Table of Contents

People insure everything in their lives, from their cars to their homes, their income, and their businesses. But what if something were to happen to you? Would you or your loved ones be able to financially maintain the current cost of living?

Taking out a Multi-claim protection policy with Royal London will grant you that financial protection for you and your loved ones.

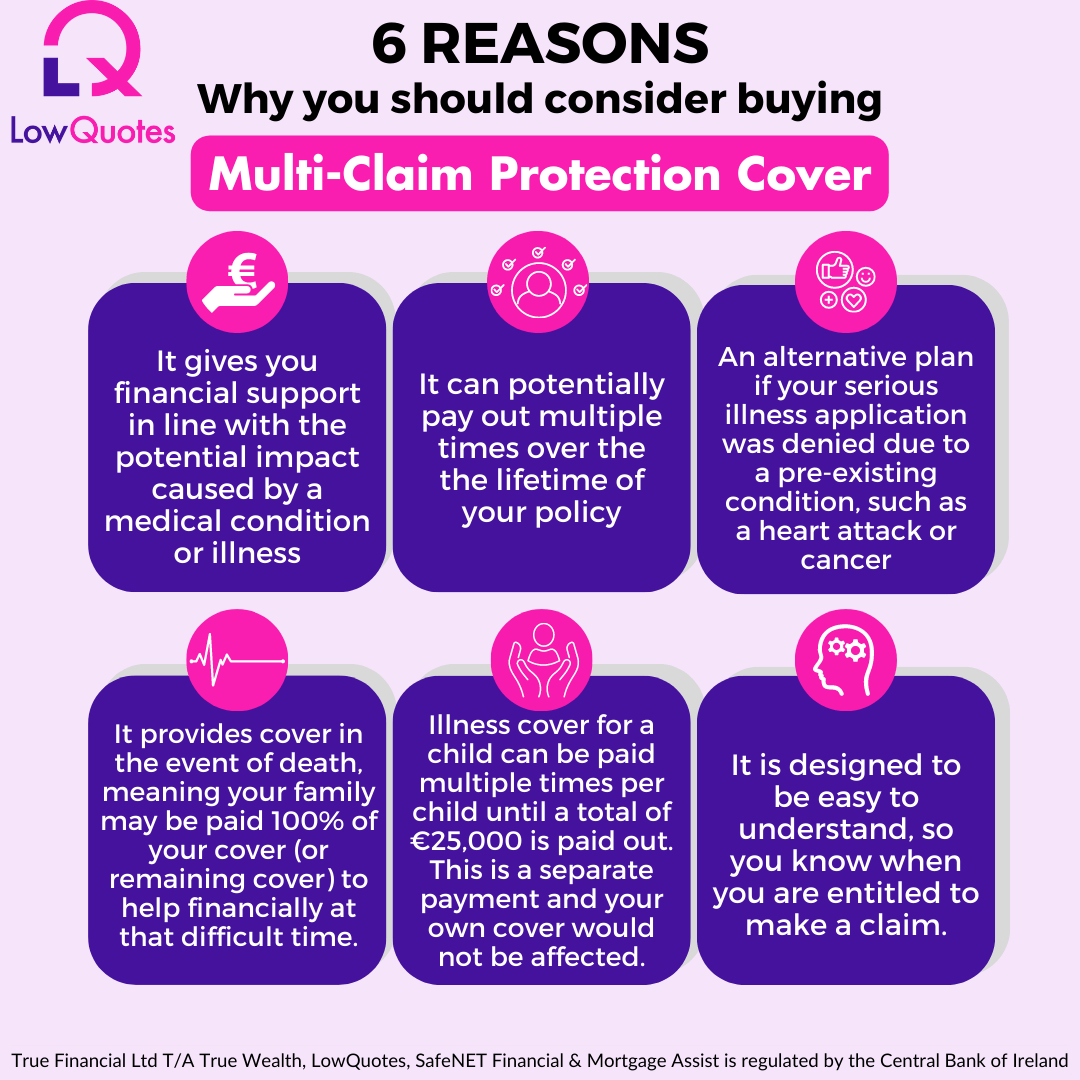

Multi-Claim Protection Cover is a unique, severity-based policy that protects you from a broad range of possible health issues that might impact you and your financial well-being.

It can potentially payout multiple times, so you can retain some level of cover even after making a claim. For the most severe health events, such as death and terminal illness, the full amount is paid out; lesser amounts are paid out for illnesses having a lesser effect on your health and lifestyle.

Multi-Claim Protection Cover can be added to an existing life insurance policy or purchased as a standalone product. Selecting the correct policy for you ensures peace of mind for your loved ones to maintain their lifestyle if the worst should happen.

What’s the difference between specified serious illness cover and Multi-Claim Protection Cover?

