Getting a mortgage is probably one of the biggest financial commitments you will ever make. There’s always a concern about in the event of your death or becoming seriously ill, your family might have difficulty meeting this large liability.

When you are trying to take out a mortgage your lender will inform you that you will need either life insurance or mortgage protection. Mortgage protection and life insurance look like the same product as both can be assigned to your lender to pay off your mortgage in case of the death of the policyholder.

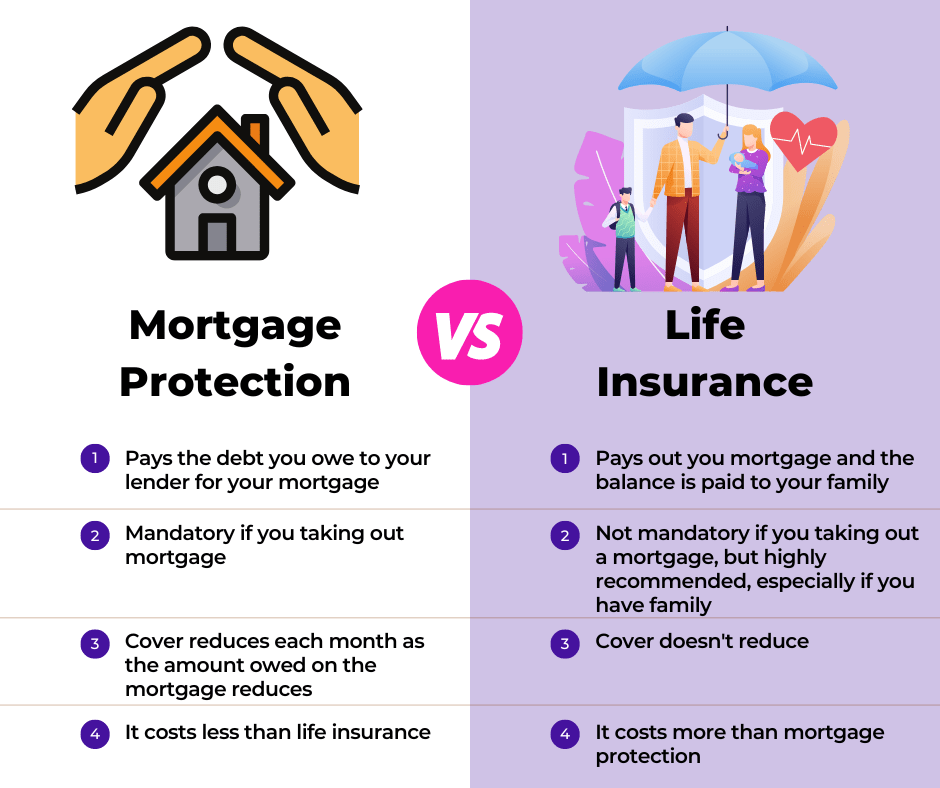

However, one of the main differences between them is that Mortgage Protection insurance is designed to cover just your mortgage repayments if you die. Life insurance policies, on the other hand, are mainly to protect you and your family.

What is Mortgage Protection and how does it work?

Mortgage protection is a life assurance protection policy that ensures that your mortgage will be paid off if you die during the term of your plan. It is compulsory and must be taken out when you get a mortgage.

