Are you a smoker who has been contemplating quitting? In addition to the obvious health advantages, giving up this habit can save you a lot of money on life insurance rates.

In Ireland, the cost of life insurance can vary significantly based on various factors such as age, health, amount covered, type of policy, and term of the policy. But did you know if you are a smoker, your premiums can be as much as double the cost for non-smokers?

A cost analysis conducted by Royal London highlights the substantial disparity in premiums between smokers and non-smokers over the duration of an insurance policy. For instance, if a 45-year-old smoker were to seek €300,000 worth of Level Term Life Cover over 25 years, they would end up paying more than €16,600 in additional premiums compared to their non-smoking counterpart.

Health risks associated with smoking

Cancer

Smoking is the primary risk factor for lung cancer, making it the leading cause. According to the Irish Cancer Society, 9 out of 10 lung cancers are caused by smoking. Additionally, smoking serves as a contributing risk factor for several other

To learn more, read our article, Is Cancer Covered Under Specified Serious Illness In Ireland?

Heart Disease

Your heart is the essential engine of your body, responsible for pumping blood to vital organs. Smoking harms this engine in several ways:

- Elevating your heart rate, thereby increasing the body’s demand for oxygen in the blood.

- Introducing carbon monoxide into the bloodstream, which can contribute to the development of coronary heart disease and potential heart attacks.

- Enhancing the risk of blood clot formation.

- Causing the hardening and narrowing of arteries, resulting in reduced blood flow to the heart.

Read our article, Does Critical Illness Cover Heart Attack?

get a quote today!

Stroke

Smokers face a higher likelihood of experiencing a stroke, which can manifest as either a blockage of blood supply to the brain or bleeding within the brain. Strokes are a significant cause of both mortality and prolonged disability.

Bronchitis and Emphysema

Smoking can either cause or exacerbate severe respiratory conditions such as bronchitis and emphysema. In cases of severe emphysema, breathlessness may worsen, particularly when coupled with infections.

Fertility and Birth Complications

Smoking has adverse effects on fertility, potentially reducing the chances of conception. Furthermore, smoking during pregnancy can lead to miscarriage, stillbirth, and various health issues during early infancy.

The Smoking Factor For Life Insurance

Smoking has long been recognised as a significant risk factor for various health issues, including heart disease, lung cancer, and respiratory disorders. Insurance companies typically classify applicants into three categories: smokers, non-smokers, and ex-smokers.

These distinctions are crucial in determining the premiums individuals pay for their life insurance policies. Let’s take a closer look at how each category affects your life insurance rates:

Smokers

Smokers typically pay the highest life insurance premiums due to the elevated health risks associated with smoking.

Non-Smokers

Non-smokers, who have never smoked or used tobacco products, generally enjoy the lowest life insurance premiums.

Ex-Smokers

Ex-smokers, those who have quit smoking and remained smoke-free for a specified period (usually 12 months), fall into this category. Ex-smokers can benefit from significant savings compared to current smokers.

Quitting smoking not only improves your health but also puts you on the path to more affordable life insurance coverage as a non-smoker.

Getting your life insurance quote only takes 60 seconds, or alternatively, talk to one of our financial advisors so you can make informed decisions.

Is vaping classified as smoking for life insurance?

Yes, vapers and users of e-cigarettes are classified as smokers for life insurance purposes. However, it’s important to emphasise that this classification can vary from one insurance provider to another. Each insurance company may have its own underwriting guidelines and policies when it comes to vaping.

How do I know if I fall into the category of smokers?

Someone falls into the category of a smoker based on their use of tobacco or nicotine-containing products, such as cigarettes, cigars, e-cigarettes, pipes, cannabis, chewing tobacco, and nicotine products (chewing gums, patches, etc.)

Compare all providers and get covered in under 10 minutes!

Is it possible to obtain life insurance coverage as a smoker?

Yes, it is possible to get life insurance coverage as a smoker. However, life insurance premiums are typically higher for smokers than for non-smokers. This is because smoking is associated with a higher risk of various diseases, including heart disease, lung cancer, and respiratory illnesses. Insurers adjust premiums to reflect this increased risk.

Despite the higher cost, life insurance remains crucial for smokers. The elevated health risks associated with smoking could make life insurance potentially more important for smokers than for non-smokers.

While obtaining life insurance coverage as a smoker may be more expensive, it remains a vital financial tool to protect your loved ones and ensure their financial well-being in the face of increased health risks. Considering the potential health risks and the value of financial security for your family, obtaining life insurance is a prudent decision for smokers.

Here are a few reasons why Life Insurance is so important for smokers:

Financial Protection: Life insurance provides financial protection for your loved ones in the event of your death. For smokers, who face an increased risk of premature death due to smoking-related illnesses, having life insurance can be essential to ensure that their families are financially secure after their passing.

