When it comes to life insurance, many people feel relieved once they’ve secured a policy. It feels like a box has been ticked. It may seem like your family’s financial future is safe, however what if your cover isn’t enough? What if you think you’re fully protected, but changes in your life or finances mean the policy no longer fits your family’s needs?

If you purchased life insurance a while ago and haven’t reviewed it, or if your financial situation has changed, you could be underinsured. Here are some signs that your cover might not be enough to protect your family as planned.

Your Policy Was Purchased Years Ago

If you bought your life insurance policy a few years ago, it might no longer reflect your current financial situation. Life changes—such as having children, buying a home, or taking on more responsibilities—often lead to increased financial needs.

Inflation also plays a major role in eroding the value of your policy over time. Inflation is the rate at which the cost of goods and services rises, reducing the purchasing power of money.

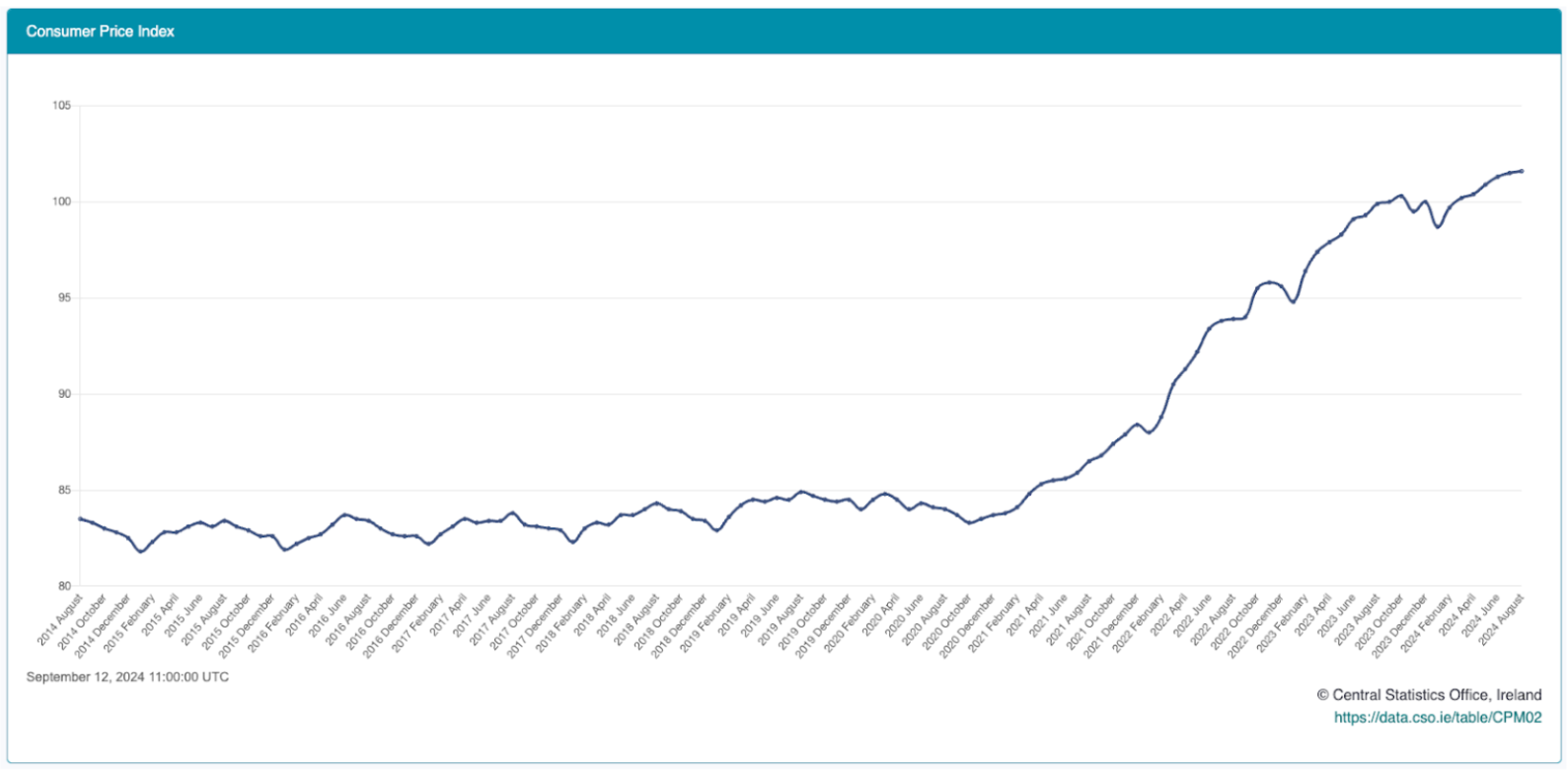

For example, if you purchased a life insurance policy in 2014 with cover of €200,000, and the Consumer Price Index (CPI) increased by 21.7% between August 2014 and August 2024, that €200,000 would now effectively be worth only €156,600.

