Table of Contents

When you leave a job, figuring out what to do with your pension can feel like a big decision. Instead of letting your savings sit in your old employer’s pension plan, you might consider moving them into a Personal Retirement Bond (PRB).

A PRB gives you more control over your pension savings, letting you decide how your money is invested and managed as you plan for retirement on your own terms.

What’s a PRB?

A Personal Retirement Bond (PRB), also known as a Buy-Out Bond or Transfer Bond, is basically a pension wrapper. If you’re leaving a job and you’ve got pension savings in your old employer’s scheme, a PRB gives you the option to move that pension pot into something you own and control.

You shift your pension savings out of your old employer’s scheme into a plan that’s yours. You’re no longer tied to the old employer or trustees.

Why might you use one?

Here are some situations when a PRB could make sense:

- If you leave employment and you still have pension savings tied up in that employer’s pension scheme.

- If the pension scheme is winding up, and you want to preserve your savings.

- If you just want more control over how your pension savings are invested and when you access them.

What are the benefits of a PRB?

Here are the positives:

- Independence: Once your money’s in the PRB, you don’t have to deal with your old employer or scheme trustees anymore.

- Control: You own the PRB; you decide how the money is invested (within whatever options your plan gives) and when to take your benefits (within the rules).

- Tax-free growth: While your money sits in a PRB, it grows without being taxed (until you take benefits), which can help your savings grow more effectively.

- Flexibility at retirement: When you eventually retire, you’ll have the same benefit choices (e.g., tax-free lump sum, income for life, leaving funds invested) that your original pension scheme offered.

- Death benefit: If you die before taking retirement benefits, the value of the PRB is paid out to your estate.

How a Personal Retirement Bond Works

When you leave a job that had a company pension, you have a few options for what to do with your pension pot. One of those options is to move your savings into a Personal Retirement Bond (PRB), a pension plan in your own name. Here’s what that means in practice:

Taking Your Pension with You

Your existing pension savings are transferred from your former employer’s scheme into a PRB that belongs entirely to you. Once that’s done, you no longer rely on your old employer or the scheme trustees, you’re in charge.

Choosing How to Grow Your Money

With a PRB, you decide how your money is invested. You can go for lower-risk options, take on more growth potential with higher-risk funds, or strike a balance that matches your comfort level and goals for retirement.

Enjoying Tax Benefits

Your money can grow tax-free while it stays in your PRB, giving your savings more room to build over time. And when you retire, you can take a tax-free lump sum from your fund (within Revenue limits).

Having Flexibility for the Future

A PRB gives you more freedom around retirement. You can access your funds from age 50 (or earlier if you retire due to ill health), and you’ll have several choices for how to take your benefits, whether that’s a lump sum, regular income, or a mix of both.

Be smart with your money. Get a personalised quote today!