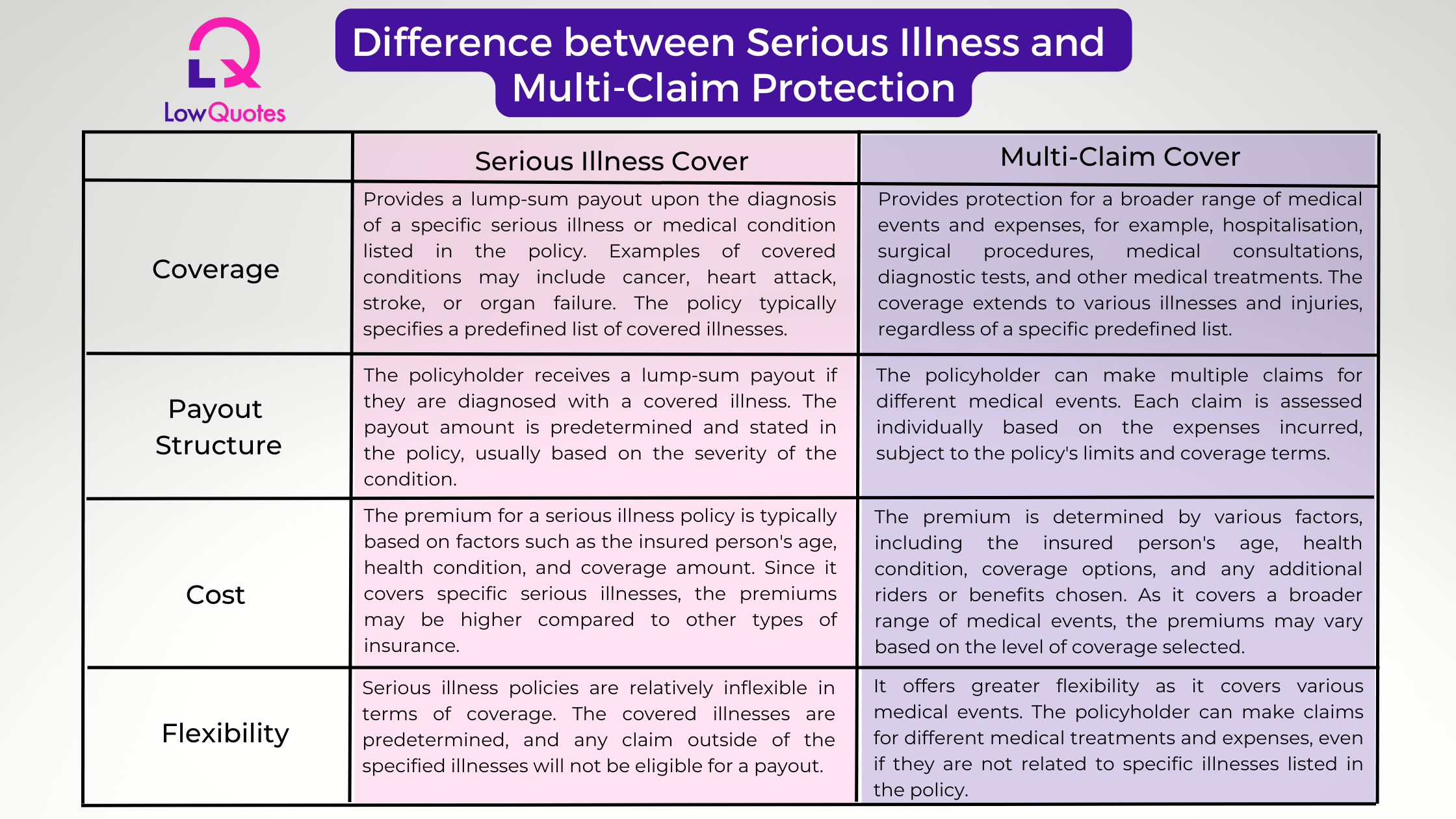

Serious illness and Multi-Claim Protection Cover are both types of insurance policies that offer financial protection in the case of specific medical events. However, there are key differences between the two.

– Multi Claim Protection Cover tends to be far more flexible in covering a range of illnesses.

– Less serious illnesses are covered under the policy.

– The previous policy is retainable even after previous health issues

It’s important to carefully review the terms and conditions, coverage limits, and exclusions of any insurance policy. We at LowQuotes can help you navigate through the specifications of each type of insurance to find the best solution that suits your needs.

Life throws curveballs. Get a Multi Claim Cover quote and be ready.

Is Multi-Claim Protection a viable choice for people who had their Serious Illness application denied?

Yes, if your Serious Illness application was denied due to a pre-existing condition, such as heart issues, cancer, or diabetes, you can still get Multi-Claim Protection cover with relevant exclusions.

You can read more in our article: Does Critical Illness Cover Heart Attack?