This drastic reduction in value means your original policy might no longer provide enough cover for your family’s financial security, making it crucial to review and adjust your policy.

This example references the inflation rate from August 2014 to August 2024. It’s important to understand that this is strictly for illustrative purposes, as inflation rates can vary, either increasing or decreasing, depending on economic conditions.

Whether you have term life insurance or whole-of-life insurance, it’s important to review your cover as your life changes. Your family’s needs may grow with new responsibilities or higher expenses, and inflation reduces the value of your cover over time. By adjusting your policy, you can make sure it will still provide the support your family needs in the future.

You can also add an Indexation option to your policy, which automatically increases your cover to keep up with inflation, ensuring it stays valuable and relevant.

Your Stay-at-Home Spouse Doesn’t Have Life Insurance

Many people think only the main income earner needs life insurance, but that’s not true. A stay-at-home spouse provides significant value—looking after kids, managing the house, and more—which would be very expensive to replace.

According to Royal London Ireland, it would cost around €54,590 per year to hire someone to handle all the tasks stay-at-home parents do.

Childcare alone can be a significant expense. The Irish Independent reports that full-time childcare in south Dublin costs up to €18,936 annually, while in Monaghan, it’s €4,080 per year.

Without life insurance for your stay-at-home spouse, you could be underestimating your family’s future financial needs.

get a quote today!

You Bought a New House

When you buy a new home, lenders usually require mortgage protection, which pays off the mortgage if something happens to you.

However, we also recommend getting life insurance. While mortgage protection covers the mortgage balance, life insurance can help with other important expenses like bills, education, and home maintenance, allowing your family to maintain their lifestyle.

According to the Central Statistics Office, the average household in Ireland spent over €1,000 per week in 2022-2023.

A life insurance payout can be essential to cover these ongoing costs if you’re no longer around to provide for your family.

If your policy has a Guaranteed Insurability Option (GIO), you can increase your life insurance cover without providing further medical information when you buy a new house. This is especially helpful if you’ve been diagnosed with a serious illness, as it allows you to boost your cover without worrying about being denied due to health issues.

You Had a Baby

Having a baby is one of the biggest life changes, bringing both joy and new financial responsibilities. Everyday costs like nappies, baby supplies, and childcare quickly add up, and over time, the financial impact becomes even more significant with education and other long-term expenses.

Research shows that raising a child in Ireland until their 21st birthday can cost as much as €105,321, and families in Ireland, on average, spend €11,033.64 annually on their children, covering everything from food and clothing to education.

The costs grow over time: the average cost of sending a child to primary school each year is €1,546, and secondary school costs around €3,090 per year. Higher education is even more expensive, with third-level education costing up to €64,400 over 3-4 years if rented accommodation is needed.

To protect your family financially, it’s crucial to ensure your life insurance covers these future expenses in case something happens to you.

If your policy has a Guaranteed Insurability Option (GIO), you can increase your life insurance cover without providing further medical information when you have a baby. This is especially helpful if you’ve been diagnosed with a serious illness, as it allows you to boost your cover without worrying about being denied due to health issues.

In addition to life insurance, starting a children’s savings plan is a smart move. Investing in a fund for your child’s education could offer higher returns than a standard savings account, helping to secure their future.

You Don’t Know the Details of Your Policy

When was the last time you checked the specifics of your life insurance policy? If you’re unsure about your cover or you don’t know what your policy actually includes, it’s a sign you could be underinsured.

Many people overlook the fine details, but understanding what you’re covered for is vital. Did you know that some policies offer more than just a payout after death? You might have access to benefits like mental health support, or even a second medical opinion.

Taking a few minutes to review your policy could reveal valuable services that help you while you’re still alive. Here are some benefits:

Aviva Care

When you choose Aviva for your Life Insurance, Serious Illness Cover, Mortgage Protection, or Income Protection, you can access an exclusive health and well-being service called Aviva Care.

This service is included free of charge with all new protection policies, offering a suite of valuable benefits designed to support your overall health and well-being.

