The festive season is here, and for many of us, it’s a mix of joy, stress, and spending! While shopping for loved ones can be a highlight of the year, it can also take a toll on our finances if we’re not careful.

So, what type of Christmas shopper are you? And more importantly, how can you stay financially organised, no matter your shopping style? Let’s find out!

How Much Do Irish Families Spend at Christmas?

Irish families are feeling the pinch this festive season, with the latest survey revealing that 77% of shoppers expect Christmas shopping to be significantly more expensive this year compared to last. Despite rising costs, more than half (54%) say they plan to spend less this Christmas by cutting back on non-essentials and looking for better deals.

According to the Competition and Consumer Protection Commission (CCPC), Irish consumers spent an average of €1,177 on Christmas in 2024, covering gifts, food, and festive extras, a 14% increase on 2023. Families with children, however, spent considerably more, averaging around €1,590.

The financial pressure of the season remains strong. The CCPC also found that one in five people planned to borrow to fund their Christmas spending, taking out an average of €631 in loans or credit. With prices still on the rise and household budgets under strain, many are rethinking their holiday spending habits for 2025.

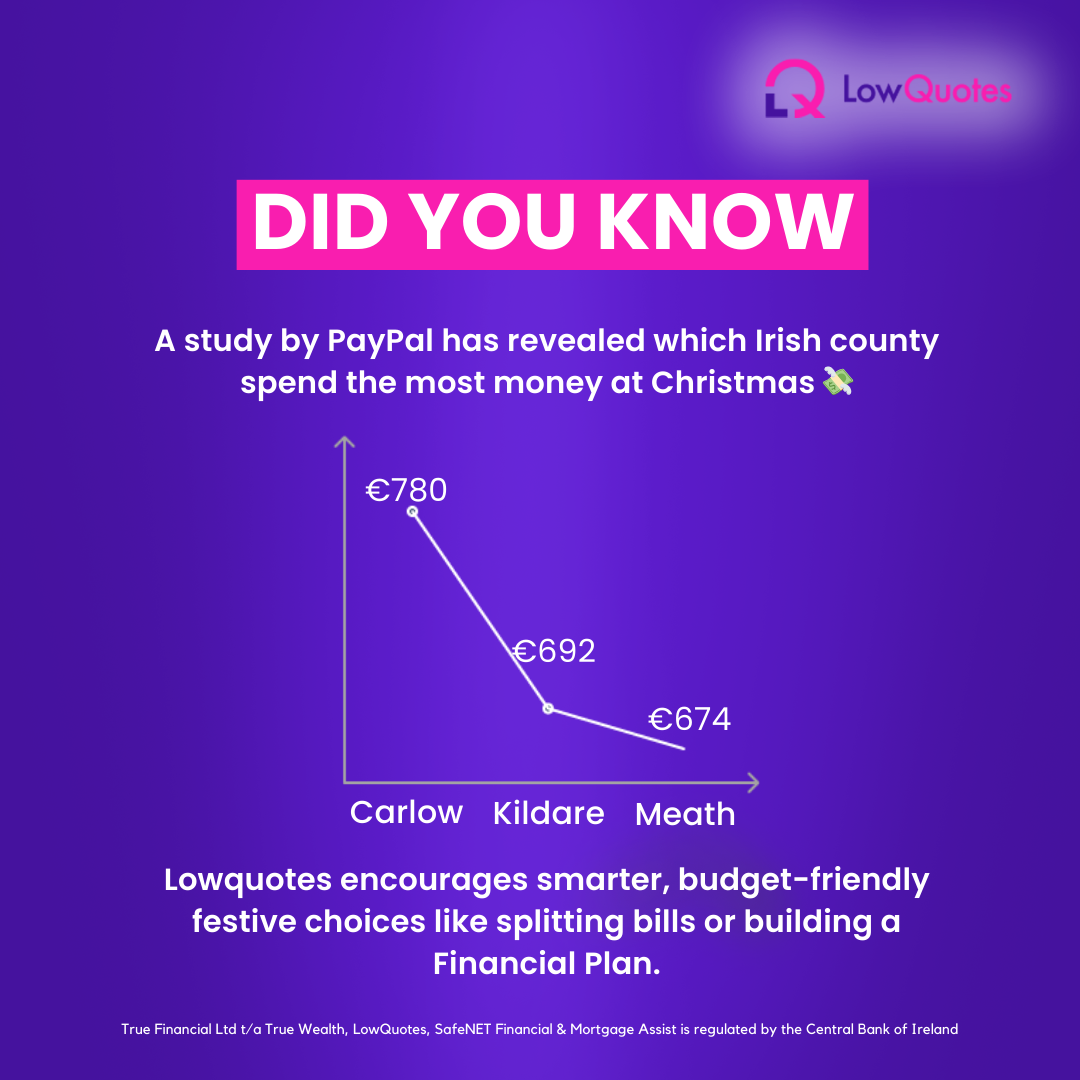

Which county in Ireland spends the most on Christmas?

When it comes to Christmas shopping, Carlow takes the crown as the biggest spender in Ireland, with locals planning to spend an average of €780 on gifts this year. Kildare and Meath aren’t far behind, with €692 and €674, respectively.

That’s well above the national average of €525. Nearly half (46%) of Irish consumers would rather send money to family and friends, skipping the hassle of shopping for presents.

Be smart with your money. Get a personalised quote today!

