.5% year-on-year.

This means that the number of mortgages taken out by individuals purchasing a home for the first time increased by 6.5% compared to the same period in the previous year. The total volume of these mortgages reached 7,011.

This increase shows a positive trend in the number of individuals entering the housing market for the first time.

These figures highlight the persistence of prospective homeowners and give hope to those going through the challenging journey of owning a home in Ireland.

What is a first-time buyer in Ireland?

If you’re buying a residential property for the first time and have never owned a home, whether in Ireland or abroad, you qualify as a first-time buyer.

You are still considered a first-time buyer even if you inherited a house or purchased one outright, or if you have experienced separation, divorce, or bankruptcy since your last property acquisition.

What does our guide for first-time buyers cover?

This guide is designed to empower you at every step of the mortgage process.

From understanding the basics, such as government initiatives, how much mortgage deposit you need, other related costs, and the mortgage application process, we’ve got you covered.

Come alongside us on this journey, where we work together to transform your dream of homeownership into a tangible reality.

Understand the Basics

Within our guide, we simplify the essential principles of homebuying, covering topics relevant to first-time buyers and explaining government initiatives like the Help to Buy and First Time Buyers schemes.

Our guide demystifies terminology, including complex terms such as approval in principal (AIP), loan-to-value (LTV), loan-to-income (LTI); and the difference between variable and fixed rates, ensuring you grasp the vocabulary crucial to navigating the mortgage landscape.

Financial Preparedness

Purchasing a house is a significant financial commitment. Our guide offers insightful information to help you assess your financial readiness for this project.

We go into important information, including the necessary deposit and strategies for saving towards your mortgage deposit.

In addition, we clarify the extra costs related to the house-buying process so that you are financially ready for the entire journey.

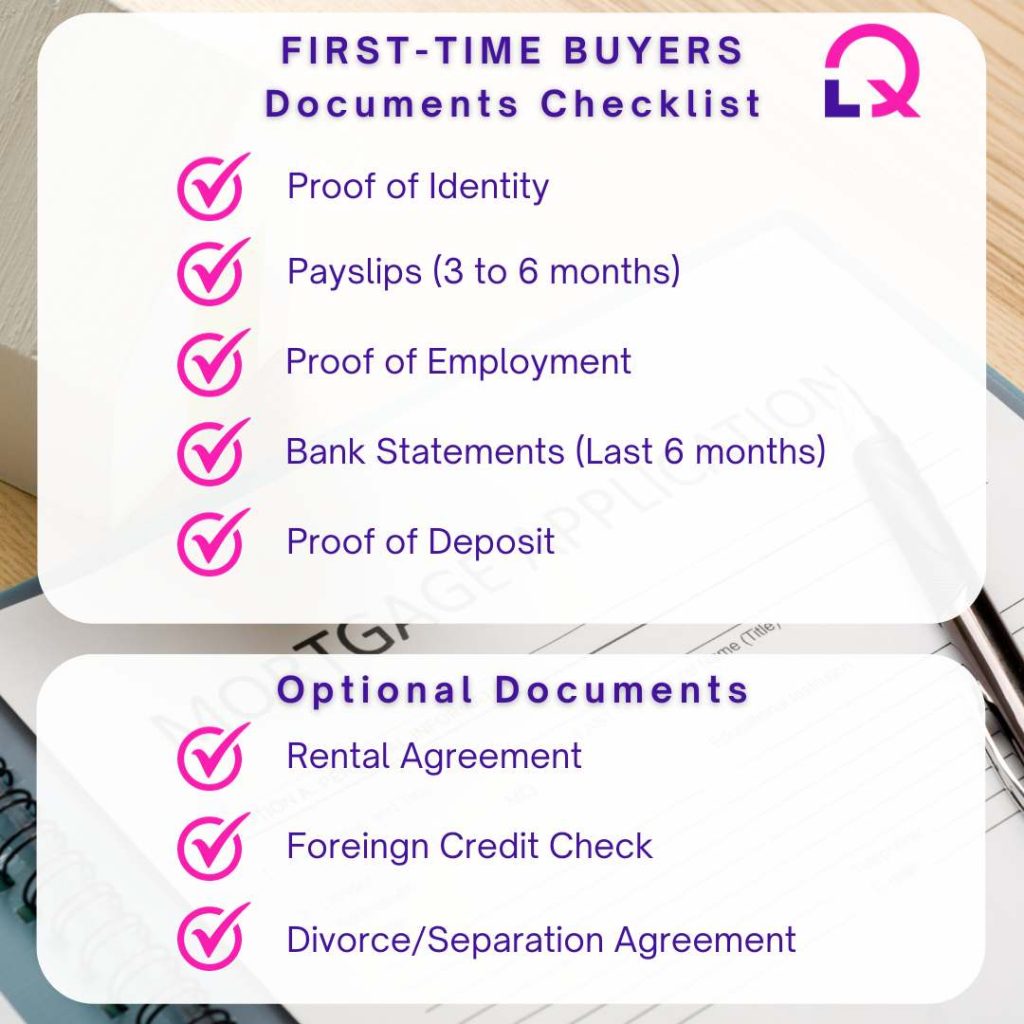

Documents checklist

Our First-Time Buyer Guide includes a comprehensive document checklist that serves as your roadmap to organisation throughout the home buying process.

The list of documents has been carefully crafted to include all necessary information. It includes financial paperwork, such as bank statements and proof of income, as well as extra requirements if you are self-employed, a sole trader, or a director of a business.

By utilising this guide, you can ensure that you have all the necessary documents at your fingertips, streamlining the entire process and providing you with the confidence to make informed decisions on your journey to homeownership.

If you’re self-employed, a sole trader, or a company director, there are extra documents you’ll need to provide.

Download our guide to see the entire first-time buyer document list.

Common mistakes to avoid

Embarking on the journey of purchasing your first home is undoubtedly thrilling, but without proper information, there are several potential mistakes to navigate, such as overlooking hidden costs associated with the property purchase or providing insufficient or inaccurate financial documents.

Within our First-Time Buyer Guide, we offer a comprehensive resource designed to equip you with the essential planning and information needed to steer clear of common mistakes.

Alternatively, you can read our article, 10 First-Time Buyer Mistakes To Avoid In Ireland.

Mortgage application process

The mortgage application process is a pivotal journey on the path to homeownership, and at LowQuotes, we’ve streamlined the steps to make it as seamless as possible.

It all begins with a crucial conversation with our experienced financial advisors, who guide you through the intricacies of the mortgage landscape.

Equipped with invaluable insights, you’ll be well-prepared to organise all necessary elements, enabling you to confidently submit your mortgage application and secure pre-approval when making an offer on your desired home.

As the pieces fall into place, progressing to a sale-agreed status, we ensure the final steps are handled with precision, leading to the release of funds and the realisation of your homeownership dreams.

With LowQuotes, your mortgage journey is not just a process; it’s a guided and efficient pathway to making your dream home a reality.

All our content has been written or overseen by a qualified financial advisor. However, you should always seek individual financial advice for your unique circumstances.

Warning: You may lose your home if you do not keep your repayments.§

Warning: The cost of your monthly repayments may increase.

Warning: You may have to pay charges if you pay off a fixed-rate loan early.

Warning: If you do not meet the repayments on your loan, your account will go into arrears. This may affect your credit rating, limiting your ability to access credit in the future.

Warning: The entire amount you have borrowed will still be outstanding at the end of the interest-only period. The lender may adjust the payment rates on this housing loan from time to time. (Applies to variable-rate loans only).