Aviva Care provides policyholders with four great benefits at no additional cost: Digital GP, Best Doctors Second Medical Opinion, Family Care Mental Health Support, and Bereavement Support.

Helping Hand

Royal London goes beyond the typical insurance offering by providing access to a service called Helping Hand, which grants you access to dedicated medical professionals from the day your policy starts—not only when you make a claim.

This unique feature includes all nurses available to give you a second opinion on your diagnosis and future treatment options without additional cost. Helping Hand isn’t just for policyholders; your spouse and children can also use the service.

Should you ever experience a serious illness, injury, or bereavement, Helping Hand offers crucial support that extends beyond financial aid. To aid in recovery or coping, Royal London, through Helping Hand, may provide access to specialist therapies such as bereavement counsellors, speech and language therapists, face-to-face second medical opinions, complementary therapies, and physiotherapy for specific serious health conditions.

Learn more by reading our article, The Benefits You Can Enjoy From Life Insurance While Alive.

get a quote today!

You’re Relying Solely on Life Insurance Through Your Employer

Some employers in Ireland offer life insurance policies as part of their employee benefits package. This means that in the event of your death, your employer would pay three to five times your annual salary in a non-taxable lump sum to your family.

While this might seem like enough cover, it’s a myth that having life insurance through work means you don’t need any additional cover. As a general rule, life insurance cover should be about ten times your annual income to ensure adequate financial security.

If your employer-provided policy falls short, you may want to consider purchasing additional life insurance from another provider.

Additionally, if your employer’s policy doesn’t include Serious Illness Protection, it’s worth exploring a standalone Serious Illness Protection plan to further safeguard your family in case of unexpected health issues.

Your Income or Debts Have Increased

Life insurance is designed to replace your income and help cover outstanding debts. If your salary has increased significantly since you first purchased your policy, or if you’ve taken on new debts, your current cover might fall short.

Think about what your family would need to maintain their standard of living and settle debts if you were no longer around. If your income has gone up but your insurance cover hasn’t, you’re likely underinsured.

If your policy has a Guaranteed Insurability Option (GIO), you can increase your life insurance cover without undergoing medical checks when your income increases. This is especially helpful if you’ve been diagnosed with a serious illness, as it allows you to boost your cover without worrying about being denied due to health issues.

You Started a Business

Starting a business comes with many financial responsibilities, like managing loans and payroll. If your family depends on the success of your business, your life insurance needs to reflect that. If something happens to you, would they be able to keep the business going or pay off any debts? Making sure your policy covers these obligations helps protect both your family and your business.

As a business owner, you can choose between regular life insurance or key person insurance. Life insurance protects your family, while key person insurance helps your business by covering the financial impact of losing a key member.

Comparing both types will help you find the best fit for your situation, ensuring financial stability for both your business and personal life.

What to Do Next

If these signs sound familiar, it may be time to review your life insurance. The good news is that you can always adjust your cover. Follow these steps to ensure your loved ones are fully protected:

Review Your Current Policy

Start by looking at the details of your existing life insurance policy. Check the cover amount, beneficiaries, and any terms or conditions that could affect your payout. Contact your life insurance provider for clarification if you’re unsure about anything.

Assess Your Current Financial Situation

Consider any major life changes—such as a new child, home, or business—and evaluate your current debts, income, and financial responsibilities. Ask yourself, “Would this cover be enough for my family if I were no longer around?”

Estimate How Much Cover You Need

Calculate your family’s future financial needs, including outstanding debts (like a mortgage), daily living expenses, and long-term costs such as education. Make sure your life insurance will cover these needs for years to come.

Check out our insightful article, which provides everything you need about life insurance. It covers important details like how life insurance works, the costs involved, and how to determine the right amount of cover for your family.

Consult a Financial Advisor

It’s a good idea to seek professional advice. Our financial advisors can help you evaluate whether your cover is adequate and recommend adjustments based on your current circumstances.

Get a Life Insurance Quote with LowQuotes

Life changes, and your life insurance should change with it. Reviewing your policy now could save your family from unnecessary financial stress in the future.

Speak with one of our financial advisors, who can guide you, help you understand your options, and ensure you get the best possible policy for your situation.

We also provide various financial services, such as mortgages, serious illness cover, pensions, financial planning, health insurance, and savings & investments.

get a quote today!

All our content has been written or overseen by a qualified financial advisor. However, you should always seek individual financial advice for your unique circumstances.