It’s quite common for people to take their health and well-being for granted until they are faced with a serious illness or health issue. Often, we get caught up in the routines of daily life and become used to feeling relatively healthy, which can lead us to overlook the fragility of our well-being.

What is Serious Illness Cover?

Serious Illness Cover is a type of insurance policy that provides a lump sum payment if you are diagnosed with a life-threatening illness that is covered and defined under the terms of the policy, such as certain cancers, a heart attack, or a stroke.

This lump sum will allow you to care for yourself and your family. You could use the money to cover costs like household expenses or medical bills. The illnesses covered and the amount paid out will vary depending on the policy and the insurance companies.

You can learn more about what serious illness cover is in our guide.

Do I need Serious illness Cover?

Imagine a scenario where you’re unable to work due to a severe illness. During your recovery, your focus would likely be on your health rather than your income. How would you or your loved ones manage to maintain financial stability?

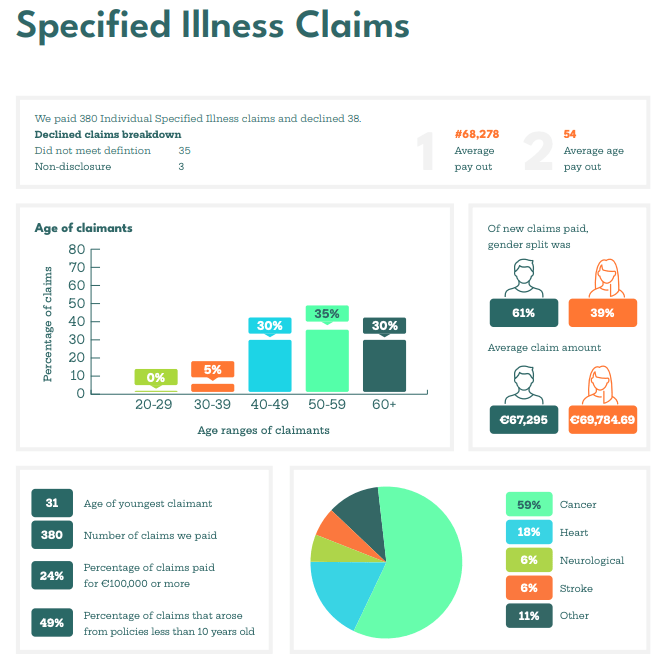

Unfortunately, the chances of facing serious illnesses are significantly high, even before reaching the age of 65. According to New Ireland, their Claim Statistics Report 2021 stated that 5% of the claimants were 30 to 39, 30% were 40 to 49, 35% were 50 to 59%, and 30% were 60 and beyond.

In Ireland, almost 45,000 new cases of cancer are diagnosed each year. This means that one person is diagnosed with cancer every 3 minutes. By 2045, it is expected that the incidence of cancer in Ireland will have doubled.

There are approximately 6,000 people with heart attacks admitted to Irish hospitals every year.

Additionally, 30,000 people in Ireland are living with disabilities as a result of a stroke. One in five Irish people may experience a stroke, at some point in their lives, which can have profound impacts on the individual who experiences it and their family members.

Given these concerning statistics, serious illness cover can play a crucial role in providing financial stability and support during a challenging and uncertain time. It allows individuals to focus on their recovery and well-being without the added stress of financial concerns.

If you want further insights about what serious illness cover read our guide.

A few things you should be aware of before purchasing Serious Illness Cover

Purchasing serious illness cover is an important decision that requires careful consideration.

1. Understand what illnesses are covered

Serious illness policies cover a specific list of serious illnesses, such as cancer, heart attack, stroke, and major organ transplants. Make sure you understand the exact illnesses covered by the policy and their definitions. Different insurance providers might have slightly different lists and definitions, so compare policies to find the one that suits your needs.

2. Coverage Amount and Cost

Determine the amount of coverage you need. Consider factors such as medical expenses, ongoing care costs, and potential loss of income during your recovery period. The coverage amount should be sufficient to provide a financial safety net for you and your family.

Your policy’s cost will vary depending on a range of variables, such as:

- The higher the coverage amount, the higher the premium is likely to be.

- Whether you have a single policy that only covers you or a dual policy that also covers a partner.

- The length of the policy term can affect the premium. Longer terms might have slightly higher premiums.

- Your health status.

- Your age.

- Smoking status.

3. Smokers will pay higher premiums

Smokers typically face higher premiums for serious illness cover due to the elevated health risks associated with smoking. Smoking is a risk factor for a wide range of serious illnesses, including cancer, heart disease, respiratory issues, and more.

Life insurance providers consider the potential risk of a policyholder developing these illnesses, and because smokers are statistically more likely to experience health complications, they are considered higher-risk clients. But don’t worry It’s still possible to take out cover if you’re a smoker.

Vaping and nicotine replacement products such as patches are also still classed as smoking by most insurance companies so this is important to bear in mind when submitting an application for non-smoker rates.

