What is Remortgaging?

Remortgaging is the process of getting a new mortgage on the house you currently own, to pay off the existing mortgage and replace it with a mortgage that has more favourable terms; for example, to reduce your interest rate or even lower your term, with the added advantage to borrow additional money against your property (this is known as an equity release). You can negotiate a new deal with your current lender or start again with a new lender.

It means that you’ll stay in your existing home and use the equity you have in the property as security for the mortgage. You might want to raise some cash for debt consolidation, home upgrades, equity release, education costs, or just to take advantage of reduced rates.

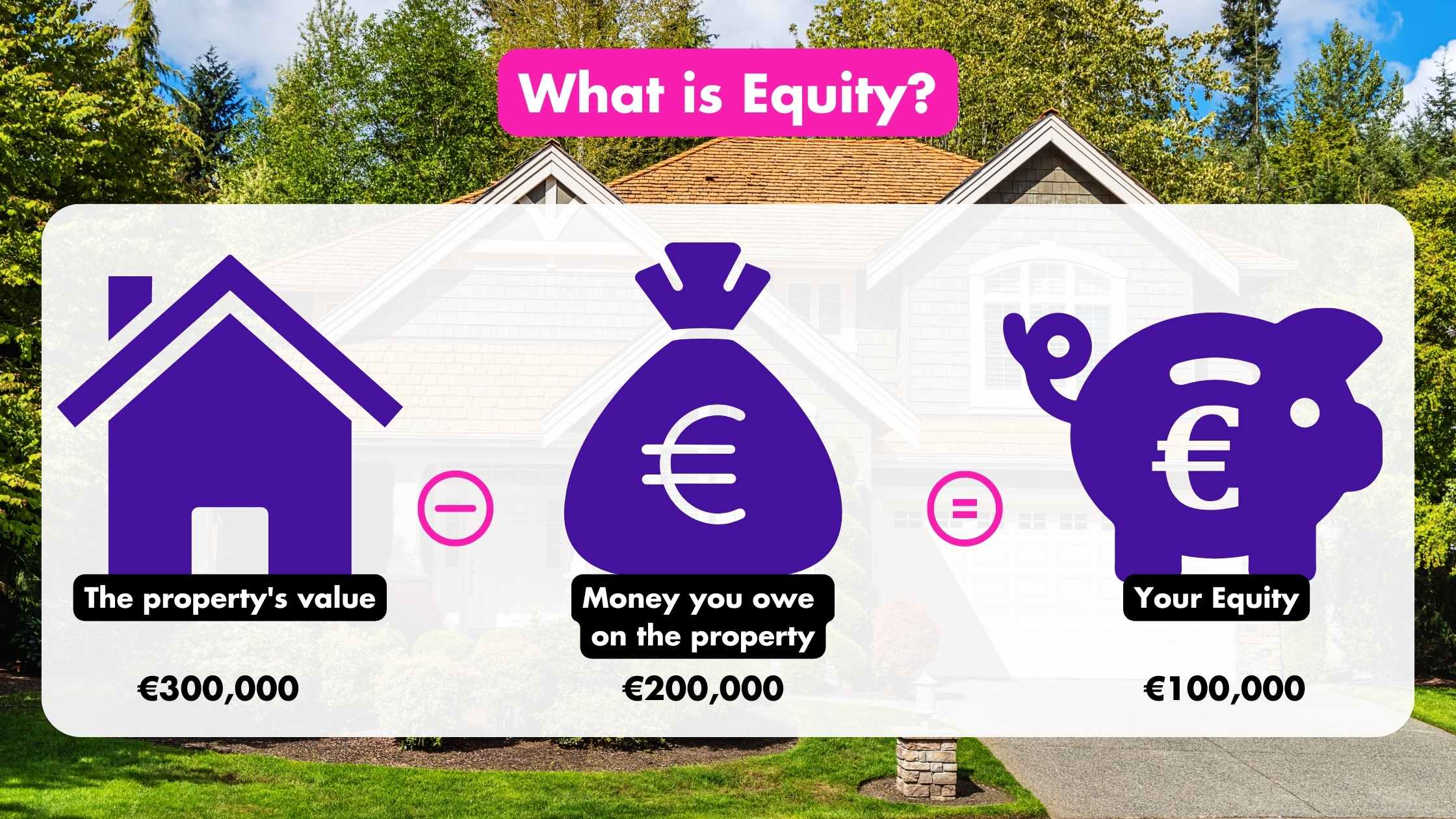

What is Equity?

Equity is the difference between the current value of your house and the amount you owe on it. For example, if a property is valued at €300,000 and the homeowner has a mortgage balance of €200,000, their equity in the property would be €100,000.

