Table of Contents

One of the most important investments you can make for your family and yourself is life insurance. In the event of unforeseen events like death, disability, or serious illness, it offers financial security and peace of mind.

Despite its importance, many people still hesitate to purchase life insurance due to some misconceptions about the cost and necessity.

We understand that purchasing life insurance can be complicated and confusing due to the various types of life insurance policies available in Ireland.

That’s why we are ready to give you the best advice, find you the lowest price, and make sure you have the right protection to safeguard you and your family.

What Exactly is Life Insurance?

Life insurance is a contract between you and an insurance provider. In exchange for your premium payments, the insurer pays a lump sum to your beneficiaries upon your passing.

But there’s more to it than just planning for the unexpected—some policies can also act as financial tools for saving and investment.

Additionally, life insurance offers benefits that you can take advantage of while you’re still alive. One such feature is the Hospital Cash Benefit, which provides a daily cash payment for each day you spend in the hospital.

This benefit can help alleviate the financial burden of hospital stays, covering daily expenses such as meals, transportation, and parking fees, which may not be included in your private health insurance coverage.

Read our article to learn about the other life insurance living benefits.

Main Types of Life Insurance

Term Life Insurance: It provides coverage for a specified period or “term”. Term Life Insurance is designed to offer financial security when the cost of losing the insured would be particularly high, such as when a person is raising children or paying off a mortgage.

Whole of Life Insurance: This policy covers you for your entire life, not just a set term. Whole of Life tends to be more expensive but can accumulate cash value, serving dual purposes as a safety net and a financial asset.

Both types of life insurance, Term and Whole of Life, offer the flexibility to enhance your policy with additional features like the conversion option and indexation.

Adding a conversion option allows you to convert your term life insurance policy to a new policy for another term without providing further medical information, thus securing cover as your needs and circumstances change over time.

Indexation, on the other hand, helps ensure that the value of your life insurance benefit keeps pace with inflation. By automatically adjusting your cover amount annually to match inflation rates, indexation protects the buying power of your future benefits, making sure that your policy’s value does not diminish over time.

Together, these options provide significant flexibility and security, adapting to your evolving financial landscape.

Life Insurance Myths vs. Reality

There are several myths about life insurance that can deter people from getting the coverage they need.

One common belief is that life insurance is too expensive. However, this is not always the case; for example, premiums can be as low as €13.72 per month.

To help you determine whether life insurance is suitable for your needs, we’ve debunked five typical myths and misconceptions surrounding it.

Understanding the realities can clarify the benefits and affordability of life insurance, encouraging more informed decisions about securing this valuable financial protection.

Compare all providers and get

covered in under 10 minutes!

What are the benefits of having life insurance?

Life insurance is an essential aspect of financial planning for anybody, as it helps ensure financial stability for loved ones in case of unforeseen circumstances. While nobody likes to think about the possibility of their own death or serious illness, having life insurance can provide many benefits to you and your loved ones.

Your Family’s Financial Security

The main goal of buying a life insurance policy is to ensure your family’s financial stability in the event of your unexpected death. Life Insurance pays out a lump sum to your beneficiaries so that your family can continue without your income. This lump sum can be used to pay funeral expenses, pay off the mortgage, help pay for your children’s education, or even keep your family’s lifestyle.

Peace of Mind

Your passing might put your loved ones in a vulnerable financial situation without your income. Life insurance can provide you with peace of mind, knowing that your loved ones will be financially secure if the worst occurs to you.

You can add Serious illness cover as an additional benefit to most life insurance policies or buy a standalone policy. It pays out a tax-free, cash lump sum if you are diagnosed with a life-threatening illness such as cancer, heart attack, or stroke.

Protecting Your Business

If you’re a business owner with business partners or others who depend on your business income, life insurance for all owners or partners of a business could pay off business debts and keep the business going during a transition period.

Tax-Free

All payouts from life insurance are tax-free which can help your beneficiaries avoid any potential tax liabilities.

While the life insurance payment itself is tax-free, some beneficiaries may have to pay inheritance tax depending on their relationship with you. For example, there is no tax liability between married couples/civil partners.

On the other hand, cohabiting couples with dual or single policies would have to pay inheritance tax as they would be seen as “strangers” in the eyes of Revenue.

We can tailor a policy for cohabiting couples that is not subject to inheritance tax. Contact one of our Qualified Financial Advisors and we are more than happy to help you make an informed decision and have peace of mind.

Secure your financial

future today!

Who Needs Life Insurance in Ireland?