In fact, you have to be off all tobacco products for 12 months before the insurers will consider you to be a non-smoker.

4. Your Application for Serious Illness Cover Could Be Rejected

It’s important to be aware that there’s a possibility your application for serious illness cover could be declined. Insurance companies carefully evaluate various factors when reviewing applications, including health history, medical conditions, and risk factors.

If your application is deemed to have a higher level of risk due to pre-existing conditions, certain medical history, or other factors, the insurance provider might decide to reject your application.

If you have been declined for serious illness cover due to particular health concerns, there may be alternative options available to you. Here are some alternatives you may want to consider:

Multi-Claim Protection Cover: If your Serious Illness application was rejected due to pre-existing conditions like heart problems, cancer, or diabetes, you can still obtain Multi-Claim Protection Cover with specific exclusions.

Explore our comprehensive guide on Multi-claim protection cover.

Cancer Cover Only: Cancer Cover specialises in cancer-related protection, making it ideal if you have a family history of cancer. In this article, we discuss this topic in more detail.

Income Protection: Income Protection is a type of insurance provides coverage in the event that you are unable to work due to illness or injury. Learn more by reading our articles about this topic:

5. You can add specified illness cover to a life insurance policy

Serious illness cover is available as an add-on to a life insurance policy. Or, you can purchase a serious illness policy separately.

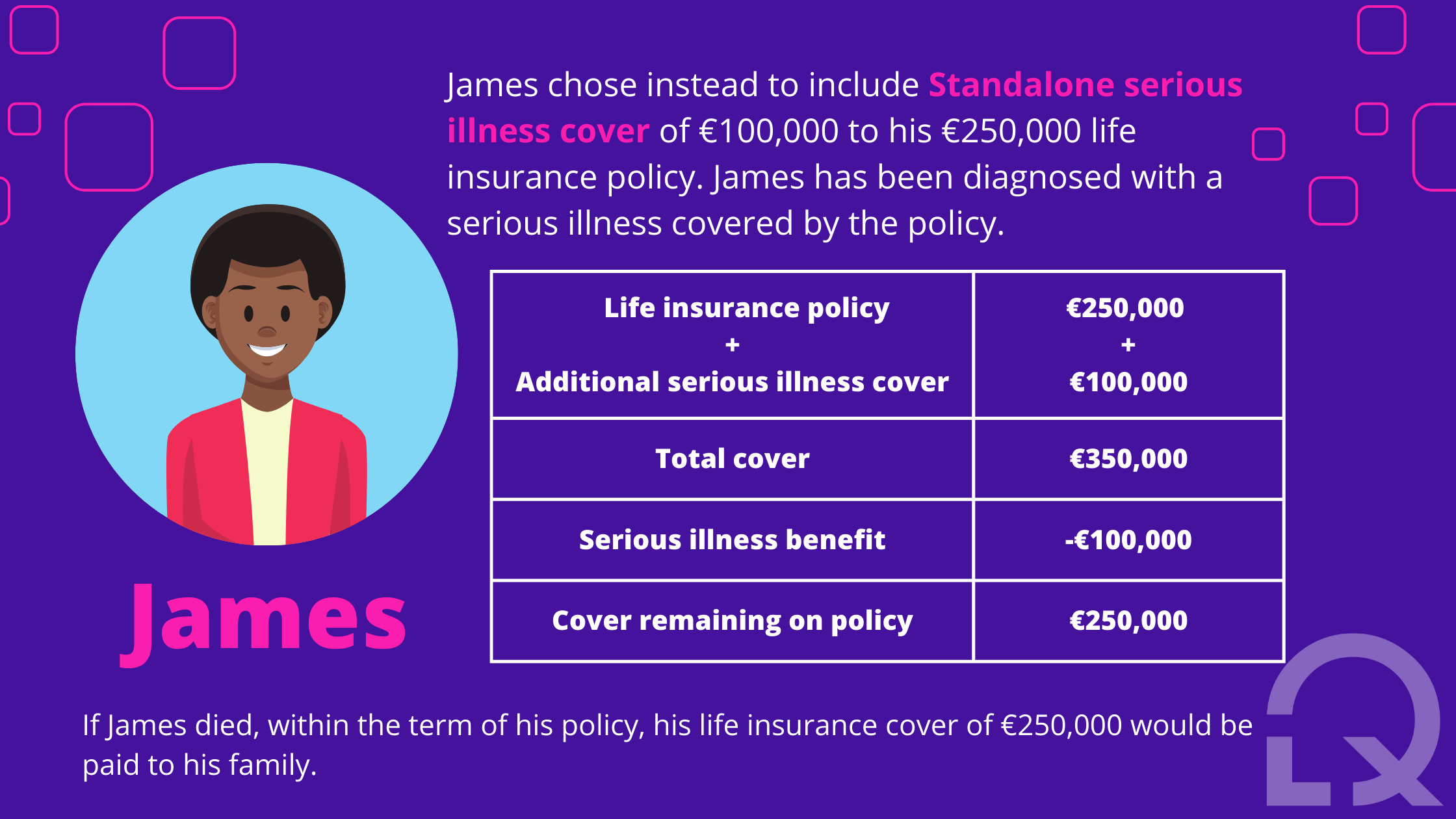

Standalone serious illness cover: it means it is taken out as a separate policy and is completely independent of any life protection you might purchase or already have.