Another option if you have health conditions that prevent you from getting serious illness insurance is Cancer Cover. Cancer Cover is offered by Zurich and is different from traditional serious illness plans because it focuses solely on cancer. It’s important to take into account that 80% of serious illness claims involve cancer.

When a policyholder is diagnosed with cancer according to the policy’s definition, Cancer Cover policies often pay out a lump sum of money that can be used to cover medical bills, maintain the policyholder’s lifestyle, or cover other costs related to the condition. You can read more about it in our article.

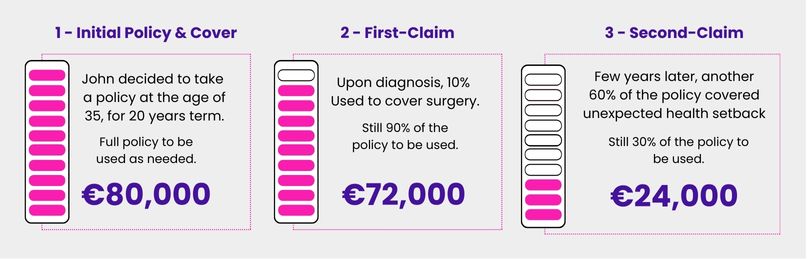

Understanding Multi-Claim Protection Cover: A Case Study

Multi-Claim Protection Cover is designed to provide financial support in the event of serious health issues by paying out portions of the total coverage amount as needed. Here’s how it works, illustrated through John’s experience:

Initial Policy and Coverage

- Profile: John, age 35, single, non-smoker.

- Policy: Single life Multi-Claim Protection Cover for €80,000 over a 20-year term.

- Premium: €23.68 per month.

First Claim: Cancer Diagnosis

- Health Issue: John is diagnosed with cancer and requires surgery.

- Payout: 10% of the total cover (€8,000) is paid out for surgery costs.

- Remaining Cover: €72,000 left for future health issues.

Second Claim: Testicular Cancer Diagnosis

- Health Issue: John is later diagnosed with testicular cancer, requiring extensive treatment.

- Payout: 60% of the total cover (€48,000) is paid out for treatments.

- Remaining Cover: €24,000 remaining for future health setbacks.

get a quote today!

Multi-Claim Insurance – Types of Cover

Single: Getting a quote by yourself and taking out a single policy.

Joint: This policy covers both you and your partner and will pay out in the event that one policyholder passes away.

Dual: Dual cover will continue to pay out after the death of the first policyholder and will continue to pay out after the second policyholder’s passing to the deceased’s family. We recommend this over Joint as it comes free of charge.

When do I take out a policy?

Making financial plans does not seem to be a priority for people aged 20 or even 30. Taking out a life insurance policy does not cross their minds as they try to figure out their next step in life.

Premiums for multiclaim protection policies generally increase with age, as the risk of developing critical illnesses typically rises as you get older.

Ensuring your financial stability is always a priority regardless of age. LowQuotes will help you obtain as much information as you need to cover you, for the best price available.

Why Should I Have Multi-Claim Protection cover?

Peace of Mind: Not knowing what is around the corner can be daunting. A Multi-Claim Protection policy can help with your mental well-being providing comfort in difficult times.

The Price: The earlier you buy a policy, the less you’ll have to pay. People believe that being young and healthy means that a life insurance policy would not be beneficial to them at a young age, but on the contrary, it’s for exactly this reason that you can save a substantial amount when paying for your policy.

Paying off Debts: In the event of your death, it will ensure that your loved ones have sufficient funds to pay off the loans.

Multi-Claim Protection Cover – Additional Benefits

With Multi-Claim Protection cover you have the opportunity to avail yourself of many benefits provided by Royal London.

Hospital Cash Benefit

Payment is made if you are hospitalised for more than 72 hours. The cover can range between €30 – €300.

Guaranteed Increase Option

A policyholder has the option to increase their coverage without providing evidence of their current health conditions. The provider’s terms & conditions vary, contact LowQuotes to get a better grasp on the benefit.

Funeral Expenses/ Accelerated Payments

Funeral expenses of up to €10,000 are paid. Read more about the terms and conditions explained by Royal London, here.

Monthly Income on Death

In the event of a death, a monthly benefit with a minimum amount of €5,000 is spread over the term of the plan. This benefit must be selected from the outset.

Terminal Illness Benefit

This benefit is paid out to the client if he is diagnosed with a terminal illness during the remaining 12 months of the policy.

Medical 2nd Opinion – Helping Hand (Royal London)

Children’s Life Cover – Payments made out of up to €7,000 in the event of the insured child’s death. The maximum age at which a claim can be made is up to 18 years old, or 25 if they are in full-time education.

Get covered for life’s surprises. Get a Multi Claim Cover quote!

All our content has been written or overseen by a qualified financial advisor. However, you should always seek individual financial advice for your unique circumstances.