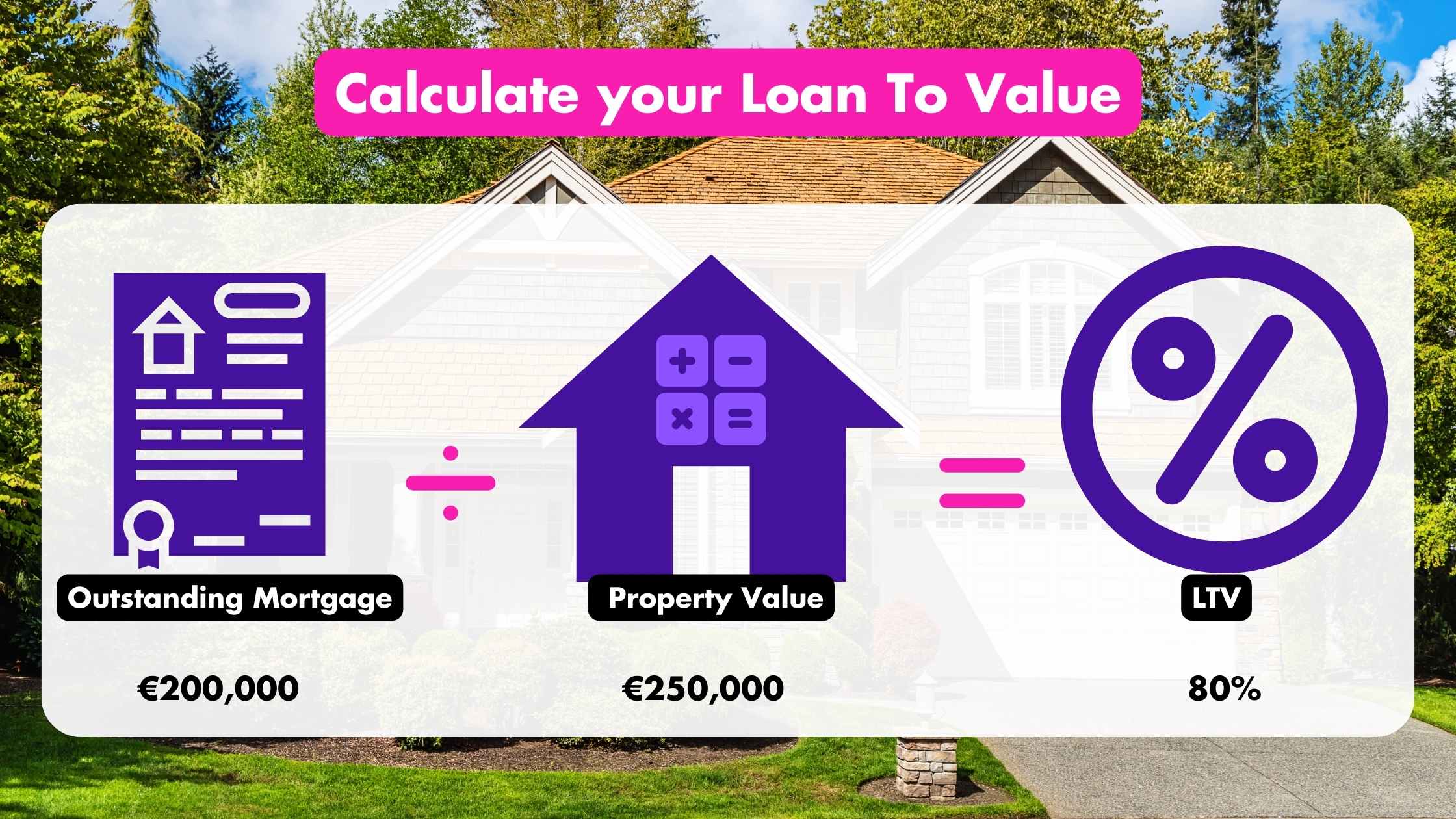

What is the LTV rate (Loan to Value)?

LTV is short for Loan to Value. This is the maximum amount you may borrow, based on the current value of the property.

This is a percentage figure which represents the difference between your mortgage loan and the value of your property.

A remortgage applicant can borrow up to 90% of the value of a property, but again, it depends on the lender and their specific criteria.

How to calculate Loan-to-Value (LTV)

How Calculating your loan-to-value (LTV) ratio is a straightforward process. To determine your LTV, you need to know the current value of your property and the outstanding balance on your mortgage. Here’s how to calculate it:

Calculate your mortgage’s outstanding balance: To find out how much you still owe on your mortgage, check your most recent mortgage statement or get in touch with your lender.

