Table of Contents

Life insurance is a vital component of financial planning, offering peace of mind that your loved ones will be supported financially in your absence.

However, inflation is a subtle force that may gradually erode the value of money, which makes it crucial to understand how it affects long-term financial commitments like life insurance.

What’s The Effect of Inflation on Money Value?

Inflation is the rate at which the general price level of goods and services rises, subsequently eroding purchasing power.

For someone with a Whole of Life insurance policy, this could mean what seemed like a substantial sum 30 years ago may no longer be enough due to the decreased value of money.

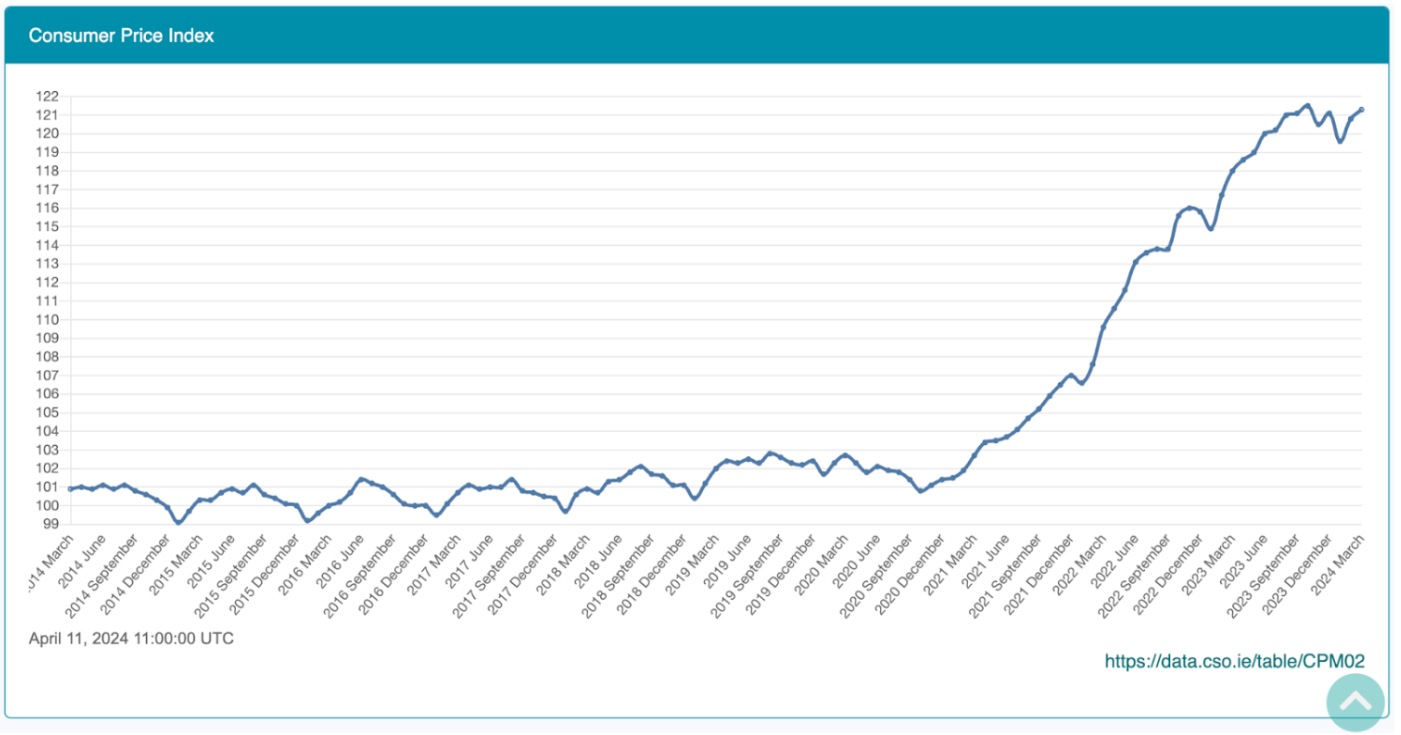

Take, for example, a life insurance policy purchased in 2014 for €200,000. With an increase in the Consumer Price Index (CPI) by 20.3% from March 2014 to March 2024, that initial €200,000 would effectively be worth only €160,000 in today’s money, which is significantly less than originally planned.

This example references the inflation rate from March 2014 to March 2024. It’s important to understand that this is strictly for illustrative purposes, as inflation rates can vary, either increasing or decreasing, depending on economic conditions.

How Can I Protect My Life Insurance Value from Inflation?

When selecting a life insurance policy, you have the opportunity to add various extras, including cover for serious illnesses or a convertible term option.

Indexation is another add-on worth considering, as it helps preserve the purchasing power of your funds against inflation.

What is Indexation in Life Insurance?

Indexation in life insurance is a feature that adjusts the benefit amount over time to reflect changes in the cost of living due to inflation.

This ensures that the value of the life insurance payout doesn’t diminish over time and continues to provide real financial security.

How Much Does Indexation Cost?

Adding indexation to your policy incurs an additional charge, which varies between life insurance providers.

Both the cost of your policy and the amount of cover provided will increase each year. However, the rate of increase in your cover is typically lower than that of your premium.

