Table of Contents

While giving love and care is essential, making sure your child has a solid financial foundation is just as important.

As a parent, you’re always thinking about ensuring your child’s future is secure and bright. With the economy constantly changing, it’s crucial to make smart financial decisions now that will help your children develop good money habits and financial security.

This article will show you simple and smart ways to ensure your child’s financial future is safe and sound.

Start a Savings Account Early

Opening a savings account for your child early on is a straightforward yet powerful way to help them build their financial future.

Most banks do not open savings accounts for children before the age of 7. If your child is younger, you can open a dedicated savings account in your own name and start saving on their behalf.

Once your child turns 7, you can open a savings account in their name. This presents a great opportunity to teach them how banking works, such as depositing money, tracking their savings, and understanding basic financial concepts.

Visiting the bank together can help them become familiar with managing their money and develop good saving habits from an early age.

It’s important to note that some banks in Ireland offer interest rates on children’s savings accounts that fluctuate between 0.25% and 3.00%. These rates can vary significantly based on the bank and the specific account terms.

On the other hand, unit-linked savings plans, such as Children’s Savings Plans, can offer much higher potential returns, with interest rates reaching up to 25% or more, depending on the plan and investment performance.

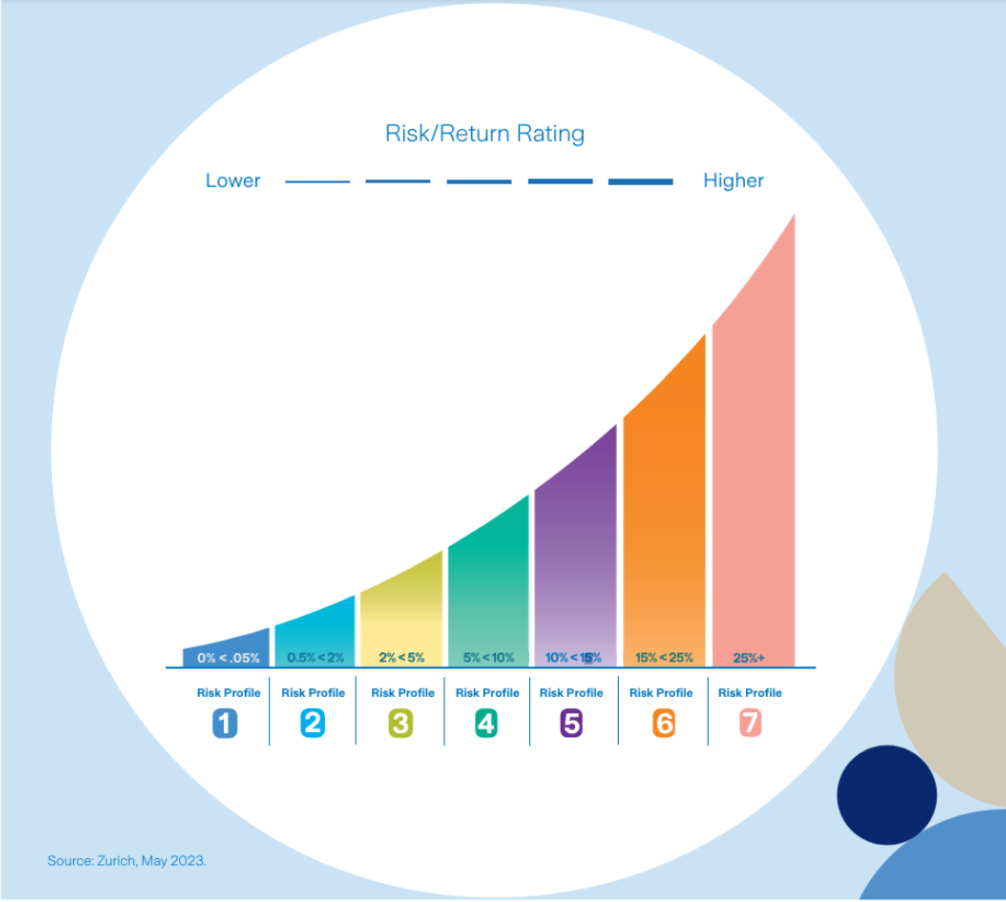

These plans combine savings with investment in financial markets, offering the possibility of higher returns but also carrying greater risk compared to traditional savings accounts. See the risk-return rating for each risk profile level below.

Talk to one of our financial advisors to understand your unique situation and goals for your children’s financial future. Our advisors can help you navigate the various options available, considering your current financial status, risk tolerance, and long-term objectives.

They can help you decide whether a traditional savings account or a unit-linked savings plan is more suitable for your family by discussing your specific needs and expectations.

Secure a brighter tomorrow for your child!

Emergency Fund

Children are expensive, and surprises can happen, making it crucial to have an emergency fund. A financial cushion can provide peace of mind and security for unexpected situations.

Whether your child falls ill, there are unplanned medical expenses, or you face extra costs for childcare, school supplies, back-to-school expenses or extracurricular activities, an emergency fund can help you manage these unforeseen expenses without financial strain.

Invest in a Children’s Savings Plan

With college costs rising, it’s wise to start saving for your child’s education as soon as possible.

The average cost of putting a child through third-level education during the period of 3-4 years is €44,268 with student accommodation and €64,400 with rented accommodation. It stands at €24,132 while still living at home, which is still a significant amount of money.

Children’s Savings Plan is a regular premium, unit-linked savings plan designed to help you invest in a range of investment funds from the start of the policy. Once you select your preferred funds, this choice remains in effect for the plan’s duration.