What’s your Christmas shopping style?

The Early Bird

You’re the person who starts shopping in September (or earlier) and prides yourself on having all your gifts wrapped by November.

Financial Tips for Early Birds:

- Track your spending: Start a simple spreadsheet or explore budgeting apps to log each purchase. Keeping a record of where your money goes helps you identify spending patterns and make informed adjustments to stay on top of your financial goals.

- Avoid over-buying: With so much time to shop, you may be tempted to keep adding “just one more thing.”

- Shop sales wisely: Keep an eye on Black Friday and Cyber Monday deals, but don’t let flashy discounts tempt you into buying unnecessary items.

The Last-Minute Shopper

You’re running through the shops on the 24th December, grabbing whatever’s left on the shelves. The panic is real, but you somehow pull it off every year.

Financial Tips for Last-Minute Shopper:

- Set a budget: Before hitting the shops, decide how much you can realistically spend on each person.

- Stick to gift cards or experiences: These are quick, thoughtful options that won’t break the bank.

- Avoid impulse purchases: The holiday rush can push you to overspend on overpriced or unnecessary items.

The Bargain Hunter

You live for the thrill of finding the best deals. You’re the one waiting for sales, armed with promo codes and vouchers.

Financial Tips for Bargain Hunters:

- Plan Your Budget Early: Decide how much you can afford to spend on Christmas and stick to it. Allocate funds for gifts, food, and decorations to avoid overspending.

- Track Sales and Discounts: Keep an eye on Black Friday, Cyber Monday, and pre-Christmas sales. Use price comparison websites or apps to find the best deals.

- Shop Local Markets: Support small Irish businesses and explore Christmas markets for unique gifts that might be more affordable than big retailers.

- Use Rewards Schemes: Leverage loyalty/reward schemes to earn money back on your purchases. Many Irish supermarkets and retailers offer excellent rewards.

- Opt for Secret Santa: If you’re buying for a group, suggest a Secret Santa to reduce the number of gifts you need to buy while keeping it fun and festive.

- Consider Second-Hand or DIY Gifts: Check charity shops, vintage stores, or make your own gifts for a thoughtful and budget-friendly option.

The Over-Spender

You go all out at Christmas, splurging on gifts, decorations, and festive outings. While it’s fun, January can feel like a financial hangover.

Financial Tips for Over-Spenders:

- Create a sinking fund: Start saving small amounts throughout the year for holiday expenses.

- Use the “four-gift rule”: Limit yourself to buying something they want, need, wear, and read.

- Avoid credit card debt: If you’re tempted to use your credit card, think about how long it will take to pay off your purchases.

The Online Enthusiast

You avoid the crowds and do all your shopping from the comfort of your couch. You love the convenience but might lose track of what you’ve spent.

Financial Tips for Online Enthusiasts:

- Use a single card: This makes it easier to track your total spending.

- Shop Irish: Many Irish retailers now offer online stores with quick delivery options.

- Double-check delivery dates: Avoid last-minute stress (and express delivery fees) by ordering early.

The Post-Christmas Planner

You’re the savvy shopper who skips the pre-Christmas rush entirely. Instead, you wait for the post-Christmas sales to grab gifts at a fraction of the price. These bargains often double as next year’s presents or gifts for late celebrations.

Financial Tips for Post-Christmas Planners:

- Create a gift stash: Keep a designated space at home for storing the gifts you buy during the sales.

- Set a budget: Just because it’s on sale doesn’t mean you need to buy it. Stick to a pre-set spending limit.

- Shop for essentials too: Use the sales to grab wrapping paper, cards, and decorations for next year at steep discounts.

- Think long-term: Focus on timeless gifts that won’t feel outdated or irrelevant by next Christmas.

How to Stay Financially Organised This Christmas

No matter your shopping style, these tips will help you enjoy the festive season without financial regrets:

- Set a budget: Decide how much you can afford to spend overall and stick to it.

- Plan ahead: Create a gift list and avoid buying on a whim.

- Track your spending: Set a budget and track your spending using a spreadsheet or our budget planner. This helps you stay on track and avoid overspending, especially with last-minute purchases.

- Embrace alternatives: Suggest a family Secret Santa or agree on spending limits to reduce financial pressure.

- Don’t forget hidden costs: Factor in wrapping paper, postage, and Christmas dinner expenses.

Looking for more ways to make your Christmas stress-free and affordable? Check out our blog on how to budget for Christmas, packed with practical tips to help you manage your expenses, plan ahead, and enjoy the festive season without overspending.

Plan for the New Year

As you celebrate, take time to think about your financial goals for next year. The Christmas season is a great opportunity to reflect on budgeting, saving, and setting yourself up for success in the new year.

Be smart with your money. Get a personalised quote today!

Get a Financial Planning Quote From LowQuotes

No matter what kind of Christmas shopper you are, financial planning is key to enjoying the season without the stress. Christmas is about spending time with loved ones, not just spending money, and with a solid financial plan from LowQuotes, you can stay organised and in control.

Start the new year empowered, not overwhelmed, by making smart financial choices this festive season.

We also provide various financial services, such as mortgages, serious illness cover, income protection, pensions, life insurance, health insurance, and savings & investments.

Happy shopping and have a financially stress-free Christmas!

Share this post

All our content has been written or overseen by a qualified financial advisor. However, you should always seek individual financial advice for your unique circumstances.