Find out what your property is now worth: You can determine this through a property evaluation, recent sales of comparable properties in your neighbourhood, or by speaking with a real estate professional.

Calculate the loan-to-value ratio: Divide the outstanding mortgage balance by the current property value. Multiply the result by 100 to express it as a percentage.

For example, if your mortgage is €200,000 on a property valued at €250,000, your LTV rate would be 80%.

How early can I remortgage?

If your mortgage rate is Variable or Tracker, you can remortgage sooner rather than later as Interest rates in Ireland are continually on the rise, at about 4%. So if that’s your situation, it’s definitely worth remortgaging to avoid overpaying. By remortgaging you could switch to a better deal with lower interest rates and lower monthly repayments and avoid further imminent rate increases by the ECB and lenders.

If you started on a fixed rate, and at the end of that fixed rate term your mortgage automatically reverted to a variable rate, then your monthly payments will increase. Remortgaging or switching your mortgage might save you thousands of euros per year by getting a lower interest rate.

We strongly advise reviewing your current mortgage terms and conditions including early exit penalties as well as charges and fees you have agreed to pay in the event you decide to transfer before making the decision to remortgage or switch.

Read more about how much you can save remortgaging/switching in our article.

We also discuss the benefits of remortgaging more in-depth in our article about the Reasons Why Remortgaging Can Save You Money.

What is the difference between a remortgage, a switch, and a mortgage top-up?

Although they all are related to modifying or adjusting your current mortgage, a remortgage, a switch, and a mortgage top-up have different implications and objectives.

Switching mortgages mean refinancing your mortgage with a new lender, while a remortgage can either be with your current lender or a new lender.

A Top-up mortgage refers to a type of loan that allows homeowners to borrow additional funds on top of their existing mortgage, also known as a mortgage equity release.

Do I need a conveyancer for a remortgage?

Yes. To handle your house documents and assist you with the new mortgage arrangement, you must hire a solicitor. To help determine your mortgage rate, you must also have an estate agent evaluate your home.

Can I remortgage to release equity?

Remortgaging to release equity is when you remortgage to get some extra money. You can take out a new, bigger mortgage that covers more of the value of your property reducing the amount of equity you own; and you can receive a lump sum of money that you can put towards debt consolidation, educational expenses, home improvements, or other planned or unforeseen life events, etc.

If the value of your property is more than what you owe on your mortgage, you might be eligible to release equity through remortgage.

Can I remortgage with the same lender?

When considering a remortgage, you have the option to either stay with your current lender or switch to a new one.

Exploring different providers and comparing offers can be a smart move as it may open opportunities to secure a better deal and potentially save money compared to what your existing lender offer.

We, at LowQuotes, have access to multiple lenders and we compare rates and terms to find the best option for your needs.

Can I remortgage my buy-to-let property?

Yes, it is possible to remortgage a buy-to-let property. A buy-to-let mortgage is specifically designed for individuals who purchase properties with the intention of renting them out to tenants.

How much can you remortgage your house for?

The amount you can remortgage your house for will depend on a number of variables, including the current market value of your property, the remaining balance on your existing mortgage, and the lending policies of the specific lender you select.

Lenders might consider the loan-to-value (LTV) ratio when determining the amount you can remortgage. The LTV ratio indicates how much of the value of your home you can borrow against.

A remortgage applicant can borrow up to 90% of the value of a property, but again, it depends on the lender and their specific criteria.

LowQuotes: Your Solution for Remortgaging with Competitive Rates

Low Quotes is a market-leading online mortgage broker in Ireland with over 775 5-star Google ratings and 25 years of experience. We are proud to be awarded as Insurance Broker of the Year 2022 as the result of our team’s dedication to providing market-leading independent advice and exceptional customer service.

If you’re considering remortgaging your property, you can partner with LowQuotes for securing a remortgage with lower interest rates. We understand that finding the best deal is crucial when it comes to maximising your financial benefits.

Visit our website or give us a call today to get started on your journey towards financial freedom. LowQuotes is committed to helping you find the best remortgage deal that suits your needs.

All our content has been written or overseen by a qualified financial advisor. However, you should always seek individual financial advice for your unique circumstances.

Warning: You may lose your home if you do not keep your repayments.

Warning: The cost of your monthly repayments may increase.

Warning: You may have to pay charges if you pay off a fixed-rate loan early.

Warning: If you do not meet the repayments on your loan, your account will go into arrears. This may affect your credit rating, limiting your ability to access credit in the future.

Warning: The entire amount you have borrowed will still be outstanding at the end of the interest-only period. The lender may adjust the payment rates on this housing loan from time to time. (Applies to variable-rate loans only).