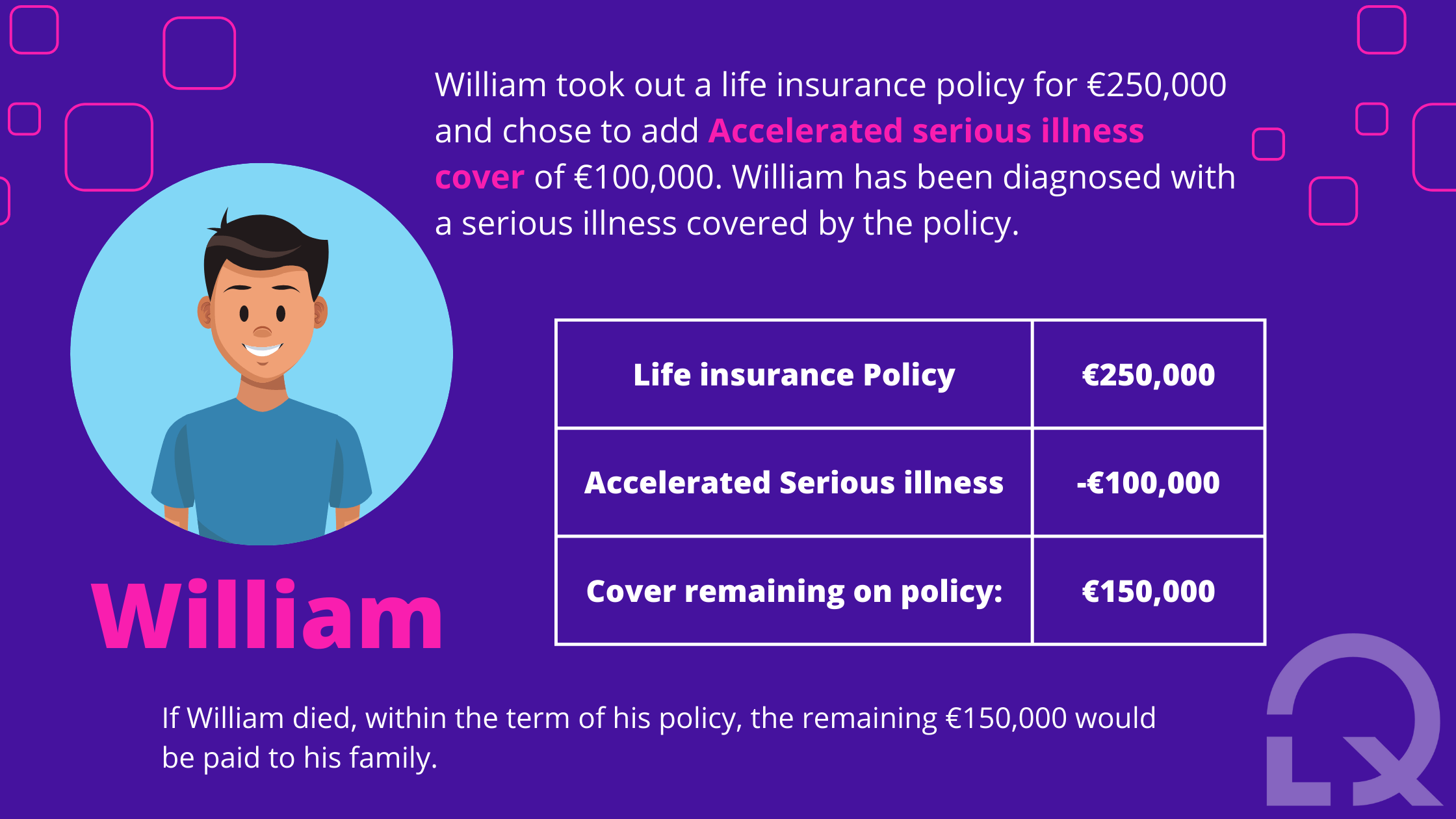

Accelerated serious illness cover: if you are adding serious illness cover to your mortgage protection or life insurance, when the payment is made, the life cover amount is reduced accordingly.

Examples:

6. Get quotes with different Life Insurance Providers

Don’t settle for the first policy you come across. Compare prices from different insurance providers to ensure you’re getting the best value for your money.

With LowQuotes, you can easily compare prices from top insurance providers to find the Specified Serious Illness cover that best meets your needs and budget. Simply fill out a short online form, and LowQuotes will provide you with a list of policies and prices to choose from.

If you have any doubts regarding serious illness cover, please feel free to get in touch with us.