Life insurance isn’t a one-size-fits-all solution. Depending on your stage of life and financial responsibilities, your needs might vary:

Single Adults

If you’re single, you might think life insurance isn’t for you. However, it can pay off debts, cover funeral expenses, and provide peace of mind to your family.

Consider whether there’s someone who depends on your income, such as a parent or a disabled sibling, and how significantly life insurance could impact their lives.

Additionally, if you’re a business owner with partners, life insurance becomes crucial. It can ensure that your business continues smoothly during a transition period if something happens to any of the owners or partners.

Beyond life insurance, you might also consider Serious Illness Cover, which pays out a lump sum if you are diagnosed with one of the serious illnesses specified in the policy.

Another valuable option is Income Protection, which replaces a portion of your wage each month if you are unable to work due to illness or injury.

Speak with one of our financial advisors at LowQuotes to understand which option best suits your unique needs and goals.

Families with No Children

There’s a common myth suggesting that if you don’t have children, you don’t need life insurance. Obviously, this isn’t true.

Life insurance primarily serves to replace lost income, ensuring that your family or partner can sustain their lifestyle or meet financial obligations should you pass away prematurely.

For couples without children, life insurance provides a means for the surviving partner to maintain their standard of living or manage shared debts, such as loans or mortgages.

They could use the payout to cover ongoing expenses and fund funeral arrangements after your departure.

Moreover, if you have dependents like a parent or a disabled adult sibling, even a modest life insurance policy could significantly aid in providing for their needs in your absence.

Speak with one of our expert,

award-winning Financial Advisors!

Families with Children

For families with children, securing life insurance is not just advisable; it’s essential. It plays a pivotal role in ensuring the financial security of your children, covering significant expenses like education and daily living costs should you no longer be there to provide support.

Beyond these basic needs, life insurance can also help your family maintain their lifestyle in your absence. It can cover funeral arrangements, help manage mortgage payments, fund your children’s education, and even assist your children with a deposit on their own mortgage in the future.

Life insurance offers a buffer against the financial challenges that may come with the loss of a parent, ensuring that your family’s future remains secure and their plans are attainable.

Single Parents

As the sole provider, whether you’re a Super Dad or a Super Mum, securing life insurance is a critical priority to safeguard your child’s future should anything happen to you.

Recognising the unique concerns of single parents, we have compiled a list of the most frequently asked questions about life insurance to offer you clear and understandable information.

This resource aims to empower you with the knowledge you need to make informed decisions about your family’s financial security.

Alternatively, for personalised advice tailored to your unique circumstances, speak with one of our financial advisors at LowQuotes, who can guide you through the process and help ensure that you find the best cover to meet your needs.

Building Wealth

Life insurance can be a cornerstone of your financial strategy. Whole of Life insurance, in particular, is not only a tool for providing financial security after one’s passing but also an effective means for accumulating wealth over a lifetime.

Unlike Term Life Insurance, Whole of Life insurance covers you for your entire life and can help your family build generational wealth after you pass away.

By integrating Whole of Life insurance into your broader financial strategy, you can secure a legacy and build wealth, ensuring long-term stability for yourself and your loved ones.

What is Life Insurance Calculator?

When planning for life insurance, a valuable resource at your disposal is the life insurance calculator. This tool provides you with an estimated amount of additional life cover you might need, acting merely as a guideline to assist in your preliminary calculations.

Additionally, you can request a quote directly through our service, which compares the best life insurance providers in Ireland all in one place. This convenience allows you to shop around without the need to visit multiple websites—we do all the work for you.

Are you wondering why purchasing life insurance through a broker might be the best choice for you? Brokers can offer personalised advice and access to a broader range of products than you might find on your own, and with better prices!

To understand the advantages in more detail, read our article on why buying life insurance from a broker could be more beneficial for you.

get a quote today!

How much life insurance cover do I need?

It’s important to ensure you have the correct cover amount in mind to help plan for your family’s financial security. Determining how much life insurance you need depends on a number of factors, including your income, your family’s financial needs, and your personal situation. There are three ways to do this:

1) To know if the cover is enough, as a rule of thumb, you can multiply your income by ten and you are going to find the right level of life insurance coverage.