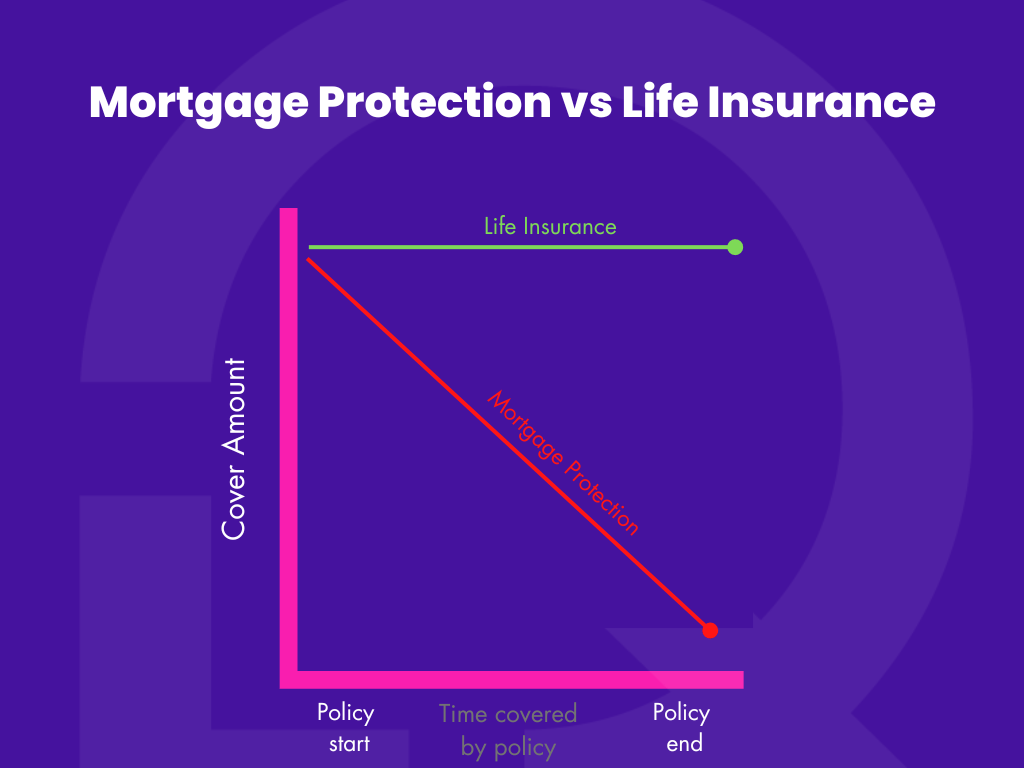

The cover amount of this plan reduces each month as the amount owed on the mortgage reduces. Your premium does not change, even though the level of coverage reduces. This makes mortgage protection the cheaper option. But is cheaper always the best? Not necessarily.

What is Life insurance and how does it work?

Life insurance provides a lump sum cash payment to your family in the event of your death. The cover of this plan doesn’t reduce like with mortgage protection and it will remain the same for the entire term of your policy.

Nobody wants to talk about their death, but failing to plan can have a serious impact on your family since they will be the ones to pay this big debt or even pay for funeral expenses. So putting the right cover in place to protect your family should be a top priority.

Of course, you can also get Life Insurance and assign it to your Mortgage lender. When you do this, your mortgage will decrease annually but your cover amount won’t. If you were to pass away, the mortgage would be paid off and any remaining cover will be paid out to your family. This option only costs a little bit more, but if it was ever needed, it’s definitely the better option.

According to the Irish Times, the average cost of a funeral in Ireland ranges from €4,500 to €8,000. And compared to other countries in the survey; Ireland was placed fourth in the ranking as having the most expensive funeral cost.

Having life insurance will guarantee peace of mind knowing your loved ones would be looked after financially. The money from a life cover plan could enable them to:

– Maintain their current lifestyle and help with their monthly outgoings.

– Pay off loans and debts.

– Invest the money for the future or to generate a new monthly income.

– Pay for children’s education.

– Create a “rainy day fund” or manage any other living expenses such as maintenance or hospital expenses.

Mortgage Protection vs Life Insurance in Ireland – The Breakdown

Both insurances will provide a lump sum in case of death during the term of the policy. One of the differences is that mortgage protection will cover only your mortgage repayments if you die prematurely and life insurance, on the other hand, is mainly to protect you and your family financially in the event of death.

Another difference is that the cover on mortgage protection reduces each month as the amount owed on the mortgage reduces. This doesn’t happen with life insurance, the cover remains the same.

