Table of Contents

Wouldn’t be perfect if we were able to work uninterrupted and earn a steady income to support our lifestyles and our loved ones? However, life is unpredictable and unforeseen events such as illness or injury can affect our ability to work and make money. This is where income protection insurance comes in.

In this guide, we answer some of the top questions about income protection insurance to help you make an informed decision about protecting your income and your future.

What is income protection insurance?

Income Protection is an insurance policy. It works to provide you with a replacement source of income if you can’t work due to an illness, injury, or disability for a period of time. It helps you supplement income for a fixed period, as defined in the policy.

You can take out an income protection policy if:

- You are in full-time work (more than 16 hours per week)

or

- Self-employed and earn a wage

or

- Over 18 (will vary based on plan)

What does Income Protection include?

The specific benefits and coverage included in an income protection policy will depend on the terms and conditions of the policy, but may generally include

- Guaranteed premium option available meaning the cost will never go up, even if you make a claim.

- Pays up to 75% of your income, allowing you to financially support your loved ones when you are out of work.

- You can still maintain your Income Protection even if you move jobs, anywhere in the EU.

- The cover can be increased every 3 years, by up to 20% of your original cover level, without further medical questions.

Who is Income Protection for?

Anyone eligible can avail of income protection insurance.

There are some standard requirements. Examples of this would be when:

- You are 18-54 years old and in full-time employment or are self-employed.

- You want to protect some of your income up to 70 years old if you cannot work because of illness or injury.

- You want a product that pays you a regular income if you cannot work because of an illness or injury, after a certain amount of time (deferred period).

- You want the option to top up your cover at a later date.

- You want your cover to continue, no matter how many claims you make.

- You want to take advantage of potential income tax relief.

- If you are looking for an alternative to Income Protection, and something where your family would be protected if you were diagnosed with an illness, Serious Illness Protection may be the better option for you.

How much income protection do I need?

Determining how much income protection you need depends on your individual financial situation and goals. Once you have a good understanding of these factors, you can calculate how much income protection you need.

Generally, you can protect up to 75% of your income but it’s always a good idea to consult with a financial advisor to help you determine the appropriate amount of income protection.

You can choose the percentage of your salary that you want to cover with Income Protection Insurance. The majority of people choose the maximum of 75% but this might not be financially possible for you. So you can choose a lower percentage which will depend on how much you require to pay your essential bills/living expenses like mortgage, grocery, electricity, etc.

Stay financially secure, even if you can’t work.

How much is income protection insurance in Ireland?

The cost of income protection in Ireland can vary depending on several factors such as your age, health, occupation, and the level of coverage you choose. Generally, the younger and healthier you are, the less you can expect to pay for income protection insurance.

You can use our income protection calculator to compare the best Irish income protection insurance market and get the best prices in a few seconds. Please contact one of our financial advisors to determine the amount of coverage that is better for your needs, the best length of time, and other details about the policy.

Can you claim income protection for mental health?

It depends on the company. Some of the lenders offer income protection insurance covering mental health conditions such as Zurich and Royal London. Contact our advisors to make sure your policy choices best suit your needs and personal circumstances.

Do I need income protection insurance?

Income protection insurance provides you with a replacement of your income if you are unable to work due to illness, injury, or disability.

It is beneficial especially if you have people who depend on your income or if you have significant financial commitments.

You may need income protection if you:

- Are self-employed and would have no source of income if you couldn’t work due to illness or disability

- Have little or no sick pay from your employer

- Have no ill-health pension protection

- Have dependants who rely on your income

- Have no other source of income

- Do not have sufficient benefits to replace your lost income and/or cover your expenses

- Do not have enough savings to cover long-term income loss

Does income protection cover redundancy?

Income protection insurance covers loss of income as defined in the policy due to illness or injury.

How many times can I claim Income Protection Insurance?

An income protection policy allows you to claim as many times as you require the benefit. For example, if you became ill, claimed the benefit, recovered and returned to work after 3 years. If you get ill or have a bad accident that prevents you from working, you can claim the benefit again.

If you return to work and relapse with the same illness, you don’t have to serve the deferred period. On the other hand, if it’s a different illness you have to serve the deferred period.

What is the deferred period for Income Protection?

The deferred period for income protection is the period of time between when you become unable to work due to illness, injury, or disability, and when your income protection insurance payments begin. It is also sometimes referred to as the waiting period.

You can choose a deferred period that fits your needs and budget when you purchase an income protection policy. Usually, the deferred period for income protection is from 4 to 52 weeks. If you are still within your deferred period you are unable to make a claim.

Contact one of our financial advisors to determine which deferred period is best for you.

What would happen if you lost your income tomorrow?

How long do your income protection payments last?

The length of time that income protection payments last will depend on the terms and conditions of your specific policy. Your benefit payment usually stops when one of the following events occurs:

- You return to work after recovery

- You reach the age established in your policy

- You pass away

Can you claim your income protection insurance on your tax return?

You can get tax relief on your income protection premiums at your marginal (highest) tax rate. To know more about tax returns you can get from your income protection contact one of our financial advisors.

If you are a member of a group scheme, your employer usually takes your premium from your salary before tax. In this case, you would not qualify for tax relief as you would have already received the tax relief.

How to claim income protection insurance?

To make a claim for income protection insurance due to illness, injury, or disability, you usually need to follow these steps.