Covering Outstanding Debts: If you have outstanding debts such as a mortgage, loans, or credit card balances, life insurance can help cover these financial obligations, preventing your loved ones from being burdened with the debt.

Income Replacement: If you are the primary breadwinner in your family, life insurance can replace your income, ensuring that your family can maintain their standard of living even after your death.

Is obtaining specified serious illness coverage an option for individuals who smoke?

Yes, getting specified serious illness coverage is an option for individuals who smoke. However, it’s important to be aware that the premiums for this coverage are typically higher for smokers due to the increased health risks associated with smoking. Smokers can still secure this valuable protection, which provides financial support in the event of a covered critical illness diagnosis, helping them manage medical expenses and related costs during a challenging time.

Serious illness cover provides a lump sum payment if you are diagnosed with a critical illness covered by your policy, which can include conditions like cancer, heart disease, and stroke. For smokers, the risk of developing these serious health conditions is notably higher, making serious illness cover a valuable complement to traditional life insurance.

While the premiums for serious illness cover may also be higher for smokers, the peace of mind and financial security it provides can be well worth the investment.

Learn more about Serious Illness cover by reading our articles:

- 6 Things to know before purchasing Serious Illness Cover

- Is cancer covered under specified serious illness in Ireland?

- Serious Illness Cover Explained: Your Comprehensive Handbook

- Does Critical Illness Cover Heart Attack?

- Critical Illness vs. Income Protection: Which is the Best?

Can life insurance be reviewed if you stop smoking?

Yes, in many cases, life insurance can be reviewed and potentially adjusted if you stop smoking. When you quit smoking, your health improves, and this can have a positive impact on the premiums you pay for your life insurance coverage.

If you purchased your current life insurance while still a smoker and quit in the meantime, you may be able to save hundreds of euros per year as a result of your new non-smoker status.

Here’s how the review process typically works:

Waiting Period

Many insurance companies require a waiting period of typically 12 months after you quit smoking before they consider you a non-smoker.

Qualifying for Non-Smoker Terms and Evidence of Non-Smoking

If you currently hold a life insurance policy and want to switch to non-smoker terms with the same insurance provider, you can do so, but it requires a commitment to remain tobacco-free.

Re-categorisation as a non-smoker with the same life insurance provider requires you to follow their specific procedures and guidelines for transitioning to non-smoker terms. This may involve meeting their criteria for a designated smoke-free period, undergoing a cotinine test, and submitting the necessary documentation.

However, if you choose to explore your life insurance options through LowQuotes, you can initiate a new application, bypassing the need for extensive documentation and tests related to your smoking status. This can simplify the process and potentially save you time and effort.

Premium Adjustment

Once you meet the insurer’s criteria for non-smoker status, your life insurance policy can be reviewed and adjusted accordingly. At this point, you can expect to see a reduction in your premiums. Non-smoker rates are significantly lower than smoker rates for the same coverage.

Keep in mind that the specific procedures and requirements for these adjustments may vary between insurance companies, so it’s a good idea to consult with one of our financial advisors to fully understand the process.