See the other differences below.

How much does mortgage protection and life insurance cost?

The cost of insurance depends on a number of things such as age, health, cover amount, type of policy, etc. Before getting a quote it is important to think about the amount of money your family will need and whether it is for your mortgage, or to give your family financial support after you die. What are your monthly outgoings?

A general rule of thumb for estimating how much cover you need is multiplying your annual income by 10 for your life insurance cover amount. This can obviously change depending on any financial goals you may currently have, such as number of dependents – saving for college, etc.

You will pay a monthly premium for the duration of your life insurance or mortgage protection. We compare the prices of all providers in Ireland, and with the highest discounts available, you simply can’t get a better deal elsewhere.

Example comparison cost of Mortgage Protection & Life insurance

Cover Amount: €250,000

Term: 25 years

Applicant: Non-smoker

Age: 30 years old

Provider | Mortgage Protection Insurance Premium | Life Insurance Premium |

Zurich Life | €10.66 per month | €14.65 per month |

Royal London | €10.64 per month | €15.15 per month |

Irish Life | €15.04 per month | €17.23 per month |

Aviva | €12.52 per month | €17.25 per month |

New Ireland | €14.71 per month | €18.80 per month |

You can see from the above table that for only €3.99 per month extra, somebody could get Life Insurance instead of Mortgage Protection. Assigning the Life Insurance policy to the lender would mean that in the event of their death, the mortgage would get paid off, but if they were halfway through paying their mortgage when they passed away €125,000 would be paid out to the family as well as the mortgage being cleared. Which is great value for €3.99 per month.

Additional Benefits of Mortgage Protection & Life Insurance

With either of these insurance policies, you have the opportunity to avail yourself of many additional benefits. The conditions for each benefit can vary depending on the provider but our award-winning financial advisors will help you find the best option that meets your needs.

Some of the optional benefits for both term life insurance and mortgage protection are as follows:

- Specified Illness Cover

Specified illness cover can be included in your policy. If the life/lives insured is/are diagnosed as suffering from one of the listed specified illnesses, the benefit amount is paid out.

- Children Specified Illness Cover (Free when Specified Illness Cover is included)

Specified illnesses benefit for children up to the age of 25 if in full-time education.

- Childrens Life Cover (Free)

It is applicable for children who are aged 30 days and older and under the age of 21 (25 if in full-time education)

- Terminal Illness Benefit (Free)

Life cover payment is made if diagnosed with a terminal illness, as long as there are 12 months or more to go until the policy is due to end.

- Medical Second Opinion (Free – provider specific benefit)

Best Doctors Second Medical Opinion (Aviva). Helping Hand (Royal London)

- Aviva Family Care (Free – Aviva only)

Unique to Aviva, it is a counselling and psychotherapy service provided with every Aviva protection policy free of charge. This service is also completely confidential and offers rapid access to tailored mental health advice.

Do you need both Life insurance and Mortgage Protection?

You don’t need both however if you have a young family with children it is recommended to have life insurance even if you have mortgage protection in place. We all know that bringing up a child can be very expensive and if you have the right life insurance policy the costs of childcare, education, clothes etc will be covered if you were to pass away. Not to forget your household income even if you didn’t have children would be severely impacted if you were to pass away.

Why is Low Quotes the best broker to choose for your Mortgage Protection and life insurance?

Low Quotes is an award-winning market-leading online insurance broker in Ireland with a 5-star Google rating. We compare all the companies available in Ireland, with the highest available discount to find you the best price policy to suit your needs.

We provide a wide variety of Financial services such as Life insurance, Mortgages, Pensions, Financial Planning, Savings & Investments. If you have any questions about one of our services, feel free to contact us today.

Share this post

All our content has been written or overseen by a qualified financial advisor. However, you should always seek individual financial advice for your unique circumstances.

2 thoughts on “What’s the difference between Mortgage Protection and Life insurance?”

Comments are closed.