- Check your deferred period to see if you are able to make a claim.

- Notify your insurance provider

- Complete a claim form sent by your insurance provider

- Submit your documentation to support your claim

Does your job affect being able to get Income Protection?

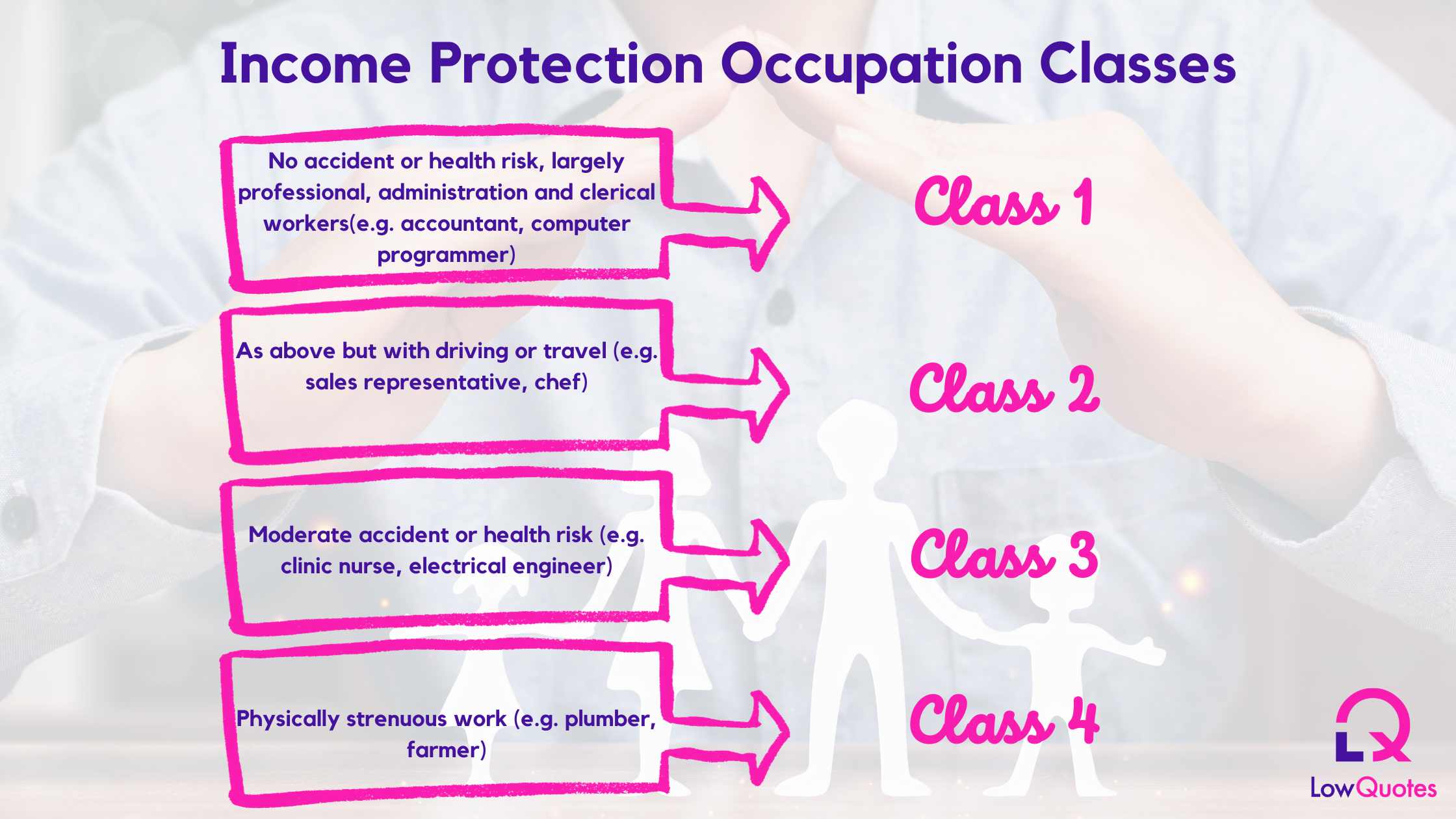

Some occupations will not be covered due to the risk factor of the occupation. See below a list of classes and which class you might fall into.

The cover of occupations might vary depending on the income protection provider. To know if your occupation is covered or not, please seek the advice of one of our financial advisors.

Who provides Income Protection in Ireland?

We work with the best income protection providers in Ireland: Aviva, New Ireland, Royal London, and Zurich. Check our income protection calculator and, in a few seconds, find the best income protection quotes.

We compare Income Protection from every provider in Ireland providing you with the lowest quote and best conditions to suit your needs.

Compare Income Protection Insurance with LowQuotes

Low Quotes is an award-winning market-leading online insurance broker with a 5-star Google rating. We compare the best income protection from various providers to find you the lowest quote.

We also provide a wide variety of Financial services such as Mortgages, Life Insurance, Mortgage Protection, Pensions, Financial Planning, and Savings & Investments. If you have any questions about one of our services, feel free to contact us today.

Don’t let an unexpected illness or accident derail your finances.

All our content has been written or overseen by a qualified financial advisor. However, you should always seek individual financial advice for your unique circumstances.

1 thought on “Your Guide to Income Protection Insurance: Answering the Top Questions ”

Comments are closed.