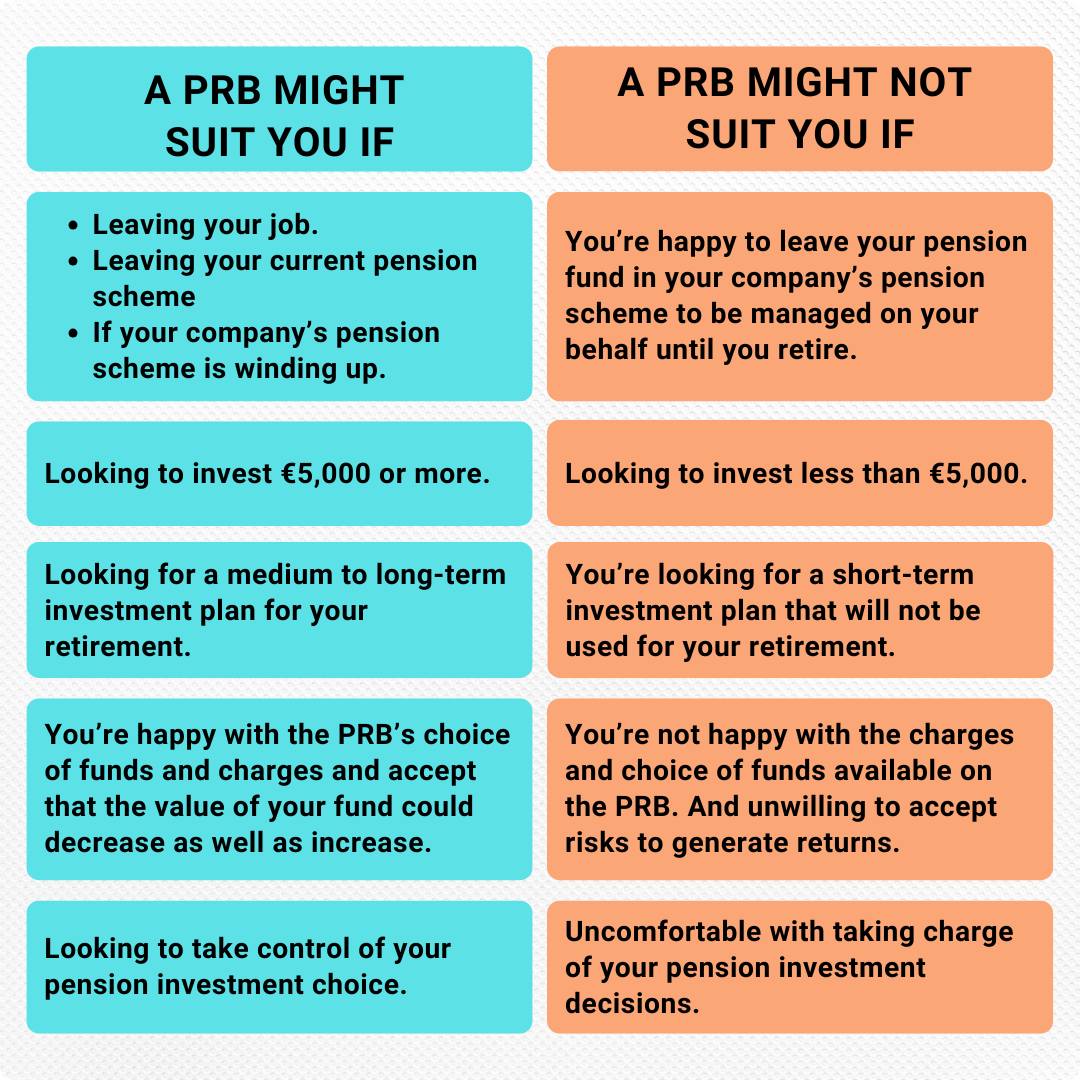

Is a Personal Retirement Bond right for you?

A PRB could be a good fit if you:

- Are leaving a job and have pension savings in your old employer’s scheme.

- Want more say in how and when you invest and access those savings.

- Want to consolidate pension pots (if you’ve had many jobs and lots of different schemes).

- Are comfortable with investment risk (since your money’s invested and its value can go up or down).

But you should ask yourself:

- Do you understand the charges and what you’ll be investing in?

- Are you comfortable tying up the money until retirement age?

- Are you okay with taking responsibility for investment decisions (or working with a good advisor)?

- Are there better options (e.g., leaving the money in your old scheme) that may suit your situation more?

Because everyone’s situation is different, it’s wise to get professional advice.

What Are the Charges?

Like most pension products, a Personal Retirement Bond (PRB) comes with a few different types of charges. These help cover the cost of managing your plan and investments. Here’s a quick breakdown of what to expect:

Fund Charges

The fund charges you’ll pay depend on two things:

- The type of PRB you choose, which determines the plan management charge (PMC)

- The funds you invest in, which determine the fund management charge (FMC)

Together, these make up your overall fund charge. In some cases, you might even receive a rebate, added as bonus units to your policy to reduce your costs slightly.

Allocation Rate

The allocation rate determines how much of your single contribution is allocated to your PRB. For example, if your allocation rate is 98%, that means 98% of your money is invested in your retirement bond, while the remaining 2% covers charges.

A financial advisor can explain the options and help you choose the one that fits your goals best.

Early Exit Fee

PRBs are designed for medium- to long-term investing, typically with a minimum period of around five years. If you decide to move your money or access your benefits early, an early exit fee might apply. You’ll find details of any such fee clearly listed in your policy schedule.

Policy Servicing Fee

In some cases, there may also be a policy servicing fee to cover ongoing administration. If this applies, it will be clearly shown in your policy schedule.

How to Find Pension Funds from Previous Jobs

It’s common to build up pension savings with different employers over the years, and it’s easy to lose track of them. Pension tracing helps you find those forgotten funds and, if you wish, combine them into one plan like a Personal Retirement Bond (PRB).

Our team can help you track down old pensions and make sense of your options, so your hard-earned savings work together for your future.

You can also check out our article on how finding lost pensions could boost your retirement income.

Read Our Articles

We’ve put together plenty of articles to guide you through key financial decisions. You might like the following:

- Why a Private Pension in Ireland Is Smarter Than You Think

- Setting Up a Private Pension in Ireland

- 6 Reasons to Review Your Pension This Year

- 7 Smart Ways to Use Tax Relief to Grow Your Pension in Ireland

- What to Do 5 Years Before Retirement

- The Essential Guide to Pension and Retirement Planning

- Private Pension Myths in Ireland

- Do You Know What Happens to Your Private Pension Plan When You Die?

Be smart with your money. Get a personalised quote today!

Get a Pension Quote

If you’ve left a job or are planning to and still have pension savings with your old employer, a Personal Retirement Bond (PRB) could be the perfect way to take control. It gives you ownership, flexibility, and freedom over how your pension is managed, instead of leaving it tied up in a scheme you no longer belong to.

Of course, it’s important to understand the details — like charges, investment choices, and access rules — to make sure a PRB fits your plans.

We can help you explore your options and find the right PRB for your needs. Get a Pension Quote Today!

We provide a wide variety of financial services, such as mortgages, serious illness cover, pensions, financial planning, health insurance, and savings & investments.

Share this post

All our content has been written or overseen by a qualified financial advisor. However, you should always seek individual financial advice for your unique circumstances.

Warning: Past performance is not a reliable guide to future performance.

Warning: The value of your investment may go down and up.

Warning: If you invest in this product, you will not have any access to your money until you retire.

Warning: If you invest in this product, you may lose some or all of your investment.

Warning: This product may be affected by changes in currency exchange rates.