For example, your coverage may grow by 3% each year, while your premium could increase by 4% annually, which is a typical approach among providers.

Initially, your premiums may seem affordable, with monthly payments appearing low, but it’s important to remember that these will steadily rise over the term of your policy, potentially becoming a significant expense over time.

For a clearer understanding, consult with one of our financial advisors at LowQuotes to determine if this option is suitable for your specific circumstances.

get a quote today!

Is Indexation Necessary for Everyone?

Indexing might not be suitable for everyone. Several factors contribute to this decision:

Nearing Retirement

Indexation may not be necessary for someone who is taking out life insurance later in life, particularly as they approach retirement. Here are a few reasons why:

Reduced Financial Obligations: At this stage, major financial obligations like mortgage repayments or child education costs are likely to be resolved or significantly reduced.

Established Savings: Individuals nearing retirement may have built up sufficient savings and retirement funds, providing financial security without the need for an increasing life insurance benefit.

Reduced Dependent Reliance: The primary goal of life insurance is often to replace lost income for dependents, but those nearing retirement typically have fewer dependents relying on their income. Additionally, retirement benefits and a pension might soon take the place of their income.

No Mortgage Repayments

Indexation may not be as critical for individuals who have no mortgage repayments when taking out life insurance. Here’s why:

Decreased Financial Burden: Without a mortgage, one of the largest financial burdens is lifted. This reduces the need for a progressively larger life insurance benefit to cover such costs over time.

Lower Coverage Needs: The primary purpose of indexation is to maintain the purchasing power of the future payout against inflation, particularly for covering ongoing large expenses like a mortgage. Without this, the urgency for indexation diminishes.

Personal Financial Stability: Individuals without a mortgage are likely to have more financial stability and might prioritise other financial planning tools or investments over a life insurance benefit that increases with inflation.

However, even without a mortgage, considering indexation is wise for other significant financial obligations or dependents affected by inflation.

It ultimately depends on the broader financial picture and future needs. Consulting with one of our financial advisors at LowQuotes can help clarify the best approach based on individual circumstances.

No Dependents

If your children are adults and financially independent, they may not need financial support from you.

Conversely, if you are younger, have children, or support others financially, adding indexation to your policy could be a prudent choice to maintain the policy’s value over time.

Indexation might not be necessary for individuals who take out life insurance and have no dependents. Here’s why:

Main Purpose of Life Insurance: Life insurance is mainly intended to provide financial support to dependents after the policyholder’s death. Without dependents to protect, the need for increasing coverage to counteract inflation might be less pressing.

Financial Commitments: Without dependents, there is less need for a policy whose value rises over time because there are no longer any financial obligations that frequently require life insurance, such as continuing support for a husband or kids.

Alternative Financial Goals: Individuals without dependents might focus their financial strategies on saving for retirement, investing, or other forms of financial security that don’t involve life insurance with indexation.

You might believe that without dependents, there’s no need for indexation or even a life insurance policy.

However, it’s important to consider scenarios in which you might be unable to work due to illness or injury. Income Protection and Serious Illness Cover can be vital in maintaining your financial stability in such cases, ensuring that you have the necessary support when you need it most.

As always, personal circumstances and financial goals should guide the decision, and consulting with one of our financial advisors can provide tailored advice.

Compare all providers and get covered in under 10 minutes!

Is It Possible to Opt-Out of Indexation?

Choosing indexation means your life insurance provider will contact you annually to confirm whether you want to continue with the indexation feature. You always have the option to opt out if you decide against it.

Most providers allow you to reject the automatic increase from indexation for one year. However, if you refuse the increase consecutively for two years, the indexation feature will be permanently removed from your policy.

What alternative is available in life insurance policies if I choose not to include the indexation option?

If you prefer not to add the indexation option, many life insurance policies offer a Guaranteed Insurability Option.

This feature allows you to increase your cover amount without needing to provide additional medical evidence under certain life circumstances, such as increasing your mortgage, getting married, or having or adopting a child.

Discover Our Life Insurance Blog

Our blog is a great resource for clarifying any doubts you might have about life insurance. Here are some:

- What Is Life Insurance?

- What Happens If You Outlive Your Term Life Insurance?

- 7 Questions Single Parents Have About Life Insurance

- Questions About Life Insurance You Always Wanted To Ask

- The Benefits You Can Enjoy From Life Insurance While Alive

- Is It Possible To Get Life Insurance After Having A Stroke?

- Life Insurance Calculator: How Much Does Life Insurance Cost In Ireland?

- Life Insurance For Families

Get Your Life Insurance Quote With LowQuotes

Secure your future with confidence by getting a life insurance quote from LowQuotes. We offer comprehensive coverage options tailored to meet your unique needs and budget.

Whether you’re looking for peace of mind for yourself or protection for your loved ones, LowQuotes makes it easy to find the right policy.

Take the first step towards securing your financial future—get your personalised life insurance quote from LowQuotes today!

We also provide a wide variety of financial services, such as mortgages, serious illness cover, pensions, financial planning, health insurance, and savings & investments.

Secure your financial future today!

All our content has been written or overseen by a qualified financial advisor. However, you should always seek individual financial advice for your unique circumstances.