This savings plan is ideal for parents who wish to save for their children’s future and for relatives or godparents looking to set aside money for a child’s future needs. It is particularly suitable for those comfortable with saving over five years or more, offering a structured and potentially rewarding way to secure financial stability for the younger generation.

One of the primary benefits of a Children’s Savings Plan is its tax advantages. It allows you to maximise the Gift Tax benefits when saving for your child or grandchild by legally assigning the savings to them. This enables you to fully use the annual Gift Tax exemption limit of €3,000 per individual or €6,000 for a married couple.

To learn more, read our article “What Is The Best Way To Save For Your Child’s College Education?” for detailed insights and strategies. Alternatively, you can contact us, and our financial advisors will be happy to guide you through the best options tailored to your needs and goals.

Teach Kids About Managing Money

Teaching your child about money early on is one of the best gifts you can give them. Understanding how to budget, save, and invest will help them succeed financially in the future.

When kids understand money, they can make smart financial choices. This knowledge helps them become more independent and responsible. Learning about money early helps children feel confident in managing their own finances.

Start teaching money lessons that match your child’s age. For younger kids, explain simple ideas like saving and spending. As they get older, talk about budgeting and investing. Use everyday activities, like grocery shopping on a budget or saving for a family trip, to show them how money works.

Books, games, and online resources can make learning about money fun. These tools can help keep your child interested and make financial concepts easier to understand.

Pocket money can be an effective tool for teaching children about financial management. A survey revealed that younger children in primary school in Ireland receive an average of €6 pocket money per week, which increases to €10 per week for those in secondary school.

A good strategy for teaching children the value of money is to have them earn their pocket money through tasks. Parents can create a list of weekly chores children must complete to receive their allowance.

This approach gives kids a work ethic and a sense of responsibility, helping them understand that money is earned through effort and contribution. It also fosters discipline and time management skills as they learn to balance their tasks with other activities.

While parents must put in time and effort to ensure the chores are completed, the long-term benefits for the child’s financial understanding and personal development are well worth it.

For more tips, check out our article on how to teach kids financial responsibility.

Secure a brighter tomorrow for your child!

Have a Protection Package In Place

Life Insurance

Whether you’re a newly married, single parent, or married with children, life insurance provides a safety net for your family in your absence. It ensures that your child will have financial support if something happens to you.

In the hustle and bustle of daily life, it’s easy to postpone critical tasks, but securing life insurance doesn’t have to be one of them. You can get a quote in seconds, making it simple and quick to protect your family’s future and give yourself peace of mind.

Learn more about how much coverage you need, which type of life insurance policy suits you best, the cost of life insurance, and much more in our article, “Life Insurance Calculator.”

Other Important Insurances You Should Have

Serious Illness Cover: This policy offers protection by providing a lump sum if you are diagnosed with a specified serious illness. Learn more by exploring our Serious Illness Cover Guide.

Income Protection Insurance: Provides a regular income if you cannot work due to illness or injury. Learn more by reading our Income Protection Guide.

Health Insurance: This insurance covers medical expenses, reducing the financial burden of healthcare costs for you and your children. Learn why health insurance is a must-have in Ireland.

Children’s Serious Illness Cover

If you have a Serious Illness Cover policy in place, it also extends protection to your children. This coverage applies to all your children from birth until they turn 18 years old, or 21 if they are enrolled in full-time education, for the duration of the policy term.

The cover for Serious Illness is 50% of your policy amount (or the higher level for Dual Life policies) at the time of diagnosis, with a cap of €25,000.

Additionally, your children are entitled to one partial payment (less severe illness) of 50% of your Serious Illness Cover (or the higher amount for Dual Life policies) at the date of diagnosis, up to a maximum of €7,500.

To qualify for the Children’s Serious Illness Cover benefit, the child must survive the serious illness for at least 10 days following the diagnosis. Additionally, any pre-existing medical conditions are not covered under this benefit.

Gain immediate access to our comprehensive Protection Package Guide, designed to enhance your financial plan and help you achieve your goals. This guide offers vital tips, step-by-step instructions, and essential strategies for securing your financial future. Don’t wait, download now and start building a stronger financial foundation!

Your journey towards financial freedom starts here!

After you download your guide, one of our expert Financial Advisors will be in touch shortly to provide you with guidance and further relevant information to build you a customised financial plan.

Create a Trust or Will

Creating a trust gives you control over how and when your child will receive their inheritance, ensuring that the assets are managed according to your wishes.

This arrangement can help your family avoid the lengthy and costly probate process, providing a smoother transition of assets.

Additionally, having a trust in place offers peace of mind, knowing that your child’s financial future is secure and managed according to your specific instructions. This not only protects your child’s financial well-being but also ensures that your legacy is preserved as you intended.

Secure Your Children’s Future With LowQuotes

Financial planning is essential for organising your finances and securing your family’s future. By creating a comprehensive financial plan, you can effectively manage your income, expenses, and investments, including setting up a children’s savings plan.

This structured approach organises your finances and allows you to take advantage of various tax benefits, maximising your savings and investments. A solid financial plan ensures that your financial goals are met, providing stability and peace of mind for you and your family.

Speak with one of our financial advisors, who can guide you, help you understand your options, and ensure you get the best solution for your situation.

We provide various financial services, such as mortgages, serious illness cover, pensions, life insurance, financial planning, health insurance, and savings & investments.

Secure a brighter tomorrow for your child!

All our content has been written or overseen by a qualified financial advisor. However, you should always seek individual financial advice for your unique circumstances.

Warning: Past performance is not a reliable guide to future performance.

Warning: Benefits may be affected by changes in currency exchange rates.

Warning: The value of your investment may go down and up.

Warning: If you invest in these funds, you may lose some or all of your investment.