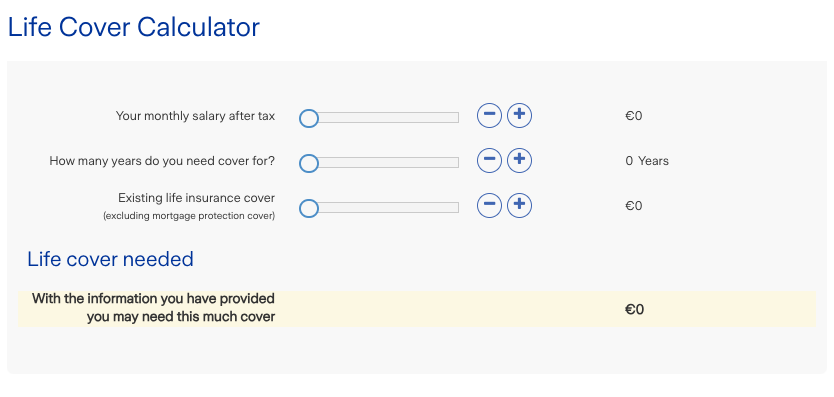

2) This life cover calculator provided by Zurich is designed to provide an estimate of the amount of additional life cover which you might require. Remember, it’s only to be used as a guideline.

3) To calculate how much life insurance covers, take into consideration your debts and how much money your family would need to live if you passed away.

Here are some general guidelines that might help you find the amount of life insurance cover that is right for you.

Calculate your current outgoings

Add up all of your current expenses, including those for housing, food, utilities, transportation, and other necessities.

Take into account future costs

Think about future costs like your children’s schooling, your retirement planning objectives, or a new baby’s arrival.

Consider your long-term debts

Consider any long-term unpaid debts you might have, like a mortgage or car loan.

Think about your family’s financial needs

Analyse the financial needs of your dependents, including their living expenses and any future financial goals they may have. You might be planning to pay for your children’s college education or if maybe you already have a Children’s Financial Plan in place. In both cases, you need to take into consideration if there will be enough funds after your passing.

Take into consideration any existing life insurance cover

If you already have life insurance coverage, consider it when determining how much additional coverage you might need.

For instance, if you have a life insurance policy through work, you might need to purchase additional life protection from another life insurance provider or if your employer doesn’t offer Serious Illness Protection with your plan, you could consider a standalone Serious Illness Protection policy.

Consider savings and assets

By taking into account your savings and assets, you can get a better sense of how much life insurance coverage you need to ensure that your loved ones are financially secure in the event of your untimely passing. You can establish a balance between your life insurance cover and your existing financial resources.

To sum up, you may find the amount of life insurance cover you need:

The sum of money needed to pay off your debts (regular bills, long-term and future debts) + your income – (existing life cover + savings + liquid assets)

= How much life insurance cover you need

You can have a better understanding of your financial situation by getting a financial plan with LowQuotes and we can give you recommendations about the appropriate level of protection and the type of life insurance or other types of insurance that would be most beneficial for you.

Not to forget, you also receive a monthly budget planner to help you manage your finances when you book a financial plan with LowQuotes.

Ready to protect your family?

Get a quote now.

Best Life Insurance Providers in Ireland

Choosing the right provider is just as crucial as selecting the right type of insurance. To ensure you find a policy that fits within your budget and meets your needs, you can request a quote from various insurers to compare prices.

However, the decision should not be based solely on cost. The special features and benefits offered by each provider play a significant role in adding value to your policy.

In Ireland, some of the top life insurance companies are highly regarded for their reliability and the comprehensive benefits they provide.

These companies offer a range of features designed to enhance security and peace of mind, making it essential to consider both the price and the value-added services when selecting your life insurance provider.

Aviva

When you choose Aviva for your Life Insurance, Serious Illness Cover, Mortgage Protection, or Income Protection, you can access an exclusive health and well-being service called Aviva Care.

This service is included free of charge with all new protection policies, offering a suite of valuable benefits designed to support your overall health and well-being.

Aviva Care provides policyholders with four great benefits at no additional cost: Digital GP, Best Doctors Second Medical Opinion, Family Care Mental Health Support, and Bereavement Support.

Each of these services is designed to offer convenient, compassionate, and comprehensive care, ensuring that you and your family have access to expert health advice and support whenever you need it most.

Royal London

Royal London goes beyond the typical insurance offering by providing access to a service called Helping Hand, which grants you access to dedicated medical professionals from the day your policy starts—not only when you make a claim.

This unique feature includes all nurses available to give you a second opinion on your diagnosis and future treatment options without any additional cost. Helping Hand isn’t just for policyholders; your spouse and children can use the service as well.

Should you ever experience a serious illness, injury, or bereavement, Helping Hand offers crucial support that extends beyond just financial aid. To aid in recovery or coping, Royal London through Helping Hand may provide access to specialist therapies.

These can include bereavement counselors, speech and language therapists, face-to-face second medical opinions, complementary therapies, and physiotherapy for specific serious health conditions, among other tailored services based on a nurse’s assessment.

This comprehensive approach ensures that you and your family receive the support needed during challenging times.