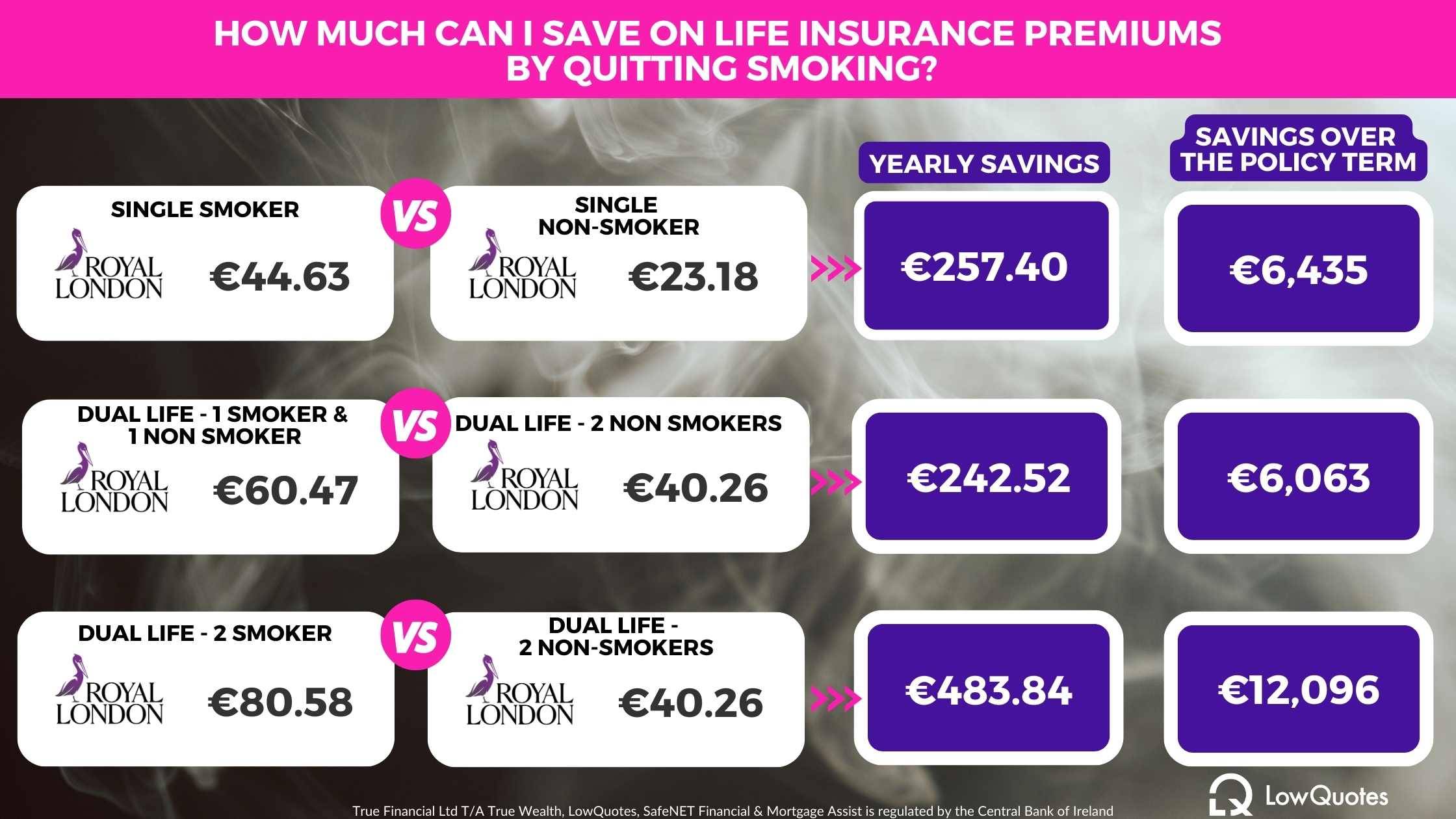

How much can I save on life insurance premiums by quitting smoking?

When you quit smoking and can provide evidence of your smoke-free status, you may become eligible for non-smoker rates. The exact savings will vary based on factors like your age, the type and amount of coverage you’re seeking, and the insurance company you choose. However, here’s an estimate: Non-smoker rates are typically about half or even less than what smokers pay for the same coverage.

Example:

Let’s take, for instance, individuals who are 37 years old and seeking coverage of €300,000 for a term of 25 years as of September 2023.

As you can see below, giving up smoking can lead to annual savings of hundreds or even thousands over the course of your policy.

If you’ve recently quit smoking and already hold a life insurance policy, get in touch with us. We can review your policy and explore opportunities for better rates. And if you’re still a smoker, this is an excellent moment to consider making that positive change.

Secure your financial future today!

Tips for maximising savings

If you’re considering quitting smoking to reduce your life insurance costs, here are some tips to maximise your savings:

- Consult Your Insurance Provider: Talk to your insurance provider about their specific guidelines for reclassifying smokers as non-smokers. Understand the waiting period and the evidence required to prove your non-smoking status.

- Shop Around with LowQuotes: Different insurance companies have different underwriting criteria and pricing structures. We can shop around for you with multiple insurers to find the most favourable rates for your unique situation.

- Maintain Smoke-Free Status: Once you quit smoking, it’s essential to stay smoke-free to continue benefiting from lower premiums. Some insurers may periodically review your status, so maintain your non-smoking lifestyle.

- Plan Financially: While quitting smoking will lead to insurance savings, it’s also essential to plan how you’ll allocate these extra funds. Having a financial plan in place can help you make the most of your savings.

Get Your Life Insurance Quote with LowQuotes

LowQuotes is a market-leading online insurance broker in Ireland, with a 5-star Google rating and over 850 reviews. We are proud to be awarded Insurance Broker of the Year in 2022 as the result of our team’s dedication to providing market-leading independent advice and exceptional customer service.

To get a life insurance quote, fill in some quick details, such as how much coverage you require and the term of the policy, and you’ll receive a quote comparing the prices of the best life insurance providers in Ireland.

Our life insurance calculator is straightforward to use, you only need to add your personal details, and you will get a quote in 60 seconds.

If you don’t know how much life insurance cover you need, read our article.

For more information about Life Insurance, read our latest articles:

- The Benefits You Can Enjoy From Life Insurance While Alive

- What Is Life Insurance?

- Questions about Life Insurance You Always Wanted to Ask

- The Benefits of Using a Broker to Get Life Insurance Quotes

- Common Myths and Misconceptions About Life Insurance

- What’s the difference between Mortgage Protection and Life insurance?

Speak with one of our expert, award-winning Financial Advisors!

All our content has been written or overseen by a qualified financial advisor. However, you should always seek individual financial advice for your unique circumstances.