Additionally, Royal London was a pioneer in enhancing the coverage of Serious Illness policies by introducing a partial payment option for those undergoing treatment for specified severe mental illnesses.

To learn more about how these policies provide support and the specific conditions covered, we invite you to read our detailed article on this topic.

Zurich

Zurich enhances its insurance offerings with a feature designed to alleviate financial stress during difficult times. If you become unable to work due to injury or illness, Zurich commits to paying your premiums after 26 weeks have passed.

These payments will continue until you recover, the policy term ends, you reach your 60th birthday, or, in the event of your death, whichever comes first.

Zurich also offers a specialised type of coverage known as Cancer-Only Cover. This type of serious illness cover is specifically designed to protect you against certain types of cancer, as defined in your policy.

It’s an excellent alternative for those who may not qualify for traditional life insurance, serious illness, or income protection due to specific health concerns such as a history of stroke or other significant health issues.

If you’ve previously been denied serious illness protection due to particular health conditions, Zurich’s cancer cover might be the most suitable option. It offers focused protection at a lower cost than broader serious illness policies.

Learn more about the cancer covered under Ireland’s serious illness insurance.

New Ireland

New Ireland provides a distinct advantage through its Whole of Life Benefit, which guarantees a lump sum payout of up to €50,000 upon death.

Uniquely, this benefit remains valid even if death occurs after the main coverage term has ended.

For instance, if the term of your cover for other benefits concludes at age 65 but you pass away at age 90, this Whole of Life Benefit will still be honoured, as long as all premiums have been consistently paid on schedule.

This ensures that your beneficiaries are supported financially, regardless of when the insured event occurs, offering peace of mind that extends beyond the typical constraints of term-based insurance policies.

Speak with one of our expert,

award-winning Financial Advisors!

How much is term life insurance in Ireland?

The cost of life insurance will depend on multiple factors, such as age, lifestyle, or the sum insured. With a tiny proportion of your income, you can put a financial protection plan in place to ensure you and your family would have the money needed in the case of premature death.

We provide a straightforward Life Insurance Calculator so you can compare several life insurance providers and determine the cost of your premium based on your personal details, such as age, policy term, etc.

Life insurance Cost in Ireland

Cover Amount: €250,000

Term: 25 years

Applicant: Non-smoker

Age: 30 years old

May 2024

| Provider | Life Insurance Premium |

| Zurich Life | €13.72 per month |

| Royal London | €15.15 per month |

| Aviva | €17.25 per month |

| New Ireland | €18.99 per month |

Why use the LowQuotes life insurance calculator?

Our life insurance calculator is straightforward to use, you only need to add your personal details, and you will get a quote in 60 seconds. You can get a life insurance quote to cover only yourself or you can choose joint life insurance.

Fill in some quick details such as how much cover you require and the term of the policy and you’ll receive a quote comparing the prices of the best life insurance providers in Ireland.

If you wish to combine Serious Illness with your life insurance the best way to determine the cost of it is by speaking with us. We can help you understand your options and find a policy that is right for you and your budget.

Alternatives to Life Insurance

Whole of Life insurance is a crucial element of financial planning for many, it’s important to explore all available options. Here are some alternatives that might suit different needs:

Savings and Investments

Emergency Fund: Building a robust emergency fund can provide short-term financial security.

Investment Portfolios: Stocks, bonds, and mutual funds can offer long-term growth potential and financial stability.

Other Insurance Products

Serious Illness Cover: This policy offers protection by providing a lump sum if you are diagnosed with a specified serious illness.

Income Protection Insurance: Provides a regular income if you are unable to work due to illness or injury.

Pension Plans

Contributions to a Pension: Besides providing for retirement, pensions can sometimes offer a death-in-service benefit, which provides a payout to dependents if you die while employed.

Get a quote today with LowQuotes

No matter what your doubt is about life insurance, we are here to help you find the best cover to protect you and your family.

By purchasing your life insurance with LowQuotes, you will get the lowest price online because we provide discounts that aren’t even available to other brokers.

We offer up to a 30% discount and you can get a Free ‘Will Kit’ worth €120, and €50 Cashback on policies over €30 p/m.

If you want to purchase other types of insurance like Mortgage Protection, Income Protection, Multiclaim Protection cover, Cancer Only cover, Whole of Life Insurance, or Over 50s Life Insurance, contact us and we guarantee the cheapest price available on the Irish market.

Secure your financial

future today!

All our content has been written or overseen by a qualified financial advisor. However, you should always seek individual financial advice for your unique circumstances.

1 thought on “Life Insurance Calculator: How Much Does Life Insurance Cost in Ireland?”

Comments are closed.